Only from the first sight. The advantageous fees of True Wealth are well compensated by the disadvantages of instruments that they employ ![]() .

.

Are we sure about it?

I am trying to play into their tool and I couldn’t really see much issues with the instruments

What are your key concerns?

The standard ETF for assets of “WHT without tax credit” (cross reference) are quite ideal, though?

Hedging can be disabled and the pension fund share class for US has been added (no JP though).

In my trial portfolio, I see the following for Japan

Seems like a BVG fund to me

There is a section about conforming to BVV requirements, but nothing about using the tax treaty. There might be something in the prospectus. But I don’t have that.

I actually already replied to you less than 2 weeks ago:

the fund on Swiss stocks is one of few (4) instruments that make sense to me.

That came from my analysis of what kind of portfolios you can construct on True Wealth.

There are some efficient instruments for 3a. The fund on Swiss stocks is one of them, but I don’t invest in Swiss stocks in 3a.

The fund with Japan stocks is not exempt from withholding tax, which immediately make it more expensive than Japan funds in Finpension, despite the fee of the latter.

The US fund is exempt from withholding tax. It is good by itself, but not as a part of a portfolio, because US is the least preferable for holding in 3a.

My goal was actually to max MSCI EM IMI ETF holding, but because of the diversification rule, I had to dilute it with the US fund. I wanted to stay with max stocks in 3a, and that’s what everyone should do. Because US has low dividend and for MSCI EM IMI ETF you only get an advantage not to be taxed on income, all in all it came out hardly more efficient (cheaper) than Finpension portfolio with a fee, but where I can use max amount of dividend-rich funds.

I don’t know when I will be able to update my table for portfolio analysis, sorry. Until then you will have to check it yourself or believe my word, I am afraid.

That was a part joke. True Wealth 3a is only good if you use it to invest into funds on Swiss and US stocks in 3a, which I don’t.

Thanks.

I read those comments but I didn’t realise the conclusion was that it’s not worth it ![]()

It’s a bit weird that the Japan Fund used is not tax efficient because it is a BVG fund. I will send them a note to check.

@True_Wealth -: would you be able to clarify ?

Since you are using mixture of ETFs & Funds for portfolio construction, which one of your instruments are tax efficient and which ones are not with respect to tax treatment in foreign jurisdictions

- US fund (it’s clearly a tax efficient fund)

- Japan?

- Europe?

- Uk?

- pacific ex Japan

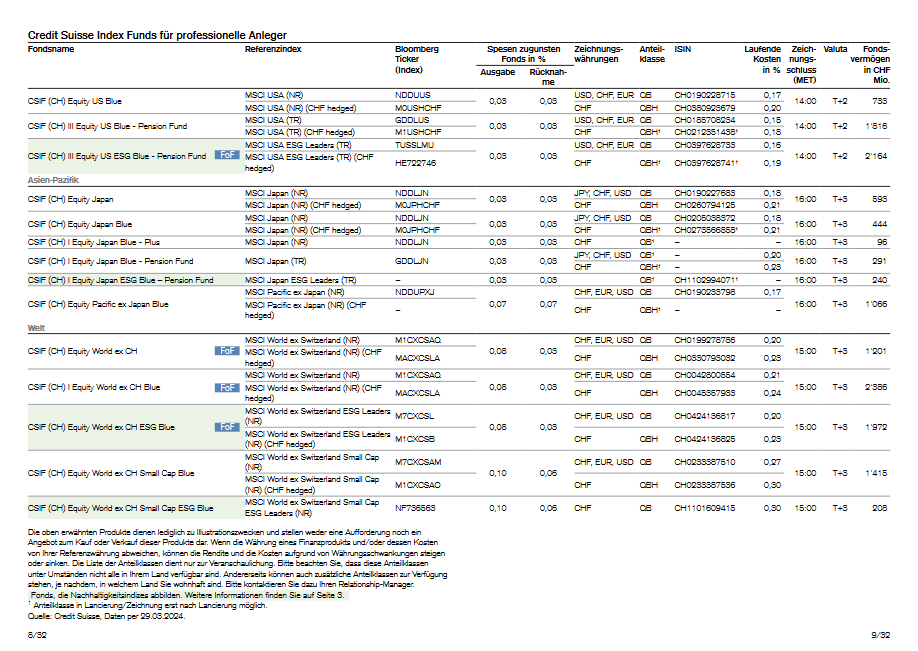

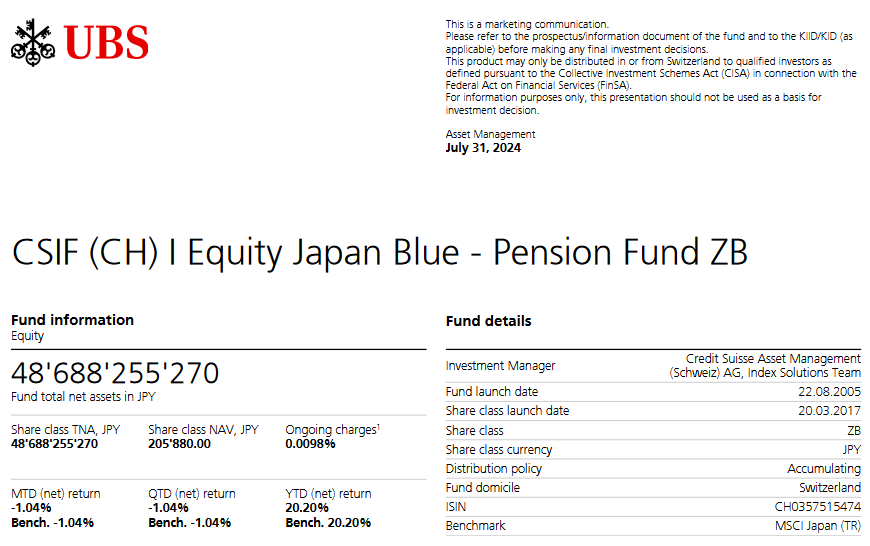

Are you sure that’s a pension fund? Here’s the one used by finpension as comparison. Notice the difference in index (net return vs. total return), and also that for the finpension one, fund and index performed 0.4-0.5% better each year.

