Isn’t this a very conservative portfolio for this forum? I thought many people had way more stock heavy portfolios.

Yes, the stocks market can (and probably will) go down significantly. The question is when.

But no, I’m not afraid. With 45% of net worth in stocks, I too think that this is rather conservative compared to others (~80% in stocks or even in crypto). Even if I loose 100% of ETFs, which isn’t likely at all, my life would go on…

It is. I’m just looking at the absolute numbers. Having a 3M NW and losing (unrealized) a 4-5-600k chucnk on a potential 30% downturm would not make me sleep well. Especially around 50 or over.

It would only be a 350K unrealized loss with a 30% downturn if we are talking about the stocks part. Or am I missing something ?

This is the issue I am having now. As I approach the final years before potential retirement, my risk aversion has grown considerably.

Previously dips did not concern me, as they were buying opportunities. Likewise, inflation was not a concern as while working, my wage increases would far outpace any inflation increase. Yet, both of these factors are big concerns for me now.

And you are right, that the absolute magnitude matters. This was a point that was mentioned in a recent Rational Reminder podcast: it’s one thing to lose 70% of your portfolio when you are 25 and your portfolio is 30k and you have your whole working life ahead of you. It’s a different matter when your portfolio is 10M and you are retired and have reduced earning ability. The interesting thing for me was that they metioned that at that level, their clients don’t talk about percentage downsides e.g. 30% down, but in more concrete terms such as 3M down - and they want to cap their absolute exposure.

Therefore, if they don’t want to lose more than 1M and they estimate a potential drawdown in stocks of 50%, then the max that they put into stocks is then 2M.

(off topic)

I’d refer to the old maxim “Don’t take the risks you don’t have to”.

It’s logical to me that accumulation and decumulation phases should warrant different portfolio structures.

If you have reached - or are close to - your targets, derisk.

I will for sure not hold 70% of my “when-retired” wealth in the stock market.

I have friends who retired early (just after 50) but are 100% in the stock market (apart from owning their own homes). With a view that they are maximizing their return and potentially have a long life ahead of them compared to normal retirement age.

It’s not a problem until it is

Historical crashes have shown us that. But only on paper for many because they were too young to feel the pain (life ahead blah blah)

Right people to talk about this are ones who retired in 2000 or 2008. how did they feel? How was their retirement? And what was their portfolio?

We are sold an idea that these crashes are just a blip in long term: but what if your long term is during that blip and what happens after that doesn’t matter to you personally

In my view everyone should simulate a 30-40% crash with 10 year recovery period. If that still works then hopefully it’s going to be fine.

People often quote Warren Buffet 90% stocks, 10% US treasury allocation for his wife. They often forget his wife can live for generations on interest from treasuries alone and will never need to sell anything. In other words she will always be accumulating ![]()

Exactly, if you have such a large pot that you reach ‘escape velocity’ whereby the growth is going to far exceed what you can possibly spend, then the asset allocation is largely irrelevant as long as you don’t do something stupid like put it in an asset that is likely to go to zero.

In such a case you can afford to put 90% into stocks (probably even 100%) as you can ride through any dips while still accumulating. I guess the 90/10 is to provide some kind of re-balancing mechanism.

That part from Marc also stuck with me in the episode. It’s completely on the mark (pun intended).

Live evidence from @user137 in this very topic as well.

At a certain networth you start to think in money terms and less in %.

Also as guys like Larry Swedroe say “once you won the game (aka reached your financial goals), stop playing”

Most degens in the world don’t see this as protecting money they have but as losing money they don’t but coulda/woulda/shoulda have. IMnHO one needs to realise the penile extensions become too expensive after a while, and there’ll always be a bigger fish. Most people aren’t even fish.

Yes, this was crazy for me. When people who hardly had any money before, managed to get some lottery-like win betting on meme stocks, crypto or options then go on to lose it all. Like that guy who made over 100M on a long shot options bet.

Even if you wanted to carry on betting, at that level, you’d think you’d reserve, say, 10M in a safe way so that you would be good no matter what. But instead, he went to to gamble the entire lot and lose it all.

