R&D doesn’t necessarily mean moonshot style research afaik. It kinda make sense they’d spend large amount of money on R&D given the number of model/variant they have, I’d guess a small fraction would go into risky/longer term projects (self driving, etc.)

I’ve read a tweet of musk about the coup in Bolivia and I frankly start to believe that Musk is a huge a.hole or worse.

https://twitter.com/elonmusk/status/1286866843307737088

What has been - or is - the apparent reason that the stock increased more than sevenfold over the last year ($1643 this July, $228 a year ago)? What didn’t the markets know back then that they do now?

Musk is often somewhat enigmatic, but frankly it does sound more like sarcasm than honest approval or endorsement.

Yeah, I wouldn’t take that tweet at face value, but it’s definitely not “politically correct”.

Btw here’s the original tweet. Suddenly I have a desire to start yet another thread on UBI…

Why he should take so much time for give you all when you can go read pdf/link and found these “logic and evidence” yourself by using Internet ?

Go read what is a bubble and try to found if match or not. For this stock this people give you free advice and you can win a lot of money but you not give him anything for that. The next stock you will lost your money if no one give you these advice. You should be able to found yourself what is a good or not company by reading their reports or search this information on Internet or cross-reference source.

Some people give you the keys for search these information but if you not spend time it’s your problem.

It’s chaos because probably bad english but mostly because you don’t know the subject matter and aren’t looking for. I’m just trying to change people’s minds by showing them that all the information is available on the internet but for that you have to take time and search. If the whole population gets smarter and knows what they’re talking about it will make the world a better place. I’m sure if someone gave you a million, you’d take it directly instead of telling them to give me 100,000 and I would make them grow on my own because everybody can do it. Unfortunately people want the easy way out instead of doing it themselves.

Knowledge is the base for all it’s almost free and unlimited now what our predecessors didn’t have. But 30% (personal number) may be more not even take this opportunity. Which is probably why humans don’t learn from past mistakes.

Just to revive this post…

https://old.reddit.com/r/WhitePeopleTwitter/comments/hy4iz7/wheres_a_time_turner_when_you_need_one/fzal6h6/

Unfortunately a paywalled article, but in essence it says that of the many approaches to AI the one that Tesla is following might be the most promising. That does not mean, however, says the article, that Tesla will also be the winner in this race, as it will take much time and lot of resources.

I like the analogy that it took evolution millions of years to develop intelligence and even the most committed long-term investors won’t want to wait that long. ![]()

Can you give tl;dr as to why they think it’s more promising? (I thought there’s a bit of consensus that the no-lidar approach was unlikely to work well, but it’s not AI related more which inputs you get).

use this https://tldrthis.com/

The example the article makes is this: a self-driving vehicle could either drive based on memories, i.e. it has digital maps of the world and relies on them to foresee what comes next — or it actually sees the world and actively reacts to it as it drives around.

The first approach doesn’t even sound like AI to me…

But apparently that’s what Google’s self-driving vehicle is doing.

No sure why people think Waymo purely uses its memory. It has to be able to handle unpredictable events (constructions, accidents, etc.).

For sure it’s easier to do that when you also have the “usual” state of the road in your memory, but it doesn’t mean that’s a requirement.

Running in selected locations is the definition of L4 driving, what are the other operational L4 systems besides waymo?

I assume once you’re confident at L4 you can start tackling L5. That Tesla could jump from L2 (is it L2 or L3?) to L5 more easily sounds unlikely.

The way Lidar approach works is that they map out a stretch of road down to a centimeter and then the car tries to determine where it is exactly. If there ever is a construction going on, or the road is defective, it will struggle. And every road has to be mapped before the car can go there. Lidar is also a bit like closing your eyes and using a stick to know where you have to go. You can check the distance, but you don’t know what that thing is: is that a paper bag or a rock?

That’s why I dig the camera approach. Humans have two cameras and a solid non-artificial intelligence unit and that’s enough. Why should the AI need a different input?

So how does waymo do it?

Because maybe we don’t need to wait for AGI for that ![]() and making it harder for the machine just because humans can do it doesn’t sound like a great argument.

and making it harder for the machine just because humans can do it doesn’t sound like a great argument.

