I was a very heavy Facebook user and when I stopped, I was surprised how little I missed it given that I spend hours on it everyday (between friends and hobby groups on there - not random reels etc.).

I stopped using Facebook a while ago (account created in 2008 and deleted in 2020). I only created a new account to post ads on Marketplace, but since I’m not active, my listings get little visibility (probably due to Facebook’s algorithm favoring active users). Honestly, I see no point in staying on the platform.

As for Instagram, the content is starting to annoy me. TikTok’s influence is very noticeable, and since I can’t stand TikTok, I don’t want to follow these trends on Instagram either.

I completely agree—Facebook doesn’t miss me at all. Since deleting my main account, I’ve noticed a significant improvement and have much more time for other activities.

Or per year ![]() .

.

Last year, I stated that I’d carry on as the year before (“Same procedure as last year, Miss Sophie?”, “The same procedure as every year, James!”).

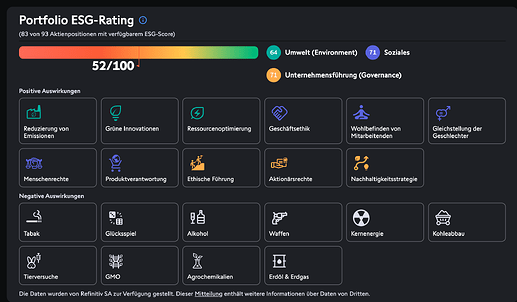

This is mostly true for 2025 with a little twist: additional new goal is to lower the ESG score of my stock picks.

![]()

Here will be my investment strategy for 2025

- Monthly investment in VT

- Monthly investment in VIAC 3a (World 80% stocks) - 3 accounts

- Monthly investment in Crypto on BTC + ALPH (10 % overall portfolio)

I’m very reluctant to break my life insurance contract linked to a 3a which obliges me to invest CHF 400/month in order to be able to invest this sum in other 3a with Finpension, for example. What do you think?

Conventional/theoretical/“mustachian” wisdom will say that you’d be better off breaking it. Practical experience (my own) says “it depends”. You need to be prepared to lose ~40% of your 3A. Do some scenarios to see the opportunity cost vs the real known cost of losing 40% in an instant. Remember most insurance 3A ETFs/mutual funds are dogshit and they’ll severely underperform even the indices they claim to track.

See if you can negotiate the monthly sum to something lower (say 250) by threatening to leave them, my own insurance 3A provider said there’s no way they go below 300/month even after saying I’ll leave them. They didn’t budge and I left. They’ll estimate their own opportunity cost of bleeding predictable fees out of you.

Hello and thank you.

In my case, I made this mistake in November 2013 when I made my first real estate purchase. I’ve been investing 415 CHF/month for about 11 years, i.e. about 55K. The current surrender value is 42K and the contract ends in 2053. Directly, I would lose 13KCHF. The final projected value in 2053 is 193K.

By investing the CHF 42,000 surrender value in a Pillar 3a with an annual return of 5% and continuing to invest CHF 415 per month until October 31, 2053, I would obtain a future value of around CHF 483,116, according to my quick calculation.

Based on this first quick estimate, I’d say it’s definitely worth breaking this contract. What do you think?

Almost always the right call.

It‘s not really an investment product. It‘s inefficient insurance.

If you highly value the life insurance part, then it may be worth it to keep.

If you don‘t value that part. Probably cancel.

You are not even getting any real return with that projection.

You paid in 55K so far, another 28 years of 400/m would be +134K = 189K paid in yourself! That‘s essentially zero nominal return and certainly negative return after inflation.

You essentially just get your money back (in nominal terms) + have a life insurance in that time.

Yes absolutely. The contract mentions a 1.3% interest… but I guess after inflation and fee, this is very bad. If I want a life insurance, I can select a pure one but not linked with a 3a

If I were you I’d also break it because probably given you’ve had this contract for ages your surrender value is a bit more generous than mine, who broke it after 2 years.

As Tony says, they basically give you your money back and give you life insurance, other than that it’s a free ride for them and massive opportunity cost for us the victims.

I follow some educational accounts on X.