“only 350k” ![]() yes, but that 350k is my 3-4 years of savings, might be 6-8-10 years for someone.

yes, but that 350k is my 3-4 years of savings, might be 6-8-10 years for someone.

After some weird choices in 2021 (like putting money in ARKK above 100USD ![]() ) I’ve reached -28% on my portfolio at one point during the dip. That alone made me stress out a lot and thankfully it recovered 3 years after. But if a “2008-type” crash had had hit us in 2021, I’d still be below zero, if not much worse and it’s hard to mentally decouple from “oh look I’ve just lost 150k in a year” to an “unrealized NW percentage loss”.

) I’ve reached -28% on my portfolio at one point during the dip. That alone made me stress out a lot and thankfully it recovered 3 years after. But if a “2008-type” crash had had hit us in 2021, I’d still be below zero, if not much worse and it’s hard to mentally decouple from “oh look I’ve just lost 150k in a year” to an “unrealized NW percentage loss”.

I think everyone looks at numbers differently.

For someone whose net worth increase from 1 M to 4 M in few years, I think they wouldn’t worry too much about 350K

But if the net worth is 650K, 350 k would be devastating

Following is how I simplify life

- When NW is less than Y times annual salary, focus on returns on investment

- When NW crosses Y times annual income, focus on RISK of the portfolio because it’s important to reap the benefits as well

This number Y can be different for everyone.

Maybe between 5-10

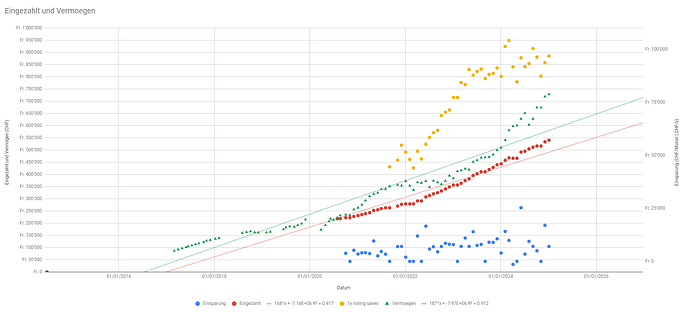

Holding the course, managing to save nearly 100 kCHF/y

EDIT : this is liquid + 3a, 2nd pillar is excluded since I am lazy to login once per year.

I’m not really doing any fancy tracking with charts, except on IBKR (CHF).

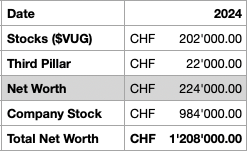

Here are the numbers for 2024:

I generally don’t include company stock in the net worth because it’s not really “liquid”. It might be worth a bit more by now, since I just calculated with the company valuation where another company invested for that price in the company I work at - so it’s not made up. Exit is planned.

I kinda only invest in stocks (100% VUG) and the third pillar is 100% Quality Ex CH. I don’t have cash, and when I need it, I use margin. I’m in my mid-twenties, so yolo.

Nice bag, congrats!

Q: No 2nd pillar?

I have only just started paying into it, so it’s really negligible. Thanks

The solution I apply here is a combination of balanced investing - AND booking my Portfolio as

- Portfolio‘s „Coverage Capital“ equating to

- „Investment + Interest“ Value

- plus Weight Loss Reserve

Meaning that when I had put 10k to the Portfolio last year, I today report my wealth as the smaller of 10k plus X% interest since, and the actual Portfolio value. This way, I play my own pension fund that builds up loss reserves. If shares go down by 30%, my „Net Worth“ still stays roughly flat as I only lost not yet realized paper gains.

Clearly, such model works best after a longer Investment period and a few great Investment years. At the Moment, and considering net new investments are small compared to the Portfolio value, I can credit myself fairly decent interest rates ![]()

Yes, its a silly move but it helps me to sleep well at night. Particularely in combination with a balanced Portfolio.

I have no idea what you mean here, but maybe you can give a numerical example to clarify?