Actually there are two risks there: for Tesla Inc., other EV makers; for the TSLA stock, the flood of new growth stocks (SPACs, Cannabis, …) on the sell side. Retail investors have just too many tickers to choose from…

It will be interesting to watch indeed. I myself also see some red flags now and then, but I won’t sell after less than 6 months. It’s funny how you value the stock at $30 and the Australian Youtuber just said he “sold a few of his organs to buy more TSLA stock” after it briefly dipped to $620. Fascinating to see wildly different opinions from smart people who have both done the research.

$10-$30 is too low but it got me interested to consider what I would actually pay for this company today.

My quick conclusion came to an absolute max of $200bn. And thats really pushing it. I’d have to put forward very bullish projections on revenue growth, margin growth, rapid global EV adoption, insignificant uptick in other transport (e.g. public transport), favourable FSV regulation, Musk factor, low interest rates remaining to justify very low risk premium, etc.

Given that its still trading at almost $700bn I’m going to continue sitting on my short position for the foreseeable future. Relative trade so have beta hedge.

I have 4 slides on the competition.

However, I don’t see it as a risk factor. Even if Tesla achieves its goal of 20M vehicles per year, it’s “only” a 20% production market share. The others can still divide 80M vehicles per year amongst themselves. Plenty of room for everyone.

The end game is autonomy and fleet learning, where Tesla is far ahead. This will become obvious once e.g. the Dojo supercomputer is completed.

I have added to my $TSLA today. Happy about the long-term risk/reward. But I don’t recommend people should buy blindly. Always do your own research. If you don’t like it, don’t buy it. Simple as that.

“But they’re more than just a car company. They’re an energy production company”

Share of solar energy of total electricity production in the US, 2019: 2.5%

Solar energy generation deployed by Tesla (as per SEC filings, 2019 from their web site), in MW:

2017: 523

2018: 326

2019: 174

2020: 205

Welll… doesn’t look as if Tesla themselves will lead us to an overproduction in solar energy anytime soon, does it? Not long ago, their solar business was so on fire, that it was literally on fire.

This has already been pointed out by @Julianek and I have no good answer. Maybe the price of solar and home battery is not at a tipping point yet.

Ah, they could be one of the reasons my post-opening gains evaporated yesterday.

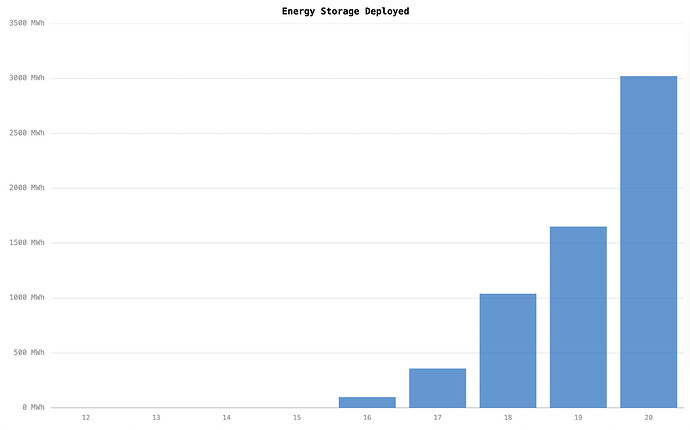

Storage is growing nicely:

Tesla had to rebuilt its solar offering and now offers the lowest cost solar in the US. The purchase and installation process has been streamlined. The bottom was reached 3 quarters ago, and since then it started growing again.

The energy business had to be put on hold during the ramp of the Model 3. I expect solar to start growing nicely from here on. Keep in mind that storage is still constrained by battery cells (as is the car business). Once they ramp up their own 4680 cells, storage will go parabolic.

@TeaCup I’m fine with my holding, not planning to sell in the near future and it’s only a small part of my NW. Yesterday I missed the 620 because of production issues at work, sadly.

My hold horizon is 2030, and will DCA from time to time to increase the position.

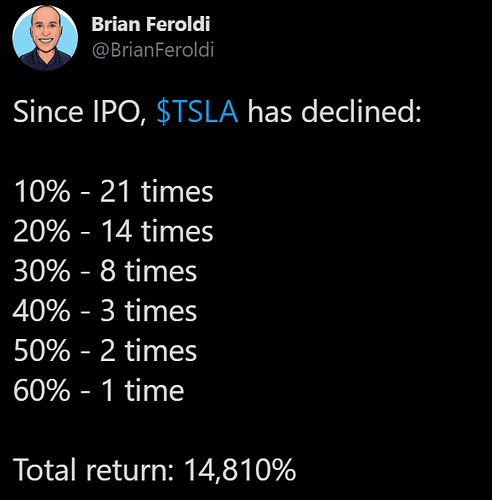

14810% is quite meaningless if you’re averaging in at higher and higher prices.

