One question I think you could ask yourself:

If you had your current knowledge and net worth but didn’t own any BTC, how much would you buy?

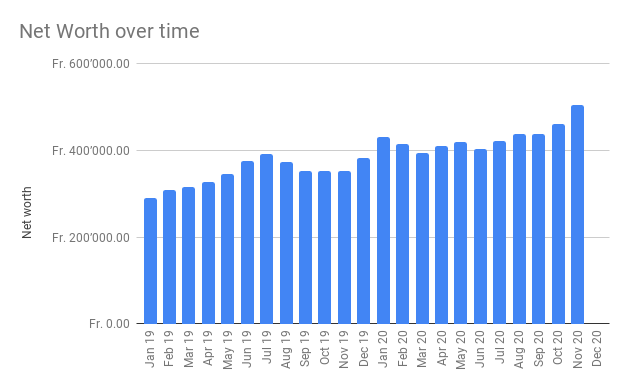

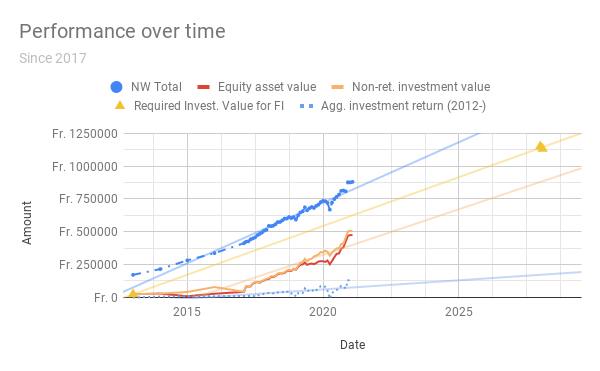

I ran the numbers tonight and yep at 504k CHF now ![]() @_MP I’m coming for you

@_MP I’m coming for you ![]()

Congrats!

How much of that is Tesla?

Edit: Or crypto, now that I see your blog.

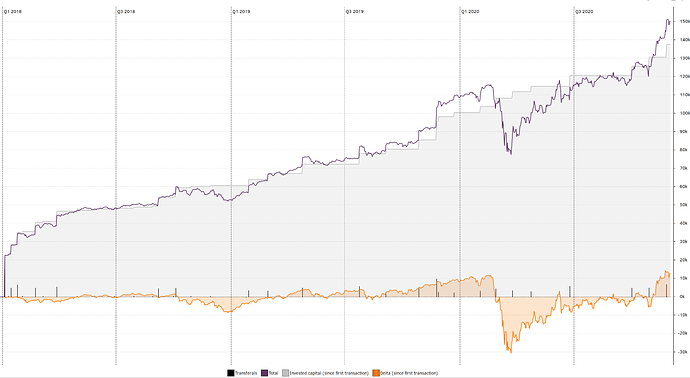

Added taxable + 3a to Portfolio Performance, here is the result since my start(excluding 3a that was a few month with ZKB before transferring to VIAC)

Not sure if I should add 2nd Pillar, as well.

You can add taxonomies to each asset and export the data as csv. Lots of room for visualization.

Tesla is around 2k (10% of ARKk) plus whatever is in 80k worth of VT.

Crypto are at around 100k now (see my portfolio page on the blog) for more details.

