Right, so that was a classic value play, congrats (I mean it!).

Yes, I guess at heart I am mostly a value investor. Though no congratulations are in order. Anyone putting 40% into FAANG or bitcoin would have done much better!

Do you find option buyers for these Swiss stocks ? Which duration do you usually target ? I do not see any action (bid/ask)…

- There are probably millions of combinations that “would have done better”. Who cares?

- Option writing may give you some limited additional cash flow, but missing out one single move in a decade and all that money is gone. Like in my case AVGO,CAT, EMR, ABBV, and that are just some quiet conservative dividend stocks. Risk has two faces: the money you lose and the money you don’t make. The losing part is probably less important, as you can only lose 100%. Option writers often ignore the more important risk, the risk of missing out.

I still believe having the conviction to pick a wrongly (?) undervalued stock and putting money on it is harder than going with the crowd. Everyone knows the FAANG stocks!

That said, I painfully get the itch of having had something that’s run well, especially if the value becomes big. I haven’t had the guts to bet big on anything, I think it running well could erode my willpower a lot faster than ups and downs in the all-world ETFs I put my money on. Hell I put 10k on TQQQ at a good time and it’s done 40% for me to date. If I didn’t have a planned strategy to follow (200SMA +/- 1-2%) I’d have sold already to realise the gain. Better a bird in hand etc.

I’m looking at a TQQQ graph, putting 10k at inception would run up to 2mn, then down to 400k, then up to 2.4mn and counting. Who the hell can hold that, I don’t know.

Narrator: “How to respond with two paragraphs (plus lengthy footnotes) to just two sentences from @Mirager …”

Mincing words:

There is no “wrongly” undervalued stock. The market is always right, especially when you want to sell (or buy) at a given point in time. It’s just the way it is.

Doesn’t mean I might have an opinion that the market might value something differently in three years or five years[5] … or maybe even longer.

I’m still very convinced – and I put my money where my mouth is – that the so-called “wrongly” valued stocks will eventually return to their fair value, it just takes at least 3-5 years, maybe more.

On “going with the crowd”:

I personally feel it’s harder for me to go with the crowd. Probably a mix of reasons for me.

Two important ones:

- “the crowd” doesn’t need to live off its portfolio (some do, the majority probably does not? At least not at my tender age of 1650) and can therefore afford a just 1.12% dividend return of something like the S&P 500.[SPY]

I also understand there’s a bunch of 4%-rulers on here who would argue differently, but I guess I’m just different than the (4%) crowd from that perspective.

(“Contrarian” would be my fancy label if you cared about words/labels )

) - I forgot the second reason. Must’ve been an important one … oh, wait, I remember! The “index” (pick yours) contains some great FAANG companies.[7]

Unfortunately, that index also contains some real headscratchers.

Do I want to own these because the crowd seemingly wants to own them? No, sir.

Or, maybe more nuanced:- Do I want to own them? Hell yes, so I can sell them to buy more sensible stuff.

- Do I want to buy them (at current prices, which is what I will do with buying an index)?

Uh, no, thank you.

5 Buying then already slightly undervalued Altria in March 2019 would have made you essentially no nominal money until five years later (probably negative in real terms).

That’s five years of your conviction being tested right there.

Of course, if you had the guts to continue believing in Altria’s value despite having made no money on it for five years, you would have made a somewhat acceptable (total) return just about 16 months later …

Further of course: if you're living off the cash flow produced by your portfolio(s), living with a dud like Altria through many years of price decline makes things much easier. ;-)Bank of NY Mellon is a another example where holding a seemingly undervalued company for five years might test your … ahem, conviction.

Bristol Myers is one that is still testing my conviction …

(They stay on the team because they keep producing and raising their cash flow paid out to me)

[SPY]

[7] They moved on to term Mag7, BTW, but I believe the latter will soon be replaced again as it also contains at least one turd. I’m an advocate for the new term to be “Mag6 + ![]() ”

”

Great post.

Indeed I don’t care if I am with or against the crowd when opening a position in my mechanical dividend strategy. However, I have the market dividend and the dividend re-investing part of my strategy that is purely contrarian.

I don’t care because there is too much randomness anyhow, nobody knows the future and what is common knowledge is already priced in. The longer I can hold the bigger the chance I make money. So I concentrate on things like cash flow and debt when selecting stocks.

I live off that strategy for more than 11 years now, seems to work. Since 2014 the CAGR is 10.55%, but I made some important changes in 2020 and since then the CAGR is 13.19%. That is with tax and debt interest already discounted. The main change was that I did not wait 2 years before selling any longer since 2020, lost a lot of money there… was a stupid rule.