If we go with artificial restrictions, maybe we could limit the reaction time to be similar to humans too, they do manage it ok ![]() Or maybe let’s not expose all the cars sensors to the computer, the human doesn’t have all that detail.

Or maybe let’s not expose all the cars sensors to the computer, the human doesn’t have all that detail.

Each Waymo car includes highly detailed maps of the region in which it is permitted to drive. These maps are accurate down to the inch and include precise locations of roads, stop signs, traffic signals, and other driving cues.

Why do you think interpreting camera input is AGI? It’s more like a complex game. You know that AlphaStar beats the best StarCraft II players in the World? And it’s a game where you have to control units on the screen, combat the opponent, mine minerals, produce new units and buildings. And it is doing that based on the visual input on the screen, just like humans.

A somewhat journalistic analogy pitting early vertebrates with good eyesight moving from the sea onto land developing cognitive and planning abilities (Tesla) against the invertebrates of the time who mainly “stored” their most common surroundings (Waymo) & weren’t able to adapt/react as quickly to changes/unexpected as the vertebrates. …and the rest is history.

But it doesn’t just stop as soon as something not on the map happens.

e.g.

The vehicle drives more assertively than it has in previous trips, breezing past construction sites at 45 mph with barely a twitch and nudging its way into intersections in a way that feels less robotic than it has in the past. The construction site, with its orange cones and hard-hatted workers milling around, is particularly impressive.

from Waymo’s driverless car: ghost-riding in the back seat of a robot taxi - The Verge

Of course it’s easier to figure those things out if you have a good baseline of what to expect, but it’s not like it can only drive on a millimeter-mapped route and gives up when it doesn’t match.

I don’t have the impression that tesla is close to match that. (and giving up on the extra sensor won’t help them).

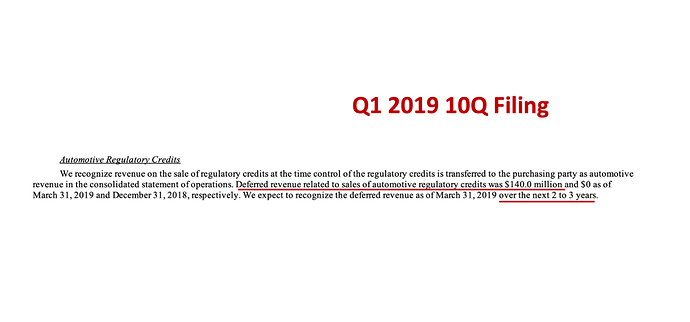

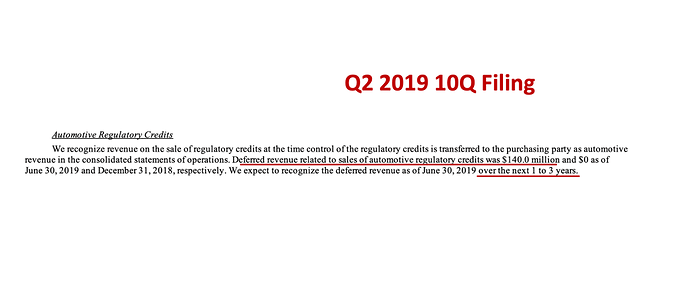

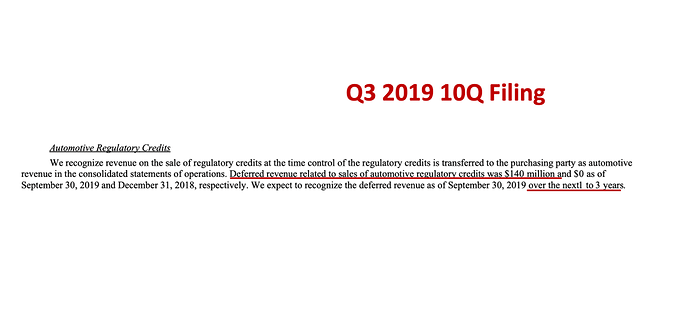

TSLA uploaded its 10-Q yesterday and the report contains interesting stuffs. If you are not tired of me talking about accounting stuffs, follow me in a lesson I will call “Profit creation for dummies”…

Increase profits by manufacturing sales:

In the first quarter of 2019 (i.e. six quarters ago), Tesla and Fiat Chrysler struck a deal on regulatory credits. In the 2019 10Q filing, there appeared this note. $140 million of deferred revenue to be recognized “over the next 2 to 3 years”. In layman terms, it means they received cash from Fiat Chrysler in 2019 but did not recognize it yet as revenue because they did not provide the service yet (but in the case of regulatory credits, what exactly is the service provided, and more importantly, how long does it take to provide it?).

