I think he meant every car maker.

Wow, that’s quite a commitment, 99.9k just in one position.

If self-driving level 5 doesn’t happen by 202x or other companies have it sooner, there’ll be a certain disappointment, no? But Elon is the master in playing for time & will announce the Tesla speed boat, and later the cyberbicycle to make up for that.

Or maybe SpaceX makes its IPO. Which I would totally buy, 10% at least.

Steven Mark Ryan holds 1000 TSLA shares and that’s basically all he’s got ![]() . Now that’s commitment!

. Now that’s commitment!

You’re behind the curve, mate. Elon already said that the Cybertruck will be floating. It could mean that with certain modifications you could even navigate it.

You’re right, what could possibly go wrong? All the lights are as green as possible.

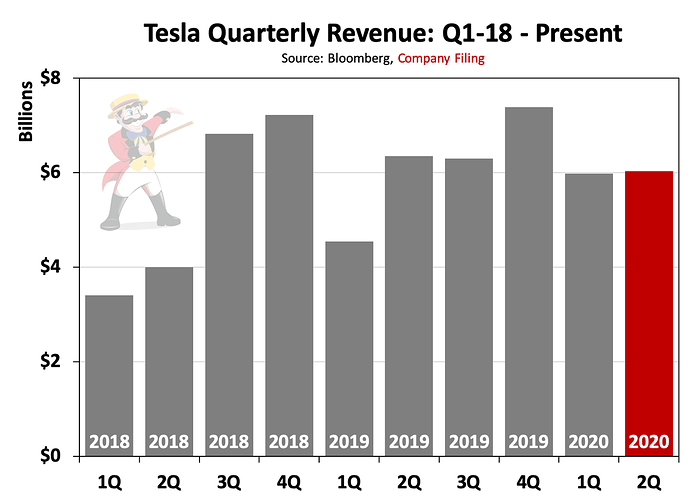

Incredible “growth” in revenues:

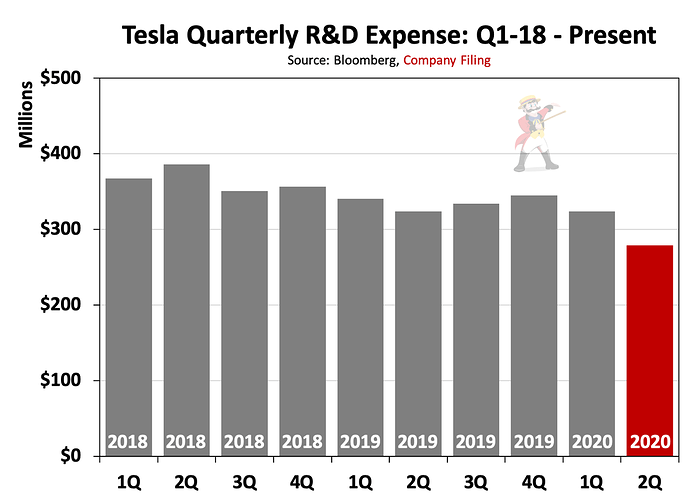

Top notch R&D

TSLA is on the cusp of developing Level 5 autonomy, building a new electric semi/Roadster/Cybertruck, creating breakthrough solar technology, and developing a million mile battery. All of this is reflected in their R&D budget, which has the luxury to go down and down…

Some numbers for reference:

Toyota R&D expenditure is $2.5 billion a quarter

VW group R&D expenditure on EVs alone is $14 billion a year till 2024

Hyundai has spent $40b over 5 years

Ford spent $7.4b in 2019 on R&D

Mercedes spends $7b a year on R&D

Don’t worry, they’ll get to level 5 before everybody else!

