Holding a minor position in Tesla shares and getting a bit concerned as both their competition is stepping up (in terms of quality and price). At the same time, the sign that Tesla decided to ax 10% of their workforce indicates they themselves were less optimistic about their future than before. Hence, I wondered if I should close my position before they go bust? Or would you even recommend me a short position?

do you have a recent '24 guidance?

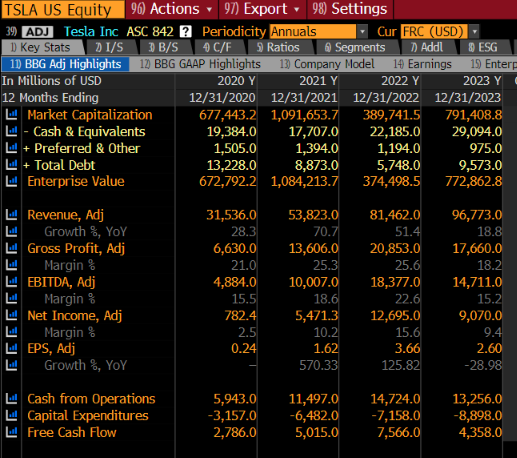

The '23 actuals show me that they grow top-line but struggle to grow bottom-line. So there seems to be quite a bit of margin/cost pressure. If they can’t get this solved fast - and considering the fact that BYD can produce cars at lower cost & higher margin - things may go difficult fast.

The key question is what happens in '24. Them cuttinig 10% indicates they see a trend reversal. This could either be just platoeing where they are (aka they stay at roughly these revenue and profitabiltiy levels and the share comes down to a 10-15 PE aka mins 50%)… or it could be worse if they realize that they can’t compete at the cost side of the dimension.

Earnings actually shrank in 2023.

Both FactSet as well as Yahoo! analysts expect earnings to fall again this year.

Understanding the difference of cost structure and the less complexity of electric cars vs. combustion cars, Tesla just scratched the surface. The market for electric cars will exponetial grow in the next years. They are getting cheaper (battery costs lower every year), the service maintenance costs are way lower compare to other big brands - the mostly people love their cars. Who will eat how’s lunch in the future is not clear, but so far Tesla has the advantage to be fist and is investing the earned money in the future grow. They are building production lines in most of the continents and those cars will get cheaper every year. So I would still be long-trem bullish for their future.

I thought that wasn’t the plan anymore (not working on new cheaper car, but robotaxi instead).

Tesla stock is pricing in a Lot of Future earnings. It was assuming very high growth rates for long period of time plus Robotaxi and other services

The problem with Tesla is always that it is priced like a tech company while its main business is still selling cars. You will find very wide views for Tesla. Cathie Wood has very bullish view (quoting very high stock price targets) while other investors think price can go to even 100 USD. This is the issue with individual stock picking. The prices move based on narrative and can move significantly to upside as well as downside. Hence your analysis of the stock is the most important one (if you ever did any)

I do not think Tesla will go bust. However please remember there is a difference between a company and its stock. Tesla might continue to be a solid company but its stock might not perform well compared to its history.

Any advice anyone will give here will most likely be based on their own narrative. You need to think about what your narrative to make a decision.

“Ben Graham said: ‘In the short-run, the market is a voting machine - reflecting a voter-registration test that requires only money, not intelligence or emotional stability - but in the long-run, the market is a weighing machine.’” — Chairman’s Letter - 1993 (berkshirehathaway.com)

No judgement or advice given, but the stock price will eventually catch up with its fundamentals.

Yes, it is a matter of narrative… we can also say:

Yes, in the future, electric cars may be more prominent BUT Tesla only proposes expensive cars that most people won’t be able to afford and other competitors already offer more entry-level low cost electric cars. Indeed, cost may decrease but they are still not targetting to offer cars that everyone can afford.

Tesla is just a car company, they did not created nothing relevant/new other than cars for the wealthy. The hype of this brand comes from Elon Musk narrative, that may be very volatile. I personally don’t see nothing special in this company, other than Elon Musk being great as a storyteller…

There are now stories about bad inside management, low paid employees, … that may impact the future of the company as well.

In despite of these points, the STOCK of Tesla will very likely be back again as I don’t see in the short term that the “love” for Elon Musk will stop. The hype will probably continue for a while…

If Cathie Woods says something, you should keep far and away from it.

On TSLA: Mr. Musk completely fucked his reputation in the last years. Many dont want Teslas for that reason alone.

In general tsla has a lot of correlation with that singular person. I would not want that for a security I hold.

When did you buy your position? What motivated that decision? Has the situation really changed from “bullish” to “going bust” since then?

Disclaimer: I believe $TSLA has more downside than upside going forward but I’ve been believing that since “some time” and I don’t hold a position in the company so your view on it is obviously different than mine.

