and SwissRe with their 7% dividend yield.

The worst investment decision I made was in ~2015-2016. I had a position in a tech stock, which has tripped in value. I’ve sold it, thinking I’d take a nice profit and that it can’t go much higher, can it? Today it would have been 10x the original value.

Thanks guys, as soon as you’re done selling your stocks I’m going to buy the s… out of VT ![]()

But honestly: Timing the market (e.g. a recession) just doesn’t work, it’s been scientifically proved so many times. You gotta get it right twice: on your way in and on your way out. Good luck with that!

Again it’s not about risk tolerance, it’s not like I couldn’t bear the 40% downturn, however, if you can avoid, why not avoid it?

Another one of my old mistakes: around 2013, I was thinking about whether to enter the market. I’ve had a look at the historical S&P 500 chart, what I saw was that the price was reaching the peak of 2000 and 2007. According to technical analysis, this were “resistance” points, meaning, that it’d be likely for the price to go down from there. And sure enough, there were enough doomsday predictions available to confirm my point. I’ve decided to stay out of the market.

in an upcoming recession

This is a prognosis, see above.

Did the title get your attention?We’re already in a bull market and heading for a recession in the next 8-12 months. Central banks might try to intervene, but in any case their hands are tied given their massive balance sheets and the fact that interest rates are already low. In addition, the long-term debt cycle points to a natural correction. If the above sounds crazy to you, then move on to another topic and hang on tight to your 7 shares of Amazon. If it doesn’t sound crazy to you…

But honestly: Timing the market (e.g. a recession) just doesn’t work, it’s been scientifically proved so many times. You gotta get it right twice: on your way in and on your way out. Good luck with that!

Nice summary for all the recent posts here.

The worst investment decision I made was in ~2015-2016. I had a position in a tech stock

my soulmate ![]() I sold all tech when Trump was elected. I don’t even dare to post those stock prices.

I sold all tech when Trump was elected. I don’t even dare to post those stock prices.

I would’ve been about a year’s income better…

You gotta get it right twice: on your way in and on your way out.

which is timing the market twice ![]()

what about 1999 to 2010? ![]()

i have the luxury to only time my way in… lol

I wanted to buy when VT was well above 100, now im happy to get a 10% discount, i just buy and buy… thats how we do it, righ? (just like the crypto folks… lol)

Do you have that luxury because you received a larger amount which you didn’t want to invest?

And do you have a plan when you buy? I mean certain numbers, how much to buy?

It’s one thing to buy and buy, but one day you’ll run out of ammunition. And what if VT keeps falling further?

I wouldn’t compare it with crypto (I know, it was more of a joke) - with VT you at least get some dividends, and it won’t get rekt magically (like so many crypto scams) ![]()

Do you have that luxury because you received a larger amount which you didn’t want to invest?

And do you have a plan when you buy? I mean certain numbers, how much to buy?

It’s one thing to buy and buy, but one day you’ll run out of ammunition. And what if VT keeps falling further?

I got some money at the end of last year but i did not feel “safe” throwing it all in. Its less than 10% of my NV so i don’t feel too bad, even if it drops further. In that case i could just buy more and average down?

In that case i could just buy more and average down?

Yes, I get that. My question is: how much are you investing (percentage wise) of that amount, and which buy prices to you have? E.g. let’s say VT goes down to 90 USD. Are you investing 10% at 93, 92, 91, 90? I’m curious about your targets.

Only like 10% of investors (private and professional) beat the market over the last 100 years.

So even if VT falls, the likelihood is quite high that you would underperform VT when picking stocks / adjusting accordingly.

So even if VT falls, the likelihood is quite high that you would underperform VT when picking stocks / adjusting accordingly.

You misunderstood my question ![]() I was more interested in his approach about when and how to invest in VT. I’m not talking stock picking.

I was more interested in his approach about when and how to invest in VT. I’m not talking stock picking.

[…] occasionally you might miss some great opportunities etc. but through that you can avoid that in a recession your portfolio goes down 40%.

[…]

Again it’s not about risk tolerance, it’s not like I couldn’t bear the 40% downturn, however, if you can avoid, why not avoid it?

Basically what you are saying is that you don’t need the extra profit and would welcome avoiding downturns.

You seem to have a high risk tolerance and a high risk capability, so the discussion is indeed not about risk tolerance. It’s about the risk profile of your asset allocation being out of sync with your investing goals.

Also, some people recommend increasing liquidity a lot right now, e.g. by holding around 20% cash or so. If then, markets go down, you could use that money to buy cheap stocks and profit from the upwards trend.

Market timing.

Yes, I get that. My question is: how much are you investing (percentage wise) of that amount, and which buy prices to you have? E.g. let’s say VT goes down to 90 USD. Are you investing 10% at 93, 92, 91, 90? I’m curious about your targets.

since i would fail at timing the market i DCA from here so that i invest my sum over the span of a year (so about 8-10% each month?)

since i would fail at timing the market i DCA from here so that i invest my sum over the span of a year (so about 8-10% each month?)

study the dotcom bubble and the 2007-2009 crisis, especially duration and recovery times before you start to buy in into a long-overdue recession with a 10% monthly amount.

study the dotcom bubble and the 2007-2009 crisis, especially duration and recovery times before you start to buy in into a long-overdue recession with a 10% monthly amount.

Well my allocation (Based on my NV excluding RE) at the moment is somewhat 70% cash.

The amount i planned to invest/i got represent 12% of my NV. So the 10% monthly represent 1% of my NV. This will not change much at my cash allocation, and i start to feel bad having that much cash lying around with no “plan”.

i start to feel bad having that much cash lying around with no “plan”.

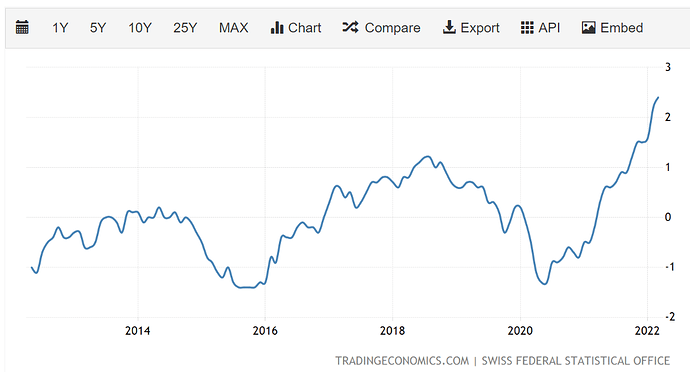

It’s actually not lying around. Its value is being reduced by inflation.