It doesn’t really matter what currency you base your calculations in. It will vary between people as some will have mostly income and expenses in CHF, others in USD others in EUR.

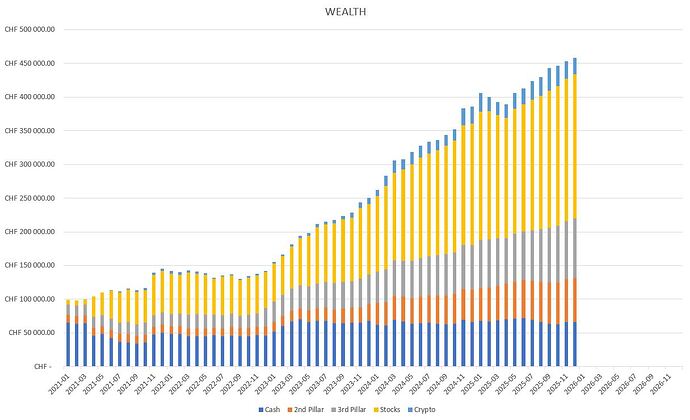

Here’s my update:

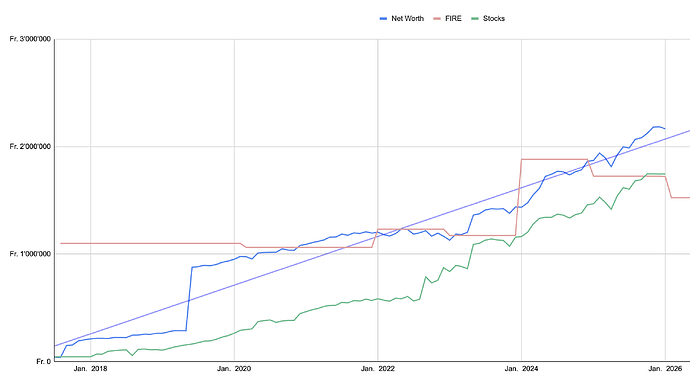

YoY: +294k (+16%) → around 140k came from savings

126% FIREd based on 4% rule

79% Stocks (VT, SSAC and similar like 3a)

8% Pensionfund

1% Gold & BTC

12% Cash

Waiting for the stocks to be at 75% to rebalance to 80%.

Costs around 70k (36yo with 1 kid, household costs are split 50/50)

Now a interesting (or boring?) period starts for me, since I reduced my job due to health reasons to 50% and now the income will cover exactly the expenses - will keep it like this as long as I enjoy it or pull the trigger if not.

Furthermore I had the last vesting came to an end and therefore I won’t experience “big“ payments for the foreseeable future… what leaves a bit the feeling of having finished your favorite game… My savingsrate will go to almost 0% for the first time since 2017.

However my health should get better slowly and thats the graph I should pay more attention to than this one here ![]()

I wish you all a prosperous 2026 ![]()

Ok, I’m having my little OCD tantrum here:

- Main criticism should be focussed towards your usage of the word ‘quiet’ when you mean to say ‘quite’. I have mentally stumbled countless times in the past year

- As this is a Swiss forum, I expect people to calculate in CHF when no particular currency is mentioned. It annoys the hell out of me when media people announce a new ATH in an asset I hold when there is really no cause for celebration in CHF yet.

otherwise highly appreciative of your contributions to this forum ![]()

Let’s befriend and keep things quiet. There’s also some actual mistakes about some current stuff.

We’re not an English native speakers forum and everyone’s their mistakes and style, their signature, it gives some personality.

Concerning the USD scandal, @cubanpete_the_swiss is a (really) active stock trader on US stocks market, it’s understandable that he compares his bets and moves to US stock market with the corresponding unit. Adding CHF forex in the mix would just jam the mechanics.

Though bearing his lombard now in CHF, he’s added that into the mix anyway.