In the second quarter of 2019, Tesla recognized none of this revenue, but the guidance language was changed to “over the next 1 to 3 years”.

And so on for three quarters, not any of these deferred revenue was recognized:

In the most recent quarter, suddenly and all at once, Tesla recognized THE FULL $140 MILLION. This revenue is widely believed to be pure margin. In other words, this one decision accounts for ~132% of Tesla’s claimed profits for the quarter. (page 12 of the last 10-Q)

And that, ladies and gentlemen, is how you fake a profit to trick the S&P 500 into including your stock in their index.

This accounting trick is known as “dipping in the cookie jar”. On one hand, you can say it is clever that they put aside some backup for planned rough time. On the other hand, it does not really fit into the narrative of a company drowning in demand…

But that’s not all!

Understate your true cost

On page 43 of the report, the company says:

Due to pricing adjustments we made to our vehicle offerings in the six months ended June 30, 2019, we estimated that there was a greater likelihood that customers would exercise their buyback options and if customers elect to exercise the buyback option, we expect to be able to subsequently resell the returned vehicles, which resulted in a reduction of cost of automotive sales revenue of $458 million. During the six months ended June 30, 2020, we made further pricing adjustments that similarly resulted in a reduction of cost of automotive sales revenue of $37 million.

In other words, Tesla does not indicate its true cost of building cars, but what it would be if maybe customers would exercise their buyback option in the future. Nobody has any clue what the true costs are.

The growth story in one chart

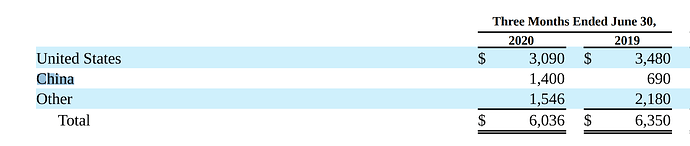

Page 35, TSLA gives a breakdown of its sales by region:

In other words, except China, the rest of the world was not really eager to buy their cars. So much for incredible demand.

That’s it for today.

Given the expectations implied by the stock price, these reports contain more red flags than a Christmas tree and there is no way i would ever risk my money in it. But the narrative can still last a long time!

And I don’t think it will go bankrupt any time soon. As long as the price stays at stratospheric levels, Musk can still raise new equity to keep the company afloat, as he did in Feb 2020 when Tesla raised around $2 billion.

Never!

Yes, but up until “short shorts” people didn’t expect them to be profitable. The Fremont factory was closed for some time. Other carmakers recorded -30% drop. Maybe there are some commentators saying that this profitable quarter is a proof for Tesla demand, but others point to the regulatory credits and Giga Shanghai.

I think Tesla revenue wasn’t growing, because they were limited to the Fremont factory. Now they have Shanghai, which saved their Q2 2020. By the end of next year, we should have Giga Berlin & Texas, which could double their vehicle output. They have learned a lot with the first factories and I expect the new ones to really cut the costs and bring in some solid profit margins.

Me neither, last I checked, they had $8.6B in cash and who knows how much they can squeeze out of S&P 500 inclusion.

By the way, at the beginning of July I was in Tesla salon in Zurich and it was almost empty, there was only one Model X. The guy told me that they were given orders to sell everything to boost Q2.

5 posts were split to a new topic: Using a company as pre-tax buffer

I agree. But I also don’t think business owners will or should expect “sabbatical years” so they would probably just pay out as much salary as makes sense while keeping the progressive tax in mind on a year-by-year basis.

What I was trying to say is that it’s not really a vehicle to save taxes unless you expect decreasing revenues, right?