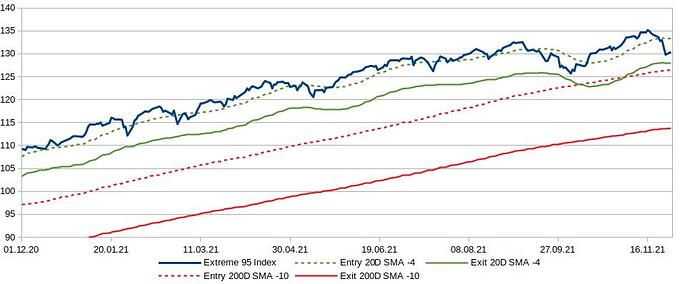

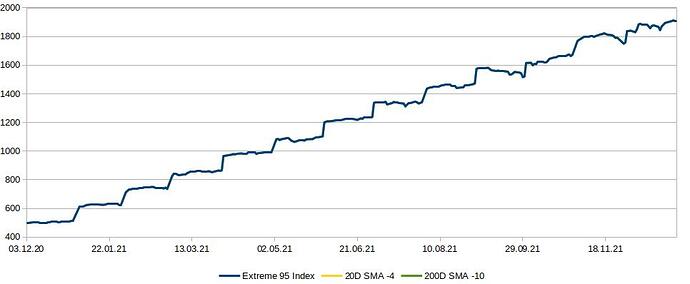

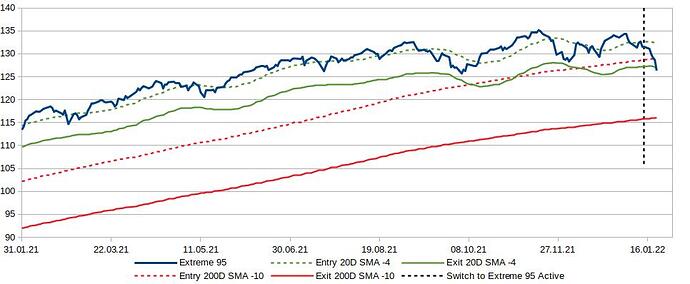

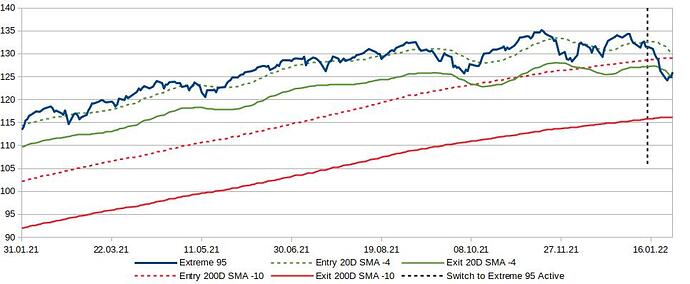

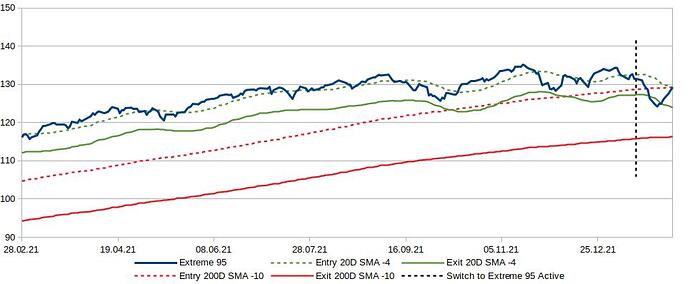

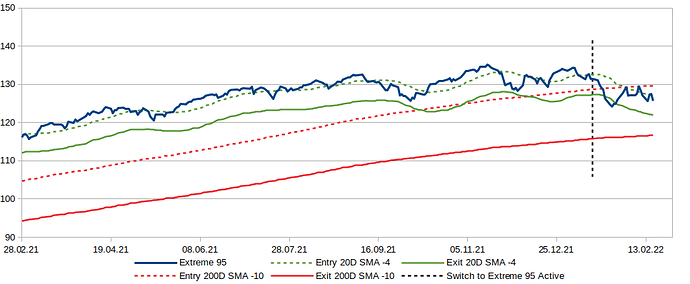

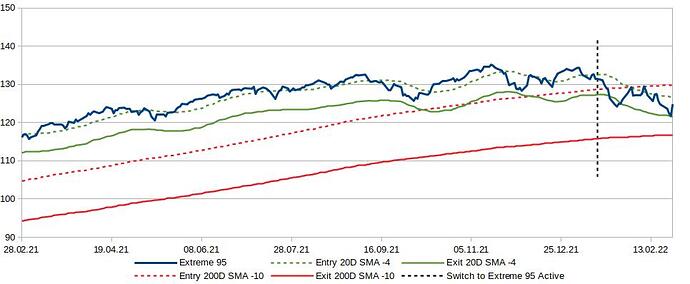

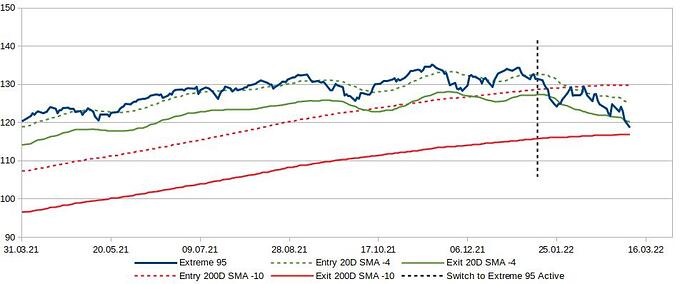

The fund used for Frankly’s Extreme 95 Index solution, topic of this thread, is getting down slowly and not anywhere near hitting a trigger (we’d need several big drops a few days appart for it to happen as of now).

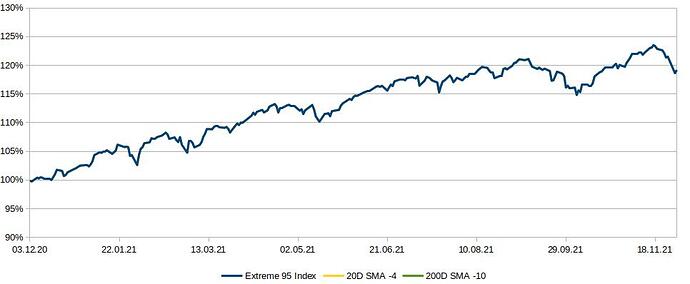

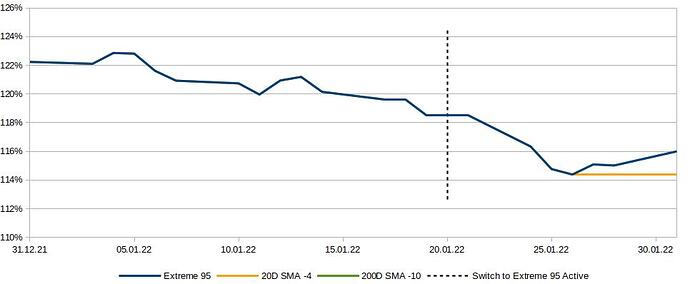

I’ve given a shot at testing this strategy with my taxable account, with a fund tracking the swiss SPI. That one hit the exit trigger some days ago and hit the entry trigger today, resulting on a net loss for me.

My reasoning was:

-

“I need as much returns as I can as quickly as I can and should take more risks in order to get a chance to get them. The market is going up pretty strongly, so there are returns to catch if it keeps going that way.”

-

It’s a small amount, so not holding new investments for 6 months shouldn’t create a tax problem since way less than my regular income is at stake.

-

If it does end up creating a tax problem, I’ll at least get to have an example of what can make the tax office qualify you as a professional trader, which would have been somewhat fun in and of itself (I don’t take loosing money very seriously at this point, missing out on heavier gains is a much higher risk for me, right now, as I need alternatives to my current employment to preserve my mental health and getting a few 10’000 CHF on the side would give me enough of a cushion to take a shot at a self employed venture that I can’t launch without a decent amount of months of savings backing me up).

-

Better to experiment with this all with low amounts before hitting a net worth where I’d put aside a “recklessly agressive” part in my allocation, meant to be invested based on momentum strategies on cryptos and leveraged ETFs.

I’ve mentioned it in answer to @user137 writing that it would be exciting to see Murphy’s law materialize, which it did, though not with the specific experiment followed by this thread.

I’ll post graphs when the fund followed in this topic hits a trigger, so as to make clear what is happening. Sorry for the confusing side story.