Hi fellow Mustachians!

I’ve been reading along on the forum “anonymously” for some months, so I think it’s time to make a “first” contribution/post. And I found this interesting potentially Mustachian topic. I just read about this on FuW, and investigated further as I am in the market for a better=cheaper 3A-with-shares solution.

A new 3A solution (similar to the VZ 3A solution with a choice of various ETF’s) has been announced by VIAC, together with WIR Bank.

The FuW article below is a bit too superficial and optimistic-sounding about the “lowest costs”, so I decided to look at the details.

IMO, it’s cheaper than the similar VZ solution (which is 0.9% = 0.68% + ~0.2% TER) ![]()

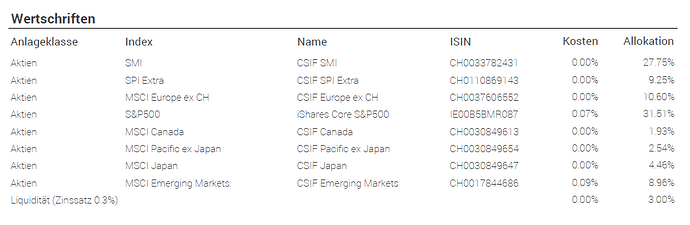

As far as I’ve found out on the VIAC website:

- 0.52% fees on the value invested, but excluding the Cash position.

- Additionally average of 0.025% ETF fees.

= Total Cost about 0.55%

I’m not totally sure if that really includes a realistic TER of the ETF, because 0.025% is a very very low ETF TER, if it’s the way as written above. Also I couldn’t find out exactly which ETF’s are available. I will try to find out more. In the article they mention a max. of 0.72%, which is still lower than VZ, but, well, doesn’t sound quite as good as 0.55% any more. I like that they do not charge the fee on the Cash position, which VZ does. The Cash position gets an interest of 0.3%. Not great, but it allows some flexibility without potentially paying 0.68% fees on a Cash position like at VZ.

Notice period when moving away from VIAC = 31 days

Fees for buying in / selling = 0%

I’ll investigate further and add to this post, when I find out more.

Looking forward to other Mustachian thoughts on this!

- Die VIAC Verwaltungsgebühr beträgt 0.52% pro Jahr auf das investierte Vorsorgevermögen. Auf dem Cashteil wird keine Verwaltungsgebühr berechnet. Mit der Verwaltungsgebühr sind die Kosten für den Handel von Wertpapieren sowie die Entgelte der Depotbank für die Konto- und Depotführung gedeckt. Diese Gebühr beinhaltet zudem alle Gebühren für die Stiftungsadministration, die Bereitstellung der Technologie sowie den Support. Es gibt keine Transaktionskosten, Retrozessionen oder andere Provisionen.)

- Bei den verwendeten Indexfonds und ETFs fallen innerhalb der Fonds Kosten von durchschnittlich 0.025% pro Jahr an (Standardstrategien), die direkt in die Indexfonds- resp. ETF-Kurse eingerechnet werden. Inklusive der Verwaltungsgebühr von 0.52% liegen die Gesamtkosten auch bei einer voll investierten Strategie unter 0.55%. Dadurch ist unser Produkt bis zu 3x günstiger als vergleichbare Produkte der Konkurrenz.)

Article from FuW 22.11.2017

Seit heute Mittwoch bietet Viac eine neuartige Vorsorgelösung zu Tiefstkosten an. Was hinter dem neuen Angebot steckt.

Allmählich drängen Jungunternehmen aus der Finanztechnologie auch in den Vorsorgebereich vor. Als erster Anbieter geht heute Mittwoch Viac am Start. Das Drei-Mann-Unternehmen aus Luzern will nach eigenen Angaben das erste rein digitale Vorsorgeprodukt auf den Markt bringen. «Unser Ziel ist es, den Kunden eine passive Vorsorgelösung zu möglichst tiefen Konditionen ermöglichen», sagt Co-Gründer Christian Mathis, der zuvor während zehn Jahren bei einer Innerschweizer Privatbank tätig war.

