This may also be a reason why they partially hedge equity funds in all of their standard strategies, even though foreign equity never exceeds 60%, as far as I can tell.

That’s exactly what I’d expect Truewealth to tell me, instead of some BS story about currency hedging being the way to go. It’s this kind of lack of transparancy and dishonesty which gets the finance industry its bad reputation.

Truewealth, kindly refrain from treating your customers as idiots.

The rules of the foundation in which our clients’ Pillar 3a assets are kept put some limits on the currency exposure of our clients’ 3a portfolios. We are assessing possibilities to offer more flexibility to our clients in this regard in the future.

I believe the limit on foreign currency isn’t nonsensical but is rooted in the law.

https://finpension.ch/en/glossary/bvv-2-compliant/

Investment guidelines are mentioned in the applicable regulation - though foundations can deviate from them under some circumstances. I think they really are pushing the envelope there.

Personally, I approve. Especially since the 2nd pillar system is rigged for benefit of the rich and high earners anyway (e.g. the infamous 1e plans).

Have a look at this Geschäft Ansehen and article 50 al 4 https://www.fedlex.admin.ch/eli/cc/1984/543_543_543/fr

In short, the limits can be exceeded

We believe that for the majority of our clients, an investment strategy consisting of approximately 100% in equities is not appropriate. We also believe that an equity strategy with a 60-70% weighting in US equities (the current market weighting) is not adequate, which is why we do not offer an ETF tracking a global index. In our opinion, a person who wants to invest in a single ETF (e.g. MSCI World) does not need the services of a robo-advisor.

Yes, no question about that, that’s what I meant by „deviate“ above.

That said, the law - at least in principle - sets limits to FX exposure and requires CHF hedging or investments. Finpension aren’t (legitimately) deviating by some percentage points, they’re ignoring the clause altogether - that’s does feel like pushing envelope to me.

While I understand the sentiment, market cap weighted investing is popular and widely recommended as the starting point if the investor doesn’t have a reason to deviate. I still consider it odd that TrueWealth makes it more difficult to roughly follow that strategy compared to direct ETF investment at a broker.

To me, an important aspect is long term maintenance of the investment strategy. I can manually tweak the investment mix to roughly match the current market capitalization. However, a country/region’s market capitalization will change over time. If I have to tweak the investment mix regularly just so it doesn’t deviate too much from MSCI ACWI, I lose the convenience benefit a robo advisor should provide.

I’m not planning on moving back from brokers to a robo advisor in the foreseeable future. However, I certainly consider this a negative point if someone asks me for recommendations (be it for 3a or for simple investing outside 3a). Maybe that’s just me.

For a single ETF outside 3a, I agree. However, there is no option to directly use a broker for 3a. Also, wanting to invest in e.g. a MSCI World fund doesn’t mean that this would be the only fund in the portfolio. One might still want Swiss equity funds for a home bias, a small caps bias, bonds, real estate and/or commodities.

Would you invest 60% of your portfolio in China? Or Japan? Any other single (developed) I randomly pick from a the list? Yeah, don’t think so.

Abstracting from the particular example of the United States and looking at it from a purely diversification point of view, there’s no good reason to invest 60% of your portfolio in one single country, jurisdiction and currency. It’s bordering madness. Because, globalisation or not, it’d entail a huge home bias, currency and concentration risk.

One of the main reasons why is - and stays - so much overrepresented in portfolios and indices is the widely-held firm belief in U.S. superiority: It’s supposed a „good“ country that harbours „good“ companies to invest in. That the country and its companies and currency will keep their economic, political and military power (and more business-friendly policies) for the foreseeable future. And thus outperform most others in the world - which it has done, historically. Also, don’t forget the huge cultural and media footprint they‘ve imposed on the world.

If you think an investment in a U.S. single-country index would have the same risks and chances as any other random developed country, you probably wouldn’t do it.

It’s probably getting off-topic, however, I’m not thinking of it as investing 60% in a country. I’m investing the foreign equity portion of my portfolio in mostly global companies, 60% of which (by market cap) happen to be domiciled in the US. These companies have employees and customers all over the world, operate in diverse jurisdictions with various currencies.