Whether that’s a good bet for a Swiss-investor-living-mostly(minus some few days)-in-Spain only him can tell, everyone’s situation is different. But from a portfolio management, there’s some logic.

And I don’t think his goal is to pump up the numbers. His balance sheet at the end of the year is in CHF, as for his tax report, he knows very well where he stands.

Completely off-topic, but:

Thanks a lot for the quiet/quite thing, wasn’t even aware of the two words and of course the corrections robot doesn’t help quite a bit. Please tell me such things, as I hardly use English any longer since I stopped working 12 years ago.

The numbers above were in CHF, all-time highs in all currencies in … let me check… in USD December 26, in CHF and EUR December 10.

As said I trade only in U.S. markets mainly because of trading cost and data availability. However, I do not only hold U.S. stocks, but the Dollar makes any type of comparison easier.

The CHF is the big exception, the exotic currency that multiplied its value by more than 4 to the Dollar since first world war. But then in that many years the accumulated interest difference was probably more than 400%. And as I said, the volatility is peanuts compared to stocks.

Happy and successful new year to all!

I won’t insert a currency vs asset pricing meme here as this quite sounds like plunging into hot water on this forum …

Happy New Year!

I’m curious as to why you have 299k as a Lombard loan and 48k in cash. Wouldn’t it make more sense to pay off the Lombard loan by 48k and extend it as soon as you need cash?

(This may be a naive question, as I am not familiar with Lombard loans)

48k is about the minimum I keep in CHF, EUR and USD in several accounts. Probably will soon have to get some more CHF, AHV is too low…

It is even worse: I keep around 1k in cash. Came in handy at the blackout in Spain: the only restaurant that was open because they cooked with fire asked to show cash before serving and many Spaniards did only have a card or non-working phone to pay… and had to leave hungry.

Got robbed once and lost the 1k, that is the other side. No risk no fun…

My own stance on that is that lombard lans are poor tools to provide liquidity. Their conditions can change at any time and they can discount your collateral at their discretion. When you intend to withtraw the cash, the availability might not be there.

Same goes for mortgage.

Margin is part of the money management of my mechanical strategies. I always use margin for taking out money, as me needing money is a bad signal to sell. Then, depending on the strategy, I just wait or I sell until the needed margin multiplier according to my money management is reached again.

I never ever go even close to my margin limit. You have to oversee your margin situation at every moment.

However, I probably will pay back the mortgage in some years, but only if the market continues its crazy bull ride. When markets go down I raise my margin debt.

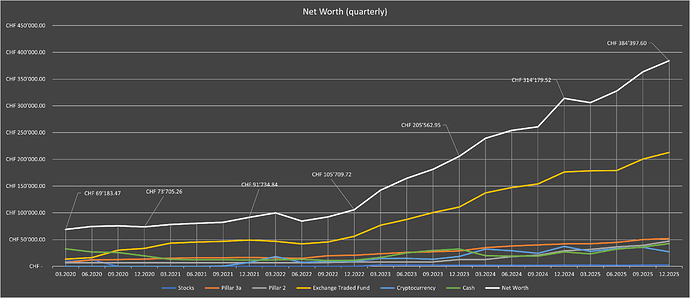

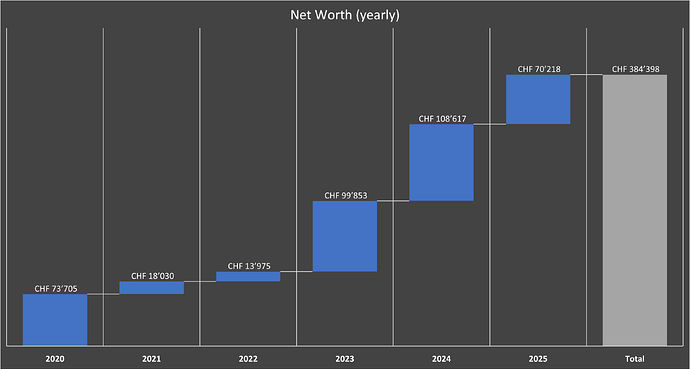

Family of two mid-30 adults.

