Their Global 100 is probably as close as you’re gonna get.

I agree. By saying “from 0 to 500’000” I wanted to emphasise the growth rate as well as the 500k, it’s all about growth for a start-up. 500k is not going to go that far for any company, on the other hand let’s hope they never employ any new “managers” at 500k, cos frankly there’s no need for them.

To compare growth in AUM, I looked at Postfinance 75, at it had a lowish TER (relative to other products back in 2016) and higher Stock allocation (relative to other products in 2016) and I happen to have a few old sheets from Postfinance 75 lying around.

June 2016 = 0 (inception)

April 2017 = 70 (10 months)

February 2018 = 150 (21 months)

December 2018 = 209 million (31 months)

VIAC = 100 million after 15 months

IMO they’re doing well on this comparison with the mighty Die Post, after all Die Post had from the beginning a name, physical branches and even a website ![]()

Yes, I suppose the asset list would allow it, but it’s not possible due the regulatory rule that about 40% has to be in CHF, which means Swiss equities (if you avoid hedged ETF’s like it is recommended to, due to cost). 60% VT-similar, 40% Swiss is the closest you can get to VT.

Maybe reduce Swiss equities outside of your 3a, so that you can lower your Swiss total exposure on average.

Hi ma0

We will launch our web version on 20th of February (if testing continues without major complications).

We are already looking forward to your feedback!

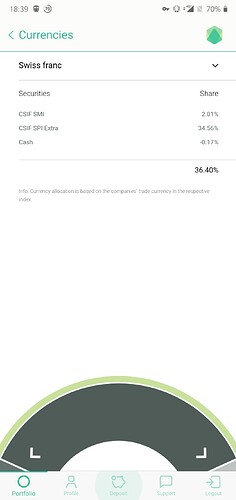

My Viac portfolio: 100.17% invested. Cash -0.17%. CHF 4466.92 invested but only a balance of 4459.28 in this portfolio

Hello, I’m new to this forum and interested to sign up for VIAC. Does someone have a reference code I can use? It seems the ones given are all used. Thank you.

Here is a code

NL3eQ0

Enjoy

I suppose there were some complications?

I was about to ask myself…

My allocation for the individual strategy:

CHF:

3% Cash

10% SPI Extra

27% SMI

USD:

60% World ex CH

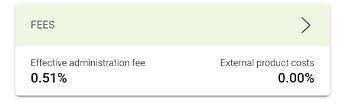

This results in a 0.51% effective admin fee and 0.00% external product costs:

I gathered my thoughts in a post over here:

Please feel free to review, critique and challenge. I would highly appreciate any feedback.

By the way: Does anybody know where I can find the current market capitalization of the SPI Extra? The most resent numbers I found are from Dec-2017.

Mine is 20% SMI, 17% SPI Extra, 20% MSCI World, 20% MSCI World Small Caps, 20% Emerging Markets

I additionally hold MSCI World ETF at a broker so that the total distribution matches MSCI ACWI as close as possible. This configuration is also very easy and cost effective to rebalance (free rebalancing at VIAC)

At source:

https://www.six-group.com/exchanges/indices/data_centre/shares/spi_extra_en.html

Interesting ![]() Does that mean that you adjust your VIAC allocations on a regular basis depending on the balance on your broker’s account?

Does that mean that you adjust your VIAC allocations on a regular basis depending on the balance on your broker’s account?

That’s where I got the data from Dec-2017 from (the factsheet). How can I get a more recent number? What am I missing? That information should be quite easy to find, right?

I hold the Xtrackers MSCI World (XDWL) at a Swiss broker and only plan to do 1-2 transactions a year to minimize fees. I will buy into VIAC at the same time and adjust allocation if necessary. General idea is that MSCI World can be had cheaper outside of VIAC, so why pay 0.5% for that?

I do my monthly purchases for the majority of my portfolio at IB.

What data do you need to pull? Market Cap? I remember I investigated that once…

So you are basically using VIAC to cover small caps as small caps would be less cheaper outside of VIAC than MSCI World outside of VIAC?

Jup. That should be easy enough, right? I just couldn’t find it so far ![]()

Exactly. I only hold MSCI World (and UBS Gold) at the Swiss broker and the rest at VIAC. Minimall number of transactions, fees, broker diversification and all that …

I then have a completely separate portfolio at IB where I’m less focused on following the ACWI (all country world index).

Indeed I can only see the data from end of 2017. By then the SPI market cap was 1553B and SPI Extra was 408B. This would mean SMI was 1553-408 = 1145B.

I wouldn’t bother too much to reproduce this with extreme precision. Roughly 3:1 in proportions is good. I think your allocation is spot on if this is what you wanted to achieve.

Hello everyone,

I am in the process of defining my investment strategy (long term) and I would like some insight on how to properly balance things using regular investments and pillar 3a.

I have 20k already in 3a, currently moving to VIAC.

I plan to invest a lump 40-50k in VT (or a VTI+others combination, not decided yet) and then 10k per quarter.

At first 3a will represent half of my investments but this share will shrink over time.

My marginal tax rate is around 20%, so first I am questioning whether to invest in 3a at all. I have not dug into calculations yet, do you have pointers on that subject?

Then regarding the portfolio allocation I looked at Mr Lean Life strategy and others from this thread and I don’t know which makes the most sense for the Swiss 40%: blue chips with SMI or more SPI extra, since I will already be exposed to big caps through VT.

Same question for the remaining 60%, TER is 0 for All World exCH but it does not include emerging markets.

What do you think?

Head over to the thread started by nugget (see snippet below for the conclusion). I personally think it’s well worth to invest in 3a due to the tax reduction aspect (free money).

Good point. I wouldn’t call you crazy if you would decide to increase the allocation towards the SPI Extra, given the fact that this will become a small proportion of your overall stash over time anyhow. However, keep in mind that there is no way of knowing if small caps will outperform large caps in the future. I personally prefer to follow the market capitalisation ratios for deciding upon the asset allocation percentages in the spirit of Vanguard’s approach for the VT.

That’s correct. I was turned off by the 0.09% extra product cost. However, if you are willing to take on the extra cost, the allocation would probably be somewhere around 12% Emerging Markets and 88% World. Multiplied with the 60% this would give you:

USD:

7% Emerging Markets

53% World ex CH

For those who completed all three referrals, does this appear to have reset in your app? I opened another portfolio today and again have to option to “Invite a friend”, which is a bit concerning as there doesn’t appear to be any documentation stating that I’ve already done this…

In the first tab, at the bottom, click on “Fees” (commissions). The breakdown should include an entry at the bottom for the fee-free amount (CHF1500 max).

Does anyone know when VIAC plans to actually launch their desktop version?.. I really like the simple and informative app, but it bothers me that I can’t check my 3a from my browser on my laptop!