Similar to how I don’t know which Swiss stock will have the best performance in the future, I also don’t know whether stock A from Europe will perform better than stock B from the US. As a passive investor I invest based on a simple strategy as I don’t have additional information. The most popular and probably simplest one is market cap weighted investing. The consistent approach is to follow this strategy independent of the company’s domicile. This is what I get with e.g. a MSCI World ETF for the developed world.

It’s not the only possible way to invest, of course. However, if you don’t think market cap weighted investing makes sense, it also doesn’t make sense to use the per-country or per-region market cap weighted indices either, in my opinion.

China is a different matter as market accessibility is not comparable to US and Europe, as far as I know.

As I don’t invest 100% of my wealth in equities and have a bit of a home bias, US-domiciled equities amount to 30% of my wealth, not 60%.

Couldn’t agree more. Not to diversify globally is pure madness to me. ANY country can suffer political turmoil and economic demise, including the US. Look at the rise and fall of empires throughout history. Look at what happened to Japan.

Never put all your eggs into one basket.

They do - but there remains a large home bias and a concentration risk (I once looked something up for this forum).

I don’t think there’s any inherent benefit in market-cap investing.

Unless you believe in “winners are going to stay winners”.

But from a risk point of view, if you’re investing irrespective of companies’ domicile, you’re increasing the idiosyncratic risk of that country (when, factually, most of biggest companies by market cap are domiciled in that jurisdiction).

If you don’t have any information, I think is sensible to diversify away the idiosyncratic risk of single countries and take a more equal-weighted approach. You don’t have information and don’t know which countries or companies are going to perform best - so diversify.

Getting back closer to the topic, my biggest single equity investment is the MSCI Quality fund at finpension. Which boasts a whopping 76% of US stocks. But that’s a conscious decision I took in trying to predict overperforming companies.

I still think there are good reasons to choose differently and that Truewealth’s decision and reasoning to not offer a single “World” index ETF isn’t unreasonable.

With the new year, I am now reviewing my strategy in terms of pillar 3a.

I already have a 3a with Viac and with finpension. I would like to open a 3a with a much more conservative approach (=100% cash or close to it). The idea is to have a dedicated 3a pillar for the amortization of my mortgage debt. In this sense, a non-invested amount seems safer and would be in line with my investment strategy.

Does the offer proposed by True Wealth seem interesting to you given the 1% interest offered on the cash?

Yes. With bonds there still remains the risk of interest hike increases.

I have been with True Wealth 3a since the beginning of December last year and would like to share my experience so far. Feel free to comment / challenge my approach.

I have transferred all of my 3a money from Viac. I was looking for an alternative to Viac because of the FX issue I have discovered with them, and nobody could explain (1) why they do it that way (trading most of the funds in non-CHF even when they were available in CHF, and charging an FX fee of 0.5%).

The transfer process went very smoothly: in the True Wealth app I was able to order the transfer form, which I had to sign and send to Viac (the address was already filled in). After probably a week, all the money from Viac arrived at True Wealth and was reinvested the same day.

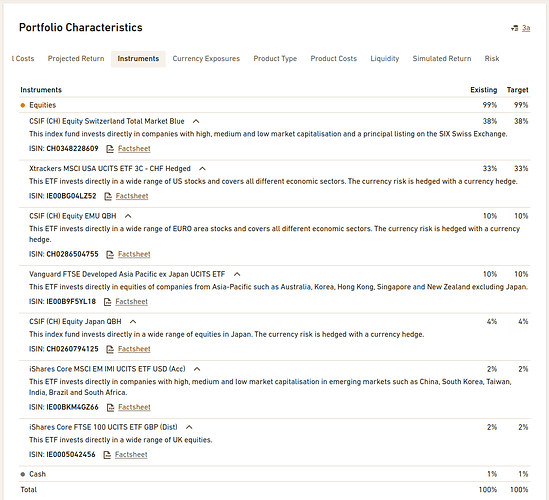

Before investing, they suggest an investment strategy. In my case (high risk level) it included real estate as well as equities. I decided to create my own strategy, which is quite similar to the Viac Global 100 strategy (2). Adjusting the strategy is really well implemented in the True Wealth app - it gives you a lot of adjustment options and is very easy to use. Take a look at the attached screenshot to see what my customized strategy looks like (allocation & instruments). The overall TER for this strategy is 0.12%.

