It’s unlikely that you’ll beat the market, but if you can put the resources, time, effort, knowledge and skills that will put you in top 10%-15% of active investors long term, go for it. Otherwise, it’s not recommend to not follow passive strategy, as odds are against you. It’s just plain horse sense, as about 80% of active investors underperform long term.

“Owning the stock market over the long term is a winner’s game, but attempting to beat the market is a loser’s game.”

"Don’t look for the needle in the haystack. Just buy the haystack!”

"Don’t think that you know more than the market; no one does. And don’t act on insights that you think are your own but are usually shared by millions of others.”

“The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has done it successfully and consistently.”

John C. Bogle

Perhaps that citation is older than 2016. A certain Warren B. is waiting for 4 years to invest further. Difficult not to know that guy ![]() .

.

Links here, here, or search “berkshire hathaway cash position” for more…

I think John Bogle knows Buffet better than anyone on this board.

He knew him. Saint of Wall Street died a year ago.

How was the average return of berkshire over the last 10 years?

Value stocks have underperformed growth stocks for the last ten years. The last time this underperformance was this extreme was 1999. Growth stocks are incredibly expensive today, but many investors are still chasing them. In fact, these investors are happily marching further out on the risk curve in pursuit of higher returns. Historical data shows that value stocks tend to outperform growth stocks by a significant margin even if they have gone through painful bouts of underperformance in the past. Vitaliy Katsenelson said: “A race car will finish the race faster than a four-wheel-drive (all-terrain) vehicle. But if the terrain turns rocky, the race car won’t even finish the race, while the all-terrain vehicle plows on through. The problem is that we have no idea what terrain lies ahead of us, so we’ll always err on the side of durability over speed.” Chasing the ever so popular vastly overvalued growth stocks is the ‘race car’ strategy while sticking with the true and tried dividend-payers is the ‘all-terrain’ approach. Back to Vitaliy: “We feel a bit like sober, not-so-popular kids with eczema at a party where everyone else is drunk on the spiked punch and having a great time. We may feel a little envy right now, and – let’s be honest – we are not having a great time. The more commonsensical and rational you are, the less fun you have been having at this party. But the party will end (they always do) […]. When the music stops and it’s time to go home, the drunk kids will be carried out and suffer giant hangovers. Just sayin’… That’s what happened in 2001 and countless other times in history, and it will happen this time, too. We just don’t quite know when.” This is a brilliant summary.

It’s always easy to call the winner when the game is already over. Nobody knows who will beat the market in the next 30 years. But in 30 years you’ll hear the same argument “Person xyz beat the market 2020-2050, so it’s possible to do it, that’s why I’m stockpicking too”.

I don’t think you need talent at all. Luck is all you need.

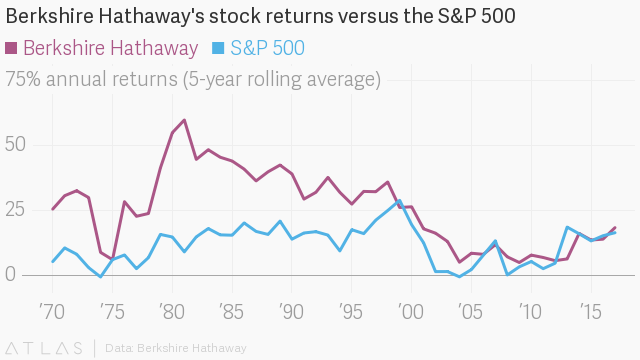

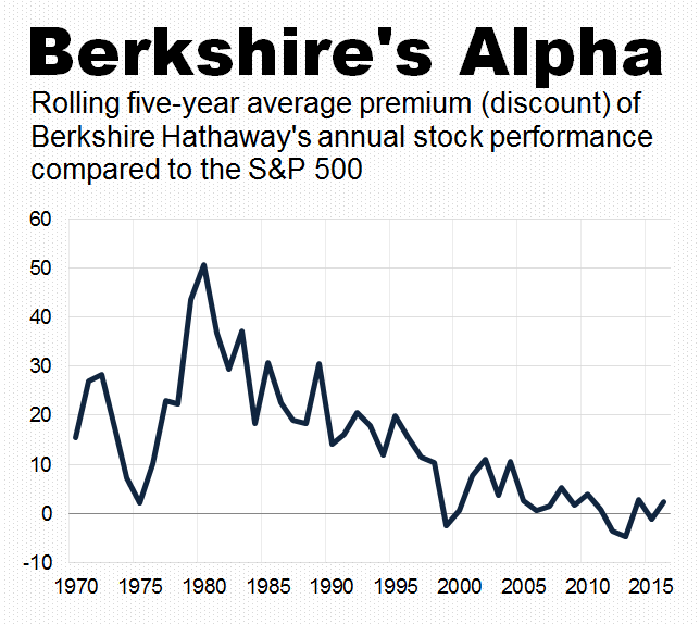

You could show some effort and actually deliver some charts ![]() . So I googled for them. Indeed it looks like BRK has no real edge over S&P 500 since 2005, that’s 15 years already.

