Thanks. Is truly just a personal opinion with goals.

I’m not going to change my mind by arguments here because it’s an emotional decision. I realize as well how complex and interconnected the world is.

But I don’t tolerate attacks on Europe or Europe interests, and so I’ll try to limit my exposure while not going out of stocks (EU small cap, CH small cap etc)

There is no perfect solution but I don’t have time to do stock pickings and ethically evaluate every company, so I’ll take some more EU/CH centric ETF and accept a part of hypocrisy. I can live with that

I read an article today that US has restricted supply of advanced chips to Switzerland. Switzerland is not considered ally in terms of technology

It can be a logical argument too. We saw how Russian stocks crashed and were sanctioned after their invasion of Ukraine. It’s one reason I limited my exposure to China as the same risks can exist there if things kick of with Taiwan or Philippines.

Given the US as an allied country of Europe, I don’t see a similar risk of outright sanctions even if the US did do something as blunt as start a military invasion of Greenland. Though there would be some volatility. Ironically, it might make China worse as US invading Greenland might give China political cover for invading Taiwan.

2 posts were merged into an existing topic: Any Stockpickers out there?

That would immediately cancel the alliance between europe and the US. Greenland is literally a european territory.

The implications for our investments are huge.

In theory. I think in practice, we’d hear a few complaints here or there, but more of less Europe would shrug their shoulders and realise there’s nothing they can do about it.

Of course, the US would not be so blunt. They’d probably dust off their CIA playbook and we’d see an independence party form that pushes for Independence for Greenland if not direct alignment with the US.

The party would get financial and operational backing from the US and win easily (with or without rigged elections), then the puppet regime will allow additional US bases on Greenland or ask for army bases to guarantee the security and Greenland becomes under the control of the US and the rest of the world can’t really even complain about it because freedom/independence/democracy.

I’m a bit scared of the US technology stocks weight in global ETFs like VT. If you are holding VT, you are investet with 75% only in US Stocks, mostly tec…

To reduce the weight of US technology stocks in my portfolio I am considering buying something like Xtrackers MSCI World ex USA UCITS ETF 1C (DBX0VH) instead of VT…

I think that’s a bit of an exaggeration. 65% of VT are US stocks as per end of 2024. And according to Yahoo Finance, only 26% of VT are in the technology sector (this includes about 5% non-US tech). US tech is certainly a big chunk but it’s far from the majority of VT.

That said, the sector classification is far from perfect. Tech is not actually limited to companies that are officially assigned to the technology sector. So the actual tech share is likely a bit higher.

Yes You are right.

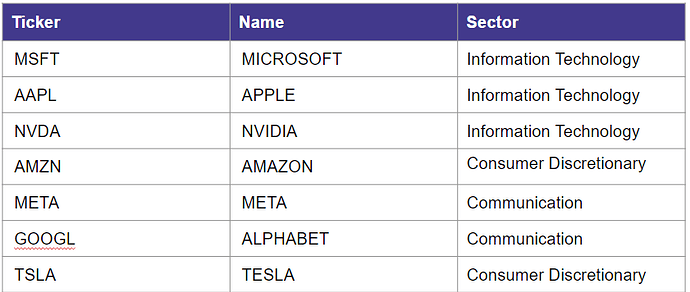

I just had a look, VT holds currently about 67.4% US Shares and the big 7 US Tec companies (Apple, NVIDIA, Microsoft, Amazon, META, Tesla, Alphabet) are with 18.5% overall in VT.

Nevertheless, 5 years ago the US shares in VT where about 10% less and the “Magnificent Seven” have doubled from 8.5% to 18.5%. So I think it could be worth to rebalance and Minimize the big US tec Companies

There is something else in play here: the new government changed the rules and made it impossible for a mining company to automatically get an extraction license for rare earths. This company is sueing Greenland to the tune of billions and has teamed up with the largest litigation finance company on the globe. If Greenland has to pay, Denmark might quickly lose interest and sell out.

My plan is easy. I started this year investing in the VT ETF with around 35K. My goal is to reach 50K at the end of the Year. I also invest 5-10% in BTC. I also need to increase my emergency fund.

Not sure this is the right topic to discuss this but I wanted to avoid openning a new one.

