It’s a typo. ![]()

Afaik ~2.5k was an “old” general price.

I believe nowadays that went up too (and nearing 3k/month in many areas).

It’s a typo. ![]()

Afaik ~2.5k was an “old” general price.

I believe nowadays that went up too (and nearing 3k/month in many areas).

Where I live you pay based on your income. High earners pay up to 4k a month for one child fulltime…

sorry, corrected.

Yes, per year, not per month

In Ticino you can find places for around 1k per month.

We live in VD and when our kid was going full-time, we were paying ~2.2k per month. We use them still after school, so significantly less, but just got the letter that starting from new school year there will be increase in rates. Calculated it - over 22% increase!

I love their usual bla bla bla - “we need to increase salaries”. Yeah, for sure, employees will get >20% increase ![]()

What I see now in Switzerland (also other example like electrician warning us end of 2022 that starting from 2023 prices of materials will go up 7%) is what could be seen in Poland already year ago. I wonder what would be the impact of this on inflation in Switzerland…

Just finished taxes, so have numbers now.

2022 was very much a down year for me (TWRR of -16% for equity, with a 35/65 split). Thanks to high income, the hit is only about 50k CHF on net worth.

Pretty happy with pension fund performance (+2% on non-mandatory assets), it’s really playing it’s role here.

It’s finally going up again:

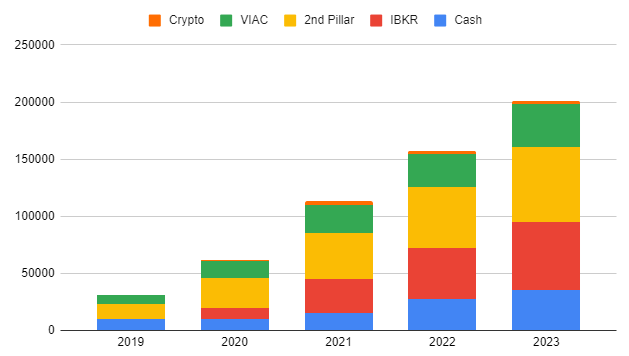

Here is mine (31m single):

The increase of 2022 was a bit lower than I predicted of course (I’m always trying to predict the on-coming year results. Hope to reach the 200k this year and 500k by 2027 ![]() ).

).

Impressive progression and prediction!

It is inspiring.

Looking back, it’s pretty satisfying. 3.5 years ago I had a net worth of 30k (4k cash, 12k 3a and 14k 2nd pillar), so basically nothing. Now close to 200k, 2 plots in Eastern Europe and an apartment in AG. We don’t drive a 2004 VW Polo anymore (now Tesla Model 3 LR) and had some amazing trips abroad in that time. Still, I think I underachieved quite a lot in my life in general. Wasted a lot of time till I was 28 and could be much further (not only NW-wise) today with 32. Maybe I’ll do a separate thread on that.

It’s hard but you should avoid comparing yourself with someone else and especially on this forum. It will bring only depression !

The only thing that matter is comparing yourself in time like you do.

I have also wated a couple of years with online gaming but I can’t change it and it was fun years.

Well done and keep on!

Which CAGR do you assume for your projections? (e.g. for IBKR and 3rd pillar)

I’d think that your 2nd pillar might be quite larger than the 3rd at the end, vs. that ratio in your sim. ![]()

I use 6%/year for my projections of IBKR and 3rd pillar, 2% for 2nd pillar and 2% salary progression. Regarding 2nd pillar: Not for me as the yearly contribution is around CHF 7’000 per year and the yield is much lower. Due to the salary increase and higher contribution by employer once I’m 35 years old, my 2nd pillar will slowly start to grow faster than 3rd pillar. But they will stay pretty even for a decade.

It kept going up, wohooo

Read more here: fondue.blog - Portfolio update March 2023 - sold car & millionaires again / +53k CHF NW

And up it goes:

Looks pretty complicated.