The main hedging costs are the costs of the currency forward contracts, which are not part of the TER. E.g. CHF-heding of USD currently costs 27.6 basis points for a month. That’s 3.36% p.a., roughly matching the interest rate difference. The expectation is that USD will depreciate 3.32% p.a., in which case the hedging cost will be fairly small. If USD depreciates more than that, you’ll profit from CHF-hedging. However, if USD depreciates less than that or even appreciates against the CHF, you lose the difference.

Thank you very much for this explanation - very appreciated!

Just for my understanding: That does mean that the net hedging costs would be 0.04% p.a. if everything would work out as expected (which of course will not be the case)?

I’m no expert on this, however, as I understand it, if the currency exchange rate exactly follows the market expectation on, e.g., a monthly basis, the hedging cost is the spread between the ask and mid prices of the FX forward contracts (+ commissions of the bank/broker but that might be part of the TER, not sure). That spread for a 1-month forward contracts is 0.5 bp according to the link above. That would be 0.06% p.a. This example also ignores the effect of stock market price changes (the hedged amount may no longer match the value of the stock a month later).

7 posts were merged into an existing topic: What are your thoughs around cap-weighted index funds

I haven’t had any issues. The returns with the global portfolio with the maximum stock component appear to fall slightly behind those of equivalent portfolios in Viac and Frankly, but I do not have clear data to back up my hunch because I didn’t replicate the exact same investment and timing on all three. However, it would seem logical for performance to be somewhat lower because the default True Wealth portfolios are more conservative (they include a Swiss real estate component). But it is possible to customize your portfolio.

Hi Compound.

Yes, we’re in the final stages of launching these pension fund share classes of index funds. By the way, there are also index funds available today that are exempt from stamp duty.

The interest rate on cash 3a now is 1.5% and the management fee is 0.0%. Let us know if you have any further questions.

Sure you can: click on “Equities” next to the chart at the top, then to the left of the slider below click “Drilldown” and there you can change the weights of each region.

Hi Compounding

Glad to see you are discovering the “slider” functionality within our app. There’s a level 1 drill down as well as a level 2 drill down. (For example, within US equities, you can adjust exposure to specific sectors within that market, such as tech or energy).

We’re also working on introducing more 3a pension funds. We’ll let our subscribers and clients know when we’re ready.

Hi there,

when looking at your sample world portfolio, two things caught my eye. Is it correct that it:

- doesn’t include Canada

- includes South Korea twice (iShares Core MSCI EM IMI & Vanguard FTSE Developed Asia Pacific ex Japan)?

Thanks, asseblyrequired, for pointing out these country-specific details.

Regarding Canada, our analysis shows that the Canadian and US markets are quite correlated when you include the oil component. However, if we were to introduce such a country-specific instrument (which we do not currently have), we would need to ensure that a highly cost-effective, tax-efficient and liquid instrument is available for both Pillar 3a and discretionary asset management (we offer both types of services).

As for South Korea, yes, there is some overlap, although Korea is not one of the big equity markets. Again, we would consider an ex-South Korea ETF/index fund as long as there are suitable instruments available for both Pillar 3a and discretionary wealth management. For existing clients, we also have to consider transaction costs, as we would not simply switch such an instrument.

Its funny, for years I look into my TrueWealth Test Account - but I fail to understand how I can configure my 3rd pillar… the user interface is simply confusing.

The list of instrument is public, you do not even need a test account. You can see it dynamically depending on your asset allocation on their demo site (just switch from “Holistic” to “3a” next to “Portfolio Characteristics” in order to filter 3a instruments only): True Wealth

I believe all those with “ETF” in the name are not pension funds, so it’s just the three CS funds for Switzerland, Japan and EU.

On what scientific basis did you come to the conclusion that market cap weighting is suboptimal, and based on which principles do you set the weight of each region?

Hi assemplyrequired, thanks for your follow-up. Of course there is no simple answer like “x% of US exposure is scientifically proven to be appropriate”.

Our suggested investment mix depends on the answers each client provides in the risk assessment questionnaire. Try it out or see our sample portfolio on our website. However, for an investor (Pillar 3a and/or Discretionary Asset Management) whose future financial needs and expenses are expected to be primarily in Swiss francs, some optimization is appropriate. This is built into our sample portfolio strategies. But again, it’s easy to make individual changes using the sliders should the client wish to do so.