I just checked the factsheet and it said the fund is for BVG purposes. But I will check later what exactly is this fund doing for BVG if not getting tax benefits.

The fund (from UBS before CS merger) Truewealth should have used would be this one “UBS (CH) Institutional Fund 2 – Equities Japan Passive II I-A1”. The benchmark is MSCI Japan (gross div. reinv.)

Looking forward to Truewealth’s response on Japan.

I assumed the fund they’re using was WHT-optimised due their response:

But now I’m not that sure anymore.

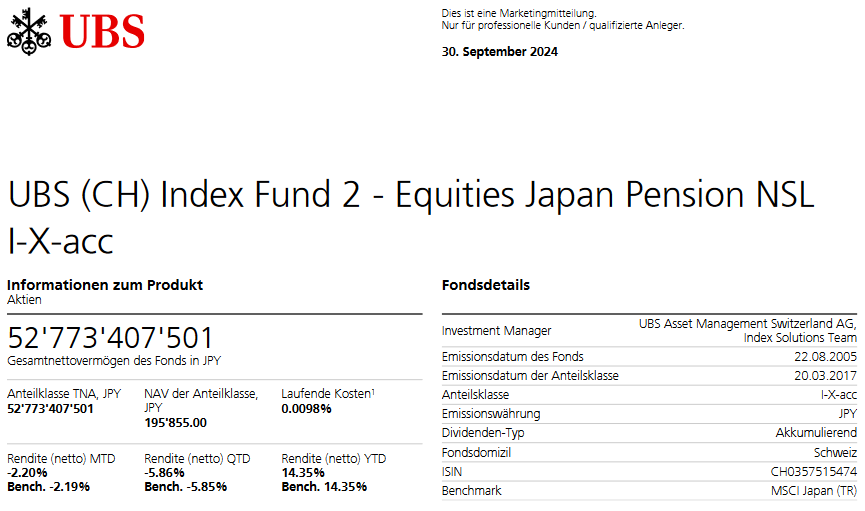

Edit: I see that it’s not the CSIF Japan QB fund anymore that they’re using, but the UBS fubd mentioned by @wapiti instead

For US and REIT, a tax-optimized Pension Fund is available in our instrument universe.

For EU, Switzerland, UK and Pacific ex Japan, we are not aware of any more tax-efficient instruments than ours.

For Japan, which generally represents a relatively small portion of exposure, we currently use the fund visible in our sample portfolio UBS (CH) Index Fund - Equities Japan I-A-acc due to the lack of a dedicated Pension Fund QB share class (has not been launched yet). Link to UBS/CS index solutions product list.

We’re constantly monitoring the instrument universe and will replace an instrument if it is in the overall best interest of our clients and preserves our ability to select funds independently.

Art. 53 BVV 2 lists what investments are allowed in BVG. The note on the fund factsheet simply means that its holdings are permitted as investments in BVG. It has nothing to do with taxes.

I’m probably misunderstanding your answer, but VIAC and Finpension are using such “Pension Fund” funds. I have this in my portfolio this very instant. The ISIN is CH0357515474.

The same fund is also in the document you posted:

In July it still had the old name “CSIF (CH) I Equity Japan Blue - Pension Fund ZB”:

Now it has the new name “UBS (CH) Index Fund 2 - Equities Japan Pension NSL I-X-acc”:

Using the search engine on UBS on the CH0357515474 ISIN returns the fund.

Why not use existing Japan pension funds?

-

UBS (CH) Institutional Fund 2 – Equities Japan Passive II I-A1

-

CSIF (CH) | Equity Japan Blue - Pension Fund ZB

Thanks for your response.

Could you clarify which instrument do you seek? And why the funds mentioned by @Helix are not available ?

VIAC and finpension use zero-TER (ZB) fund share classes, which are only available to organizations with a contract with UBS (requiring payments, of course). TrueWealth presumably doesn’t have a comparable contract with UBS, so it can only use the QB (or FB) share class. And not all share classes are available for all funds.

I have no idea whether TrueWealth will move towards a similar contract or whether that e.g. conflicts with their goal of cost transparency or their preferred mix of fund providers.

If it would lead to them having to charge management fees I’d rather not have a Japan pension fund there. Truewealth’s very competitive as is

I don’t see a reason why Truewealth can’t just be upfront about this instead of evading transparency. Finpension’s way better at that, also in terms of not patronizing investors.

Well, after more research, i see following issues

- Investors need to always try to figure out which fund is tax efficient and which one is not. Japan fund is not tax efficient. US fund is. But Hedged US ETF is of course not tax efficient as well.

- Because of these inefficiencies, investor might need to try to balance across accounts (taxable accounts like IBKR, other 3a accounts). I think i can manage it but it can lead to complexities & I am losing interest

- It would be best if there was a way to establish Total cost of investing instead of just average TER%

@Dr.PI made these observations too.