. So I googled for them. Indeed it looks like BRK has no real edge over S&P 500 since 2005, that’s 15 years already.

For reasons why - check Ben Felix / CSI videos on youtube on small cap value stocks (and why all small cap including growth is not a good idea)

He’s a very clear and concise explainer, and backs things up by facts.

And yes, I am considering allocating a part of my portfolio to it as well, now might be a good time, since small cap value has underperformed for the past 10 years. ![]()

E.g.

[Rant mode ON]

Since this forum has been launched 4 years ago, the topic of active vs passive has been discussed many times.

It is a bit sad to see that nevertheless the same arguments and dogmatisms come back again and again, without building anything new on existing blocks. This topic is a sad proof of it, containing already 90+ posts in a few weeks and we are still going in circles.

So let’s cut the crap and start from what has already been debated and concluded/synthetized. If you disagree with the below and want to debate, you’d better bring a REALLY good counter-argument.

About beginners:

- If you’re starting in the investing world, you’d better index and stick to a simple ETF portfolio

- If you are not sure if you should go active or passive, that tells me you have no conviction in your strategy. Go passive then. Especially if you have to ask it on a generalist forum.

- As with everything in life, only 20 percent of the people can be in the top fifth. If you want to be part of it, you’d better be ready to spend a lot of time working on it and understand very well the underlying core principles of why your portfolio is going to outperform.

About active funds:

-

Most active funds are not in the business of generating performance, but in the business of amassing assets (surprise, this is the definition of an asset manager) so they can charge a fee. All they have to do is not posting too shitty returns. As a consequence, most will never stray too far from their benchmarks, and after fees the result is likely to be sub-optimal.

-

With such a dis-alignment of incentives between these managers and investors, i am still wondering why people keep judging them on their returns.

-

On the other hand, there are managers and private investor who DO over-perform consistently.

-

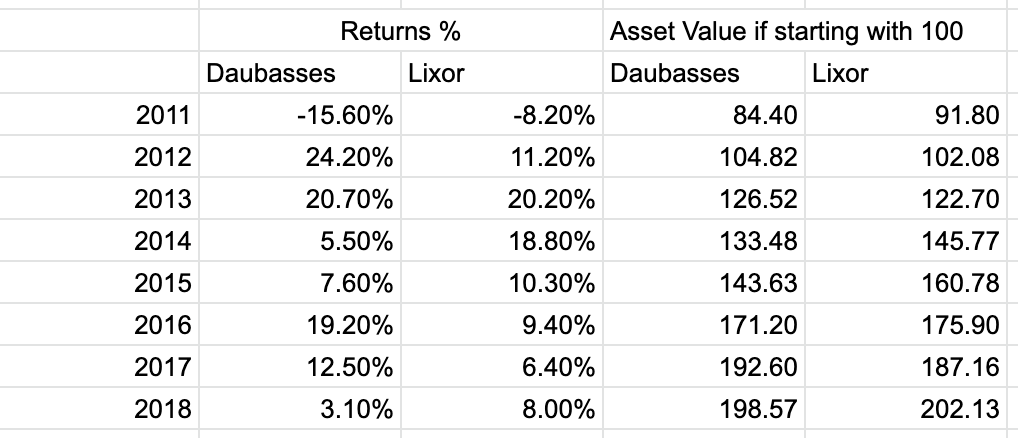

Finding example for these outperformers is not too complicated. And NO, it is not due to luck. In this essay dating back from the 80s, Buffett gives a dozen of examples of outperforming managers who had outperformed for many years, and kept outperforming afterward, until their retirement, or their death. Another example is Terry Smith who has been outperforming this decade with Fundsmith, and who was outperforming as well in the 2000-2010 decade with his previous company when most investors were losing money. Les Daubasses are another one (simply applying the principles devised by Graham 90 years ago). Anyone calling this luck should go back to his probability classes. We are getting way too many monkeys typing Hamlet by mistake on a typewriter…

-

This does not mean these good managers outperform every single year. But it does mean that over the longterm, their investors will be better off than if they had invested in an index fund. It is like the Tour de France bicycle race: at the end, the winner is not the guy who won all stages, but the guy who was the most consistent (in fact, I’d be surprised if any bicycle racer ever won ALL stages of the Tour de France).

