thanks Grog for being persistent, you might have contributed to me changing my attitude.

going back to my not that outdated calculator from the opening post (the one for a single year’s investment)

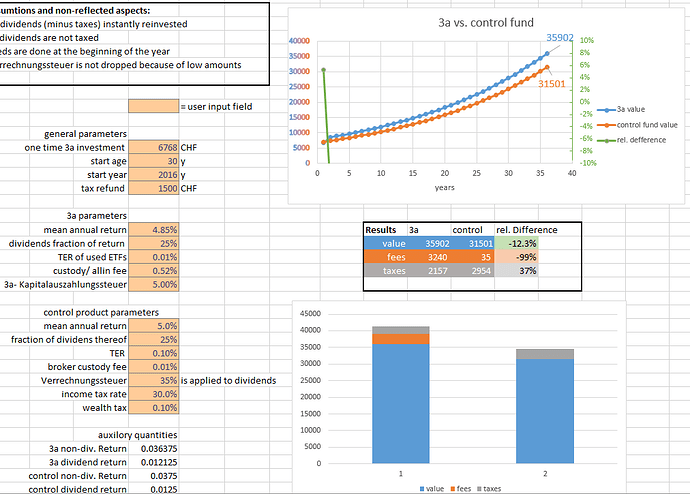

i find a more than 10% advantage for 3a. this includes taxed dividends, Kapitalauszugssteuer. the wealth tax might not kick in in this simulation.

parameters & assumptions in the image:

hm… ![]()

![]()

![]()

i might get back into this. 10% would be clearly above what i would require for this illiquid investment