I think you’re not their target audience. They’ll optimize allocation between 3a and taxable if you have your taxable assets with them.

…can anyone please confirm that a 1% cash and 99% US equities portfolio isn’t possible with True Wealth? I often see True Wealth touted for its customization features, but my understanding is that the above asset mix isn’t supported even with the highest possible risk profile (in which case better to go with Finpension or VIAC, if correct)

Last I checked this was correct. Curious if this has finally been changed, @True_Wealth ?

I just checked - in the interface I see an option to go 1% cash and 99% equities, but restricting those equities to be US? I don’t see any way to customize what equities are bought.

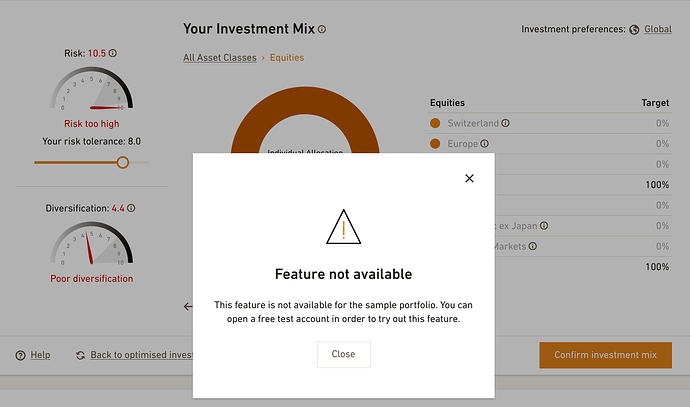

Click on Equities and then click on “Drilldown” on the left of the slider for the allocation. You can then customize the equity allocations. At least the demo allows 99% US equities.

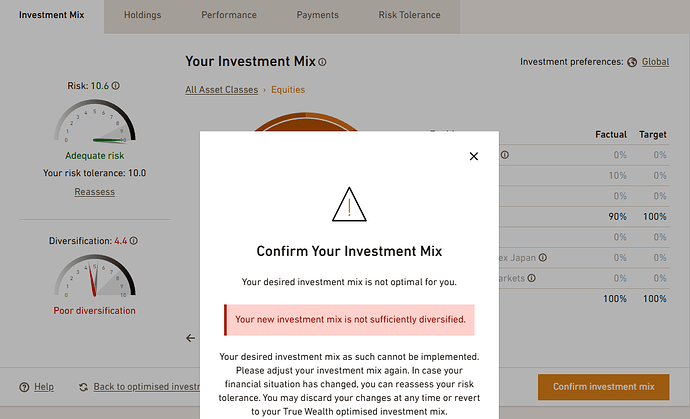

Strange. I haven’t been able to replicate this in the demo as I receive the following error:

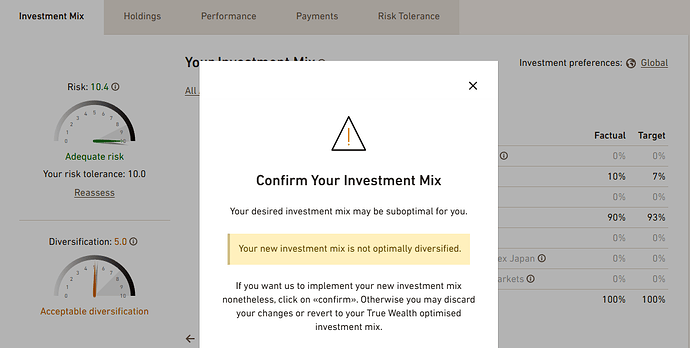

Per the screenshot below, it seems the maximum possible US allocation is 93% as anything higher results in the error in the image above:

@jay can you share a screenshot depicting what you wrote above in your demo account?

![]()