That would take all the fun out of it.  If the purpose was not playing with building my own strategy and pitting myself against the market, I’d pay a manager to do it.

If the purpose was not playing with building my own strategy and pitting myself against the market, I’d pay a manager to do it.

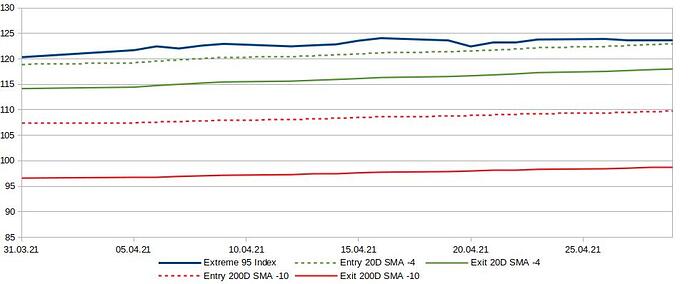

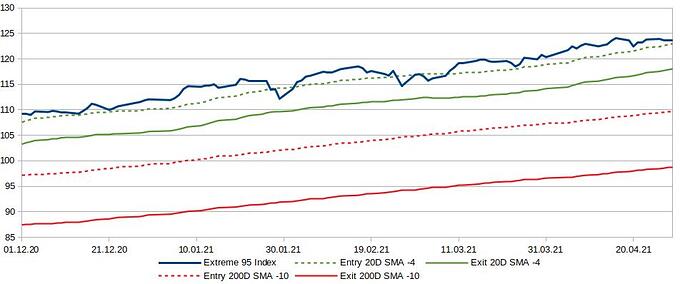

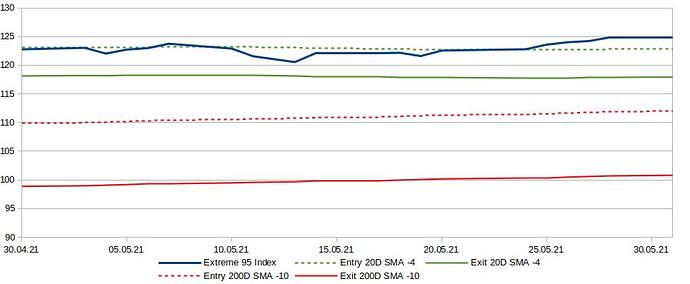

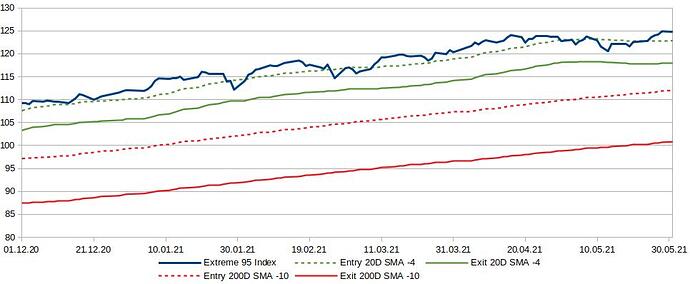

