Anybody has good hard facts/forecasts on how does the real estate market in Switzerland look in the short/medium term?

For now the discount rate for pension funds for institutional investors has not (yet) been altered, this means on paper the real estate development still works fine for the bis investors.

This is reflected in the huge volume of buildings that are in construction/panned.

At the same time the building costs and the cost of capital are rapidly rising.

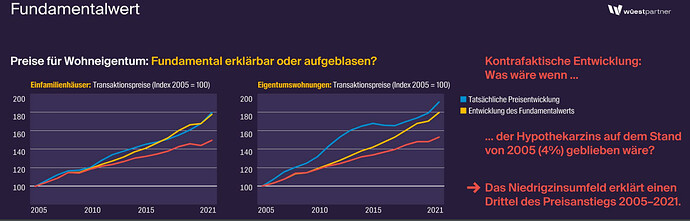

If we believe the following rating agency 1/3 of the price increase is due to the low interest rate we had over the past years, see graph below.

They are still predicting an increase of new buildings, especially renovations, ESG and C02 reduction is a huge request, it will not be so easy to tear down old buildings and just build new ones.

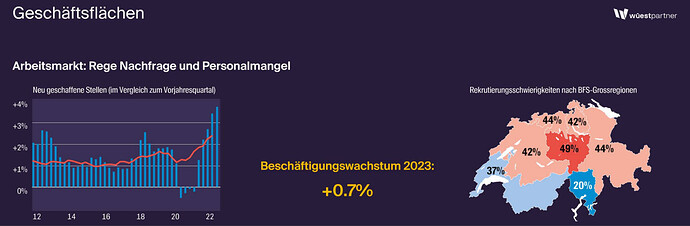

At the same time a growth of 0.7% occupation is expected from the economy. This means the “Personalmangel” could get worse in certain areas.

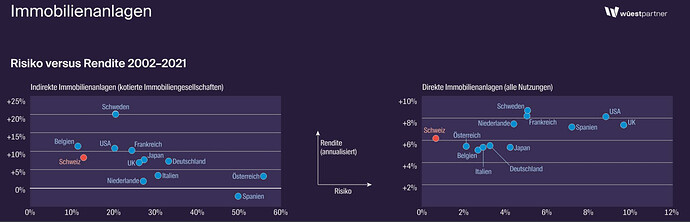

If we believe WP we can assume that the Swiss RE markets is still one of the less risky one compared to EU/USA. At the same time the returns (should be) at around 6%.

Those numbers paint a pretty “mild” outcome of the changes. Still the author of those slides is one of (if not the biggest) rating agency in Switzerland and so they might not want to scare markets.

At the same time it is true that we see the labor market holding up strong, there is a shortage of people and the request for “Wohneigentum” is strong at this prices, this can inspire confidence.

We will only see the true cause of higher loans once a bigger part of the population will have to refinance their homes.

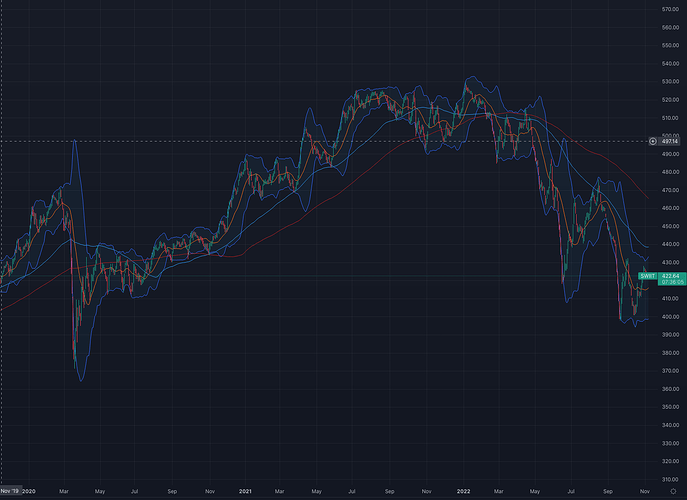

The SXI Real Estate® Funds Broad index comprises real estate funds with a listing on the Swiss Stock Exchange and at least 75% of their fund assets invested in Switzerland.

But maybe some experts could comment if that any indicative value?

The real estate funds’ market is overracting, as always. In the short term, the market is a voting machine, in the long term, it is a weighting machine

The index is composed of funds that owns big residential buildings and commercial real estate. The funds’ NAV are not very correlated with individual homes’ price anyway.

The NAV and the share price are on a slightly leveraged basis (maximum 33% financed with mortgages), so it doesn’t even correspond to the variations in assets prices

Huh. My guess is that “risk” is mostly FX volatility. I guess it would look different in the native currency, but of course it’s not relevant for a Swiss investor.

As said, i believe the numbers shown most probably are tweaked to make the Swiss market look better since they have a vested interest, after all they are a consulting firm.

We can speculate if more people will want to sell their propriety once the loan prices increase by x2 or x3. I think we will have a chance to see the following houses on “sale” in the coming year(s) if the high interest persist:

Vacation homes

Lots of people make money by renting trough Airbnb and not using the home them self. If the payment “eat” the revenue generated there is a chance people just liquidate the homes.

Homes of elderly People

Grandparents 60 or 70+ living in big homes. At the moment there is no pressure to move out, since the payment of the house is cheap and an apartment or a care home may cost more.

If the payment rises there will be pressure to free the space.