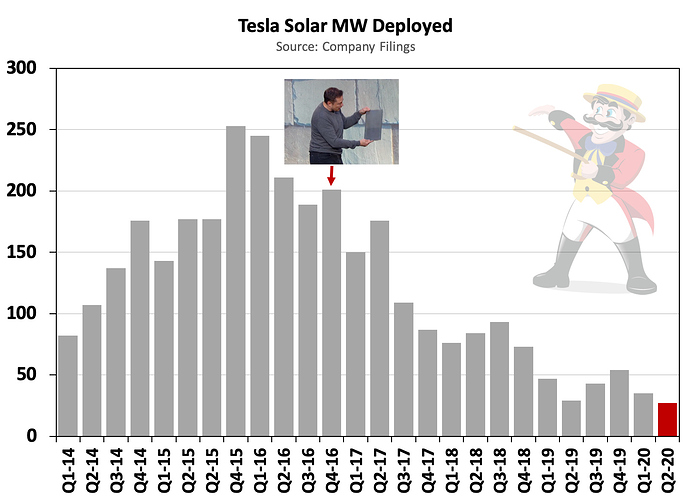

A very healthy solar business.

Don’t worry, Solar City is not a dud! Shareholders must be happy that management bought it for $3b (more than TSLA book value at the time). Growth, growth everywhere.

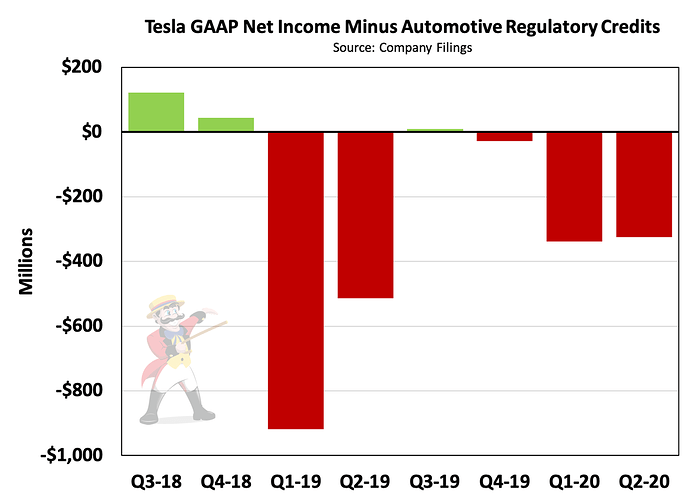

A core business on steroids.

But surely TSLA’s focus is on cars. It’s core business has been profitable for 4 consecutive quarters! Except if you remove the trading of carbon emission credits… Not much, really. In Q2 regulatory credits only amounts for 400% of earnings…

In other words, the only reason the company will be accepted in the S&P500 is because ICE automakers sell cars. The irony…

No accounting shenanigans

And last but not least, for the accounting nerds. Year on Year, the company’s revenue are down 5%, while its account receivables (which are usually already quite high in percentage of sales, around 20%) jumped higher by 30%. In layman term, it means that a material part of the “sales” that the company recognized did not led yet to any money received. Quite curious, for a business where the customer pays upfront.

In conclusion, TSLA appears to be “selling” regulatory credits based on cars they may not have yet sold to people who have not paid for them.

But don’t worry, a P/E ratio of 800 is totally warranted for such a profitable and growing business. As long as people buy the narrative and don’t have any look at the 10-Q / 10-K filings…

Wow, @Julianek to the rescue of blinded TSLA fanboys  . No seriously, I’m glad we have someone who can provide such a detailed analysis. (btw: where did you get these circus guy charts?)

. No seriously, I’m glad we have someone who can provide such a detailed analysis. (btw: where did you get these circus guy charts?)

You paint a very bland picture:

- I’m shocked to see that the revenue is stagnating

- and R&D is actually dropping

- solar: ok, they might have to increase efficiency & lower cost to become attractive to the consumer

- credits: yeah, this I have known

So tell me, how is TSLA priced so high? Is all investing just guesswork and luck? Is trading of some stock dominated by fanboys and even if there are many shorts, they don’t have enough funds to push the price down?

I do not own Tesla shares but for those here who are already long or want to buy some, I would consider the short sellers on the other side of the trade and mainly Jim Chanos. He is famous for looking for fraudulent companies or companies using accounting trick and he is short Tesla. He was short Enron, Luckin coffee and very recently Wirecard as well as many other but just to name a few. I would treat very carefully when betting against him.

