Still working but taking 6 months at a time. I am for sure am in last 1000 days but not sure where ![]()

Indeed. But 2022 was a round zero, all my contributions evaporated in a tough year, 2023 was just catch up. I dont get too obsessed about these swings anymore either way

27% is impressive! are you all in stocks? I’d find it hard to get a 27% increase in a year due to a large proportion of real estate and bonds/cash/pillar2.

70% stocks, rest is mainly pillar 2a with minimum dividends, 2% or so. But 2a shielded from fluctuations in market and certainly a good tax saving vehicle in our situation. I have zero cash and maybe 3-4% in bonds. 27% is NW increase, not equity return. I still save and invest significantly with the firehose of cash from my job, as long as it lasts

if you’re looking to retire soon, you might consider stuffing more into the pension over the next few years so that you can transfer it into a vested benefits account and continue the growth in a tax sheltered fashion (assuming you plan to retire in CH).

Indeed the plan, I will max out my 2a plan in very start of 2025, got a million and change more I can plow in

Even if you leave CH, you can leave your account here, or if you pick the right retirement country, get them as free assets at minimal CH tax via Finpension, or similar, domiciled in Schwyz after the 3 years quarantine

I feel the 2a is a golden scheme for FIRE, especially for high earners very close to exit. It is a great hedge against market dips in final years, with a massive tax discount

Yes, I ignored it until now as I figured I could earn more outside the pension. So I’m in the same situation and will fill up the pension over the next 4 years or so.

Wow, you have that much income that 1M in 2a will keep you at top marginal tax rate? (if not consider, splitting it over a few years to maximize the tax benefits)

maxing out by start of 2025 still potentially means 3 years: 2023, 2024 and 2025. pay, say, 400k each year and you filled 1.2m in just 14 months.

i started in the last 3 months of this year. i wanted to spread over 3 years, but next year i have huge renovation costs, so will spread over 4 instead.

Ah yeah maybe the post is ambiguous and it didn’t mean in 2025 (but previous year as well).

IIRC he has 800k household income so leaving just 80k taxable, would give 2x720k=1440k contribution in 2 years.

Hey @Cortana , I see you’re using Google sheets to track your net worth progression. I’m currently struggling to build up my own sheet, would you care sharing a template of the sheet that you’re using? The charts look very clean and I would love to have something like this in my own net worth tracker. Thanks a lot for your response!

edit: Nevermind, I figured it out ![]() Thanks for the inspiration!

Thanks for the inspiration!

I should probably wait till the actual end of the year before making this post, but as of 24.12.2023, it has been a great year. My wealth increased by around 200K chf. It was a combination of higher income (both from an increase in base and variable components), and good market conditions.

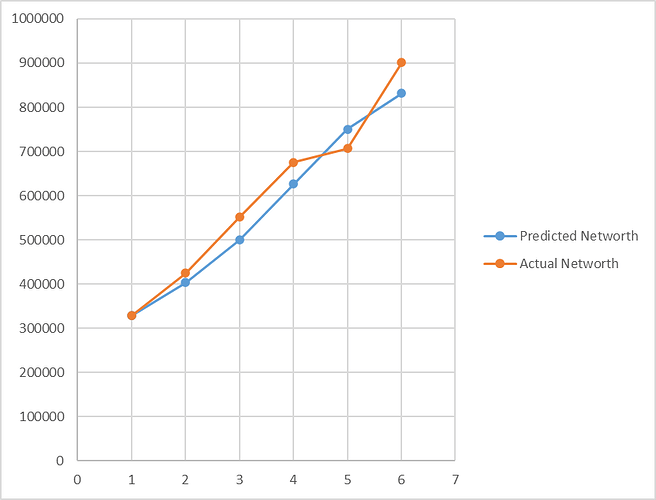

Here is my ugly excel plot:

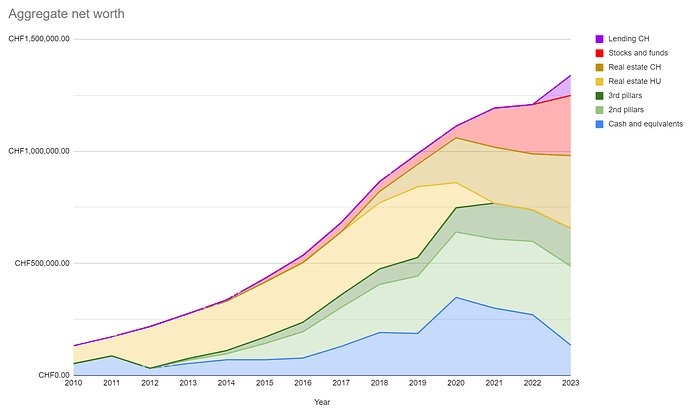

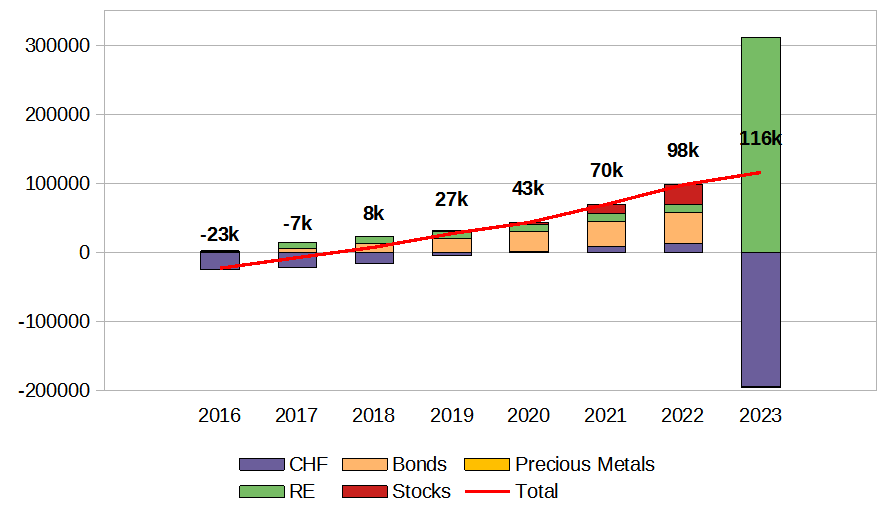

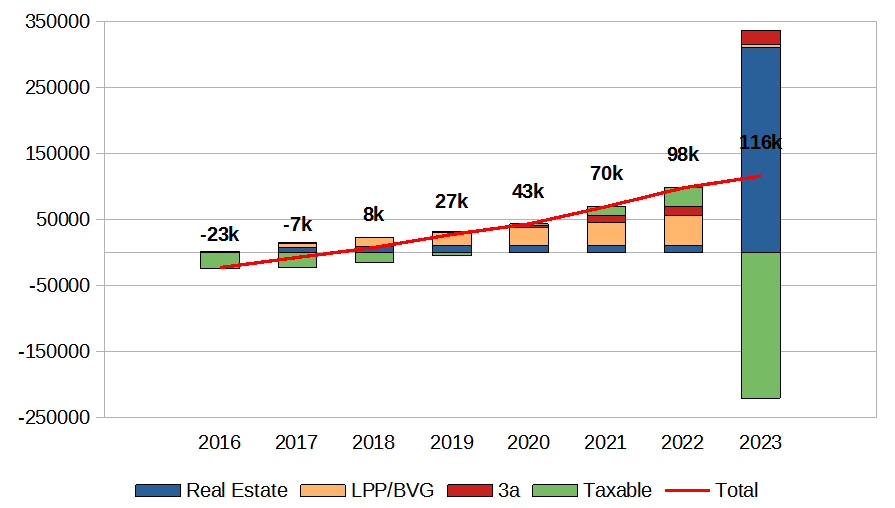

Back to to our stable growth at 100k/yr (~50% savings rate).