-

Does that mean you should invest with these superior managers? It depends. As said in point 8, there is going to be years when they won’t perform as well as the market. This is the time when you will need to know REALLY well why you trust this manager. You will need to have a clear understanding why his strategy is sound in the long term, and more importantly, have a further conviction that it WILL continue to outperform. Hoping on and off from managers without knowing what you are doing is certainly not a good idea. Les Daubasses are a good example. No doubt that a lot of people are wondering what the last few years of underperformance mean, without looking at the underlying principles of their strategy.

-

As a consequence, if you are not able to explain from first principles why a given manager outperforms, you should probably not invest with him. If you don’t know what you are doing, the stock market is an expensive place to figure out.

-

Buffett is a particular case. During his tenure, he has compounded the share price of Berkshire Hathaway from $11 to $336’000. So he basically went further than everybody else ever did. Berkshire is so big now that it is almost 1/40th of the US stock market. As a result, his investment opportunities are now strongly reduced and he and Munger have repeatedly said in their letters to shareholders that we should not expect Berkshire to grow more than 10% per year in the future.

Misc:

- The whole discussion above about randomly labelling dividends as “good” or “bad” is symptomatic of what I am condemning. Labelling dividends as a whole as good or bad without looking at the peculiarities of the underlying businesses (capital intensity of the business, reinvestment needs, returns on invested capital…) and the price paid for these dividends is utter nonsense. Dividends alone will never tell you if the company is a good investment case. Most participants showed one thing: they have no idea what they are talking about, and as such they should stick to indexing. If not, i’ll be very happy to be their counterparty.

Can we please go ahead now and stop repeating the same old half-baked truths over and over?

[Rant mode OFF]

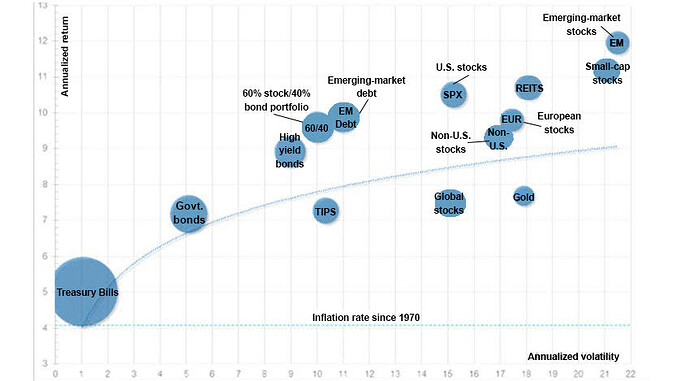

It’s about the old concept of return vs volatility. You probably know this curve which puts assets on a curve: increasing potential return comes at a price of increased volatility. The asset class that you choose depends on your appetite for risk. Small caps are up there with higher returns and higher volatility. So people who overweigh small caps are people with a higher appetite for risk than the average of the stock market.

Good paper about factor premium.

Surely you know the difference between compounded returns and the arithmetical sum of annual returns? I bet you used the latter, while you should use the former. Allowing for rounding, i get + 979% if i redo the calculation.

Quickly done the math here.

Since 2011 (ok, I’m cherrypicking the start date but maybe 2009 +300% is an outlier?) the two column returned the same, assuming the returns are in the same currency.

Actually 100 (USD?CHF?EUR?) invested with the Daubasses portfolio returned slightly less than 100 “same something” invested in the benchmark. That’s before Daubasses fees I suppose.

I also wander why is not “MSCI ACWI Total return” the benchmark (even though it performed a bit worse than the chosen benchmark)

To me it does not look at all like they are investing gods… simply that they got lucky in a single year (2009).

I do not really know much about the Daubasses but I am interested in the debate it sparked and the new insights I get from it. Currently thinking about adding VIOV to my current VT-only portfolio to tilt a bit towards small cap value…

Doing value investing myself (stock picking) would take way too much time for me and I feel more comfortable doing this via an ETF even if it means getting slightly lower returns.

Daubasses are investing gods, but they try to make 119 Euro on investing advice from you and me, rather than managing their own hedge fund ![]()

The problem I think is mathematically rational investing is too boring and passive, especially for people that are interested with investing. They cannot just not do anything.

I wouldn’t draw parallels to 1999. Much of growth stocks are IT/tech and there’s a radical difference between their fundamentals in 1999 and today. Only Uber/Lyft and maybe Tesla have valuations reminiscent of dot com era, but the rest of tech is much more healthy. Expensive, yes (for good reasons - those margins and growth!), but not dot com crazy expensive when people were paying insane money for companies with no profits in sight.

Returns are aggregated using products, not sums

Total return index doesn’t consider dividend taxation at all and so is not practically obtainable by buying its basket of stocks.

Are you sure? On MSCI website you have charts for price, gross and net indexes (net = after paying withholding tax). And I heard that ETFs like to take the net index as a benchmark, because then they can hide their operating costs and still hug the index.