I borrowed this from @ChrisQuinn from LinkedIn. It holds rather timeless advice for those who want to succeed in investing and cannot refrain from holding company stocks.

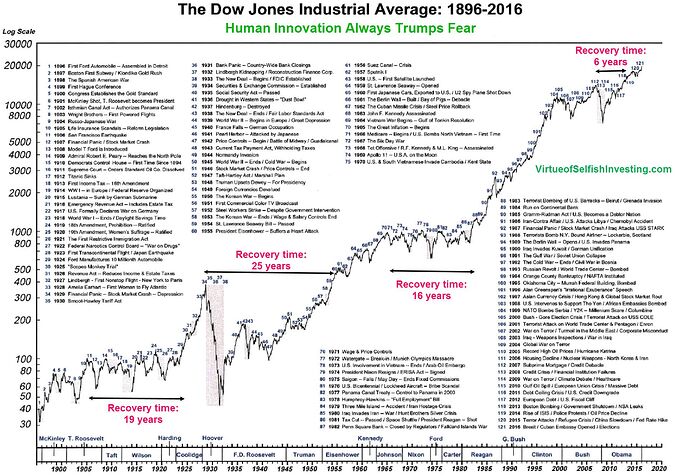

"120 Years of stock market history in one chart

Here are 15 things I learned from 120 years of stock market history:

Lesson 1: Invest for the long term. In the short run, stock returns can be very volatile, but they are very robust in the long run.

Lesson 2: On average, you double your money in the stock market every 10 years.

Lesson 3: In the long run, stocks are less risky than bonds. For 20-year holding periods, stock returns have never fallen below inflation.

Lesson 4: Don’t try to time the market. Time in the market is way more important than timing the market.

Lesson 5: Our world continuously changes. Avoid companies who are highly exposed to rapid changing industry dynamics.

Lesson 6: This time it’s not different. History doesn’t repeat itself. But it often rhymes.

Lesson 7: Let your winners run. Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

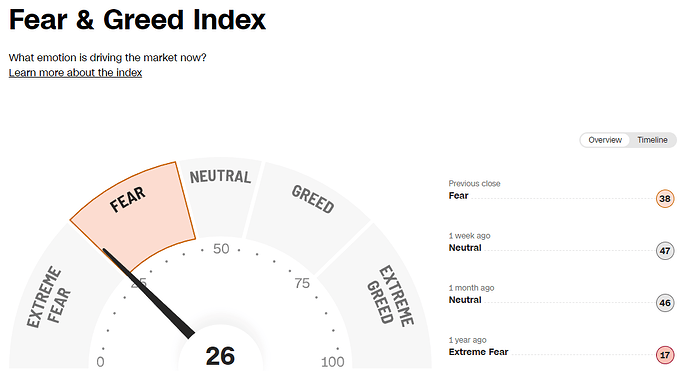

Lesson 8: Low stock prices are great for investors.

Lesson 9: Invest in companies that translate most earnings into free cash flow. Earnings are an opinion, cash is a fact.

Lesson 10: In the long term stock prices always follow earnings growth.

Lesson 11: Look at the equity premium. Over the past 200 years, the equity premium (the spread between the return of stocks and return of government bonds) has averaged between 3% and 3.5%.

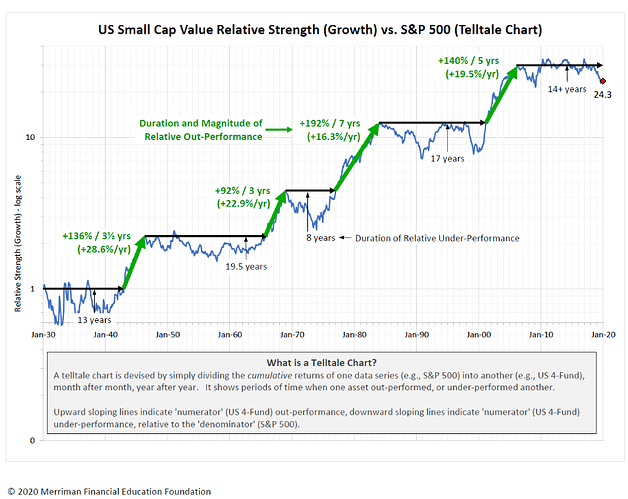

Lesson 12: In general, small cap stocks outperform. Smaller stocks generate a higher return on the stock market. Between 1926 and 2006, the smallest decile stocks compounded at a CAGR of 14.0% compared to 10.3% for the S&P500.

Lesson 13: Cheaper stocks outperform the market. Based on the price-earnings ratio, the 20% cheapest stocks outperformed the S&P500 by 3.2% between 1957 and 2006.

Lesson 14: Do not invest in IPOs. From 1968 through 2000, a buy-and-hold strategy on IPOs underperformed the index in 29 out of 33 years that were studied.

Lesson 15: The stock market is a leading indicator for the economy. On average, the lead time between what happens on the stock market and what happens in our economy is equal to 6 months."