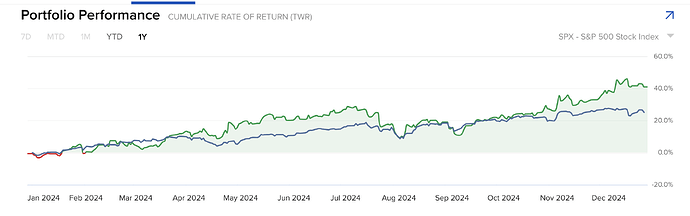

You can say so. RSU is 25% but my other stocks also did well last year

Congrats!

I was once similarly lucky and only due to my ignorance did not diversify forever.

The irony: had I not started diversifying just around when you started accumulating, I’d now be well into 10 figures. ![]()

Ah, well.

Hätte hätte, Fahrradkette, as they say in German.

As always, hindsight is 20/20. Sometimes, ignorance is bliss. Most of the time, it probably is not.

Good luck with picking a strategy going forward!

10 figures like in billions? This would have made you the richest member of this forum ![]()

Trillions, obviously.

And I would like to correct my claim to well into 8 figures.

Chalk it down to a glass too much of Sunday dinner wine.

(10 figures still sounds very nice, though …)

That’s the thing -: most significant returns in equity markets mainly come from concentration. But even a larger number of portfolios suffer due to concentrations. Mostly we talk about the first group ![]()

Folks who are heavily exposed to Mag 7 either by luck, Choice, rules, or ignorance must have significantly outperformed market over the last few years. The question is always at what point this changes and would they diversify in time.

It can go either way…

I know guys who worked for citibank in 2007 and had been there for a long time (= lot of unlocked company stock)

The stock did horribly. But back then banks were the untouchable gods and the place to make money. So who could have expected this?

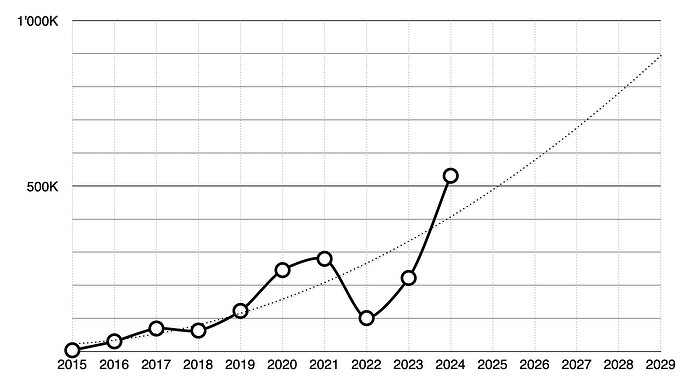

I set out to reach 500k EOY when I started investing ten years ago and thanks ot a stellar market it somehow worked out. I’ve given up on my timeline at some point after having had a terrible drop from 300k down to a low of 96k in 2021. I am equally glad and surprised to have recovered so swiftly! 80% stocks, 20% VT.

Yep, as almost nobody will post the loser portfolios online. And if so, nobody cares for them (except the occasional yolo bets of wsb people).

This skews the picture a lot.

It‘s a big deal if I win the Lotto tomorrow, but nobody cares if I lose it.

Congrats on reaching your target! When you say 80% stocks and 20% VT, do you mean 100% in equities with 80% in individual stocks? That is an impressive risk profile…

It is indeed 100% equities, but no options. With quite a long investing timeframe in mind, I am hoping I should be fine and benefit from big years like this year.

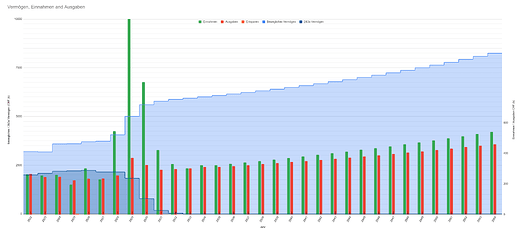

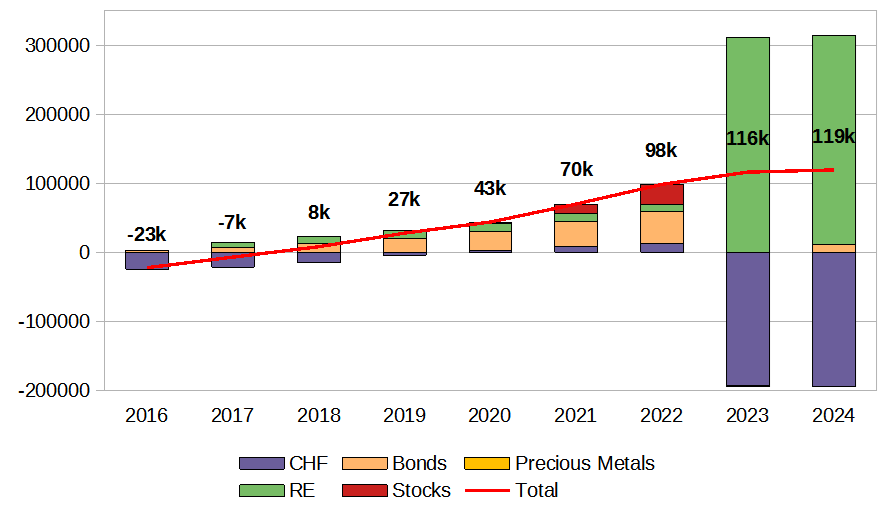

At my stage I am more forward looking than backward looking. Still, some recent and mostly* current numbers, as I have just swung onto my horse to ride into a Marlboro like Altria-dividend-paying sunset:

Next couple of years are probably somewhat accurate numbers wise, the rest is projections with these assumptions:

- dividends growing annually by 3%

Ceteris paribus – all other things being equal – dividends have grown- this year and on average in the past five years: 4.5%

- in the past ten years on average: 6.6%

- capital growing (without dividends) with a CAGR of 1%

(total CAGR – including dividends – has been about 15% since mid June 2019) - 0.2% housing cost inflation, 1.4% cost of living cost inflation, steady housing and living costs base line otherwise.

