Why buy MSCI EMU instead of VEUR? Same TER and VEUR has more countries. Why skip the rest of the World? No Canada, Australia?

You are right @Bojack, VEUR is better than XD5E.

Is there something like VEUR but even better?

I would like to find VXUS but domiciled outside of the US.

And preferably traded on the US exchange - this would be perfect if only it exists…

My goal would be to hold VTI + VXUS (but not VXUS)

My reasons:

- I prefer to have US and ex-US divided in 2 stock instead of single VT

- US estate tax over 60k so all 60k would be in VTI (I’m aware that Swiss-only tax residents don’t have this problem), not to use the limit for non-US stock

- Preferably without skipping Australia and Canada

- And traded in the US cause of spread and exchange charges

and the fact that you have a Polish tax residency alongside the Swiss one makes it a different story?

It’s more that I don’t want to assume that I will have a Swiss tax residency until retirement. And the rule might also change - I would prefer to be under the limit of US estate tax with out of US investments.

What do you mean, that you would prefer to be under the limit? The limit is 11 million, as long as you’re domiciled in Switzerland. And when you decide to move out, you can sell your VXUS any time, and buy VWRL on the same day.

And owning 60k of US ETF just seems to me like going through too much hassle to make some minimal savings. If you’re not convinced by US ETFs then just buy VWRL.

And most likely you should do that anyway if you leave Switzerland since many countries have capital gain tax so you want to reset the cost basis of your holdings.

That’s not how this works.

Your worldwide assets are counted towards the limit. The tax rate based on worldwide assets is then applied to your US assets. (In other words, it’s pro-rated to just your US assets.)

Holding 60k means you end up with the worst of all worlds: you (or descendants) have to deal with the paperwork for estate tax, on a small amount, and you’d still be giving up the lost withholding on the rest of your US holdings.

Thank you for all the answers!

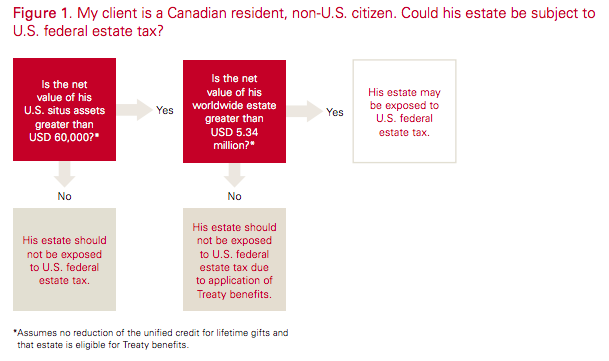

I’ve done some more searching and this thing looks very bad ![]()

Have a look on post #8

https://www.englishforum.ch/finance-banking-taxation/275699-buying-vti-potential-estate-tax-liability-us.html

“Unless you are a Swiss passport holder you wont then get the exemption if just living in CH. US meaning of domicile is different to Swiss, being a Swiss resident is not the same as Swiss domiciled.”

And then 60k in US assets plus up to 5M worldwide would hopefully mean 0% US estate tax (this is from Vanguard docs):

Glad we are having this discussion, I will worry about this for the next 30 years until I reach 5M net worth.

Lesson 1 of the Internet: never believe anything some random person has written on the internet.

If you look at the actual treaty, you’ll find the following:

(3) For the purpose of the present Convention, each contracting State may determine whether the decedent was at the time ofdeath domiciled therein or a citizen thereof.

https://www.eda.admin.ch/dam/countries/countries-content/united-states-of-america/en/tax1951.pdf

What the US thinks your domicile is is irrelevant, and being registered with a B or C permit in Switzerland is perfectly sufficient to be domiciled in Switzerland.

(Being Swiss has the advantage that you can make use of the treaty without living in Switzerland.)

Oh, and the limit is 11M nowadays, not 5M (but the democrats are threatening to bring it back down… and who knows how far).

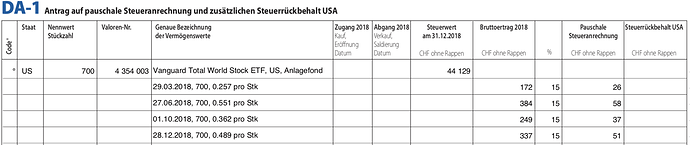

A question regarding L2WT for US-ETFs: IIUC the way it work is you fill in the famous DA-1 to get the already paid (L2WT) withholding tax subtracted from your normal CH income tax - which in the end effect means you get the part back which is higher than your tax bracket. But overall it doesn’t matter if you paid 15% or 30% - if your tax bracket lets say is 12% you either get 3% or 18% back.

So overall it wouldn’t matter “much” how high the L2WT is… the difference would “only” be in the money being “locked” with the “tax system” for a year or so, unproductive, non investable, yes, but in the end you’d pay the same amount of tax overall.

And if that’s the case, then I guess the really relevant part of taxes for ETFs would be L1WT!

Or am I getting something wrong?

PS: IIUC that DA-1 is only for US securities - if you’d hold something domiciled let’s say in Hong Kong or Australia you’d need some other way to reclaim L2WT - but it might exist as well… perhaps it’s just not as common and doesn’t have its own form  ?

?

I guess this is my main point: if L2WT is reclaimable (up to the CH tax bracket which you pay one way or the other) then it should be removed in the comparison between US and IE ETFs - and we should only be looking at L1WT!

In which case the original comparison is wrong!

Are u referring to Post 1 of this thread? Where is the wrong bit? It says L2WT is zero for IE and reclaimable for US & makes the correct analysis/recommendation IMO.