My mechanical dividend strategy is a rare mix of value, carry, contrarian and momentum investment. Yes, they do not exclude one another…

- Value: I don’t buy if the enterprise value is too high compared with free cash flow. There are some more parameters…

- Carry: The dividend yield must be 2% or higher. Is not much, but man, it can grow…

- Contrarian: Dividends and market dividends are invested in positions that are still on buy and less than 4% of portfolio value. Market dividend is a stock reaching 6% of portfolio value and it will be sold down to 5%. Buy low, sell high.

- Momentum: This is only for not selling. If a stock that would be sold is in the better half of momentum I keep holding. Whatever gets expensive can get much more expensive.

You can find the complete rule set in my mechanical investment thread.

Yes, no sale without a buyer. My durations are generally not extremely short as that would further inflate the number of trades. Mostly 3-6-9-12 months out, sometimes 2-3 years out. Premium % of strike price plays a role (i want trades which generate a material premium) but also balancing (for multiple quarter ends out) potential cash inflow (having to deliver) vs. outflow (having to take ownership) so I’m not exposed too much.

I understand your point and yes this has occasionally happened to me. However, it’s a one sided point.

Selling call options locks in the premium (upfront) and potential sales price upfront. I’d argue that it would be a sales price i should sell at even without a written call.

That stock may rise further afterwards… but so may there be an opportunity to get gains on using the funds from delivering on the call to invest in another stock (e.g. with a written put).

Besides, the stock may rise… but also drop again.

I worry less about missed opportunities as that would never end.

You missed out one (or more than one) single move in a decade and all that money was gone, but you still think it is a one sided point? You probably still did not in this case…

I am in the stock market for the big gains, accepting the risk. Accepting the risks and forfeiting the big gains is not for me, sorry.

I understand your points and I probably have read every book written about option strategies. Still I think option writing is picking up pennies in front of a steamroller. Because you just cannot ignore the risk of missing big gains in a position you are in. Ignoring that risk however is very popular among option writers.

You refer to missing an opportunity… but you assume you would have grabbed that opportunity in the first place which is speculative to say the least. Stocks with upward volatility can also be downards volatile.

My point: stock is at 100, sell a call for 120, get dividends, get option premium and I might get a 20 gain if I have to deliver and then I can reinvest all this into another stock where at that point in time I see more upside.

Your point: wait a minute, what if the stock winds up going to 140? 200? Well

- I upfront sold the call in the first place because I wasn’t expecting that to happen

- Had I not sold the call it’s not unlikely I would have sold the stock at 120 given above so might as well sell the call on top

- Even if the stock had increased to whatever value above 120, it might have resulted in no gain if the stock drops again and of course the opportunity cost of other stocks having passed me

I get it there are categories of stocks where there is much more potential for vast gains. In those cases I’d sooner either buy the stock OR buy calls OR write puts (and rewrite and rewrite) to get income stream (in the latter case) while putting zero capital up. Generally, i only very rarely buy options so it’s buy the stock, sell a put or sell a call for me

I am curious if your conviction is consistent in the sense that your logic would seem to point towards a high level of comfort with a very, very concentrated portfolio whereas my approach is a bit more diversified with many ‘small’ gains adding up.

many ‘small’ gains adding up

Exactly, picking up pennies in front of a steamroller. While, at least, you don’t know exactly how much you are missing because your capital is bound.

The risk of losing is always there and visible. But the risk of missing out is not that obvious and therefor is, as I said, ignored by many option writers. You need hundreds and hundreds of those small gains just to make up for one missed big gain. And there are many many big gains in the stock market, more than statistically can be explained. One 2’000% gain missed and you need a decade of option writing just to make up for that.

Your example shows this. You have to keep holding a stock and you miss whatever your capital would have made at other places. That may be much or not that much. But you never will know and that seems to be enough.

Your logic extended implies that your stock portfolio should consist of 1 single stock (your highest conviction choice) because any diversification surely would limit your returns…

consist of 1 single stock

No. There is statistical evidence that a diversification of 25-50 stocks reduces volatility, but adding more does not. I think the sector is more important and diversify sectors.

True, you may miss something if you compre that plan to the thousands of holdings of the holy grail. But this is compensated more than enough if you catch one singe big gain and by the fact that you leave out all the dirt.

No. There is statistical evidence that a diversification of 25-50 stocks reduces volatility, but adding more does not.

