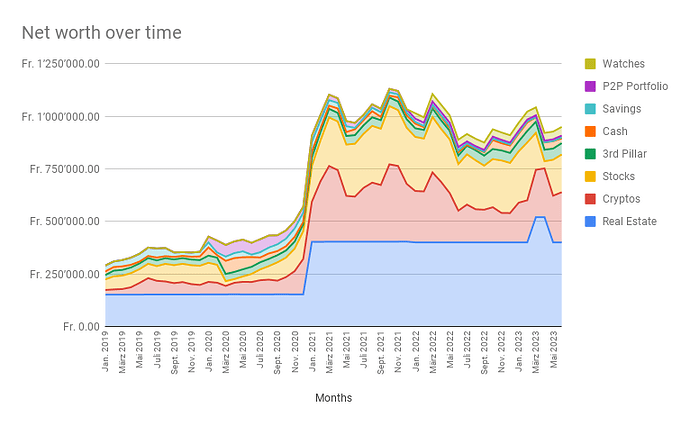

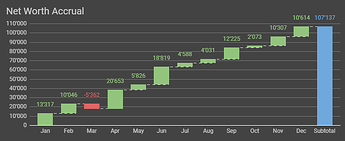

What’s the RE bump in march?

A failed and therefore reverted attempt to buy more real estate

With which program you calculate your NW ?

Excel

20 characters 20 characters

Seems like a pretty good climb from my perspective. At the start, new inputs are what really get things started and it’s way harder to save 40% of a 50K salary than 60% of a 200K one.

I’d ponder whether you are devoting enough resources to yourself and enjoying life as is but I see that collection cars and watches are on your sheet so I guess that’s not really a problem to you (unless you keep them in a safe, never to be seen or touched, of course).

You should start to see the returns on your investments have a more meaningful impact going forward if you manage to stay the course. If you can manage to improve your income, that will probably have the most impact on your progress. Keep it on.

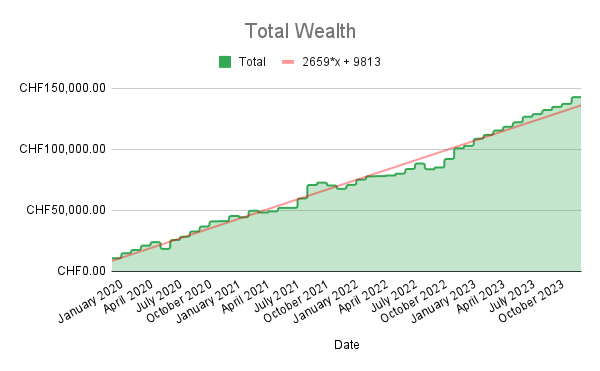

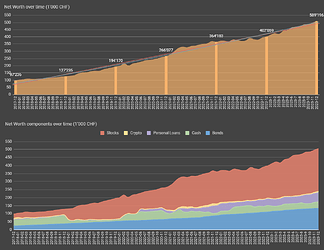

Found this thread today and decided I would add to the knowledge. I feel like my graphs will be very different from many here (in a “sub-optimal” way). I’m 29M living with my gf. We both came to Switzerland in late 2018 for an internship after finishing our studies. I should have started investing more/sooner, something that I am correcting but at least we were saving (and saving more now).

I only started tracking in January 2020 (actually only recently, but UBS’s records don’t go that far, however up 2019 would be mostly flat and uninteresting.

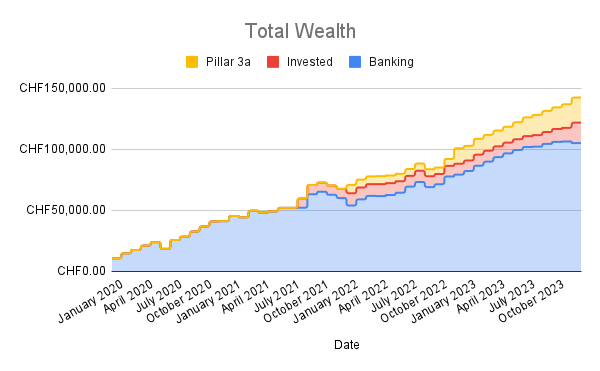

Or with some categorization:

Invested = Selma + IBKR (more recently)

Banking includes my normal bank account and after I have discovered this sub most of it is at wiLLBe at a savings account. We’re eyeing a possible RE deal soon hence why it’s so high, but for now I’ve decided that this category is capped, and maybe it will even be reducing slightly. Meaning that 100% that I save now goes into IBKR and maybe a bit more.

Missing from the chart is my pillar 2a (need to actually see how much it is there and how to account for it) and also crypto which at current prices is around 20k CHF, almost all purchases before this graph starts.