It seems to me that we are living a change of paradigm, or at least a transformation of the Free Trade policies (at least with the US, which is a major part of the economy / stock market). I don’t care about the political side - please let avoid a discussion about Trump - but I am just wondering why all this announcements are not having a deeper impact on the markets?

I assumed that the day Free Trade will be over (which is not the case yet), markes will stumble. I am wondering what is wrong with this hypothesis? Given the fact that markets seems to ignore it, or it is too soon to know.

In any case, do you expect this topic to impact your investment strategy? (…to come back to the main topic of this discussion).

My strategy will be a continuation of my 2024 strategy: Long gold.

I didn’t quite reach my target 6% allocation last year. I might increase it to 10% this year and reach it by leveraging up by selling some GLD and buying 1oz futures contracts instead.

I’d also started buying a bit of platinum this year and wonder whether it might finally be time to buy some silver too.

Most likely people want to believe that Trump would do everything to avoid a stock market collapse in US

Regarding the rest, the markets are cheap in other countries , so it’s kind of priced for bad news

In general, I agree. The world equation would change in long term. Seems like we would go to three spheres of influence -: Asia, Americas and Europe.

Quite tough to define what to do in terms of investment philosophy. Only thing we can do is diversify across regions & asset classes

The market is currently betting that it’s mostly bluff (which so far was true for Canada/Mexico). Whether the market is right is another question.

Yes, I had also that feeling that the market is not believing that will ever happen. I see it more like short-term event, a way to negociate as it seems to me that tariff will have a negative impact in GDP, jobs & stock market for the US. But who knows…

In terms of investing, I just expected more volatility due to this events.

Things are evolving so quickly. Trump just released a couple of hours ago quite the executive order, that most people are imagining will be struck down by a court order, with the problem that court order are ignored by trump, since US Marshal that must enforce the court order are under his control in the DOJ.

For us, this executive order means that

![]() The SEC, FTC, FCC, and FEC are no longer independent.

The SEC, FTC, FCC, and FEC are no longer independent.

The Stock Market is now subject to White House control, enabling insider trading, favoritism, and targeting of political opponents. Antitrust laws can be selectively enforced, allowing administration-friendly monopolies to expand unchecked. Political opponents in the tech sector, media, or finance can be targeted with regulatory action while allies are protected. Elections are now influenced by direct White House oversight of the Federal Election Commission (FEC).

This would make the US an emerging market of some sort, with shady separation between state and stock market. So for the moment there is hope that this will never really happen, but you never know. If anything remotely similar comes to fruition, I’m pulling myself out of VT. If there is no longer an independent control of the stock market, this is not what I signed up for when buying US stocks. F*** the gain.

The executive order is published here:

Very poignant sentence:

These regulatory agencies currently exercise substantial executive authority without sufficient accountability to the President, and through him, to the American people.

He is proclaiming he is, in fact, America. That is some North Korean rhetoric.

More information and analysis here in r/law:

https://www.reddit.com/r/law/comments/1isvzgu/the_full_executive_order_is_out_this_is_the/

If someone was wondering how Soviet system used to work, new policies in US might give an idea

Control media

Suppress questions

Have praisers around

Say whatever

I don’t understand the legalese, but I do understand these two paragraphs:

"However, previous administrations have allowed so-called “independent regulatory agencies” to operate with minimal Presidential supervision. These regulatory agencies currently exercise substantial executive authority without sufficient accountability to the President, and through him, to the American people. Moreover, these regulatory agencies have been permitted to promulgate significant regulations without review by the President.

These practices undermine such regulatory agencies’ accountability to the American people and prevent a unified and coherent execution of Federal law. For the Federal Government to be truly accountable to the American people, officials who wield vast executive power must be supervised and controlled by the people’s elected President."

They’re essentially saying in semi-good English:

- Previous administration bad for letting them run wild, and they ran too wild

- They have too much power I can’t touch (Mirager comment: that’s how they were designed to be, for good reason, by the Founding Fathers who understood democracy better than most, anywhere in the world or history)

- I need to take some of that power away from them so I get to tell them what to do

- I am the People (Mirager comment: this is a very common trope of authoritarians, equate themselves with the people and hence anyone against them personally is an enemy of the people)

I’m seriously thinking hitting the BIG RED SELL ALL button and waiting it out at 0.5%/year.