Happy we could substantially cut back on our cash pile.

We need a 100k+ extension of the stocks pile next year to be more balanced.

For the first time we are extending into RE-crowdlending.

A nicely distributed rainbow!

A good financial year ends.

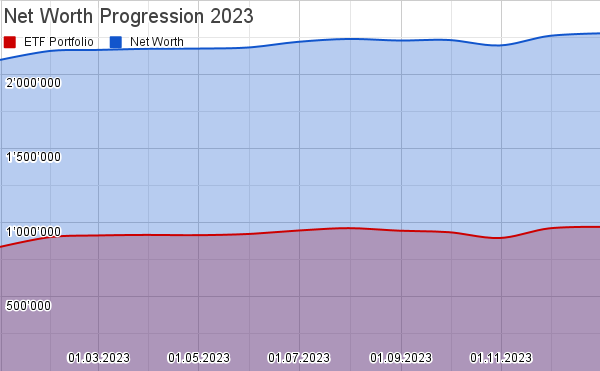

Net worth on 31 December 2023 is CHF 2,275,100 (up 8.5%) and at a new All Time High.

The share of equities (pure ETF portfolio) went up from 39.9% to 42.7% (goal is 45%).

Have a great year 2024 everybody!

what’s your non-equity pile look like (if you don’t mind me asking)?

This would give you a pretty good idea.

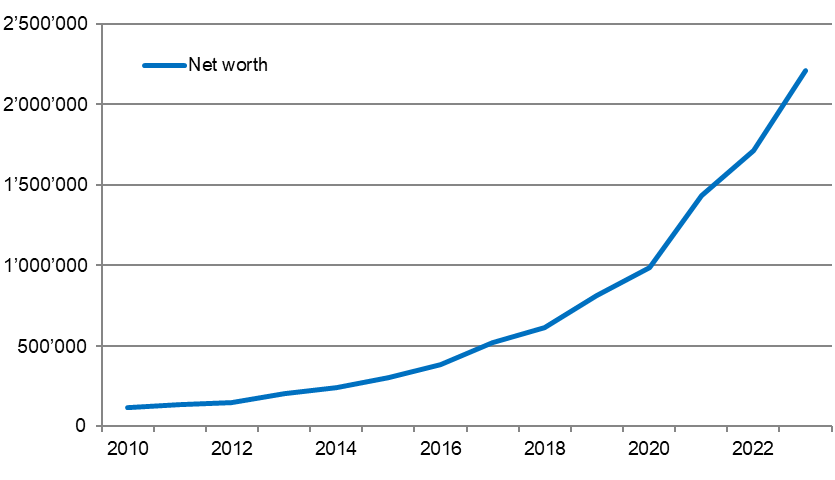

2023 was a very good year despite slightly missing two (irrelevant) milestones:

Not really much to say on investments. Return just shy of 11% on invested capital, basically equal to the return of global equities (with share picks overperformance compensating mandatory bond investments in pension fund). Biggest contribution is new savings with just over 300k thanks to large promotion (which comes with uncertainty on final bonus payout, so this may be off a bit and is not final). Total increase of 494k, not quite reaching that half a million.

And only thanks to the weak USD of the last few days I also missed my lean FIRE milestone by less than 20k ![]()

Wishing everybody a happy and successful new year ![]()

The graphs are not easy to read but the main take away is that my own home and the mortgage on it now overwhelmingly trump my other assets.

2023 had a 1.5 months period without salary and heavy fees/taxes due to own home acquisition, which is why my progress is slowing down and I’ve not reached +30kCHF this year.

The 100k threshold has been breached early in the year. I’m now looking forward to working on getting a minimal stock allocation back once I’ll be done with real estate costs/investments (probably not in 2024).