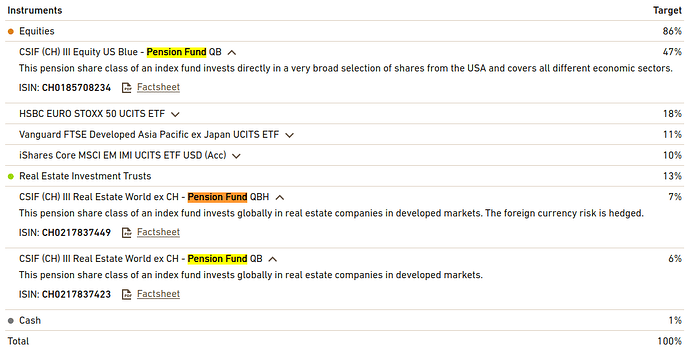

I think I have discovered something interesting this weekend: while supporting a friend with setting up 3a at True Wealth, I have noticed that they new seem to offer pension index funds finally:

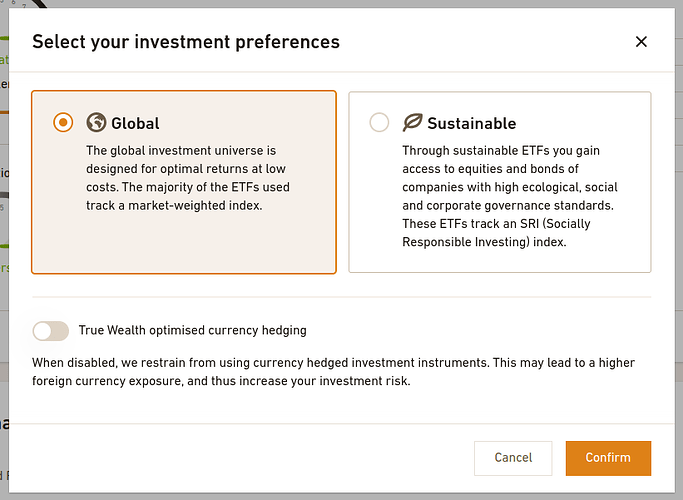

And another interesting thing which I was not ware of: you can even disable currency hedging for your portfolio:

These things are only visible on my friends new account, but not mine. I am also able these instruments on their website: True Wealth

@True_Wealth When do you plan to activate these new features for all of your clients?

Hi locenad. Well spotted! Yes, we’ve completed the first step and rolled out the new instrument universe to new clients. We’re in the process of finalizing the user flow within our application to make the transition seamless for existing customers, and will be emailing everyone in the next few weeks. In the meantime, it’s also possible to use the new instrument universe for existing clients. By clicking on “Reassess Risk Tolerance” and then resetting the portfolio to the “True Wealth Optimized Mix”, the new instrument universe will be imposed, including the on/off toggle for (partial) FX hedging. Lastly, any customizations to the investment mix will need to be redone if desired.

Thanks @True_Wealth, this is IMO pretty awesome news. Will give it a try in the evening.

This change is quite a game changer in the 3a area and helps me recommending True Wealth 3a even better. So far, I always had to say: “it is nice, but you need to be aware that some funds are not optimal”. With this change, I think it is clearly the lowest priced 3a I am aware of (comparing against finpension and viac). Great work!

Thanks, Compounding. TER actually went down with our new, optimized instrument universe (which includes partial Fx hedging). About 0.13% for an equity heavy portfolio (and 0.21% for SRI). Our sample portfolio including TER is fully public, see here:

I have not digged though all instruments yet, but at least the following pension funds are listed on their website, but not included in my portfolios. I think all funds with the new “pension fund” are new:

- CSIF (CH) III Equity US Blue - Pension Fund QB CH0185708234 (TER 0.1534%)

- CSIF (CH) III Equity US ESG Blue - Pension Fund QB CH0397628733 (TER 0.1592%)

- CSIF (CH) III Real Estate World ex CH - Pension Fund QBH CH0217837449 (TER 0.2127%)

- CSIF (CH) III Real Estate World ex CH - Pension Fund QB CH0217837423 (TER 0.1823%)

Quite sure I have missed some of the new instrument, @True_Wealth please complete if so.

In my understanding, viac and finpensions are using the same funds without TER, while True Wealth uses these funds with TER (which makes sense IMO since they do not charage any flat fee). This is still great news in my understanding ![]()

If you compare against finpension, most of their funds are also not “pension funds” - for these instruments, nothing changes at True Wealth. The downside of True Wealth so far was that they were not using pension funds for some classes, which caused missed withholding taxes in some cases.