Would you just postpone FIRE? A year? But I’m gonna help you with the transition: transfer your income into my account so you can simulate what it’s like IRL -on a financial side- and you’re keeping optionality if you change your mind after a year without income.

Impressive, that’s the only word I can think of.

Out of curiosity, do you say you are 35 or that you will be FIRE by the age of 35? Do you really plan to stop working at that age, or just take a break and then return to a less stressful job?

I understand people who want to retire early at a certain age, or reduce their workload or take on a less stressful job simply to enjoy a more peaceful life. So I’m curious to know what you plan to do once you’ve achieved your theoretical FIRE at the age of 35 (if I understand it correctly)? Asking because I’ll be 36 and still questionning myself in my current job ![]()

I agree, we are on a Swiss based forum. Why would you not calculate in CHF? Because you plan to leave for RE? But still, everything for you is in CHF right now, going abroad do people really calculate what the costs are in USD rather than CHF? Your entire frame of reference is CHF, I find it bizarre one would not track one’s assets in CHF. And this includes me having mostly USD denominated stocks/ETFs (though my Excel does show actual return and constant FX return).

Planning to spend FIRE in another country would indeed be a valid reason if the prospect is spending the accumulated wealth there and to simply keeping accumulating while in Switzerland.

For some comparisons, also, what matters is how assets behave with regards to one another. If data is more readily available in USD or another currency, taking the extra step of converting everything into CHF wouldn’t enlighten the decision more. This doesn’t apply to the net worth perspective of this topic but can be true for allocation/strategic/tactical decisions happening more broadly on the board (and I think this discussion is about more than just this thread).

I personally think it’s important to label things appropriately and compare what is comparable but people should use the metrics applicable to them or convenient for them. Financial decisions are personal after all. None of us will partake in the benefits or share the losses another one of us does because of their decisions.

One thing probably going on under the surface, which certainly affects me, is that we tend to / may compare ourselves to the other posters so we would like that comparison to be meaningful and fair. I think it should apply to topics like this one (‘share’ your net worth progression implies taking into account the recipients/readers more than the poster, it’s data sharing) but not necessarily all topics on the board.

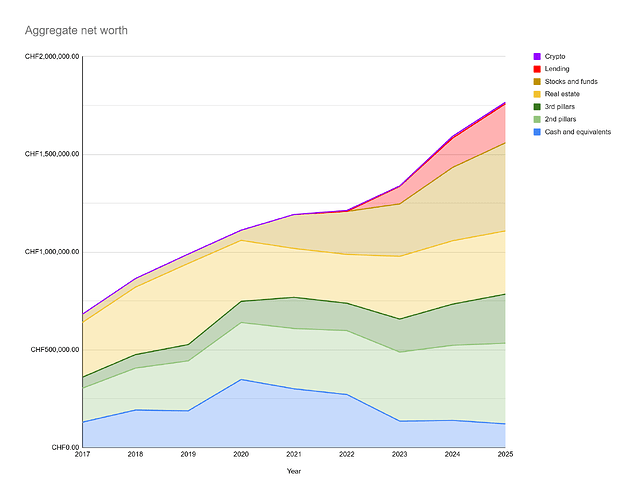

I hold assets that are valued in USD, CHF and EUR. The balance sheet I did provide is in CHF and I have it calculated in USD and EUR too.

But my stock trading happens all in USD, all dividends are in USD, all realized capital gains are in USD, why should I measure it in an exotic currency like CHF, a currency which I spend less than EUR.

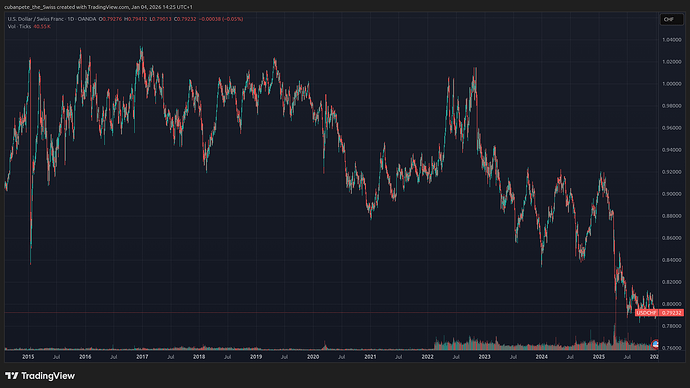

I am in the process of changing my USD debt to CHF; the interest difference is a nice insurance long term. And it looks like I got a temporary low with slightly under CHF 0.79 to the Dollar.