For those interested a rencent article from the Financial Time (you can subscribe and get 3 reads for free) and another from Gurufocus:

https://www.ft.com/content/ccb46309-bba4-4fb7-b3fa-ecb17ea0e9cf

https://www.gurufocus.com/news/1169974/jim-chanos-updates-his-tesla-thesis/r/caf6fe0e0db70d936033da5461e60141

To finish, just for fun:

https://www.cnbc.com/quotes/?symbol=3STS-GB

In the US (and many other places) there is now a combination of runaway government debt and deficits and intense paper money creation to absorb it. Some of the money created to monetize the debt finds its way to hot stocks.

It’s not a new thing. Read what happened exactly 3 centuries ago here and also here (in French).

“The kingdom’s finances are then in a disastrous state after decades of war. The debt then amounts to 2.8 billion pounds, the equivalent of ten years of revenue, an absolute record.”.

Fast-forward to now: US debt 26.5 Trillion, annual tax revenue : 2.3 Trillion. Uh-oh…

This does not explain why all that money goes more into Tesla than other companies.

Because we chat and think more about Tesla and Musk than anything / anybody else. It’s a question of buzz, mental attention of masses, media presence, etc.

It reminds me on a phenomenon that scientists found when they analysed the link between people (think the six degrees of Kevin Beacon etc.). There was a lot of small communites and some big hubs. When most people gets to connected to a small community, it was always via those big hubs. They found similiar structures in other fields of science.

I guess what happens is that new investors begin their investment journey with big trendy companies like Tesla etc

source (in french) https://www.youtube.com/watch?v=UX7YQ6m2r_o

Calling bubble : https://www.investopedia.com/terms/b/bubble.asp

Tesla probably back to ~400$ just no reason for this valuation sell less than VW or other car maker

MrCheese Good luck with you 10 shares at this current price

There are two categories of short sellers: those whose primary goal is to make money and those who want to expose fraud/enjoy the intellectual challenge.

- I’d guess by now there are only Jim Chanos and David Einhorn in the second category

- Every institutional in the first category has exited since a long time. Their losses have been staggering since last year (when the stock was a $200 per share). No manager who wants to keep his AUM can justify a trade where the losses are -800% so far.

So no, there are not “many” short sellers.

Add to that the following factors:

- Everybody wants to root for TSLA, we really want the technology to succeed.

- Musk is a marketing genius, doubled of a great innovator. He has already proven with other ventures that he can do great technological things so he has some “credibility”

- People want it to succeed so much that i don’t have the impression anybody reads the financial reports. I mean, we are already 230+ posts in this thread, on a forum where people are supposed to have a higher financial conscience than average. I’d be surprised if anybody on the thread even opened a TSLA 10-Q or 10-K. Even you Bojack you are usually paranoid about your hard earned money, but your investing thesis relies more on Youtube videos than on audited facts in filings.

- Musk knows what he is doing when he sells his short shorts. This is just a good move to warn investors “Don’t even try to short me, i have the marketing power to hurt you badly”.

- With the shorts gone and the stock being parabolic for a year, FOMO is all over the place. Re-read this thread and count the number of times where the fear of missing out is the primary factor for justifying buying the stock (“it’s going to be 1 trillion!”).

Now tell me, if you had never looked at the stock price during the last year, and only checked the reports, have the fundamentals changed so much that the company is worth 8 times more what it was worth last year?

I got them on the Tesla Charts’ Twitter account. But since they are really putting graphically what is already in the filings, i’d advise you to go directly to the source, either on the SEC website or on the company’s investor relations page. Read quarterly reports (10-Q) and annual ones (10-K):

- you will base your opinion on facts, not everybody else’s biased opinion.

- you will learn to read financial statements, which is a very useful skill. I am even willing to help: if some stuffs are too obscure, you can contact me for explanations.

