I have no idea what you mean here, but maybe you can give a numerical example to clarify?

Lets assume that my Portfolio was worth 2M, by the end of 2023. In 2024, I now invested another 50k and the Portfolio returned 10%. Hence, the Portfolio was now somewhere at 2.25M.

In my wealth tracker however, I only value the Portfolio at 2M plus 5% return and 50K additional invest. Meaning that my Portfolio now was „worth“ 2.15M.

Meaning that my „balance sheet“ was 2.25M, out of which 2.15M was my net worth and 0.1M was a Fluctuation Reserve (worth approx 4.5% of the Portfolio).

Now rinse and repeat this for a few years, until the fluctuation reserve was somewhere in the range of 30% times your shares percentage (18% for a 60/40 Portfolio). Tadaa, you are in a situation where you can grant yourself a steady return on your wealth (CPI plus e.g. 3%)… and this no matter what Stock markets did. If there was a crash, the fluctuation reserve shrinks but chances that it falls below zero (aka your wealth reduces) was very low. And if that happens, you just rebuild the fluctuation reserve in the next rebound.

Its all mental accounting but it helps me sleep well at night.

Ah, so you keep track of a virtual portfolio value based on a constant 5% return and then treat differences to actual value as ‘fluctuations’?

If this is done like a pension fund, I assume the return is dynamic based on the reserves.

If you have more equity/more risk than a pension fund just make sure you build up more reserve in your model (pension fund typically use only 110%)

Exactly. I upfront at the beginning of the year grant myself an interest rate of CPI + 2% times Share Percentage or so - and then at the end of the year I grant myself ~ 1/3 of the excess reserves (which are 30% times share percentage; 18%).

Hi everyone, end of last year I have started investment via my 3a. I would also like to keep track of my net worth, however I am not sure how I can know how much I have in the 1st and 2nd pillars. Indeed, without this I doubt my graph will be relevant. Many thanks in advance for your help!

For the second pillar, you should know if you pay yourself your taxes.

For the first pillar is kind of complex:

Read here: Retirement income in Switzerland

there should be also a link to the simulator.

For the second pillar, your pension fund should provide you yearly with a certificate with all the relevant data (how much you pay, how much your employer pays, your insurance coverage, your current retirement amount and a projection of how much you’d have at retirement age, usually with conservative assumptions). I’d contact them to ask for one if you don’t have one at the ready.

The first pillar doesn’t work on a capitalisation basis, that is, you don’t actually “have” a first pillar. You can, however, know how much you’ve contributed and try to assess how much you’d qualify for at retirement under current circumstances. In addition to the resources pointed to by ma0, you can ask for an extract of your situation to the AHV/AVS.

Many thanks, ma0 and Wolverine for clarifying that. I will see when I receive the certificate (I guess it will be around that period). For the 1st pillar, thank you I got confused and now is clear.

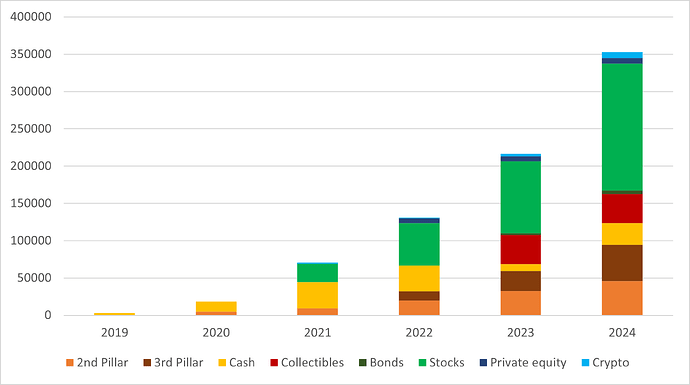

Another year, another chart!

I’m quite pleased with how last year turned out. We achieved a savings rate of 48% and benefited from market returns of +22%. All in all, our net worth grew by an impressive +136K, which feels particularly rewarding considering our ages (30 and 31) and the fact that neither of us works in IT or finance.

While I don’t expect the markets to be as generous in the coming years, I plan to stick to the strategy: consistently investing in VT each month as planned.

Looking ahead, I’ve been toying with the idea of taking a short break—something like 3 to 6 months—to travel and explore before life becomes more demanding with responsibilities like kids and work. This could serve as a mini-retirement, leveraging the savings we’ve built over the past year. Let’s see where this idea takes us!

Congrats!

What are the 40k collectibles - cars, watches, Pokemon cards? ![]()

Thanks:)

The cathegory is dominated by a '69 Alfa Romeo 1750 GTV. Pokemon cards are not included since their value is quite negligible ![]()

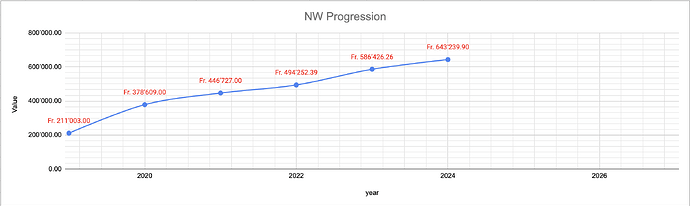

A rather “boring” year financially and graphically. I’m currently repaying a personal loan for a real estate purchase abroad that I made in September 2023 (I’ll be done with it by July 2025). On the other hand, I managed to save over 13k on my 2023 taxes thanks to renovations on a real estate project. This project, which includes 3 apartments, will be ready for rental in June 2025.

This year, I’ll finally cross the one-million mark in assets and hope to start buying ETFs on a monthly basis. On top of that, I became a dad and launched an e-commerce side hustle to develop new skills and diversify my assets.

Summary of my 2025 goals:

- Repay the personal loan (25k remaining).

- Rent out the 3 new apartments (June 2025).

- Rebalance my allocation by increasing my investments in the stock market (currently 71.3% in real estate and 16.1% in stocks).

- Find a daycare

You believe you will increase your net work from 643k to 1m in 2025?

And e-commerce side hustle, i.e. drop-shipping?

Wait. How will NW increase by an additional 300k in 2025?!

“aim at the stars”…

I think he refers to assets, not net worth

Ah. Makes sense. But if he has a secret money-making scheme, I want in! ![]()

Also interested to hear about the e-commerce side hustle!

Thank you for your input! Just to clarify, when I mentioned the one-million mark, I was referring to total assets. Of course, liabilities like mortgages and the personal loan (25k remaining) need to be deducted. I’d definitely prefer if it were my net worth, but hey, it’s a start, right? ![]()

No, it’s not dropshipping. My partner and I created our own brand and launched it in Q4 2024. We keep our own stock in our basement and prepare each package ourselves, always including a handwritten note to personalize the order. For now, it feels more like a fun side project than a real business, but I’ve been able to develop skills like SEO, Meta Ads, and logistics, which makes the whole experience really enjoyable!