I don’t follow the stock closely, but Tesla has been on the verge of bankruptcy and among the most shorted stocks in and out for the last decade. Then this happened. ![]()

It will remain a risky stock, either way. If you see old stock prices quoted somewhere, keep in mind there were stock splits in between. Competition is increasing, and market demand for EVs not as certain as it seemed just a few months ago.

Also, if we believe 2015’s Elon. FSD has been available since 2017.

2017’s Elon tells us level 4 autonomy sensor hardware and computing power have been present in Teslas since then, even potentially to level 5 level.

2017’s Elon also tells us we can sleep on a driving Tesla since 2019.

2020’s Elon tells us with good expectations that robotaxis have been deployed since 2021.

2020’s Elon also is extremely confident, 100%, we’ve been having full autonomy since 2021.

2022’s Elon is shocked, shocked I say that we haven’t achieved FSD safer than humans since 2022.

The narrative really hasn’t changed. I would see no reason to change my outlook…

For the timeline: ELON FSD TIMELINE

I would also not invest in a company promising me Artificial General Intelligence in the near future. Current AI is not suited to do a huge chunk of the things it’s hyped for…

Former Tesla … fanboy? … Fred Lambert of electrek.co just put out an article on the pivot from Model 2 to Robotaxi: Elon Musk is putting Tesla all-in on Robotaxi | Electrek

This guy didn’t have an edge on the bull case, not sure he has one on the bear case, but sentiment wise, I probably agree with his last paragraph in the linked article:

“For Tesla shareholders, it’s also confusing. Elon is taking all this risk, betting everything on AI helping Tesla solve self-driving, saying that ‘Tesla is now an AI company’, and at the same time, he threatened $TSLA shareholders that he would not build AI products at Tesla if he doesn’t get 25% control over the company.”

Be well and invest well!*

* Blatantly stolen from Jason Zweig.

I’ve been wrong a lot about TSLA (the stock) in the past, and I would have lost a lot of money had I shorted it (yup, i was skeptical since 2019). So take my point of view with a grain of salt.

That said, in the long term I still think Tesla (the company) is nothing more than a car manufacturer, and one that is currently having a bad time:

- Its models S, X , 3 and Y are getting older and their refresh have been commercially underwhelming

- The cybertruck is a dud and has a lot of quality issues leading to many breakdowns, sometimes even before the truck delivery

- I haven’t heard about the semi truck for a long time - from what I have heard their above-average autonomy was only good when the truckload is almost empty. Good for Lay’s chips bags (hence Pepsi being their first and very advertised customer), but not much more

- The $25k model plans has recently been put back on the shelves according to Reuters

- Most of their profitability comes from the Chinese market, which becomes more and more competitive.

- As an overall result, demand has taken a deep dive, and margins are getting slaughtered. The business is not yet in the red, but the growth is lackluster given the valuation expectations.

- The “Dojo” is nothing proprietary. They recently admitted that they are buying Nvidia GPUs like everyone else.

As for the FSD, I’ll share below the point of view of an ex Cruise employee.

So i don’t expect the business to earn its cost of capital over the next business cycle, which means “in theory” it should not be worth more than its book value, i.e $65 billion as of Q4 2023 (vs a current market cap of $500b, i.e 9x more).

THAT SAID, what i have vastly underestimated in the past is Musk’s prodigious skills at promoting the company and raising capital. I had never seen something like that and although I dislike his character, I have to admit that he is truly fantastic at promoting the stock.

Now for FSD:

A thread about this Tesla fanatic statement: “Well Tesla is trying to do the only FSD system that truly, truly works at scale: camera-only and without a geofence…”

My response: “What’s Tesla’s plan to getting that to market?

How do you catch your competitors?”

“Just more data. Just more edge cases. Tesla’s got this.”

I particularly hate the ‘edge case’ answer:

Teslas are failing at basic driving, not edge cases… Parked Firetrucks, cement barriers, and unprotected left turns are not “edge cases.” But we’ll get to that.

=================

First off, “safer than the average human” was never the bar.

That’s not how liability works. You’ve gotta be safer than the 95th percentile human, at least.

There are a lot of drivers that have never been in an at-fault accident, or haven’t since they were young.

But as competitors make progress, a different bar does begin to form: in the ballpark of other market alternatives.

Waymo robotaxis had 1 safety-critical incident every 2.4 million miles in 2023.

And they’re not alone in these high magnitudes: Zoox, Nvidia, Hyundai, Baidu, Aurora, etc.

They are all articulating a safety-focused business plan. They have fully autonomous cars on the road today. They are setting the bar. Not just on metrics, but on transparency and communication.