Cathie Wood said in an interview, that the longer the period is, where company price goes sideways, the stronger the breakout will be. So maybe there was not much change it the company itself but:

- the mainstream media and experts have started talking more favourably of Tesla

- many shorts have given up trying to pull the price down

- the pandemic may have paradoxically helped to see the difference between Tesla and other carmakers

That’s true, but I’ll tell you why. These 10-K and 10-Q reports have hundreds of pages and you really need to learn how to read them, which in itself is a tedious task. And I’m sure the people at ARK Invest or some other market analysts have this skill. So if they still put their valuation of Tesla so high, then I just assume that it’s all OK for them. But yeah, I would like them to explain to me why they don’t worry about the things you mentioned. I really lived under the impression that Tesla is growing. But it looks like status quo since the last 8 quarters!

One page I saw where you have this info all in once place is HyperCharts.

Then I would encourage you to:

- actually look up all the analysts estimates: they are all over the place (from $300 of $2400)

- study the historical accuracy of financial analysts in general, not just Tesla ones (hint: it is not great)

- figure out how these analysts and research companies are compensated (hint: most of the time they are paid by a broker to write good stuffs so transactions can happen. 90% of companies have a “BUY” rating)

Then figure out by yourself if maybe a bit of due diligence would not be warranted.

Personally, the last time i trusted a financial guy without doing my due diligence and checking the fact, they sold me a 3a life insurance. It was in 2016 and since then, whenever someone linked to the finance industry says something, i fact check it.

Now coming back to Tesla, what do the facts say?

- the growth story is that there is no growth

- the core business (selling cars) is not profitable, and the regulatory credits will not scale. If Tesla sells 10 times more cars, it will not receive 10 times more credits.

- this means that if the volume increase, the losses will increase as well

- how to reconcile it with a $1000+ price per share in

analystssalesmen reports? As said in one of my previous post, it can only happen if:- Tesla reaches level 5 autonomy (which the industry claims is doubtful. For the record, Tsla commercialised vehicles are currently at level 2. There are rumours that Audi is at level 3 but did not want to commercialise them by fear of penal liabilities in case of accident). I am interested if someone can confirm/refute Audi’s case.

- Nobody else will do it so Tsla will have a monopole. That may be the case, or not. As said above, other automakers are spending way more than Tesla on R&D (Tesla has to actually reduce its R&D because the business is not profitable).

- There won’t be any regulatory friction coming in once these autonomous vehicle will arrive on the market, so Tesla will be able to construct a fleet of autonomous taxis.

- Tsla will find the capital needed to build all the Giga factories and vehicles needed to build this fleet, WITHOUT raising equity and diluting shareholders (since the core business is not profitable, the money has to come from somewhere else).

So there are a lots of maybe’s that need to come true to justify a $1’000+ price per share. And all those maybe’s are located beyond a 5 years horizon.

Otherwise, i think we can agree that if there is no level 5 autonomy and no monopole on it, Tesla’s current business is not worth more than its book value, i.e ~$40/share.

What is book value anyway, if you care to explain? The value of the factories and other tangible assets? Any non-tangible assets like brand? Any future predicted sales, discounted?

When I see the amount spent by carmakers for R&D I wonder wtf they do all day long… Are they sending car against walls of diamonds and gold every day? 14 billion dollars a year? I wonder if we can start measure R&D with some more significative metric rather than money. (no. not patents please)

Stop Julianek because it’s useless. Bojack have view a youtube video with a tesla in orbit and a tesla truck boat so this stock can go up to 1b/share for these two videos ![]()

Let these people lost all their money and let smart people win something like 1000$/share by shorting this stock ![]()

We can’t win money if other not give their money so if we can have some $ from Bojack or MrCheese why not ?

Actually a lot of people think than market can up without any limitation but this planet is limited and resources too. Tesla PE 737 may be never reach this valuation.

Just to set things straight: I always value the input of @Julianek because it is based on logic and backed by evidence, unlike many of your posts, which are pure chaos.

Agreed. Innovation has been there, but nothing to show for that kind of money spent IMO.

10B a year is the amounts the biggest pharma companies spend on R&D also as a comparison, huge departments, expensive equipment, it’s a lot.

Add to that instead instead of real and useful innovation, auto-makers of late most famous for their R&D into stuff to outwit (or circumvent) the authorites & regulations.