You don’t find this to be too low?

If this trend is confirmed, any strategy will be fine

Well, it seems to be getting less orderly, though soaring is of course still a possibility. I’m inclined to believe a bit less in it than I previously did. (Not actionable, I just wanted to amend my previous statement with the benefit of 8 additional days of hindsight.)

I don’t believe in socialism and I think it will be the downfall of all those countries. It’s an active bet, I know.

What socialist countries are you talking about?

EU countries especially.

done. need more? ![]()

I‘m not a chart specialist but there are some interesting pictures with (death) cross where we see bigger indicators as the 200d EMA been crossed downwards. While I continue to accumulate my monthly VT, I think I will reduce the amount of these and try my luck with some short mini futures to gain some leverage. Does anybody try to do the same (knowing that it most likely does not work out  )?

)?

That is normally not part of my investment strategy but only buy and hold is sometimes just boring

Don’t use leverage. Leverage killed Long Tetm Capital Management, leverage was one of the major issues of the 2008 financial crisis. Always keep in mind that leverage works in both directions and it’s devastating if it works against you.

Compounding a lot of money in the long term is not boring for me ![]()

I know that making money is not boring  but I did that also in the past besides accumulating VWRL and VT as main position playing some site games with mini future, meme stocks and shitcoins. So far the outcome was overall positive. However, it took me some time to investigate etc compared to 10min of monthly effort to buy ETF‘s. It will always be just a small part of the portfolio about 0.2% per trade and only one trade at the time. As a summary I know it’s probably not the smartest solution (guessing it would be smarter to put everything in VT) but I like it and it is fun to feel the emotions which you do not get if you buy and hold ETF (that‘s the point of ETF to not get yourself uncomfortable

but I did that also in the past besides accumulating VWRL and VT as main position playing some site games with mini future, meme stocks and shitcoins. So far the outcome was overall positive. However, it took me some time to investigate etc compared to 10min of monthly effort to buy ETF‘s. It will always be just a small part of the portfolio about 0.2% per trade and only one trade at the time. As a summary I know it’s probably not the smartest solution (guessing it would be smarter to put everything in VT) but I like it and it is fun to feel the emotions which you do not get if you buy and hold ETF (that‘s the point of ETF to not get yourself uncomfortable  )

)

Not sure where’d you see -20% happening?

Not sure either but I checked some charts from growth companies with low earnings like Netflix, zoom, some biotech stocks and they all look quite bad from a chart perspective. I’m aware that if the FED changes the game again that would look quite different but with real inflation and interest raising I‘m confident that some of these stocks will have a hard time in the near future.

Exactly, I fully invest in VTI. I was doing so. As I said previously in the other post I am thinking to switch from VTI to VT this year, I have all there. The main reason for me is to have even more diversification. At the moment I don’t like to have everything in the USA market (rationale for me is the risk to have it in one market, also I think in the long run USA will not be as strong as it is at the moment.).

Also, another member of the forum commented that maybe keeping them and buying another two ETFs for the emerging markets with a lower TER than VT is also a good option (like VWO).