Yes, I agree, really relevant is L1WT, when L2WT is zero or reclaimable.

The DA-1 is for any country levying withholding tax that happens to have a dual-taxation agreement with Switzerland, Thurgau have a nice list of those:

http://formular.tg.ch/dokumente/temp/F70DC775-D0F4-D1D0-A00150AFB6DF2F61/2018_Vertragsstaaten_DA-1-2-3_01.01.2018.pdf?CFID=6911430&CFTOKEN=47180888

Hong-Kong isn’t on the DA-1 list… but doesn’t appear to charge withholding tax on dividends.

Thanks @flumpertrank for the hint! (The link didn’t work for me - but I found the same one here)

You’re right, it does say L2WT is reclaimable for US. But what I find wrong (or misleading) in this context are the conclusions - because if L2WT is reclaimable (leaving aside how complicated that might be) then it should be excluded from the calculation mostly! Because even if with IE L2WT is 0%, you’re still going to have to pay CH income taxes on the dividend (which is of course very individual depending on your tax bracket).

PS: I’m saying “mostly excluded” because one could argue that it would be money (USD) blocked for a couple months, maybe a year. And in that time you have currency and missing time in the market risk. So you could attribute indeed like 10-15% of yearly “cost” of that L2WT after all. BUT only on the part which you wouldn’t pay to the CH tax authorities anyway. So assuming you have a tax bracket which is in the area of 15% or higher, it doesn’t matter still (unless you go with a non-QI and pay 30% L2WT - then you’d have to include this cost imv)

So again: I’d argue L2WT should be ignored for the cost comparison.

Based on that, the following statement is actually wrong, as the TWR is not reflecting your costs accurately:

… if you remove L2WT from the picture, the numbers (taking latest figures for TER / L1WT based on latest annual reports from vanguard.com and vanguard.ch) would be:

TER L1WT TER+L1WT(assuming 2.3% div)

VT 0.10% 5.53% 0.23%

VWRL 0.25% 12.43% 0.54%

VOO 0.05% 0.0% 0.05%

VUSA 0.07% 14.72% 0.41%

VWO 0.14% 9.72% 0.36%

VFEM 0.25% 10.67% 0.50%

(Note that VWO has lower L1WT than VFEM, if I did read the annual reports right - presumably these numbers change over the years, so perhaps it should be assumed they’re equal for the calculation, not sure…)

Based on these numbers the US domiciled funds (VT/VOO/VWO) would always have been better than the corresponding IE ones. There was no case the IE ones were better - which is a disappointment for me actually! I had hoped those holding non-US stocks to be better in IE but that seems not necessarily to be the case…

Now while I’m at it, one final aspect. It looks like for buying US ETFs you really want a broker that is a Qualified Intermediary. From other posts discussing this (including this one) it seems Interactive Brokers, Swissquotes are, while CornerTrader and Degiro aren’t. Is anyone aware of some official list where this could be confirmed? For example, what’s with Saxo Bank? PostFinance? Strateo?

And finally, if someone, for some unknown reason, would choose to buy a US ETF with a non QI broker, I read you could file a form to reclaim the “2nd 15%” withheld from IRS. Sounds utterly complicated and unsure to me. But just for the sake of it, has anyone tried this? Is it “doable”?

@male I agree that the initial table can be misleading when comparing.

That emerging markets have similar L1WT means that the IE domiciled have no advantage over US ones when including personal taxation. That´s a surprise.

For Total world, it´s not a surprise that US domicile is better because it includes over 50% US shares. For a larger global portfolio, you could further optimize by adding more local funds for example US shares in US and Japan in Japan. To me, only makes sense for major markets in your stock allocation.

Maybe someone has numbers of US vs IE for some popular regional funds like Europe ex UK, Asia-Pacific ex Japan or developed world ex-US?

For taxation as hedgehog and flumpertrank confirmed, DA-1 works for all countries with tax treaty and withholding tax. This is called “pauschale Steueranrechnung” in German tax form.

Misleading here can be the second term in DA-1 called “Steuerrückbehalt USA” which applies for the special case if you buy US shares via a Swiss bank.

That would be indeed interesting!

PS: Is there any ‘developed world ex-US’ (VXUS style) in IE at all? I didn’t find any so far.

Another thing I would like to figure out is how does L2WT look like for LU and DE (Japan or other AsiaPac ones would also be interesting though!) For LU/DE specifically there are some interesting ETFs around - and I’m wondering if they have 0% L2WT for CH based investors like the IE ones…

If anyone has an insight that would be greatly appreciated!

LU and DE are 15% WHT for dividends, which can be fully reclaimed via DA-1.

You find a country list at the tax administration webpage: https://www.estv.admin.ch/estv/de/home/internationales-steuerrecht/fachinformationen/quellensteuer-nach-dba.html

See the document “Vertragliche Begrenzungen der ausländischen Steuern“ available in French and German.

0% at source applies to Hongkong, Indien, Irland, Kuwait, Malta, Singapur, das Vereinigte Königreich (UK) und Zypern.

I don´t know of any attractive developed world ex-US from IE, that was only an example. You could substitute with two ETF, Europe and Asia-Pacific.

I do have interests in IE-domiciled Europe ex UK from Vanguard and Asia-Pacific ex JP from iShares but have not analyzed these for tax efficiency.

Did someone actually manage to reclaim L2TW with a DA-1 for a US-domiciled etf? I live in Basel Stadt and the tax pc program (Baltax) would not let me choose DA-1 for any ETF, only works for US shares. Anyone willing to share the practicalities of doing this?

Thanks,

Sunny