The first graph is very simple but I do like the consistency, though I know that ideally things would be more exponential and less linear… ![]()

2023 has complied. ![]()

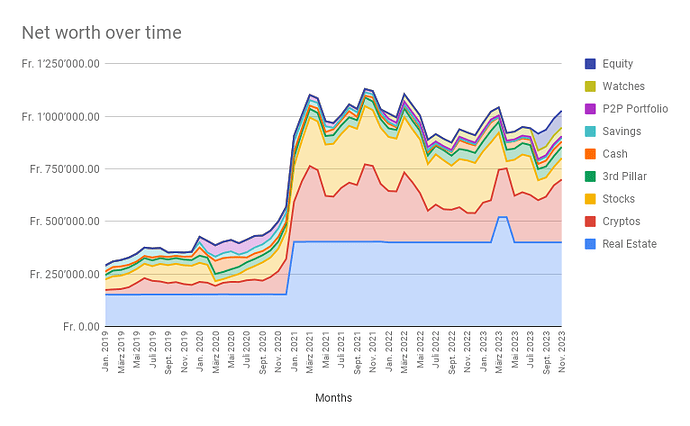

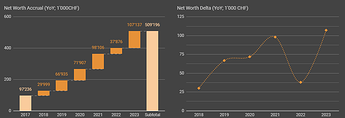

Time for my yearly update.

First highlight -

Just broken through the 500k ceiling in a strong Dec finish! ![]()

YoY: ~27% / 107k

(roughly 50/50 coming from savings/investments)

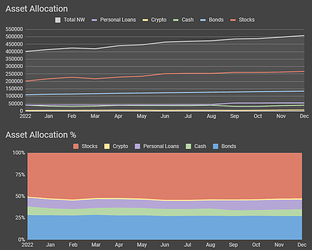

Asset allocation remained relatively flat across the year (~55% stocks).

Admittedly a bit higher cash cushion that I’d like, but keeping a bit of a buffer due to some personal anticipations.

The big picture

Delta waved back up. ![]()

Happy ending of 2023 to everyone, and wish you a healthy and fulfilling next one! ![]()

(I’ll update my spending/saving analysis after December ends, in a dedicated thread)

Wow, fantastic result!

How much of your annual annual increase is from capital gains/investment income and how much from savings?

Thanks!

I don’t have the final analysis yet (after Dec ends), but approximately 50/50.

Nice job. A big milestone and half way to the 2nd comma!

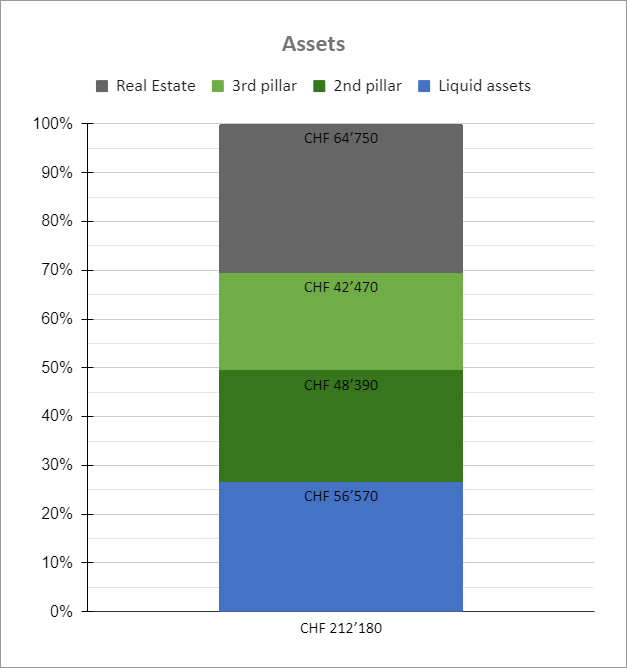

Lurking here, I realise that our 2nd/3rd pillar forms a higher percentage of our net worth than many of you guys/gals…Specifically it is around 51% of our NW (or 43% when also adding the equity we have put down to buy our house)…In 2nd pillar we use the “standard” contribution option of our employers (and have never done additional contributions) and contribute maximum 3rd pillar amount every year…

Could this be a high-level sign we are not saving enough?

It depends on the numbers. The pension probably indicates how much you will get at varying retirement ages. If that is in line with what you expect, then no worries.

Pillar 2/3 could be very small for those who were not born here and only have a few years of contributions compared to someone who was born here and contributed early.

That said, as a FIRE forum, I’d expect people to have either aggressively paid into their pension fund to retire early. Or built up substantial non-pension assets to retire early.

Unless you aim for fire, its normal that your P2 was your biggest saving. For most swiss people, its by far the biggest savings component…

Congrats!!

Also +27% NW increase here - NW 6.5M, up 1.4M

2023 was good to us financially, we count our blessings

Spending was high too, but as you say another thread ![]() . I will hence do a little step dance on NW increase before agonizing how much spend was exactly

. I will hence do a little step dance on NW increase before agonizing how much spend was exactly ![]()

Not at all. Pillar 2a can be an extremely attractive vehicle, but all depends on your salary, tax rate, age, years to retirement, free assets, staying in CH or not, and company plan.

If you share more details on the above we could help you assess… the answer is anywhere from stupid to no-brainer

Wow, 27% NW increase with 6.5M. not too bad.

Still counting down or do you consider yourself already FIREd?