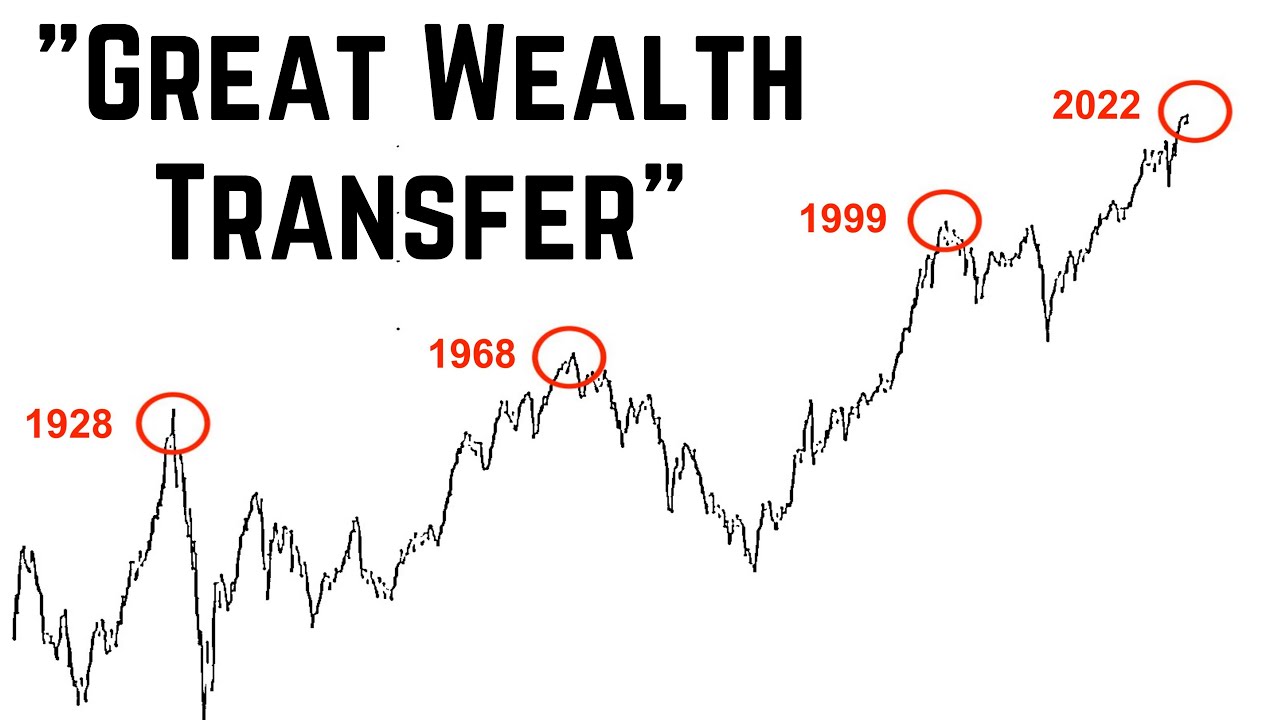

let me share this one here (especially about the “dips” that take forever to reconcile).

I like the guy’s analysis a lot, comments welcome where you think he might be wrong.

And increase the risk of never reaching FIRE.

But also limit your profits ![]() . Here are some simulations from vanguard with data since 1926: Model Portfolio Allocation | Vanguard

. Here are some simulations from vanguard with data since 1926: Model Portfolio Allocation | Vanguard

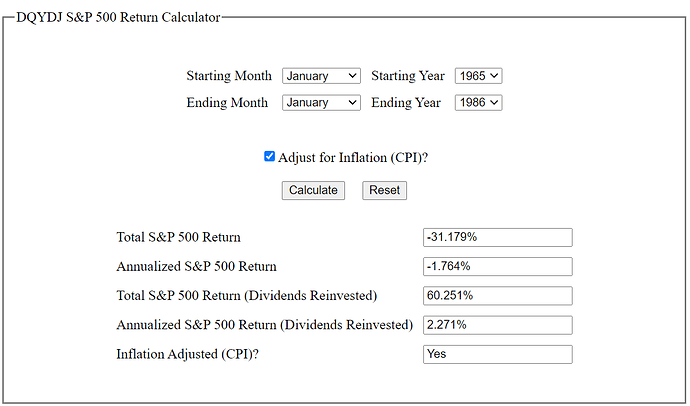

His claim around 6:20 that you had to wait for 30 years to start making money relative to inflation is just wrong. He’s making a typical mistake of looking at S&P price chart while ignoring dividends.

If I look at total S&P return from '66 to '95 I get something like 21x return, while cumulative inflation in that period was just below 5x. (using https://www.usinflationcalculator.com/ and S&P 500 Total Returns by Year Since 1926 for data sources).

And can actually increase the chances of Running out of money in retirement

The trick, of course, being to design a plan we are able to follow. Behavioral mistakes can kill an early retirement plan more easily than a small allocation to bonds.

Better an imperfect plan we can stick with than a perfect one we’re going to drop at the worst possible time.