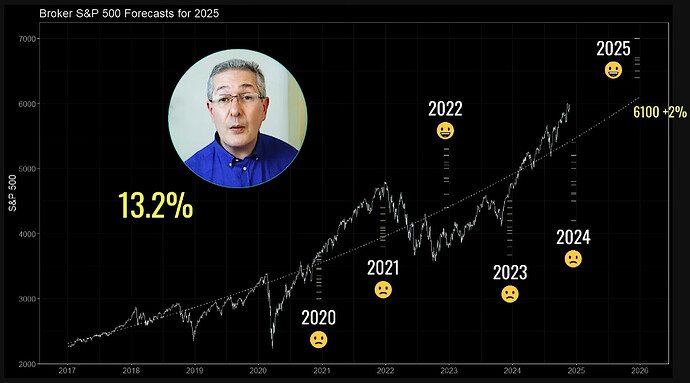

@Dr.PI we may need a “what’s your investment strategy [2025]” thread? Or this thread can do given despite the sentiment being 96% of new contributions going to stocks, we all seem to have similar thoughts.

Personally I’ve been building cash liquidity, after pushing hard as hell in 2024 I am easing the gas in 2025 and looking into alternative assets, chiefly the Managed Futures. Also eyeing leveraged ETFs though, recently backtested TQQQ and saw madness: 10k invested in 2010 would grow to 2mn by 2021, crash down to 400k in 2022 and back up again above 2mn in 2024. I have no clue how this crash can feel…

I think I’ll put a small bet (2-3000) in TQQQ at some point (you all know what point I mean) next year and just let it ride.

Edit for strategy:

- Not buying anything until 12 months of no buying have elapsed (June 2025)

- Save the same amount I’d be using for buying as cash

After June 2025 observe the situation:

If there’s a crash: plug into 3A, bet on something leveraged (TQQQ), add the rest into VWRL

If there hasn’t been a crash: plug 10% of current portfolio value in KMLM, continue saving cash