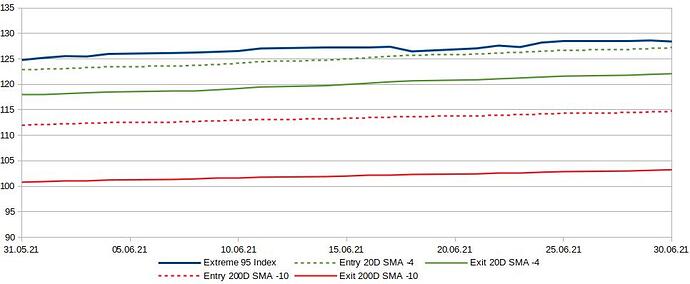

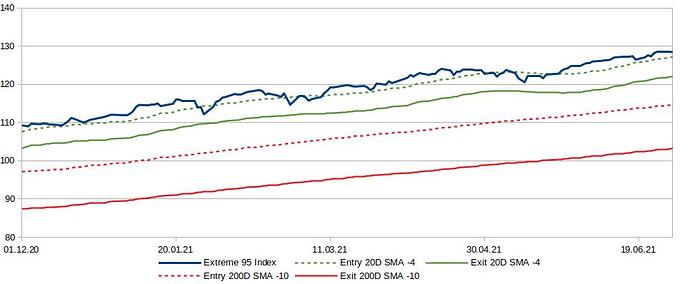

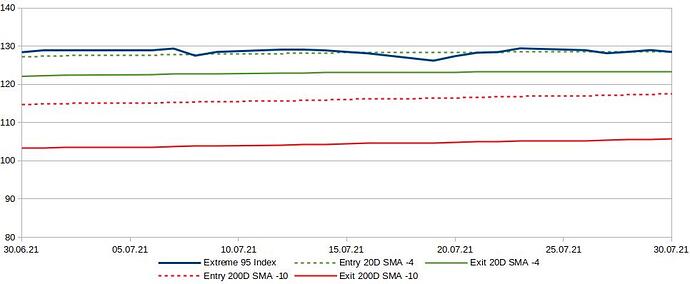

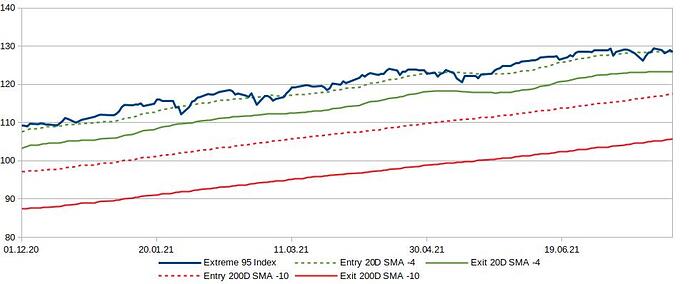

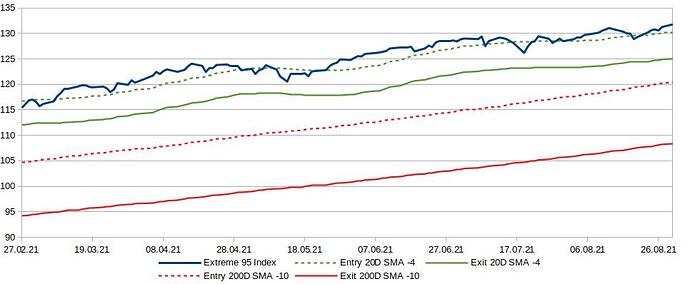

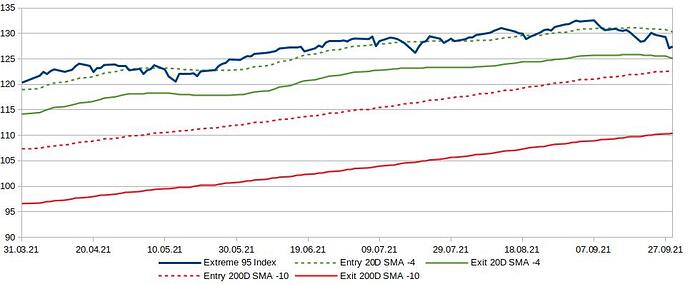

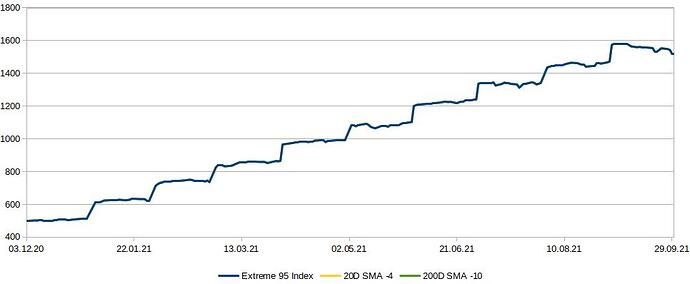

Edit: also, the cut taken on the moving average to shift it down is a core part of why I’m confident in this strategy. I’ve yet to find an automated tool that allows for this parameter.

