You can discuss it as much as you want. What I personally don’t like is when there are some statements about “active investment” being made and when people are being asked about some quantification of outperformance of their strategy (if talking about past) or how their desired strategy would perform historically, people start to get insulted. Granted, last 10 years or so it was top of S&P 500 that outperformed everything else, so it was difficult for an active investment to outperform. Surely it may change in the future, but don’t tell me that you or any “expert” can predict anything.

True for consumer price inflation but not house price inflation

exactly. property prices (as well as that of stocks, gold and commodities) have appreciated due to near-zero interest rates and QE for years, but this is not the definition of inflation.

QE caused inflation in consumer prices (mostly outside of Switzerland, soon to be within CH as well), but you can still buy a loaf of bread for 3 CHF just as 10 years ago.

Talking of asset price inflation: QE has affected not only real estate, but also stocks to a massive extent, hasn’t it?

Permabear Jeremy Grantham’s talking of an “everything bubble”, doomsday’s looming ![]() My take on that: If everything’s in a bubble, it’s a perfect equilibrium, and that’s the exact opposite of a bubble.

My take on that: If everything’s in a bubble, it’s a perfect equilibrium, and that’s the exact opposite of a bubble.

Any opinions on the Vanguard VAW ETF? I’m considering different scenarios, including investing in commodities as a hedge against inflation.

You do that before inflation starts hitting (i.e. make a plan and set allocation when “times are good”), not after…

I totally agree with the principle, but is it really too late?

The pressure on interest rates, the FED which is going to communicate the implementation of its first rate hike on Wednesday, the use of electricity which is constantly increasing (and therefore the use of copper among other things), the Russo-Ukrainian conflict which seems to be going to last for a while…

I have the impression that there is still a significant upside potential, but it is true that I do not know enough about this asset class…

I know nothing of commodities, but it seems viable if you need a justification for an investment. ![]()

I am not looking for a justification to place an investment. I am looking for understanding and information, from people who have more experience, if my thinking is right or on the contrary totally wrong. The goal is still to make money, not to lose money ![]() .

.

I guess one of the most important things is to first get clear on your goals. After that, you can check which instruments you want to use.

Do you want to protect against inflation? If yes: you already have some sort of inflation protection by investing in world-wide passive ETFs. If inflation gets more serious, the companies in the the index will also raise their prices.

If your goal is mainly to not lose money, then you might want to look at your asset allocation. Or, if you really want to deep dive, you can check the Swensen/Yale story. I only know it very superficially, but he implemented a strategy to protect against downturns. Hint: is not as easy as buying VT and defining your risk/“risk-free” percentages of your portfolio ![]()

So, did anyone lose their patience yet in the last 20% slow-crash? ![]()

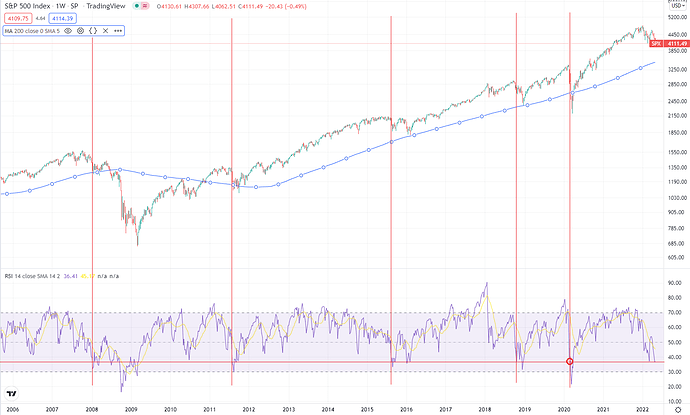

I have looked at an interesting chart lately, weekly SPX, which seems to have touched the weekly 200MA every single time during a larger dip (current trendline coming around 3550), and in crisis mode dipped 50% below that (~1800).

Will you keep buying the dip monthly?

Good note, but you are basing the 50% assumption to one event only…

the dotcom bust was only 38% lower after breaching the 200MA

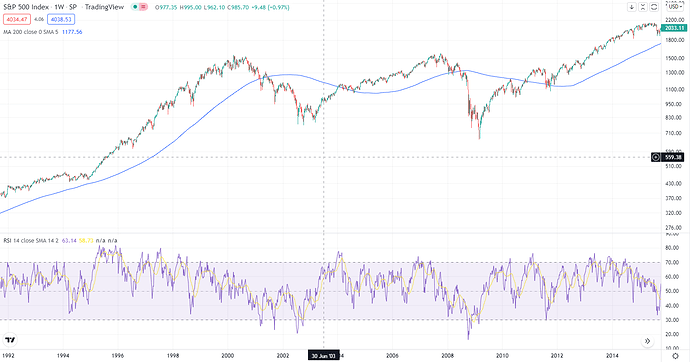

A friend of mine proudly told me how smart his bank advisor is: Since my friend’s investment horizon is ten years, the advisor based his recommendations on data from the past ten years.