YoY: +18.74% (35’635 CHF of savings)

Maybe we will reach the 500k threshold next year, if there isn’t a crash with the stock market and if we can put money aside.

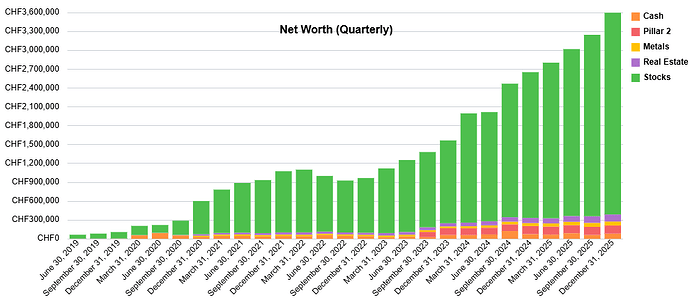

Happy new year everyone. Spent some time updating my spreadsheets, here’s the snapshot as of 2025.

Key numbers:

- Net Worth CHF 3.596M (+944k), both new all time highs

- Allocation

- ~90% stocks (includes Pillar 3 and 1E portion of Pillar 2)

- ~10% spread across Pillar 2 BVG, real estate, metals and cash

- Portfolio TWR 8% (quite hurt by USD devaluation in first half of year)

- Remaining increase is from income

- Allocation

Overall I am very happy and realize I am in a lucky position. Market held up well, compensation was good and I fully exhausted Pillar 2 (1E) buy backs. I feel that I have FIRE achievable with 35.

My current tax rate is as high as it gets for Zurich and looking back a move to a tax advantageous canton and city would have substantially helped accelerate the timeline. That being said, it is against my convictions but I admit it does hurt a little to think a 20-something minute train commute would have saved me about a million those last few years.

Objective for 2026: preparations for FIRE mid 2027, assuming stock market holds up. To me, this means:

- Diversify from US

- Reduce stocks exposure just a little (by ~10%?)

- Goal: reduce exposure to a possible AI bubble eventually deflating (both income and savings quite exposed today) in preparation for eventual FIRE in 2027

Here’s to a great 2026!

wow, 373k after the buy-in? That’s some serious comp, congrats! (probably 7-digit or close).

What would have been your hourly rate for the commute (taking tax savings as income and additional commute time as the time spent)?

Buy-in amount was limited (all things considered).

Interesting way to look at it. Assuming my average 2 days in the office, 1 hour extra commute per day, works out to ~ 2500 CHF/hour. Thank you for making me cry ![]() .

.

More seriously though, I live in the city, I enjoy its services, I believe one should pay for those and that also counts for high income earners. I don’t believe in externalizing costs (e.g. traffic, those huge ZG plated SUVs that make my life as a bicyclist a little more dangerous every day). I can only hope the city and canton put that to good use.

At the risk of making your cry more, is that more or less than your all-in hourly ‘rate’ at your job? If less, I guess you can easily put it down to not wanting to ‘work’ longer hours. Otherwise… here’s a hankerchief ![]()

I guess large part of the comp is not covered by pension? (otherwise I would have expected a fairly large gap, esp. if most of the compensation above the 1e threshold)

Out of curiosity, what’s the sector? (I haven’t really heard of people in tech having 1e, so I guess it’s financial?)

Quite a lot more simply from the fact that I’m taxed at 37% ~25% (ZH city+canton) whereas ZG would be ~9%. Commute time, even one hour extra a day, is a fraction of my yearly hours. So, yes. I’ll go and grab a beer tonight and congratulate myself to being a good citizen.

Some of us in tech do have a 1E (fairly recent though).

Oh nice, you did a better job than the really big tech employer around ![]()