- pillar 2 and 3a capital withdrawals are taxed as today

Just to satisfy my 10 figure (Rappen) target, let’s dial dividends to growing at 4.5% and capital growing at 1.1%:

Anyone intending to comment that I am not depleting my stack fast enough: you’re damn right, and I hope it remains that way!

![]()

* Don’t you gals and guys know that the market will swing another 20% tomorrow on its last 2024 trading day? Sheesh!

Just for my understanding: do you mean 80% individual stocks? I’m asking because VT is an ETF which is composed of stocks, so it could technically also be considerd stocks.

I’m confuzzled - You are anticipating 10M CHF income in 2029, then 6M in 2030? ![]()

Edit: I am probably reading the axes wrong.

I see the right one is on a different scale (and for Einnahmen).

That’s it! I’ll DM you the IBAN details to help me stay on course with those projections.

More seriously:

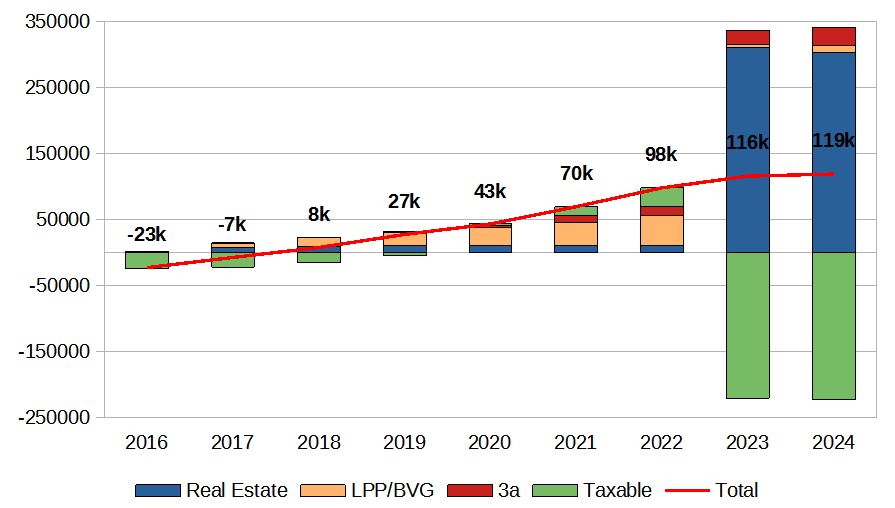

Yes, cash flows are on the right vertical axis, settled (or desired) balances are on the left vertical axis.

btw consider doing a stacked graph for the net worth? (it’s a bit weird to see it go up when it’s actually distributed differently between taxable assets and retirement assets)

You are right and as you have correctly figured i simply wanted to say it is 80% individual stocks vs. 20% etf. ![]()

What is your (target) asset allocation ? You indicate dividend stocks, what stocks do you target here?

If I understand your graph you anticipate in 2033 (at full retirement?) 300k income with a 6M stache? How much is this in terms of (post tax) portfolio return vs AHV/pension?

I think I mostly already am at my target allocation (for the taxable assets), which is about 3/4 the stock picked portfolio, 1/8 ex US equity (VXUS) and the rest in bonds (BND, BNDX, VDET).

The allocation doesn’t have some big return theory behind it, it’s just what I feel comfortable with and what produces the cash flow that I need as income.

For dividend (growth) stocks I try to pick those that reliably pay, and ideally keep raising their dividend. I’ve linked to my picks in this post. The topic of said post also discusses how I (and others) arrive at potential picks.

I haven’t run the numbers to compare to pension return, but I would accept a lower return on my portfolio in order to pass on an inheritance. As it stands today, the (entire taxable) portfolio returns 4.3%. When I’m eligible to withdraw capital from pillar 2 (or the Freizügigkeitsstiftungen), I’ll aim at investing with an initial 3% return, most likely into the stock picked portion of the portfolio.

I don’t know how to compare to AHV, as regardless of what I paid in I’ll get a mostly fixed amount out starting 2033.

Full retirement is hopefully earlier than 2033 … I’m reducing from 50% to 10% starting next year (tomorrow!), and depending on how comfortable I’ll feel with this setup I might dump the remaining 10% in a couple of years as well.

YoY sum says 17% gain in stocks and 16% in 3A, pretty damn good. Onwards and upwards.

Edit: probably not super accurate, I’d planned of doing some sort of analysis of what % did the 2023 tranche do, what did individual tranches in 2024 did etc but in the end can’t be arsed, it’s just EoY value of 2023 vs EoY 2024.