There’snot a mustachian approach, we follow rhe same investment principles as non-mustachians.

To be fair, O.G. Mustachianism (the Mr. Money Mustache (or MMM) version) would have been 100% stocks with a 50%+ savings rate, very low expenses (no fancy pants allowed whatsoever) and a very heavily handyman approach to life that can be used to productively gain money if the worst happens.

Pete Adeney (MMM) is very positive in regards to the “long term” prospect of stocks, which is not always warranted. I would be more conservative, especially when in the withdrawing phase of the life of my investments. To me, the Bogleheads’ approach to investing trumps MMM version by some margin, that is: determine an asset allocation you can follow through whatever happens, use low cost funds/solutions, buy the haystack (the whole stock market) and stay the course.

I use net after tax income + the savings part of my 2nd pillar (Including the employer’s contribution, both for the savings and income part of the calculation) to compute my savings rate. I could see using gross before tax + 2nd pillar, since higher earners have an easier ability to save a bigger proportion of their salary, which would then be countered somewhat by higher taxes, so it would even the field a little bit. My logic is that, like most things finances, savings rate are often talked about in a US centric context and they do count their 401K/403b contributions for it.

Incidentally, I also account for my 2nd pillar in my asset allocation (accounting for it as bonds).

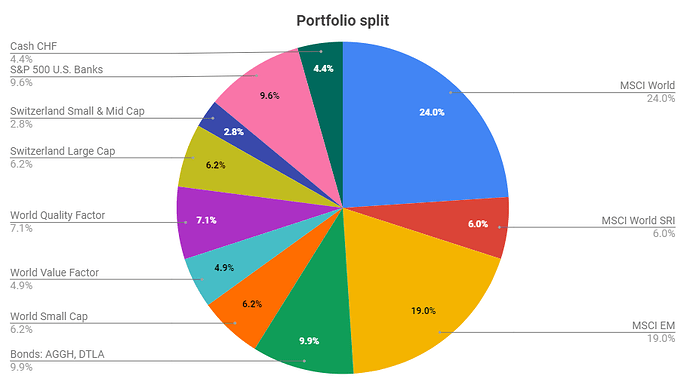

Huh! You are a big fan of US Banks… With all that World factor funds, I wonder what is your exposure to JPM for example ![]() .

.

Not a fan of US Banks, but it was a small personal bet I did, when all banks dropped heavily a couple of months ago. I have a 12,6% return on that one and will probably close the position sometime end of Q2 '24.

AGGH is a EUR-hedged Global Aggregate Bond ETF, correct? Do you have a particular reason for the EUR hedge?

Absolute no reason, just that most of my portfolio is bought in EUR, also accumulating ETFs and it was just easier at that time. In my opinion, hedging is not worth it when you are in this game for a long term, but this is the topic of another thread ![]()

Bond ETFs should always be hedged but I would hedge it in my spending currency which would be CHF.

See: Currency Royale - Should You Hedge Your Bonds? (bankeronwheels.com)

I use bonds as ammo for buying stock. I load up with bonds in periods like this year and I sell them and buy stock when they go back up. Which is also when (theoretically) stocks should go a little down.

Off topic, as you already state, but I agree: hedging isn’t worth it for long term investors.

(thus, IIUC, I am only slighty confused about why you still hedge? It seems like a short term bet as you prefer to avoid shrinkage in your dry powder keg at the expense of paying the insurance premium if the short term FX bet goes against you?)

Moderators, if you are still reading, please fork this off to the Hieronymus Bosch themed light hearted discussion section for slightly differing asset allocation opininion (esp. regarding hedging) sections, see below pic for easy guidance on slotting into the appropriate section:

Maybe more generally on why hedging is IMO a money losing stratey:

Hedging is paying for insurance. Insurance by intent and on average benefits the seller of insurance, not the buyer.

If you buy a hedged instrument, you’re the buyer of insurance.

And then finally speculating on why hedging, despite all this discouraging evidence, is still so popular … (IMHO):

-

Insurance sellers (financial institutions) on average benefit from selling insurance, so why not promote it?

Aka:

Customer (C): “I would like to invest in a low-risk-high-return thing.”

Bank (B): “Well, we have this incredible investment product X.* We expect super high returns. There’s risk Y, but we can hedge against the downside of unlikely event Y occurring, really a very low probability event.”

C: “Uh huh?”

B: “So, to be on the safe side, we can hedge against this Y event. Here’s the hedged product X^2 that does just that. If Y occurs, your bet on X is completely safe. In fact, it goes up!”

C: “Ok, I’ll put all my money in X^2. Make it happen now.”

B: “There are still risks associated with product X^2, please see the fine print on this cute leaflet.”

C:

B: “Please sign here.” -

Most professional asset managers benchmark their funds to indices. Hedged funds benchmark to hedged indices.

They prefer giving up potential outperformance to avoiding losses (relative to the benchmark) which seems completely in line with the “loss aversion” preference of most retail investors (augmentend, in the case of professional investors, by bonuses tied to the performance relative to their corresponding benchmark).

It’s probabyl a little more complicated than that, but not much, IMNSHO.

Summary:

If you’re really not comfortable without a currency hedge, perhaps just stick to assets denominated in your preferred currency? No insurance premium money shelled out to the usual suspects.

Otherwise, accept that you’ll shell outmoney for those insurance contracts called “hedges”. I’m personally mostly on the other side of your hedge contract, so your choice is fine with me.

* Any resemblance between “X”, the placeholder in this post, and X, the social media platform taking over the world akin to Tesla, Space X, the Boring Company, Neuralink, etc, is purely coincidental.

