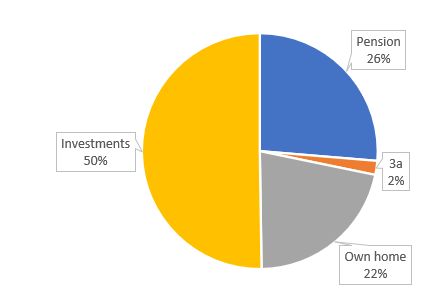

Easier to visualize in a chart. Here’s mine:

As you can see, pension is too low. I plan to double it in the next few years by shifting part of cash/bonds/stock portion into it.

Investment account is 100% stocks. Pension is 25/75 stocks/bonds.

Easier to visualize in a chart. Here’s mine:

As you can see, pension is too low. I plan to double it in the next few years by shifting part of cash/bonds/stock portion into it.

Investment account is 100% stocks. Pension is 25/75 stocks/bonds.

I’ll one up you:

Two people did not understand the assignment ![]()

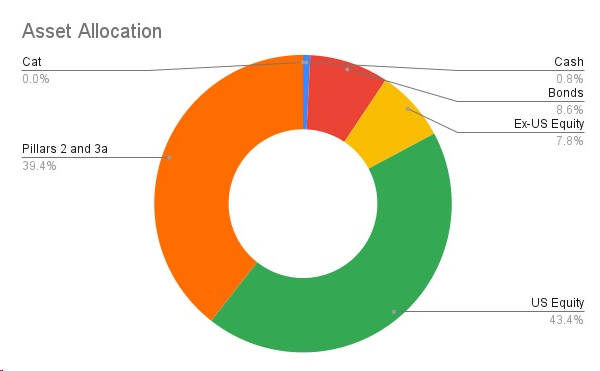

Quick and dirty version.

Investments are ETF with more or less MSCI weighting.

Own home is what I put in.

I exclude some 0.03% in physical gold in the chart. It was a gift.

Question to those who added their home in the chart: do you use as number the full price you paid for the house (e.g 1mio) or do you use the price of the house minus the mortgage (e.g. 0.2mio)?

I just count gross assets at market value (excluded all debts). I don’t state stocks and shares at purchase price either.

I conclude you don’t work on the sell side (“Number Always Goes Up!”) or you’re well able to separate your work persona from your non-work persona. ![]()

Complicated way of congratulating you on your conservative valuation approach.

Stocks == IBKR + 3rd pillar accounts.

Bonds == 2nd pillar.

Part of cash is in a savings account at wiLLBe.

@Your_Full_Name To people I know and trust with the business they are doing.

What are “Personal loans”? Loans you make to people you know? Or to people you don’t know, but via some securitization way to put money into? Something entirely different?

Sorry in advance if the answer is obvious.

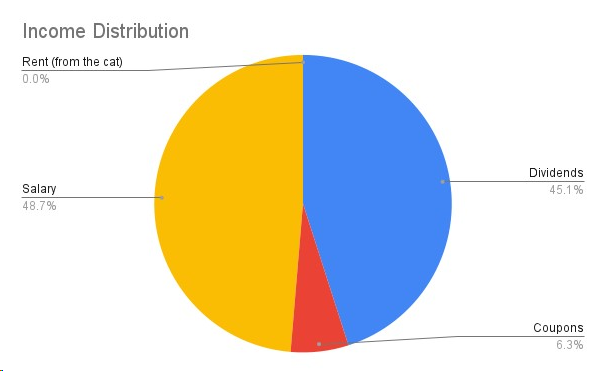

This is our (my girlfriend’s and I) asset allocation. A little clarification on the LPP. This is our first year of real contributions. Before that, we had a bunch of internships or fixed-term work contracts for several months with little pay. That’s why there isn’t a lot invested in it and it’s likely that this part will never exceed our combined 3rd pillars.

Last update was on 31 October 2023 :

Throw-away account.

A bit different format.

And I already included Dec 23. Should be quite accurate if the market doesn’t crash or jump crazy.

What’s LPP? What’s LPP?

you get rent from a cat?

It appear the cat lives rent free ![]()

Oh sorry, it is the 2nd Pilar ![]()

Thanks for asking!

The rent is admittedly securitzed via a structured, somewhat complicated derivative, a new and revolutionary MMTR (Mice Meat Total Return) no barrier basket financial instrument* … but … in short, yes.

* For details on how we’ll pull you over the table with this derivative product, please see the prospectus (including the fine print).

Close, but no cigar.