Say the stock went public and went from 1 USD to 14811 USD.

You’re now buying one share for 14811 USD and it drops 50%.

You would stand to lose - so to speak - 7405% on the very same basis.

Or 50% of your newly invested capital.

And it’s not like they’d be able to gain another 14’810 easily.

One answer to that tweet serves as a good reminder and (possibly) an example:

Cisco:

Were they technologically ahead of the competition in 1999 or 2000? Sure. ![]()

Huge sales growth? Something like 40% YoY in 1999, 55% in 2000. Check ![]()

Market leader in revolutionary high-growth technology that would shape our everyday lives? ![]()

Had it been a great investment for early investors? At +1000%, absolutely! ![]()

Were people buying it as a high-growth stock at their peak, despite high valuation? Of course! ![]()

Did Internet and Networking stayl a high-growth sector? We can confirm that from hindsight. ![]()

How did that turn out for investors who bought at their peak? Let’s look!

At some point, TSLA will likely come to mirror that Cisco chart from 20 years ago.

Kind of. You could argue that TSLA is earlier in their growth trajectory.

But then, Cisco was trading at a P/E of only a lowly 100 or so back at their peak.

TSLA is at over 100.

Their Panasonic 4680 cells? Also likely to be made by LG Chem and possibly CATL?

In fact, relatively speaking it could work out pretty similarly:

If TSLA were to grow tenfold, selling 5 million cars - with that, they’d be one of the top five or six manufacturers in the world.

If over the same time their stock price were to decline 80% of from their current level, they’d be somewhat reasonably priced at a P/E of 20.

Still high for a car manufacturer - though why shouldn’t we give them that, considering their loyal fanbase and charismatic founder.

“The last thing Powell needs is to trigger a reaction and have a significant correction in equities.”

- 20% market share would actually be huge. Nobody has 20% market share in cars. Even Volkswagen and Toyota have only half that.

- The swan song for “legacy” automakers is premature. Will some of them shrink or go out of business? I wouldn’t be surprised. Will basically all of them? I would be surprised. Will they yield the field to Tesla? I would be surprised. If anything, new emerging players from China will take their place.

- Allegedly superior battery tech. Somebody will throw out a few fancy slides and buzzwords. When I look things up, Tesla doesn’t make it themselves, they’re buying it from suppliers - and other car makers can get it, too. They probably already have, somewhere in China.

I would appreciate a deep dive into how much ahead they are actually. Does anyone, maybe you, have any pointers. I’m no expert on this, but from what I gathered, Tesla probably has the best self-driving system of car manufacturers, based on current performance tests.

At the same time, they refuse to integrate superior sensor tech (LIDAR) into their machines, “even if it was free” (Musk). It remains to be seen how they’re able to cope the (potentially) dangerous “corner cases”, where superior sensors might actually help.

Overall, I get the impression that Tesla is slightly ahead - not many years though.

Not surprising. While other self-driving car manufacturers take a more cautious approach, Tesla has been advertising their system under the “Autopilot” moniker, suggesting that it works with very little user supervision. And Elon is regularly touting it as such (or almost finished… next year …by next year) on his Twitter. And there seem to be enough fanboys drinking their kool-aid.

Tesla also seems to have the worst - laxest - driver monitoring system among their competitors. By considerable margin. No camera on the pilot, monitoring whether he’s paying attention to the road, his surroundings, basically if he’s actually driving the car.

In essence, it’s not hyperbole to say they’re ahead in fleet learning - not least because of their apparent lack of safety ethics. They’re basically using traffic participants as Guinea pigs.

I’m not going to comment on mere buzzwords in the pipeline.

In other words: Don’t withdraw the drugs.

In more specific news, how much is Tesla’s market share in Europe - and how much will it be?

These days CBs are even considering increasing the injections… So far they only threatened to do so, with the exception of Australia’s CB which just doubled the dosage Monday. So far it was successful stabilizing rates…

@San_Francisco how is that short position going? You consider closing it already? Or do you expect the price to tank even further?

I would wait, todays premarket is -6%

Anyone planning to increase the holding position?

Ok the tumble seems to continue for now…

I am adding to TSLA through increasing my ARK position, although if the market continues like this my cash allocation is fairly quickly drying up.

I was seriously considering it. If I bought another 100 shares for $600, then I would have 200 shares with an average cost of $500 per share.

But maybe I have invested enough already… Michael Burry, who is regarded as an expert of going against common belief, says TSLA could tank to under $100 and is shorting the stock. @Julianek made similar claims and @San_Francisco is shorting too. So I guess I will wait and see what happens.

My next buy order is 25-50x400… but maybe I should just stick to VWRL