I can suggest

Yumi

Probably more for swing traders, but still good imo

If you can share, have you done dca with btc and no selling? Thanks

Ive been buying, DCA or lump whenever I have money left. I’m not planning on selling anytime soon, I don’t need the cash and there’s no better saving plan out there ![]()

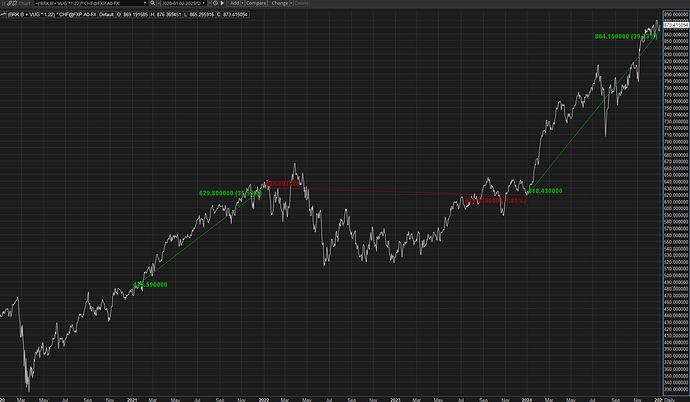

With year end complete, holding Vanguard Growth Fund (VUG) + Berkshire Hathaway (BRK.B) in equal weights delivered 39.73% capital gains in CHF…

Add 0.47+0.46+0.45+0.53 = $1.91 in dividends. So an additional 0.3% return (in USD vs $310.88 initial price as half the portfolio) so lets call it roughly 40.01% CHF total return.

Fee drag of just 0.04% on VUG and 0% on BRK.B so 0.02% on entire portfolio. No brokerage fees paid during the year as its buy and hold with interactive brokers.

Tax drag of ~0.5% wealth tax (impossible to minimise with stocks) and ~40% marginal income tax on dividends (Geneva). So roughly 0.5% + (0.4 * 0.3% = 0.12%) = 0.62%.

So overall:

- 40.01% return

- -0.02% fees (but included in the price so no need to net)

- -0.62% taxes

- = 39.39% return in CHF after taxes and fees

- SNB forecasts 2024 inflation at 1.1%

- So 38.29% real return after taxes and fees

Of course, this was a phenomenal year and one shouldn’t expect these results every year. But for a passive investment with minimal fee and tax drag, I find it really hard to do anything else with my cash than just keep buying this for the next decade.

It does overweight you big tech (especially apple with berkshire holding 7% in AAPL and VUG 11.5% so average of 9.25% of your portfolio). But then berkshire has value stocks to help offset the growth stocks in Vanguard and holds 28% in cash to buy some bargains if market does correct.

I’m a big believer in BRK.B as well, but haven’t put my money where my mouth is, I am just buying it with dividends.

Anyone else currently very reluctant to convert salary CHF to USD to buy mostly US stocks?

The exchange rate is getting ridiculous. -8% from a year ago. We had this zig zag pattern over the las two years and I fear the zag coming again ![]()

I’ve wanted to buy BRK, but never bought. I would need to wait for a market panic otherwise I will never manage to buy as in recent times, Buffet himself has set a floor price higher than what I want to pay.

A year ago it was around 1.2 USD for 1 CHF, so phenomenally good value. I was sad, I’d already bought my fill of USD before then.

I feel it’s going to skyrocket in a market panic ![]()

It’s true BRK hasn’t been a value stock for over 20 years but…I don’t care as I don’t even count it as part of my portfolio, it’s a position I am building slowly with the intention to leave to my kids.

My own positions will be spent in an as-long-as-it-lasts binge of ladies of the night and various psychotropic substances. I didn’t say that out loud did I? I meant charity! It’ll be spent on chaaaarity, pandas, cormorants, research into whoever’s rights are in vogue when I’m 65.

My plans for 2025:

- Max out 3a at Finepension

- Record expenses with YNAB[1]

- Invest monthly in VT at IBRK

- Leave FWRA and VWRL untouched at Saxo

[1] That’s what I’ll have the most trouble with, because it’s stupid work