Did you just say that “this time is different” ? ![]()

Two sectors performed over S&P500 last year, the tech surged 50% and the financials gained 32% , all others trailed the broader market.

The most popular dividend focused ETF-s returned between 20-27% vs the s&P500 31.5%

There were a lot of dividend cuts, what I managed to awoid.

All in all I have a very deffensive approach to the investing and my target is to keeping pace with the broader market return in the long term and outperforming in downturns preserving capital.

7 posts were split to a new topic: Free Shareholder Swag in CH

Good point, but not considering dividends at all is plainly wrong.

Really? Last year? Dividend cuts in Telecom sector & some banks, certainly not what I would describe as “a lot”. I would say dividends went up “a lot” actually.

That dividend cut was meant to be split from the previous sentence, sorry for bad writing…![]()

It’s always a different time. Market’s unlikely to crash twice for same reason. Stop trying to time it and look at fundamentals, tech 2020 != tech 1999.

I’d argue cloud/SaaS/PaaS/subscriptions business model of many (though definitely not all) tech companies today is more defensive than it used to be the case in the past. Although certainly they are no consumer staples. But we’re no longer living in the world where people buy software in a box. Big businesses are built on AWS/Azure/Office365/GCP and they can’t stop paying Amazon/Microsoft/Google/… or they won’t exist. Ease of switching between cloud providers is an illusion, in reality it can be an enormous burden.

Correct. Gross aka Total return index is without any consideration for dividend taxes.

Yes, typically, net return index is used as benchmark, and these typically come with pessimistic tax assumptions such as US at 30%. But the guy I replied to said specifically, I quote, “Total return”.

While it’s probably not something you’d want to directly benchmark your portfolio to (except as an upper bound), it’s still very useful for running calculations like how much of dividends did the index companies give on a given day. Different investors have different tax situations, there’s no single one-size-fits-all after-tax index. Official net return indexes as mentioned above are also “wrong”.

What’s FuW and why should I invest in it?

Crappy 0.8% management fee, some extra no-name intermediary between my and my stocks - no thanks

If this is them, then they didn’t seem to have managed to beat S&P500. Why should I not just buy a much safer S&P500 for 0.03% fee from highly respected Vanguard instead?

Looking strictly at their performance chart, no, I wouldn’t invest with their strategy. They don’t show any consistent patterns of beating S&P 500. I see on the chart they outperformed it in 2008-2009 - could be luck, and then it looks like they just kept hugging the index and in the end underperformed/matched it.

Compare with https://www.fundsmith.co.uk/fund-factsheet for an example of an active fund which may be worth your while and its 1% fee. They don’t have as nice and simple chart to show comparison with S&P500, but believe me they outperformed it a lot and pretty consistently. They’re also rather open about key principles of their strategy. Of course, beware past performance is not indicative of future results and that they run a much much bigger fund today than when they started, which is a negative thing for returns.

Um, I wouldn’t say they are value, at least not in the sense than index companies (S&P, MSCI, et al) understand value (low P/E, P/B…) so it’s not really appropriate to just compare them with S&P 500 Value or a similar global index

Google, Apple, Microsoft - these are growth companies

There is value - mostly meaning low P/E, which is what index companies’ value indexes are tracking. They are not it.

And then there’s value investing - buying companies for a good price. This is a much broader and less formalized concept, which could involve a good deal of qualitative analysis. High P/E companies with a great earnings growth potential like Google or Microsoft can still be great value from this perspective, but not from the POV of S&P/MSCI which are more focused on shallow and easily quantifiable characteristics like P/E in their value indexes.

Finally a video from Ben Felix about this fund.

The stat arb funds must have made a fortune with last weeks’ volatility!..

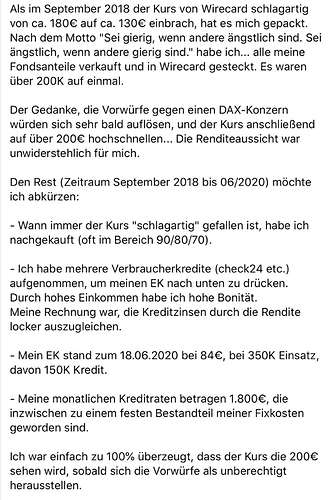

I hope some of you guys are able to read German:

Everybody is only talking about the few winners out there. But nobody is talking about the losers, that make up 90% of the market participators.

If I understand well, this guy sold his good “diversified” fund to buy a single stock with his life savings and then took consumer credits (at 9%+ probably) to buy more as it continued to go to zero?

That’s correct. Now he sold everything and has 60k in debt left (at 9% interest).

Twist: As a self-branded “TradingCoach” he has been offering paid seminars, personal coaching and advice to other wannabe traders.

Well, at least he didn’t threw himself under a train unlike some other guy

Orkan Koyas (a german trading coach) – shared a story – he isn’t the guy behind the story…

ooh that ruins the thread ![]()

So that might be an ad for his services.

I’m not sure about that. Swisslos have 99.9% losers

Rega made a good advice about that more likely to take one of their helicopters than win

Stock market you can win, lost or stay flat for each stock the percentage is a lot more high than other games. If you spend some time to take information about company because ETF is almost not possible you have a great chance to made some profit.

After yes you have external events like trade wars an outbreak but if the company is really good should probably stay good in a short term.