They just neatly cut off the 2008 financial crisis…

![]()

Just found a nice post on /r/stockmarket:

From Barry Ritholtz:

- Stock picking is exceedingly difficult: The academic data overwhelmingly demonstrates that the vast majority of Alphas chasers underperform the indices after a few years. After 10 years net of fees, there are practically zero outperformers. And that is just buying – selling is even harder, and stock pickers are terrible at it. We know the names of people like Ron Baron and Peter Lynch and Warren Buffett not because they are typical stock pickers, but because they are the rare outliers.

- Market Timing is even harder: There are many reasons why, but perhaps the most compelling is that the biggest up and down days tend to be clustered near each other. Overbought conditions lead to sell-offs aka (lol) profit-taking; oversold conditions lead to snapback rallies, but the long-term trend is where actual capital gets compounded.

- We are oblivious to our own cognitive shortcomings: Just as most drivers believe they are above-average, so too do most investors believe they can generate alpha. We are over-confident, imagine we can ofrecast the future, and generally have a high opinion of ourselves. We cannot distinguish between outcomes that are the result of luck or skill. Other managers that do well? That’s due to their lucky breaks, but our own great trades / market calls are obviously due to our own brilliance.

- Behavior is the biggest determiner of investor returns. This is the most important point I hope to make today: Do you chase the hot stocks or managers during bull runs? Do you panic and sell during volatility? How investors behave has an enormous impact on their long-term returns – far greater than either stock picking or market timing.

- Consistent average returns turn into above-average returns over time. Howard Marks has discussed why typical managers who finish in the top 10% in any given year underperform over the long haul. They tend to be narrow and specific, and their sector/style/region goes in and out of favor. Bouncing between the top and bottom deciles is not a formula for long-term performance. Instead, consistently achieving a modest target in the middle will eventually turn in top quartile returns (or better).

- Don’t overlook tax alpha: For non-qualified accounts – not 401ks, IRAs, endowments, or philanthropies – managing around your capital gains can lead to enormous improvements in net after-tax returns. Approaches like direct indexing, asset location, and appreciated stock sale planning can yield substantial savings. And, they are risk-free.

- Fees matter a lot: There can be no doubt that high fees are a drag on long-term performance. We do everything possible to lower costs to clients. The obvious and easy thing to do is we use managers like Vanguard, DFA, and Blackrock which are the cheapest in their class for mutual funds and ETFs. But we also do several things with our own RIA fees: Our Milestone Rewards cuts fees by 15% for clients who create and regularly review their financial plan and exhibit good financial behavior. And, we offer a robo-advisor that comes with a dedicated human advisor at less than half of our regular fees.

- Use Tactical portfolios tactically: Goaltender is our tactical portfolio, and it is the only such vehicle I am aware of that refuses to suggest outperformance as a goal. But it serves a vital part of an investor’s plan: It keeps their “real money” fully invested while allowing the investor to feel like they did something as opposed to nothing. This acts as an enormous emotional relief valve.

- Financial literacy requires constant refreshers: Studies have shown that the half-life on financial literacy is quite low. Thus, if you want your clients to understand why you are not picking stocks or market timing, and why you are willing to ride out volatility and drawdowns, you must constantly reinforce the data on this. RWM uses blog posts, podcasts, videos, clients letter, and quarterly conference calls all to reinforce these key notions above.

- Investing is simple, but hard: Nothing on the list is overly complex or impossible to achieve. None of these things require extraordinary skills or ability. But they are difficult to perform consistently, over long stretches of time, without occasionally messing up. The best investment strategy for you is the one you’re likely to stick with. Achieving this requires dedication and commitment, something most of occasionally find ourselves lacking.

Not taking the US specific statements into account but this is a really nice summary IMHO.

Apparently your post of Dec 21 was spot on.

How did it go your strategy so far?

of course it was ![]()

I almost cashed out at the first bear rally, but then I didn’t, so I’m riding the bear. ![]()

Can’t buy property anyway now, so the invested money will not be needed for another 3-5 years for sure.

- I’ve exited my 3a with PostFinance and I’ve regrouped that money into 30% cash, 30% gold and Swiss bonds and 30% minimal volatility CHF-Hedged ETF’s at Finpension

- the other 3a bucket was left in 90% Quality - that kind of lost all the win from last year

I’m gonna step back to growth stocks slowly under SP3500 (all the way to around 2600 where I expect to land somewhere late next year). I’m cautios with when to top up my 3a, probably will go into the first bucket for now.

My strategy is the same as it was 6 years ago when I started - I’m in the global stocks (VT ETF) for the long term.

As always, monthly DCA in a broad world market ETF, and thinking to add a (very) small position in a US Small-Cap fund (for example VB or IUS3).

Hell of a ride this year. My plan really worked out very well for me. I hope everyone got a chance to buy at discount a little more this year ![]()