If you can shrug it off, indeed, a portfolio of broad, diversified assets and a buy and hold strategy is all you need. I think we mainly agree on that and on the concept that the optimization must not be financial only, but that freeing our mind and time for other activities is a huge plus that allows for a better life.

Time is precious. We shouldn’t waste it chasing profits.

Not everybody is an accumulator, though. The GFC (Global Financial Crisis - 2007-2008) lasted 2 years, those who lost their job during the first hit to the financial sector went out of unemployment benefits during the crisis, when finding a new job wasn’t that easy. Meanwhile, those who had available money could buy real estate on the cheap as the prices crumbled down.

For me, part of this is entertainment. Part of it is rising up to the challenge after being a bit bored of reading again and again that you can’t time the market and that even if you get your exit right, you still have to re-enter at the right point. I’m under the impression that the people having these discourses think that, in order for a market timing strategy to work, you have to exit at the exact peak and enter at the exact bottom, everytime.

That’s not my belief. For me, for it to work, you have to make it somewhat predictable and working most of the time while fully acknowledging what can happen when the timing is wrong. This experiment also aims at either affirming my belief or help me craft the belief that I can’t, indeed, time the market and that buying and holding is the best strategy for me. Tinkerers gotta tinker. I am a tinkerer, I need to experiment by myself and get burnt from time to time to learn and flourish.

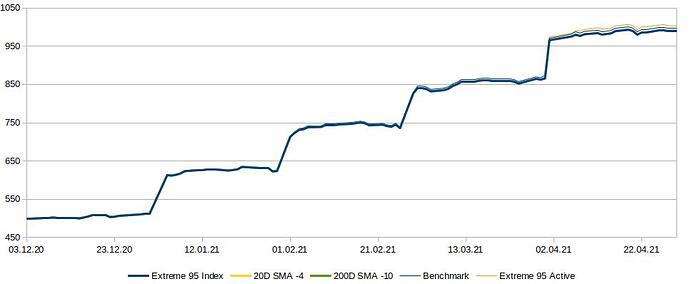

By itself, I would not expect anything more out of it than reduced drawdowns. If it works, it can be paired up with lombard loans, inverse ETFs, derivatives or other kinds of funds or assets to boost the returns, in which case, I’m confident it’s possible to overperform though it’d be time consuming and probably not very scalable. It’d raise a bunch of tax issues in Switzerland, too (use of leverage, holding periods, use of derivatives, amount of returns).

