I think typically everything sells off. Just look back at covid times. Even gold sold off briefly before running u p.

Invest monthly in IUSC at Degiro

Invest monthly in SPICHA at Degiro

Investing in some Swiss and US stocks

What is your target allocation between S&P500 and SPI?

I support your breaking the contract. I did it too, after 10 years, and it was painful. It helped me expose an abysmally low annual return which most likely would not have reached the projected value they baited me with. I have since more than made up for my loss!

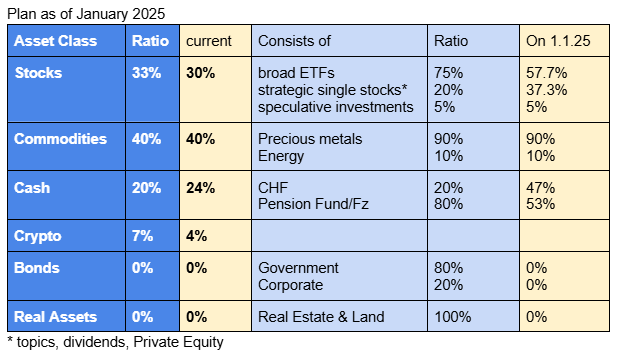

I just finalized my asset allocation for 2025. There are a couple of gaps I need to address

- Direct cash to BTC

- Sell “strategic single stocks” when in the green and buy more VT-type ETFs

- Use whatever surplus for even more VT-type ETFs

- spend pocket money on speculative stocks (this part I enjoy most)

IUSC 70%

SPICHA 25%

Swiss and US stocks 5%

![]()

What does energy commodities investment mean? Hopefully energy companies rather than futures?

Actually you’re right, it did lose a good chunk in all big drops (2000, 2008, 2020, 2022). Oh well, more opportunities to buy more.

What trading platforf do you use to buy TQQQ?

I think if you zoom out a bit 1.1 has been long term average. I think CHF would gain but I would not wait

Energy is a bit of a misnomer. The following stock/ETF are in there:

- Anglo American

- Glencore

- Gazprom

- ITM Power

- IXC ETF

- Rio Tinto

Very interessting and clear view ! Thank you.

Can I ask you why you mix Precious metal with Energy ? This line “commodities” in my understanding, is to secure your portfolio no ?

Another question : you haven’t planned to invest in real assets like real estate. Why ? And if one day you will do it, how can you “count” the value on this array ? (market value less mortgage?) ?

It is available on Interactive Broker for example

It seems (for many) that we are at the end of the cycle, with one possible last leg up, but ofc if you are in for the long run (like ETFs or whatever else you believe will go up), it doesn’t matter

Commodities are to me what’s ripped out of our earth’s mantle. I didn’t want to call the subcategory “fossile fuel”, what it probably is nowadays. There used to be Uranium (URA ETF) in it. ITM, Glencore and Rio Tinto have a few other natural resources it takes to make, use and store energy. I take after Lyn Alden and others who believe that the energy transition was declared a bit hastily and that it is going to take much more time than originally anticipated. Hence this topic in my asset allocation.

I used to own houses with my ex, so real estate is still very present in my thinking, as are the prices from 20 years ago ![]()

Having my whole wealth in liquid form allows me to quickly deploy capital wherever I seem fit to generate returns. At my age, a home would have to able to appreciate or to generate some income. At current prices and global debt levels, this is not a given. Yes, I would calculate a market value minus the liabilities to follow the same style as with unrealized gains from the stock market.

Sticking to the plan.

Monthly additions to my main ETF via IBKR. 5% also in BTC

Sticking to the plan is the best idea. I will do that, even if it starts to get boring. Investing is not to entertain me but to make me money. ![]()

I use my two mechanical strategies as I did many years and as I probably will as long as I can.

We are inside an already long-lasting bull market in stocks, nobody knows when it will be over. That means my “growth-momentum” strategy hardly finds new stocks to invest in. But that is OK. There still are some that I can buy more, double down, if my money management tells me that I have to invest more. My money management is based on the actual value of the portfolio, the minimum value of the actual portfolio value and the value at buy time and the difference of the SP500 to it’s last high (which is close to zero at the moment). That means I have to buy more only if the SP500 goes down or if the system tells me to realize gains.

Now, my mechanical dividend strategy was always boring. But I live off that strategy, so it better stays boring. The only real action there is the “crash recovery” that takes place in bear markets. I think next week there are numbers for DOW, a stock that is with me since over a decade, more than 40 nice dividends. But if the stock does not fulfill my criteria any longer it will be sold and the money will be distributed to all stocks still on buy that are worth less than 4% of my portfolio. The Dupont merger and separation probably left DOW in a strange state and the numbers may rise the risk for me. Does not have to be a problem at all, but my objective is to hold as long as possible but not longer. And if the risk rises my strategy commands me to sell.

Details about my mechanical strategies and a complete description of the dividend strategy here:

I’m starting to get these thoughts that if the US really start to act on some of the Trump ideas, I may pull out completely from USA due to ethical reasons etc.

If they take Greenland by force…I cannot possibly be a US stock owner, is already difficult to see the Tesla position in my index…

So my 2025 strategy is going to be: if the US start annexing territories by force, starts implementing true fascist policies etc I’ll act on the portfolio. I don’t want to make money out of it. I may get back into USA if something changes in 4 years. But I don’t want to make money from a country attacking Europe (Denmark).

I will leave this post, as it expresses a personal opinion and actionable goals, but any escalation and politization follow-up posts will be removed.

I understand

But I also think we should see this as an investment risk too.

Lot of our assets are tied to USA. And if US becomes unfriendly to EU then there is a potential loss. Right?