I read the review by @thepoorswiss among others. Based on my experience, I do not really agree with some of the points mentioned there.

The customization is much better with Finpension 3a. True Wealth only lets you have a global portfolio shared between your free assets and your 3a. On the other hand, with Finpension 3a, you can have a different portfolio for each account, and everything is highly customizable.

That is an interesting point. With Viac, I also had several accounts, and each one had a separate strategy assigned to it. Sounds like the same pattern that Finpension uses. In case you want to adjust the strategy, you have to do this for every account individually. I do not really see the benefit of using different strategies for different accounts - I really only need these different accounts for tax efficient withdrawals, because you cannot split accounts. For this reason I like the True Wealth solution much more where you have one strategy for all accounts, and you do not have to manually mange individual accounts. This is probably a personal preference I assume.

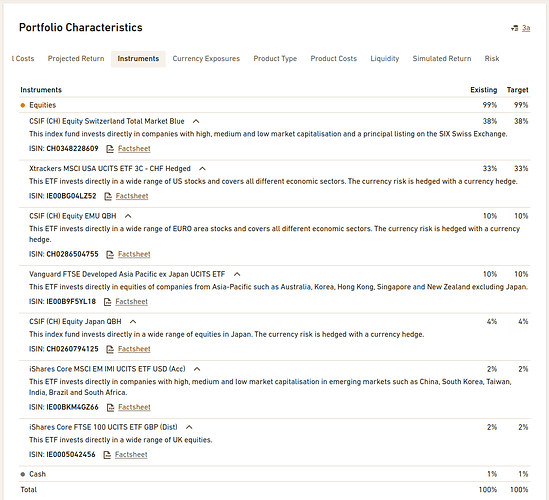

On the other hand, the portfolios by Finpension are better diversified than those by True Wealth 3a. Indeed, the portfolio from True Wealth 3a is heavily biased towards Europe.

This is probably true for the default strategies, but you can very easily customize the strategy. To be honest, I do not really see this as a disadvantage - the True Wealth solution looks very flexible to me.

Also, True Wealth 3a forces you into a lot of currency hedging. This hedging will eat your returns.

I am not really sure about this point, but my understanding is that there are additional costs associated with currency hedging, but these are basically covered by the TER. Example:

Xtrackers MSCI USA UCITS ETF 3C - CHF Hedged IE00BG04LZ52: TER 0.12%

vs.

Xtrackers MSCI USA UCITS ETF 1C IE00BJ0KDR00 TER 0.07%.

This means that the hedged instrument is 0.05% more expensive in this case, but True Wealth’s total annual cost is still much lower than any other provider as far as I can tell (see my cost comparison in the post above). But I also hope they get rid of this currency hedging as I do not really see the point in using it for long term investments.

Use ETFs and not index funds

This is not true for my strategy, see above: more than 50% of my portfolio is invested in index funds. But perhaps the author meant to say that True Wealth does not use pension funds optimized for the US and Japan asset classes?

Management fees could be added in the future

This is true, but any other provider could change their fees at any time. There is no guarantee that fees will stay the same forever. I have had this problem with banks in the past - as long as you check the fees from time to time and see if there are others with better prices, and then just switch, everything is fine in my opinion.

I would be interested to hear your views on these points.