We lack one critical insight. Will truewealth claim back WHT on Non-Pension funds? Like e.g. the SPI Index Fund they use? Or is WHT lost with them?

Just checked it in my account, and it looks pretty like they are refunding withholding taxes: even for accumulating funds, there are dividend payments visible:

This is exactly 35% (22.04.2024 / CHF 10.80) for my holdings of 3.16 pieces.

I see potential disadvantages:

- You can’t choose the funds you want to invest in.

- The funds on TW are of a different class (example: MSCI USA on TW and on finpension, TER of 0.15% vs 0.00%)

- The equity weights of each region (US, Europe etc.) are not set according to a widely-used metric (e.g. market cap or GDP) but set by TW according to an undisclosed metric (they claim it is based on each client’s answers in the risk assessment questionnaire). That is not in line with principles of passive investing IMO.

It looks fairly promising. What still bugs me a bit is the bad product they use for Europe (EuroStoxx 50) but to be fair - that is a relatively small drag. At the moment, they are probably en-par with VIAC/Finpension and if they finally introduce a “normal” ETF / Index Fond for Europe - they will be great.

Sure. But (apart from leaving money on the table for no reason) still weird, no? Raises all kinds of questions. Is 3a even important to them? Do they know what they’re doing?

It looks like a very good offer and there is some customization possible.

0.13% TER vs 0.39% is a very good deal.

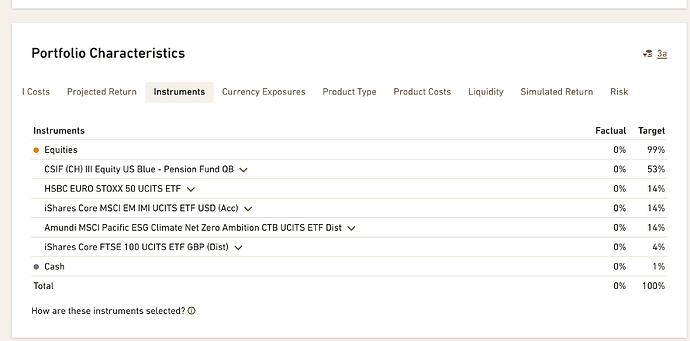

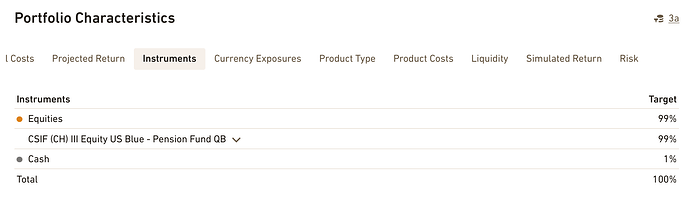

Can you set 99% on CSIF (CH) III Equity US Blue - Pension Fund QB?

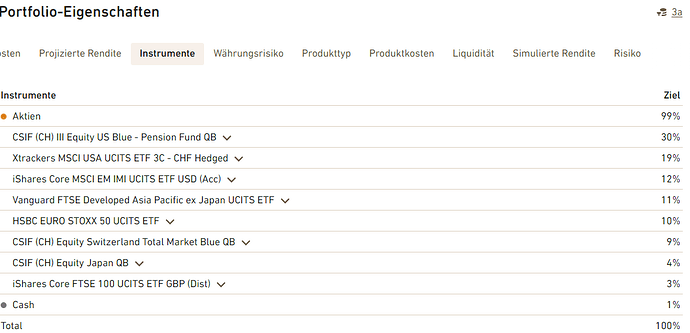

No, below is the proposal without currency hedging.

Only the stock % can be chosen, not the repartition inside the stock class.

Also I don’t really understand why the ETF “Amundi MSCI Pacific ESG Climate Net Zero Ambition CTB UCITS ETF Dist” has been selected. The TER is 0.45%

Will then stay with finpension (I am currently moving from VIAC to finpension; the FX limitation is annoying).

No chance that I am investing in Euro Stoxx, EM or MSCI Pacific ESG - even if it is free of charge with a free account ![]()

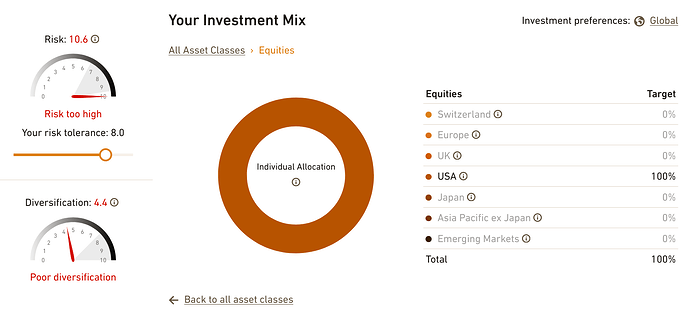

That’s not correct. You can double click on ‘Equities’ in the investment mix (top part of the page) or click on ‘Equities’ once and then on ‘Drilldown’ to change the allocations within equities.

You are right. The UI is just pretty bad …

This is indeed worth a thought. I would have added Switzerland as well (even though its a small one). US and Switzerland with TW, Europe ex. Switzerland, Japan, APAC, Canada & EM with FP.

