Right! This is something I always wondered and wanted to understand better. High inflation would be terrible for capital gain tax on property then.

Or even lose money.

Let‘s assume you buy something for 1 million and 5 years later you sell it for 1.5 million with 30% capital gains taxes (150k). So you end up with 1350k net. If inflation is above 6.2%/year, those 1350k are worth less than 1000k at the beginning.

The tax (Grundstücksgewinnsteuer) in the Canton of Zurich is close to 40% for selling within 5 years, for net gains from 100k. You can make some deductibles.

The leverage is in your favor though. No one pays full house price in cash. In your example: 200K invested turns out to be 550K nominal in 5 years.

The less money you put in as equity when you buy, the more monthly payments go up when interest rates move. In countries where variable rates are used a lot it is not unreasonable to expect 100% increase in monthly payments, not CH I guess.

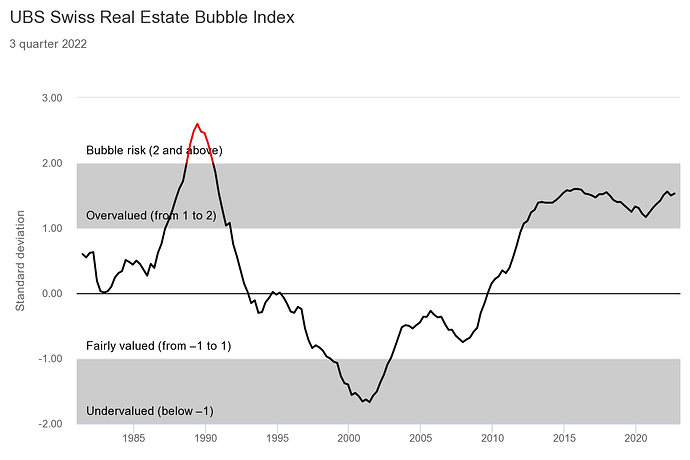

Real estate prices are still increasing in Switzerland according to the latest UBS report: https://www.ubs.com/ch/en/private/mortgages/real-estate.html

“In 3Q22, prices for owner-occupied properties were again unaffected by the rise in mortgage interest rates and increased by a further 1.4% quarter-over-quarter.”

Not super related but I am hoping you guys can help me.

What website/tool are you using to calculate the monthly payment if you decide to take a mortgage in Switzerland (with current rates)?

Some tool where I could input, downpayment, purchase price and income and it just spits out the monthly payment and if I would be approved or not.

Thank you!

I found the Credit Suisse one the best:

SNB increased their interest rate to 1.00%.

Another rate hike is expected in Q1 2023, could be 0.25% or 0.50% according to experts because swiss people purchasing power is supposedly way too high despite the increased energy, housing and healthcare insurance costs.

Given a 1.25% or 1.5% Saron rate, add 0.6% bank margin and it comes close to 2%, which corresponds to 2 or 3 years fixed mortgage rates.

A couple of months ago, I saw no reason to choose a short term fixed rate over Saron, I am not so sure about it now…

Will it stay at 2% for 2 or 3 years, though? Maybe, maybe not. The banks do their calculations when they offer fixed rates; they take into account how they expect rates to evolve. They could be wrong or they could be right but I don’t see a compelling reason to think I am better than them at guessing what future rates will do.

That is to say, I would not frame the question as a “which solution will cost me the less money” but as "fixed rates are insurance against rising interests, do I want/need to purchase that protection or am I not interested in such a product?

Edit: that last question should be assessed outside of any guess regarding future rates, except for anticipating if there is a threshold at which the interests would become unsustainable for me, at which point, the insurance is worth it (the insurance being just as well worth it if I want to have known costs in the future rather than fluctuating ones).

I agree but my point is that Saron and 2-3 years rates are about to get so close that Saron is no longer a no brainer (at least for me).

The Saron option felt much more attractive 2 rate hikes before. At that time, fixed rates already had the entirety (or a large portion) of the future rate increases priced in while Saron was still below 0%. As a result, risk/reward was largely in favor of Saron, but it doesn’t seem so obvious now.

Sorry German.

There was no way that Saron and the 10y rates wouldn’t converge. Only the blind didn’t see that.

Actually, the 10yr fixed rates might even be cheaper in a year or two than Saron.

At any given moment yes, sure. But fixed rates cannot go down. So it is always a question if you go for rates fluctuations.

The only point in time when you can compare which one was cheaper is at the maturity of the 10 years and compare what you paid vs what you would have paid with the other product over the same period. If you take a SARON anyway you speculate and it’s always a matter of identifying your risk profile / how flexible you want to be. Given that mortgages in CH eventually mature and you need to renew, the security offered by fix rate mortgages is anyway limited as you’ll eventually be exposed to a new rates at some point. It’s all the more true that the vast majority of borrowers have mixed maturities and end up renewing part of their mortgages every 3 years.

Swiss House Prices Drop as Global Trend Reaches Booming Market

How far it can go?

Long time since I saw numbers of private ownership in CH. I guess pension funds are bigger player, wonder when if at all they would decide to exist RE market for other assets?

Lots of Bigger player have to sell RE cause Stocks are down and the need to balance the portfolio to keep the Stock/ Real Estate ration in balance. But this sell pressure will come in forms of funds or trash Real Estate…

Ticino started a drop, other regions are flatlining.

The SNB might not stop at 1.50% as inflation is higher than expected. What would you guys plan for in the near future?