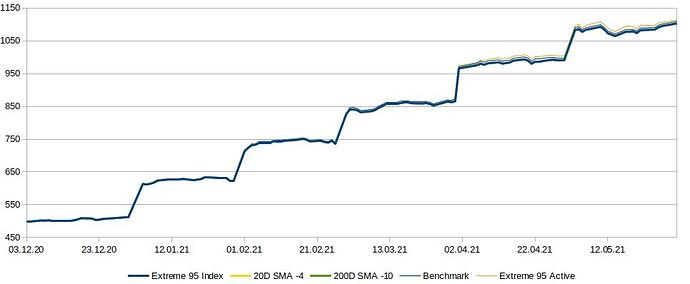

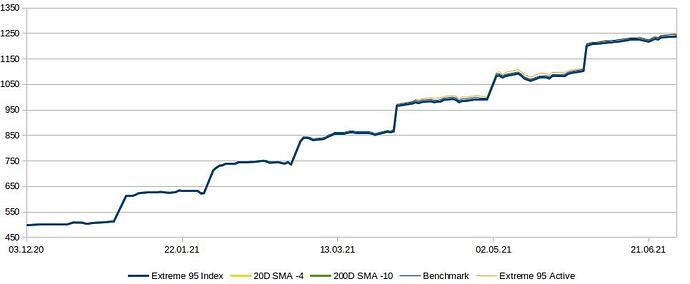

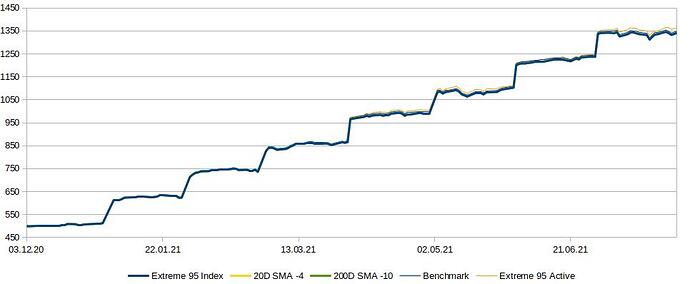

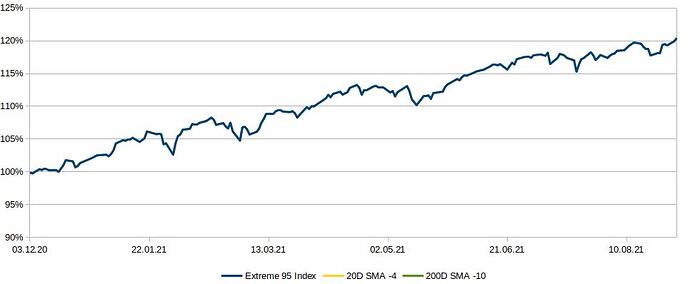

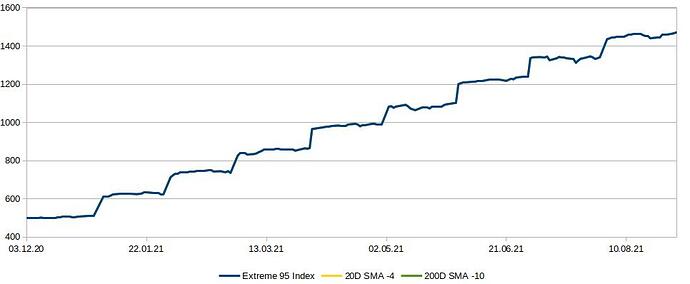

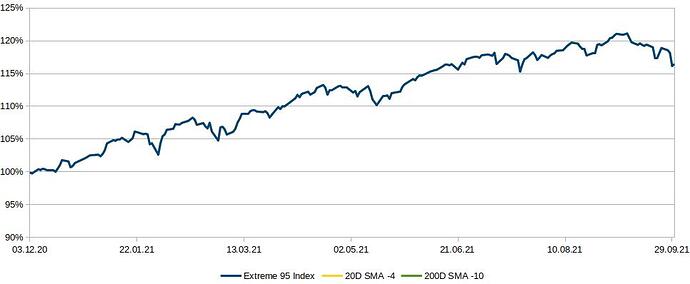

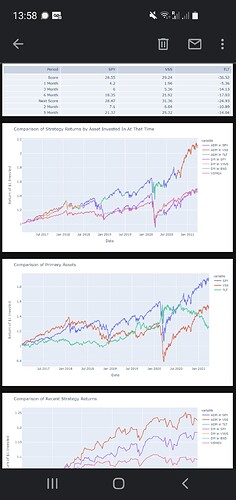

It is highly dependent on the parameters chosen, which, as you note, raises a different layer of risk. I’m confident the behavior of the Extreme 95 fund is close enough to the SPI (or S&P500-like) and that their behavior shouldn’t change drastically in the near future, so I’m confident the retrofitting I’ve done should work in a relatively satisfactory fashion for the coming times. I have to stay aware and may have to adapt it if the conditions change drastically. I’m confident it’s relatively sturdy, though, we’d be speaking Bitcoin-like volativity or anti-stocks legislation for the parameters to fall completely off track, in my opinion.

because it may only works if you are exactly consistent. Which in certain situation is very stressful.

because it may only works if you are exactly consistent. Which in certain situation is very stressful.