I do not plan to leave Switzerland, but don’t spend too much time here neither.

Wonder what the Dollar will do on Monday…

I’m slighty tempted to change my avatar name to ‘Jones’ to make it easier for all of you to keep up with me. ![]()

As in “Keeping up with the Joneses.”

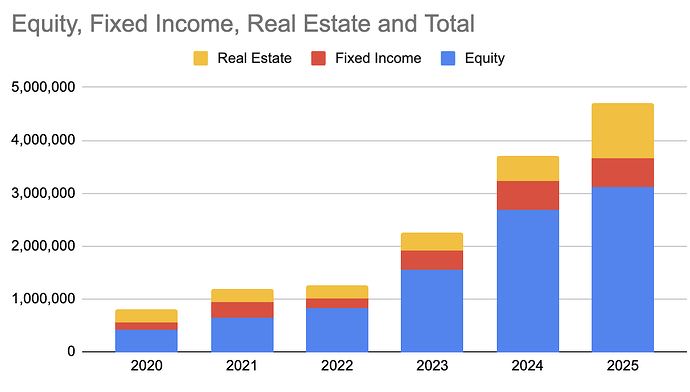

~27% growth mostly fueled by RSU vesting. On Personal front bought a house and welcomed our second son.

you already had real estate in your portfolio - was that some kind of rental property or funds or something else?

also: congratulations! ![]()

![]()

![]()

That was the property I bought for my parents in my home town (not in CH).

| Year | Networth | Returns |

|---|---|---|

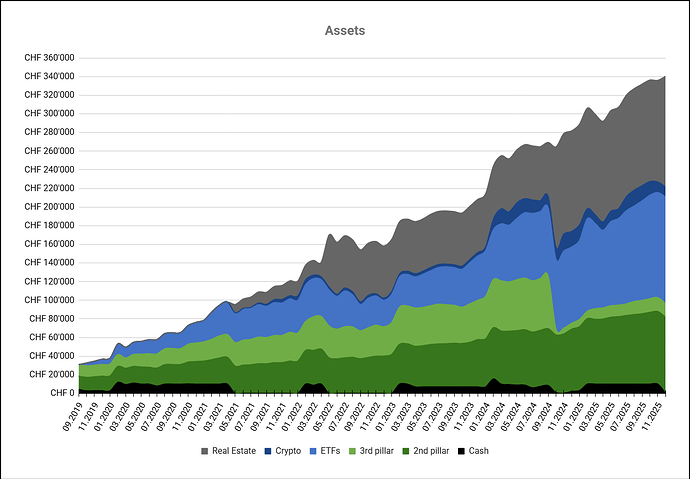

| 2019 | CHF 36’900 | |

| 2020 | CHF 76’400 | + CHF 4’020 |

| 2021 | CHF 120’900 | + CHF 19’040 |

| 2022 | CHF 158’300 | – CHF 20’630 |

| 2023 | CHF 208’300 | + CHF 11’340 |

| 2024 | CHF 281’800 | + CHF 37’570 |

| 2025 | CHF 340’400 | + CHF 3’430 |

Yeah in 2025 growth was mostly driven by a good savings rate (+42.7k) and pension fund increase (+11.5k), not so much by market returns (+3.4k). Bad year for crypto and got unlucky again with my timing. Almost half of those savings/investments were from my bonus (as usual) which is paid out on February 20th every year. Which was exactly the top before the March/April crash in 2025.

Btw, I bought another plot last month in Bosnia for 10k. I’ll see how this will play out long-term, but I think it will be a great investment. 5 years ago I wasn’t planning on any RE and today it’s 35% of my total NW lol. Next goals are to hit 400k in autumn this year and 500k before the end of 2027.

Family of 3 living in Geneva with 1 kid.