There are two things to note about this strategy:

- True Wealth is not using pension fund optimized index funds for the US and Japan classes yet. This means that my strategy misses out on about 0.11% tax per year (calculated based on the discussions above in this thread). According to the True Wealth FAQ, they are aware of this and plan to optimize this.

- Some funds are CHF hedged. This is not necessary in my opinion as it adds a bit to the cost. But the average TER of 0.12% in my strategy already takes this into account and is still acceptable to me.

Overall, I am happy with my decision so far. My 3a investment should hopefully perform better than Viac because of the lower overall annual costs. According to my calculations, it is also quite a bit cheaper than Finpension and Frankly (True Wealth 0.23% (TER + lost taxes for US & Japan), Finpension 0.39%, Viac 0.44%, Frankly 0.45%). I am really happy to see new competition in the 3a area. Let’s hope the other players start to lower their fees too. And let’s also hope that True Wealth fixes the two minor issues mentioned above.

Do you agree with my conclusions? Or have I missed something?

Interesting as I am with Viac myself.

Why so much Swiss equity ? 38 % instead of 3% in a MSCI World or Vanguard Total.

Should you not bump your EMU allocation which is only 10% and should be at 25-40% ?

There is a comprehensive review and comparison to the other providers on the @anon95353169 website. You might be interested to have a look.

I read the review by @anon95353169 among others. Based on my experience, I do not really agree with some of the points mentioned there.

The customization is much better with Finpension 3a. True Wealth only lets you have a global portfolio shared between your free assets and your 3a. On the other hand, with Finpension 3a, you can have a different portfolio for each account, and everything is highly customizable.

That is an interesting point. With Viac, I also had several accounts, and each one had a separate strategy assigned to it. Sounds like the same pattern that Finpension uses. In case you want to adjust the strategy, you have to do this for every account individually. I do not really see the benefit of using different strategies for different accounts - I really only need these different accounts for tax efficient withdrawals, because you cannot split accounts. For this reason I like the True Wealth solution much more where you have one strategy for all accounts, and you do not have to manually mange individual accounts. This is probably a personal preference I assume.

On the other hand, the portfolios by Finpension are better diversified than those by True Wealth 3a. Indeed, the portfolio from True Wealth 3a is heavily biased towards Europe.

This is probably true for the default strategies, but you can very easily customize the strategy. To be honest, I do not really see this as a disadvantage - the True Wealth solution looks very flexible to me.

Also, True Wealth 3a forces you into a lot of currency hedging. This hedging will eat your returns.

I am not really sure about this point, but my understanding is that there are additional costs associated with currency hedging, but these are basically covered by the TER. Example:

Xtrackers MSCI USA UCITS ETF 3C - CHF Hedged IE00BG04LZ52: TER 0.12%

vs.

Xtrackers MSCI USA UCITS ETF 1C IE00BJ0KDR00 TER 0.07%.

This means that the hedged instrument is 0.05% more expensive in this case, but True Wealth’s total annual cost is still much lower than any other provider as far as I can tell (see my cost comparison in the post above). But I also hope they get rid of this currency hedging as I do not really see the point in using it for long term investments.

Use ETFs and not index funds

This is not true for my strategy, see above: more than 50% of my portfolio is invested in index funds. But perhaps the author meant to say that True Wealth does not use pension funds optimized for the US and Japan asset classes?

Management fees could be added in the future

This is true, but any other provider could change their fees at any time. There is no guarantee that fees will stay the same forever. I have had this problem with banks in the past - as long as you check the fees from time to time and see if there are others with better prices, and then just switch, everything is fine in my opinion.

I would be interested to hear your views on these points.

I think @anon95353169 is highlighting that there is only one asset allocation shared between your taxable account and your tax-deferred accounts.

I see reasons why one would prefer the possibility to have 2 different AA here (e.g. keep dividend paying assets in the tax-deferred account).

With reference to multiple 3A, I concur with you that it could be interesting at least to have the option to have one shared asset allocation for everything.

In general, more flexibility/options is better than less (for people who want it).

It is not really so difficult to pull a few sliders 2-5 times - you’re not doing this on a weekly basis (I hope).