So let’s benchmark expenses against say simply going all in for VT fund.

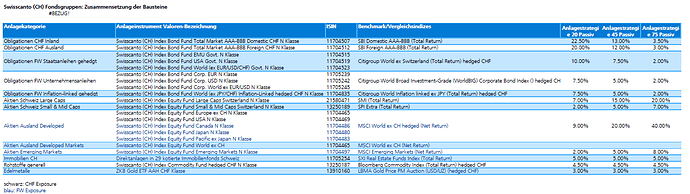

On VZ side we’ll match it with 80% iShares MSCI World CHF Hedged + 20% CHF cash - cause max stocks is 80% and most of portfolio has to be CHF hedged

VZ: 0.68% [VZ fee] + 80% * (0.55% [TER] + 1.8% [hedging costs, ~ diff in 1 month bond yields] + 2% [div yield] * (10% [est. loss to foreign taxes] - 25% [your tax savings]) + 20% * 5% [est. loss on cash vs stocks] = 3.32% p.a

vs

VT: 0.11% [TER] + 2% [div yield] * 25% [your marginal tax rate] = 0.61% p.a.

=>

2.71% diff. Your tax advantage on initial investment of 25% - 5% (withdrawal tax) will get eaten clean after about 8 years. Many assumptions have been made, but I think this is about ballpark right. Plus you’re making yourself dependant on VZ, a single provider of this 3a account with ETFs and competition in 3a space is very poor. Whereas switching ETFs on the free stock market can be done any minute it’s open, and changing brokers isn’t that hard either

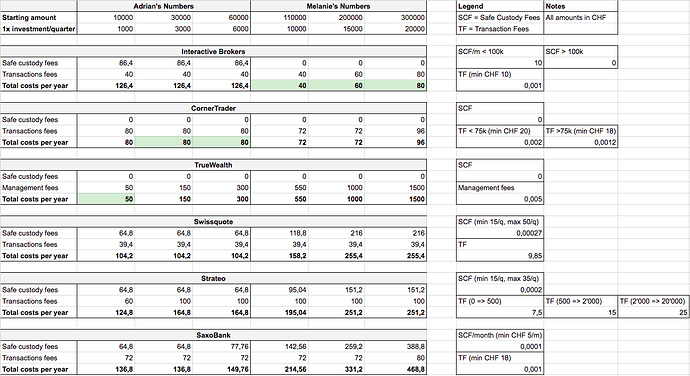

IB is the cheapest retail broker I’m aware of. You do need however a much higher initial investment, or they’ll charge you account maintenance fee $10 a month. You could initially sign up though with some of their white label resellers like captrader or lynxbroker. Trading fees are little higher (but still practically neglible for buy and hold and US ETFs), but no account fees from $10k balance or so. I’d avoid any swiss brokers: much higher trading fees, in part due to swiss stamp duty, crazy expensive currency conversion rates, unnecessary additional withholding taxes on US stocks/ETFs, no deposit protection like SIPC - esisuisse doesn’t cover securities

1.5 + 0.5-3% yearly fee + 1.5-3.5% on inpayments if i’m reading that right (terms aren’t clearly worded, a sign of bullshit). Not bad - for the fund. That’s serious hedge fund appetite they’ve got there

No kind of any deposit protection in sight, but in fact exactly the opposite - “Investments in the underlying Funds [are] the property of the Company”. What you own a contractual claim against the Company. They go belly up and so do all your investments with them.

Plus it seems to be some kind of mix with life insurance. Generally these tend to be poor value and unneeded especially in younger age and with no dependants

It’s not such a bad country. Democratic, english speaking, far from anyone worth nuking, quality of life is ok, great climate, CGT free and no tax on foreign sourced income. Not a bad choice to retire in, although Malta would be my first preference. No idea about laws - for actually keeping the investments in I’d rather stick to more well known jurisdictions, like US or IE.