@Your_Full_Name We need you here more often on Fridays ![]()

![]()

Sorry, but 1) I consider this thread to be “Coffee” where everything within the common civilized limits is allowed and 2) currency hedging is one of the second-rank recurring topics of this forum. If you find an appropriate topic to transfer this discussion into, I will do it.

All in all this topic for me is a sign of boredom among the forum members and an indicator that things go smoothly without unexpected swings to positive or negative side.

I was able to resist for an epic 30 seconds before deciding I’d reply anyway after I googled ‘hedge thesaurus’:

And of course there is a counter party that takes a premium: it’s the spread your FX trader has on the currency pair, wether it’s a spot exchange or a forward exchange contract (which is typically used for portfolio hedging).

The foreign exchange market is by the way by far the largest market in terms of trading volume.

Anyway, I feel we’re just debating terminology. Good luck with your bonds, hedged or not!

@Dr.PI I feel caught …

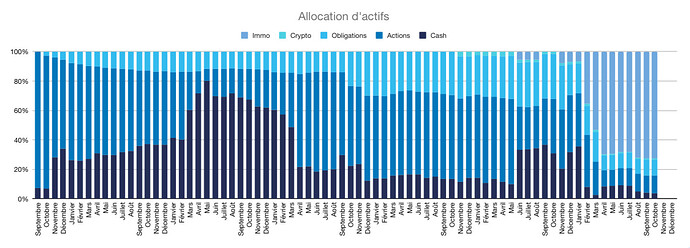

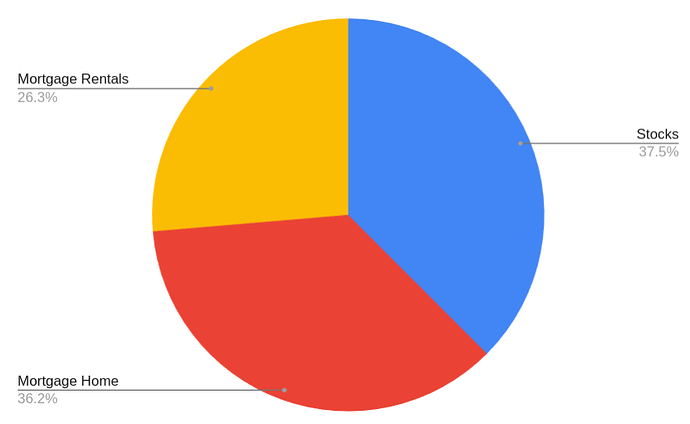

Please find below my current und historical asset allocation

I do account for the full price of my real estate and not only the equity part as the goal of my asset allocation is to monitor my exposure to the different asset classes.

I see no logical reason to account only for the equity part of the house since the price variations apply to the whole house and not only the equity part. This results currently for me in an overweight exposure to real estate, which I will address in the coming years.

Feel free to share your rationale as why you only consider the equity portion of your real estate in your asset allocation as I am not 100% sure that I am right about this ![]()

Probably because it’s too hard to represent being negative cash (mortgage) in those graphs ![]()

I’m doing it the same way you do: using market exposure for asset allocation purposes and considering the mortgage as negative cash (if Saron rate) or negative bond (if fixed term rate), for the reason you state (returns are tied to market exposure, not raw equity) and because with its interest rate, the mortgage does behave like a negative bond/cash.

Similarily, I represent:

- stocks/bonds bought on leverage as per the exposure they provide, with margin loans (or leverage included in futures, options) as negative cash (I don’t buy leveraged ETFs so am not sure how I would handle them but probably like I do leveraged derivatives, so considering the built-in leverage as negative cash)

- short stocks/bonds as negative stocks/bonds exposure.

- loans of any kind as negative cash or bonds depending on how the loan is structured.

On needs to be careful with offsetting liabilities and assets against each other in the same graph. Else shorting Tesla for 100% and buying Microsoft for 100% leaves you with an allocation of 0% (and 100% in maybe cash that sits there for counterbalance). This would be clearly misleading.

Maybe a SARON mortgage will be somewhat close to negative cash. Still you can’t exit it and the return is also not the same (spread between retail credit and debit interest). This last part also applies to the very flexible margin on IBKR.

It sure would but if one is dealing in individual stocks to a meaningful extent that doesn’t make them broadly diversified, my opinon is that one should monitor them beyond a simple “stocks” moniker.

Edit: on interest rates on cash: money in a checking account yielding 0% and in a savings account yielding 1%+ both qualify as cash. There is a certain margin for variations in yield regarding cashlike instruments. Cashlike properties, to me, are liquidity, absence of default and market risk (when used domestically). Your point about SARON mortgages is right: I should probably account for the part that can’t be amortized discretionary as a negative bond rather than negative cash.

I guess you could do 2 charts: one shows long portfolio, the other the short portfolio.

New thread: What’s your liability allocation? ![]()

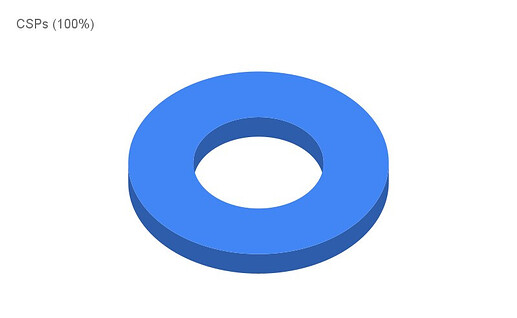

though it might be better to do a double donut chart to show the proportion of assets to liabilities clearly.