This is the clearest evidence of what priced-in means.

Sorry but your comment is contradictory. Since Tesla stock increased by 10%+, clearly not everything was priced in yesterday.

One could say that. Tesla’s numbers fell short of analysts‘ expectation but must have beaten the „whisper number“ expectation. Go figure.

We must have a different definition of “earnings are price in”.

Yours seems to be something similar to “it went down a lot recently, with earnings announcement it should rebounce in the other direction”.

My definition is that these earnings release confirmed the economic situation of Tesla (more about this below), and as such the economic reality of Tesla should not warrant a valuation of more than $20/share ($30 if we are generous). So I persist in saying that it is definitely not priced in.

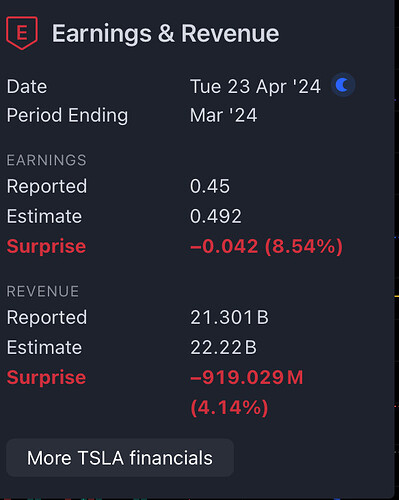

I mean the release yesterday confirmed that:

- They have declining sales (-10% yoy)

- Declining profits

- Operating margins among the worst in the industry

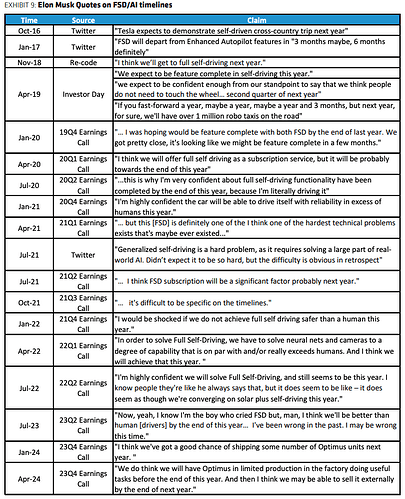

- An ageing fleet and no new vehicle in sight before the end of 2025 (if Musk keeps his promises, a habit that would be new for him)

- While accounting profits are still positive, the cash generated from operations is barely positive, i.e.

the cash situation of the business is worse than it looks at first sight. - The new vehicles won’t be based on a new platform, but on existing ones (i.e probably the Model 3). We have to believe that the $25k car will be an even more stripped-down version of the Model 3, if such a thing exist. Notwithstanding the fact that the Model 3 already costs around $25k to produce.

- Last but not least, FSD. FSD is nowhere near. I don’t believe they will solve it within the next 5 years. And if someone does solve it, even if it is Tesla nothing says that it will be a winner-take-all market. And nothing says that any of the current Teslas on the road have the hardware required to run FSD.

Also, they are still presenting FSD to regulators as level 2 autonomy, and haven’t applied for autonomous driving in any state at all.

Given all of that, we are left with a run-of-the-mill car manufacturer that is not even earning its cost of capital. Any analyst would tell you that such a business economic reality is not worth more than its book value. If you want to look at it from an earnings basis, declining earnings are worth less than 8x forward earnings. So even if i am generous and say that TSLA is worth its book value, i.e roughly $65b, with 3.5b shares outstanding we are left with roughly a cap of $18.7/share.

But you were considering starting a position, so maybe you can explain to me a justification of the current valuation ($500b) based on yesterday’s earnings (plus/minus 20% is more than enough accuracy for the exercise).

EDIT: ah, and they also admitted that the 4680 batteries were only “an exercise to understand the fabrication cost of their providers”. So all the bullsh*t related to their competitive advantage in energy storage and vehicle range is also unraveled.

EDIT2: oh, and if Tesla ever solves FSD, by the time they’ll deliver it most of their car will have a battery that is running at the end of its life, meaning the cars will need to be replaced. There is no existing potential robotaxi fleet.

Stock price is not based on current earnings only.

It takes into account

- realised earnings

- expected earnings outlook short and long term

I think the main reason TSLA is up because people were worried that Elon will ditch Model 2 for Robotaxi dream. But he actually said they are accelerating model2.

This mean earnings outlook for coming years will improve (vs feared )because selling cars make profit and robotaxi won’t make any money in next 5 years

I still don’t know if Tsla stock will beat S&P in next 10 years. It seems most of its potential earnings are exaggerated and penetration of EV is oversimplified. @Julianek has mentioned very good points in this regard

Robotaxi stuff is good, but we cannot pay money on hope. We need to see evidence. However in general people have so much FOMO that they don’t wait for evidence these days be it EV, AI or Blockchain

What they announced isn’t model 2 no? (they’re planning on making cheaper car on the existing production lines, at least based on what was said)

On a conference call, Musk refused to be drawn on specific plans for an affordable “next generation vehicle” or how it would be produced using Tesla’s current infrastructure.

Though maybe they don’t actually have a plan.

The stock has been beaten down for months and bad earnings didn’t cause another -10%

I was under impression that new model is the cheaper one. Not sure what is the difference?

I guess we are all here to share opinions in order to make money and maybe to RE, right?

Imo TA > FA

I started the position based on that and will exit the position again in the same way.

I think this is one of those fascinating moments that shows me why I don’t shouldn’t invest in individual stocks. It’s because it’s really not obvious what is going to happen.

It’s plausible to me that FSD pays off and is a sufficiently difficult problem that the lead is worth a lot. It is also plausible (and more likely to me) that nothing marketable appears for 3 years, while competition from Chinese automakers slowly reduce any profit from the existing models. I struggle to see how any of us armchair investors can develop enough conviction to make a big bet with such an obvious downside risk.

Totally agreed

However I really hope a lot of active investors still exist (institutional and retail) and make money. Otherwise we would end up with a broken market with no one to make price discovery .

In other words for us( index investors) to exist, we really need the great minds doing all this research and build the conviction to go long or short on stocks.

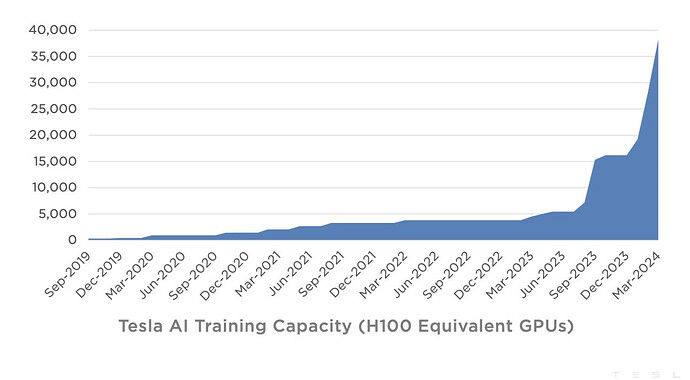

That’s great … for Nvidia! ![]()

Whether it helps Tesla with FSD or AI remains to be seen …

(source: https://twitter.com/BrianSozzi/status/1783168094501777815)

+14% pre market

Bingo

One more proof of point to show how difficult is to invest and forecast in individual stocks.

Meta and TSLA almost went in opposite directions in 10 days ![]()

Just for your info.

Form probability point of view it was favorable on the chart