The more I think about it - the less I understand TW’s strategy. What’s in for them? Kind of doesn’t make much sense to me… do they know what they are doing?

A few other things I’ve noted:

- For the non-pension fund investments, you’ll be paying stamp tax and won’t get the withholding tax back. That’s in addition to higher TER.

- They have a currency conversion fee of 0.1%.

- They theoretically have a fee of 0.225%, they currently choose not to charge it, but may do so at any time. If you’re serious about having 0% fees, why not change the regulations? This way, it looks more like the strategy “let’s use these 0% fees as a marketing tool to increase our AuM, and after a while start charging fees.”

1/ Swiss index funds are not subject to stamp duty. In addition, funds that distribute dividends are initially subject to withholding tax. However, this is reclaimed by our pension foundation from the Federal Tax Admin and refunded to the client in the form of a cash distribution. In the case of accumulating Swiss funds, they are also withholding tax neutral.

And for the US and global REIT investments, as mentioned above, there are the pension fund share classes.

2/ Thanks to netting and pooling, the effective FX markup is lower for 3a.

3/ It’s been 0% since 2022 and there are no plans to change it. There would be half a year’s lead time if it were to be surprisingly enacted by the 3a pension foundation.

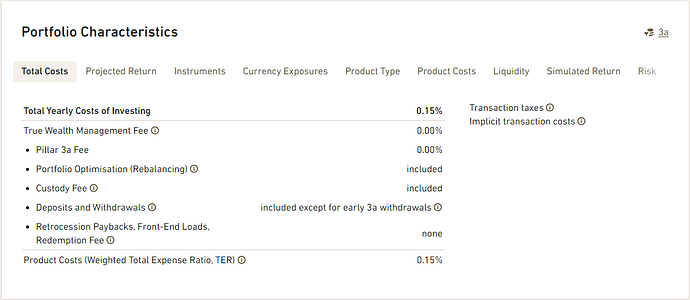

Uh, nice! 99% of the mentioned CSIF (CH) III Equity US Blue - Pension Fund QB results in following overview of costs:

Finpension uses the ZB version of it (if I am right, ZB version is available for all (?) investors and QB only for professional clients?). But why does the ZB version has an TER of 0.02%, and the QB 0.15% p.a.? This also leads in a much better performance of ZB during all these years.

Ah crap, just switched to finpension. It seems, I have to check TW in more detail, since 0.15% vs. 0.39% p.a. fee is quite a difference ![]()

What are your thoughts?

FB is the version for retail customers: highest TER, anyone can buy shares. QB has slightly lower TER, is restricted to qualified investors (and intermediaries) and there may be a minimum investment amount. DB and ZB share classes have even lower TER but require a contract of the wealth manager with CSIF where (at least for ZB) there will be management fees outside the TER.

As you’ve already mentioned, the sum of TER and wealth management fee is what matters, of course. At least for the US, TrueWealth 3a is now clearly the best offer with regards to fees, as far as I can tell. Likely also overall but you may not be able to have exactly the same strategy as at other providers (I myself prefer being able to choose a market cap-weighted world allocation).

If you decide to make a geographic split of the portfolio, the most logical first step is to invest to US stocks market via a US ETF. Therefore I really don’t understand this excitement about the US index fund.

I will keep an eye on this offer to see if they can provide a reasonable collection of funds to construct MSCI World ex US (ex CH), but for now the proposed funds for stock markets ex US and ex CH is a mess.

I will personally still not switch. To me, the biggest risk on 3a is that I am somewhen forced to get out of the market if I need to switch providers. TW is too small and in my view not 100% clear in what they are doing. If they 3-5 years down the line close the shop - that can force me out of the market for a few weeks until I can re-invest post the transfer. Based on this logic, I as well stay with Frankly and Viac. Didn’t happen yet but will over the next 2-3 years (using mew investments as an offset) migrate FP over to Viac.

Of course, they always could change their pricing model, but same can happen with any other provider. IMO you have to check out the currently best offer in the market which also looks serious. If a lot of clients switch from viac / finpension / frankly to True Wealth, it puts some pressure on these, and hopefully they will lower their prices again (IIRC all of these providers have actually lowered their prices a bit when True Wealth entered the market two years ago). And even if they would apply the 0.225% fees, they would still be cheaper than any other provider I am aware of. If you assume the TER of 0.15% of the US instrument on average, you basically miss out 0.24% performance compared to the other cheap providers - this adds up over the year.

A longer time ago, I was also in contact with True Wealth and I also questioned their “pricing”. They also explained me that it helps them to gain new clients for their non-3a-product where you have to pay fees. I am sure most of us are not their target users for their non-3a-solution. - but why not profit from it? ![]() Some details I have also found on their website: The cost regulations of the pension foundation mention an administrative fee. Why does the website say that the offer is free of charge?

Some details I have also found on their website: The cost regulations of the pension foundation mention an administrative fee. Why does the website say that the offer is free of charge?

Regarding the 0.1% FX markup: I think this mostly applies to their non-3a product, since most of the funds (in my portfolio) are bought in CHF anyway.

Yes, looks like that for any other fund I have checked. In my understanding, @True_Wealth also clearly confirmed a few posts above, that they reclaim WHT, and now use pension funds where foreign WHT is involved.