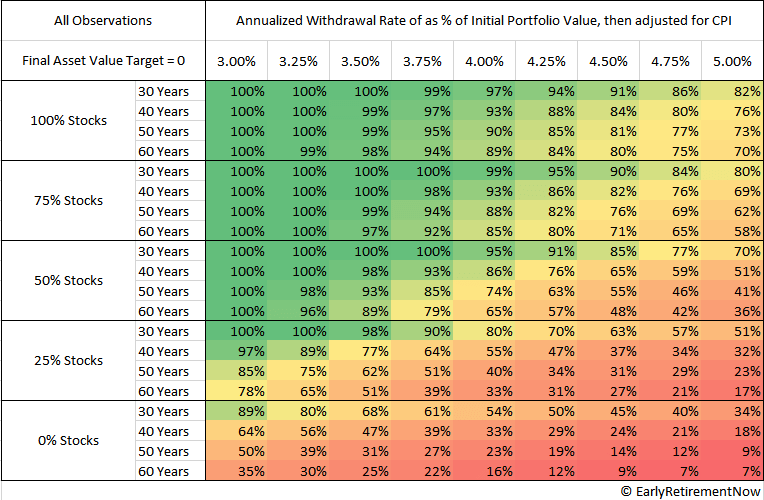

You can compare the results with cFIREsim if you want to double check, though this also seems to be a black box to me. Big Ern came to the conclusion that a 3% withdrawal rate had a 100% chance of the portfolio not being depleted after 60 years if it included 50% stocks or more.

Safe withdrawal rates are usually affected by the worst possible starting years, with the portfolio being likely to grow under more favourable circumstances, which are most of the time. I’m not surprised a 2.5% SWR shows high chances of high growth.