Tatsächlich unterbieten die Gebühren die derzeit am Markt verfügbaren Lösungen um Längen. Je nach Aktienanteil belaufen sich die Gebühren auf 0,17 bis maximal 0,72%, wobei sie auch allfällige Produktkosten und Depotgebühren beinhalten. Die tiefen Gebühren sind deshalb möglich, weil die Kosten nur auf dem Anteil des Vorsorgegeldes anfallen, der in Aktien investiert ist. Je tiefer der Aktienanteil, desto tiefer die Gebühren. Andere Anbieter von ETF-Sparplänen wie etwa VZ Vermögenszentrum oder Moneypark weisen je nach gewählter Strategie deutlich höhere Gesamtkosten aus.

Auch bei den übrigen passiven und aktiven Wertschriftenlösungen sind die jährlichen Kosten bei 1% oder höher. Im stark regulierten Vorsorgebereich sind die Anbieter bislang kaum Wettbewerb ausgesetzt und spüren deshalb wenig Kostendruck, wie «Finanz und Wirtschaft» in einem aktuellen Vergleich von 3a-Fondslösungen gezeigt hat.

Das könnte sich mittelfristig ändern, wie der Einstieg von Viac belegt – sofern sich Partner finden lassen. Denn Vorsorgelösungen können nur von entsprechenden Stiftungen angeboten werden. Im Fall von Viac ist es die Terzo-Vorsorgestiftung der Bank WIR, als Depotbank für die Wertschriften fungiert die Credit Suisse. «Es war sehr schwierig und zeitaufwendig, eine Bank zu finden, die mit uns zusammenarbeitet», sagt Mathis.

Das Beispiel von Viac zeigt, wie wichtig es ist, in die private Vorsorge neue Ideen und Modelle einzubringen. Die tiefen Gebühren sind dank einem schlanken Geschäftsmodell möglich. Die ganze Abwicklung läuft über eine App auf dem Smartphone, wo auch sämtliche Dokumente hinterlegt werden. Für das kommende Jahr ist geplant, auch eine browserbasierte Version herauszubringen, die eine Anmeldung am Computer ermöglicht.

Im Gegensatz zu allen übrigen Anbietern verzichtet Viac im aktuellen Umfeld auf jegliche Anlagen in Obligationen und setzt stattdessen auf eine Zinskontolösung. «Obligationeninvestments sind derzeit nicht vertretbar», sagt Mathis. Zu der potenziell negativen Rendite kämen Zinsänderungsrisiken. Als Alternative bietet die Bank WIR an, den Teil, der üblicherweise in Obligationen investiert würde, zu 0,3% zu verzinsen. Das entspricht in etwa dem aktuellen Durchschnittszins bei 3a-Konten.

Dieser Mix von Aktien- und Kontolösung ermöglicht es den Sparern, die 3a-Vorsorge individuell zu optimieren. Bei einem tiefen Aktienanteil fallen entsprechend wenig Kosten an, die Zinslösung muss nicht zwingend beim selben Anbieter liegen. So liesse sich derzeit bei der Bank WIR über das 3a-Konto ein doppelt so hoher Zins (0,6 statt 0,3%) erzielen. Der Cash-Anteil kann aber auch bei der Hausbank deponiert werden.

Das Modell von Viac könnte Nachahmer finden und den Wettbewerb in der Säule 3a ankurbeln. Zwar haben in den vergangenen Jahren einige Banken passive Lösungen lanciert. Allerdings differenzieren sich diese kostenseitig nicht deutlich von den aktiv gemanagten Produkten. Zudem zeigt sich, dass es sich gerade im aktuellen Umfeld lohnen kann, Gelder in einem Mischfonds aktiv zu managen. Passive Produkte, die starr an eine Obligationenquote gebunden sind, haben in den vergangenen zwei Jahren deutlich schlechter performt. Aktive Fonds hingegen weisen einen grösseren Spielraum auf. Für sie hat es sich zuletzt ausgezahlt, stärker auf Immobilien als auf Obligationen zu setzen.