And it’s high bar. If there are competitors out there that have demonstrably higher multiples of safety, how do you think Tesla gets past regulators if they’re significantly worse?

Yeah, the geofence is an operational inconvenience. It covers a lot of driving though, and stands to grab a lot of the rideshare and commuter market.

There could be enough demand inside geofences to be cash-flow positive.

How does Tesla get approval to run their “robotaxi service” in San Francisco if Waymo is setting the safety bar? 2 years ago, fanatics would say the plan was “end-to-end Neural Net.”

And here we are. How often have we heard this same story now?

“Oh, X new AI technology in Y version will be it! And then just give it more data!!!” Tesla has had “FSD Beta” on the road for three years now.

They released version 8 to the public - they’re now on version 12.

They’re at 400 miles per safety-critical disengagement (and that’s from http://teslafsdtracker.com, not Tesla).

For a fleet that’s 1000x the size of any other competitor in North America? Just 400 miles. 400 miles until the software would cause an accident. 400 miles until software could have killed someone if not for an attentive human driver.

What’s Tesla’s plan for improvement from here? How long is it going to take? Who is accountable if they’re not at 10k miles by the end of the year? Is it just “we’re continuing to refine models”?

I thought this was end-to-end now?

“Just wait, more data” - it’s just another empty promise. It’s the Solar Roof. It’s the X user numbers. It’s just another “Paint it Black” video.

“Just more edge cases, just more edge cases, just more” - I watch the videos. Those aren’t edge-case failures. The car isn’t screwing up on edge-cases.

Want to know what an edge-case failure is? A tree falls down right in front of your car. Or someone throws a CPR dummy onto your car. Or an escaped zoo animal jumps out. Or an earthquake severely deforms the road.

Fails to stay on the road properly? v12 has messed that one up multiple times. Hell, here’s one where the car tried to accelerate into a cement barrier: (https://youtu.be/fbBdIza4FqM?si=wzgPJpqqzkZ_nk1e&t=619)

You can start to BEGIN to talk about edge-cases when you get to 1 safety-critical takeover every 10k miles, and that’s an absolute minimum. Only then are you in “edge case” land. So, really, what’s the plan? Walk us through how you get from “Drives worse than a 16 year old” to “Waymo-level safety.” Tell us how you get from “we only report deceptively positive numbers” to being a trusted source of data. Explain to us how you get from hitting firetrucks, or the sides of trucks, or even just hitting curbs or cement barriers, to “we are a trusted communicator on vehicle safety.”

Yup, all of what you stated.

Further, being a former Hoolie insider: I’ve heard the “it’s ready real soon now” slogan as an insider/employee for … hmmm … probably a decade (until I quit in 2020)? Includes promo (inside Hoolie only) presentations from the two founders (“X (large) number of teenagers die from drunk driving every year which can solved with this technology”), research level self-driving leads like Sebastian Thrun (“drive across the country cross country with this technology soon now, a few years”), later (IMNSHO mostly self marketing) “star engineers” taking the moonshot significantly further, at least marketing-wise (usually their own career and especially their compensation leapfrogged the project progress, though).

To Hoolie’s credit: they were always hesitant about publicly marketing the technology as “it’s ready in a quarter, please price GOOG accordingly”. Probably mostly risk management which seems absent at TSLA.

Slightly biased: I feel Waymo is still the market leader capability wise, also equipped with deep and very profitable pockets from the parent/sister company with advertising money, but I personally wonder when Waymo would turn a profit (let alone making up for their already spent R&D).

Is robotaxi technology the golden standard 50 years from now in developed nationsj? Yes.

Does this mean that current contenders for winning the race will still be around, even 10 or 20 years from now? No.

Is Tesla one of these contenders even 5 years from now, alongside GOOG, GM (Cruise) and others? I’d be very surprised.

Be well and invest well!

Wth is that Hoolie thingy I read (from you?) all the time. Is this some kind of running joke I dont understand. Because this company does not exist (except a golf club named like that).

Or do you make a joke about Hooli from

silicon valley series?

Sorry, Hoolie stands for Google, I am just trying not to be too obvious.

Oh, and there is some TV show named Hoolie (which I didn’t watch) which apparently mimicks Silicon Valley start-ups, their founders, and early years?

Anyhow, sorry for using apparently just confusing jargon.

Maybe, maybe not. The love for the above-mentioned Cathie Wood certainly did. Though obviously her successfully delivering on her flagship product can be measured more objectively.

And she’s not nearly as political vocal as Musk. Musk is a polarising figure. To his (and his company’s) benefit. And their detriment.

While I certainly believe his outspokenness (and often provocative nature) helps carving out a boisterous and loyal fan base, I’m not sure how well that translates to achieving broad mainstream appeal.