Slow increase on my side:

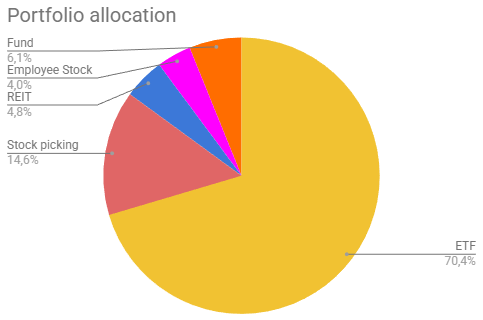

Equity composition

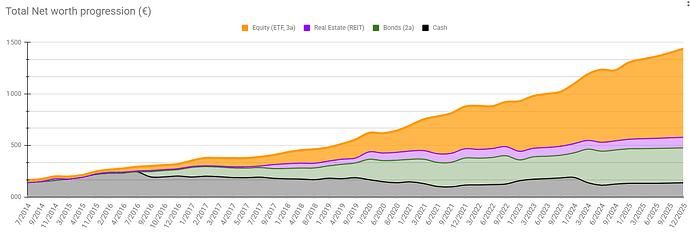

My NW increase of 134k since last year (+9,7%).

I’ve saved 95k (including LPP) with an average of 50% saving rate.

Unfortunately this rate will drop as my wife is still looking for a job with no more unemployment benefit.

Still with too much cash on the side and too much stock picking (underperforming the ETF section.)

| Debt ratio | 7,43% |

|---|---|

| Safe Withdrawal Rate (SWR) | 3,50% |

| Target Annual Expenses | 75 000 € |

| Target Net Worth to FI | 2 142 857 € |

| FI ratio | 67,17% |

| Lower guardrail (3%) | 1 500 000 € |

| Upper guardrail (5%) | 2 785 714 € |

what are the guardrails used for?

Go back to work or find alternative to generate cash for the lower guardrail.

The upper will be to increase your spending if allowed.

No 3a, or you count that to equity?

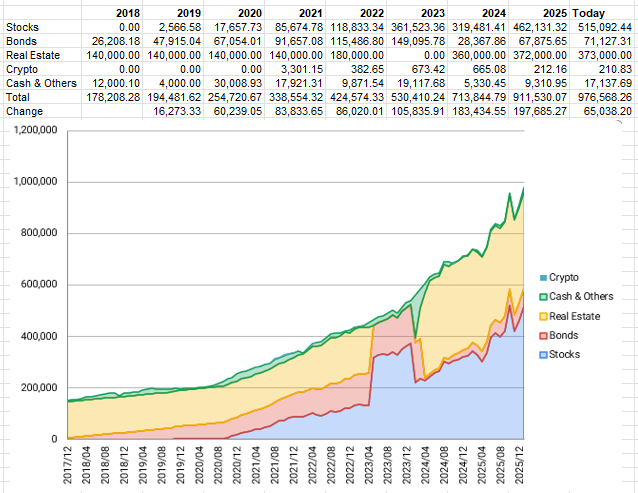

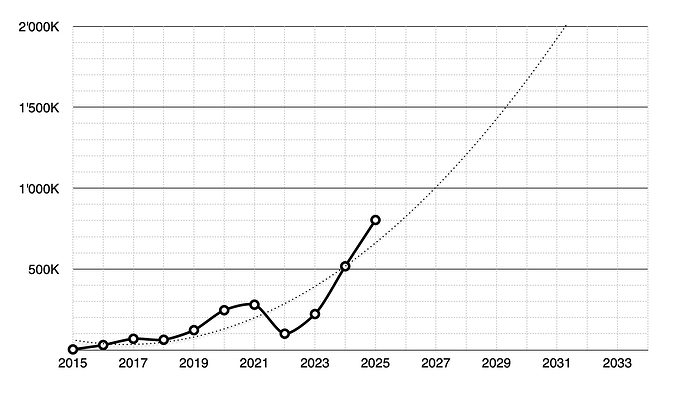

Here is my annual reporting from my investment account, keeping 100% stocks.

2015: 4’000

2016: 31’000

2017: 69’000

2018: 63’000

2019: 123’000

2020: 246’000

2021: 280’000

2022: 101’000

2023: 222’000

2024: 517’000

2025: 803’000 (+286’000 / +55%)

Twas a very good year all in all. Hopefully the portfolio will break through to seven figures in 2026, fingers crossed. ![]()

that’d be an awesome double-in-two-years bingo.

2025 update

- nothing interesting happened

- 11.5% NW increase, stock portfolio (again) underperformed VOO with about 11% gains in CHF, with some questionable stock picks and my employee stocks going the wrong way

- the one good thing I can be happy about is that my SO now has an almost-equal mix of BVG / 3a / corporate bonds / stocks / real estate

Did it? (in CHF)

VOO did ~18% in USD,

Yet USD/CHF went -12% or so over 2025.

11% in CHF is great!

Congratulations on the excellent returns from investments. I am curious if the returns are from individual stocks or options.