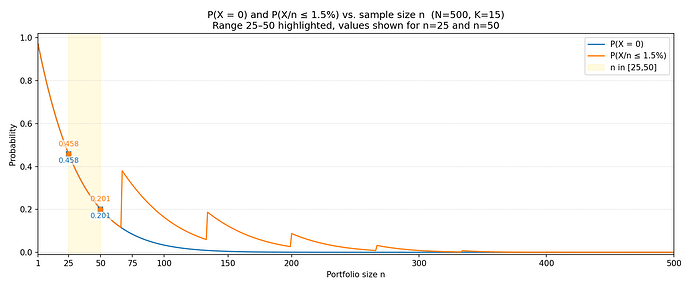

Felt like playing with an LLM and plots for a while today.

Assuming N=500 stocks (lets say S&P 500) from which K=15 (3%) are the big out-performers, what are the chances of ending with 0 of the out-performers when you construct a portfolio by randomly picking n=25, 50, … of them?

Also plotted the probability of ending up with a portfolio with less than 1.5% out-performers. (There are some spikes there due to 1.5% resulting to less than 1 stock in small portfolios but you get the picture)

Important: This does not disproof your statement about volatility.

It just shows that with small portfolios there is high chance you miss the big winners that make the total return positive.

Of course one can be super lucky, get all the winners and miss the big losers ![]()

![]()

The SP500 is maybe not the best example, as it is already picked stocks by a board. Maybe the holy grail with 85% of all world stocks would be better for comparison.

And of course as almost always, position sizing is the key. If you have all winners, but only 0.0001% of your money invested there, your gain is close to nothing. Because the position sizing is done by market cap.

So with less positions you pick less winners and less losers, but you pick them with more money. The key point is to avoid the “obvious” losers with rules, that is what I do. Winner take care of them self.

The SP500 is maybe not the best example, as it is already picked stocks by a board. Maybe the holy grail with 85% of all world stocks would be better for comparison.

Sure. I had another plot with 5000 stocks but didn’t published it as the results were more or less the same.

And of course as almost always, position sizing is the key. If you have all winners, but only 0.0001% of your money invested there, your gain is close to nothing. Because the position sizing is done by market cap.

![]()

So with less positions you pick less winners and less losers, but you pick them with more money. The key point is to avoid the “obvious” losers with rules, that is what I do. Winner take care of them self.

Actually it is more important (and difficult) to include the big winners VS to exclude the big losers, because the distribution is skewed (positively, negatively? I am not good at this ![]() )

)

Losing e.g. the top 3% is far more impactful VS including the worst 3%. No sure, does it makes sense what I am saying ![]()

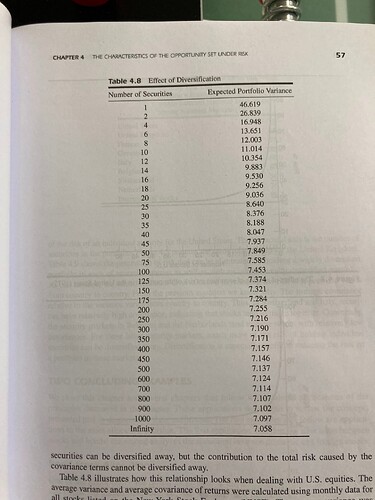

There is statistical evidence that a diversification of 25-50 stocks reduces volatility

From the MPT textbook:[1]

The average variance and average covariance of return were calculated using monthly data for all stocks listed on the New York Stock Exchange (with data from the 70s, I believe).

1 Elton, Edwin J., Gruber, Martin J., Brown, Stephen J., Goetzmann, William N., “Modern Portfolio Theory and Investment Analysis,” Wiley, 9th Edition, 2017

So, up to 40 is more than enough, and one could get away with 20 and capture most of the diversification premium (=volatility reduction) then?

My favorite high dividend yield stock is BRK.B.

For me the statistical (volatility) data is more an argument of having at least some amount of stocks to smoothen volatility – unless you’re Charlie Munger[CM] – and not necessarily an argument to limit yourself to x number of companies but not more. Peter Lynch used to have hundreds of companies in his portfolio.

Maybe I want to have more stocks, but I’m not motivated by less volality. If I have, say … (checks stockpicking portfolio) … 96 companies in my portfolio and I come across something else that I potentially find interesting, why not add it to the portfolio once I’m convinced it’s a good investment?

YMMV, of course (especially if you’re Charlie).

CM “The whole secret of investment is to find places where it’s safe and wise to non-diversify. It’s just that simple. Diversification is for the know-nothing investor ; it’s not for the professional.”

— Charlie Munger