Yield Property

People who bought at the peak, are over exposed or not well balanced might need to sell property (to cover losses on other bets).

Eidt:

To add, i don’t think there will be many people or family selling the homes they live in (unless we witness huge unemployment numbers).

For the most, real estate purchasing has a simple rule:

- buy the biggest house for which you can afford the monthly payment (and use whatever means the government allows to make said monthly payment low, which makes the total price high, and the realtor/bank/loan generator fee high, sweeeeet, everyone wins, even existing homeowners)

So interest rates up means new houses must be priced lower than before in order to move. Basically young people can’t get in, older people can’t upgrade existing house as making new loans is not interesting.

But first, the market freezes of course. Unless people loose their income and can’t make payments on existing loans.

Now, after the freeze, don’t home owners have to “refresh” 3/5/7 year fixed term loans in CH?

So depending on the kind of loan ladder the monthly payment eventually goes up for existing loans, kind of smoothly over the next 7 years…

Also some of these will require homeowners to fork more equity into the deal, no? Isn’t that a CH rule? (you tell me!)

Team transitory will say there will be no problem in housing market.

Team permanent higher rates (in the next 10 years) will say the market will freeze and then will adjust at an inflation adjusted lower price but possibly nominal higher price?

Not sure…comments welcomed

Any insights on what an “inflation adjusted lower price but possibly nominal higher price” might look like? How much have the housing prices deviated from the inflation in the last years? Feels like a lot, but now OTOH inflation is on the rise…

I am personally interested in the development in my city, Zurich.

I am not sure if anyone has data, but since there is leverage involved in real estate: Any nominal house price gain (even if there is a real value loss) has a multiplier effect to your downpayment.

So if the cumulative inflation is 50% after 10 years, but your house has only appreciated 20% you have nominal return of around 100% ie: 5x leverage impact, assuming you had 20% downpayment. Despite your house lost value in real terms, your investment does pretty well.

I think the only negative impact for housing market is if we see nominal house prices decline, possibly due to extensive unemployment or huge supply increase due to liquidation of short term borrowers. Possible of course, but not very common.

Assuming you pay an interest of 2%, your annualised return in nominal term is only 1.39%, because you paid 20% down + a cumulative nominal 16% of the original price in interest and you get back 40% of the original value

EDIT : Your real return with an inflation of 4.15% (from your cumulative 50% inflation) is -2.65% annualised

Of course it’s more complicated than this, but if we are talking of overall return including all aspects, then you also save potential rent cost as a return, deducting any maintenance costs. As you need a place to live. That should “cover” the interest cost.

We are talking hypothetical numbers but in high inflation periods, leveraged real estate purchases for a primary residence is rarely a bad investment.

do we know what’s the average loan term left in the population?

… and then go where? I know people who pay 500CHF interest-only mortgages on the silver coast for houses they bought for 600k approx 20 years ago, now it’s worth 3M+. If the mortgage gets triple as expensive, why would they move out for 1500CHF?

Because they can’t afford it?

CHF 500 interest is probably more on the lower side for big homes. Think about suddenly paying CHF 3’000 instead of CHF 1’000, that’s going to be hard for lots of people with only their rent from AHV/pension fund.

you might be surprised. I got excolleagues who had single family homes in Horgen on 500+sqm of land who paid exactly 500 a month (for the last 15 years since they already amortized to 65%).

In his place and if I’m stretched for money, I’d rent the house for 5000, move out for 3000, and move back in when things got more stable.

I did not say that it’s not possible, I just said it’s probably rather exception than the norm.

First you need to find someone willing to pay 5’000 a month, again not impossible, but also not easy. Then you’ll probably pay more taxes when you rent it compared to “Eigenmietwert”. In addition you need to consider renovations, especially in older buildings and last but not least all the hassle of renting out your property. Personally I’d rather sell it and move to a small house/apartment at age 60+, as I’d anywqy would not need such a big house at that age.

I don’t think bigger RE issues and prices drop would be caused from individuals having issues paying interest. After all, Swiss have rather low private ownership %. Rather this would be triggered by institutionals ie pensions funds, who went for RE chasing yields, getting margin calls or so…

Doubt this would be 3% level…

Most people who bought a home recently bought the biggest home they could afford monthly.

Of course Switzerland being a rich country there is elasticity in the family budget and other things can be cut first, e.g. expensive holidays, new car, etc. It however seems too much to deny that a 100% or 200% raise in interest rates will have no effect in prices or affordability…

The interesting thing in Switzerland is that it’s neither a 30y fixed loan nor a 30y flexible loan. So, it won’t blow up like some EU countries (not all!!! just some) but it won’t behave like the US either (which is already freezing).

It all probably depends on the loan ladders people have and if they are enough to bridge the next years.

Not to forget the generational wealth transmission. I am swiss and know only few friend who proudly paid for the home all on their own. Mostly swiss families that have been here for centuries etc, these people end up receiving an advance on their inheritance to finance the home, or even the entire home while the parents relocate to smaller apartments. It happened to dozen of acquaintances. I think some of them may have some margin, meaning the parents could share again a missing 50k as an inheritance advance if really needed to cover for raising interesting and lower evaluations, particularly the one of moved out without directly finance the home.

Please don’t forget that value increases in real estate are taxed under most circumstances when selling the property.

As the gains tax is not inflation indexed, your real returns are much lower. The decrease in the tax rates, the longer you own the property, is supposed to compensate for that, but if there is prolonged high inflation, after tax you may not have much gain at all.