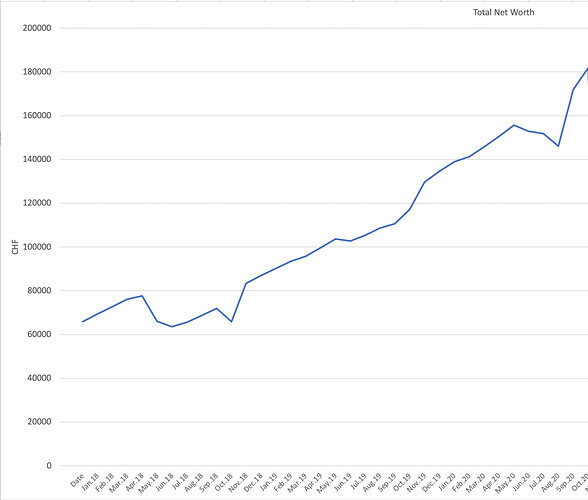

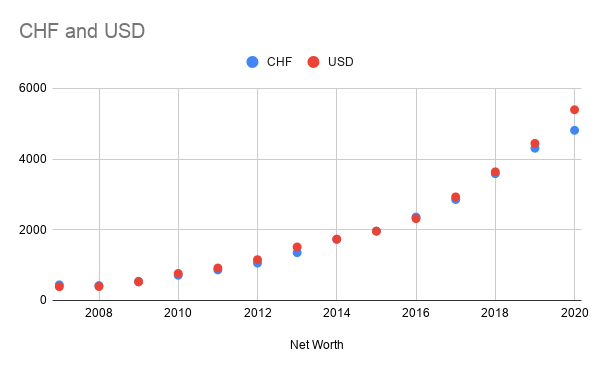

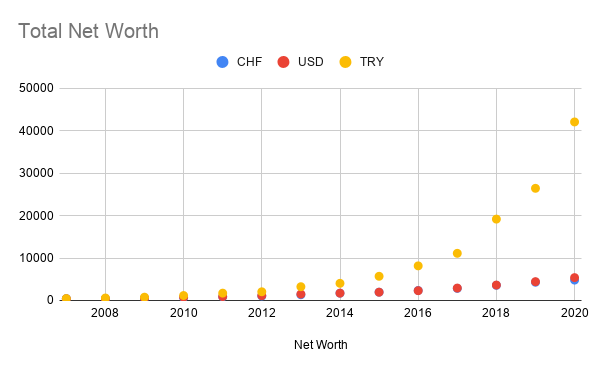

This post inspired me to finally start an Excel spreadsheet. Thankfully all my banks provide some kind of history to pull from. Here’s where I am so far:

Those fluctuations are… taxes

I have a tip (which a finance friend gave to me):

Maintain a separate “taxes” cash (or whatever, liabilities) line item, and track the negative value there (e.g. reduce by -2000 chf) each month.

When you “sum up” your cash value, make sure to include that line item in the calculation.

When the tax payday comes by, just reduce your “normal” cash position by the amount of taxes paid (-24000chf), and compensate for that amount in this “taxes” line item (e.g. go from -24000chf to 0chf).

That way there is no drop in accounting, as in your chart. ![]()

Hope I made sense.

Funny but I never managed to put togheter a proper nw tracking. Too many moving pieces to go backwards but I will start fresh with this month. Thanks for motivation everybody

Still annoyed that there is not a single tool that can solve everything (track etf, balances, tax liabilities, works for ch and eur, multiple currencies, real estate, Nw plots etc)

True, I used to do that by having another bank account dedicated to tax money where I would deposit a certain amount each month. I stopped doing it, as I don’t really mind the dips (on the contrary, now I always know that in July/August I always have big expenses, as well as December, where I pay my full year of health insurance).

It would make sense to divide it up on all months, but it doesn’t bother me enough to fo through the hassle.

No need to have a separate account, just a separate line item to track it (into negatives until payday).

Portfolio Performance seems to hit all or at least most of your points.

The only thing that I find missing is deferred tax liabilities for 3a accounts.

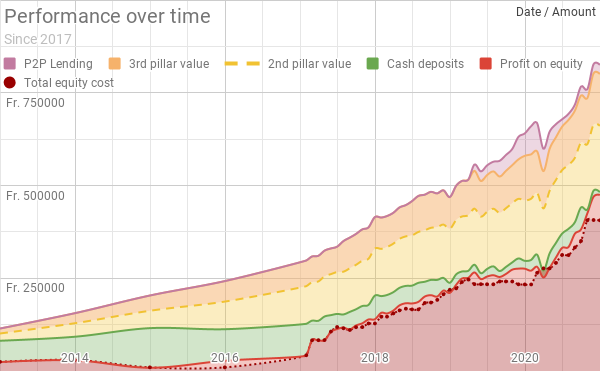

The line leading to the 2 yellow triangles is the progression required to meet my EFU number for FIRE. 2020 has so far been a great year in terms of ETF returns (even after having seen all my gains wiped out in March)!

Hi,

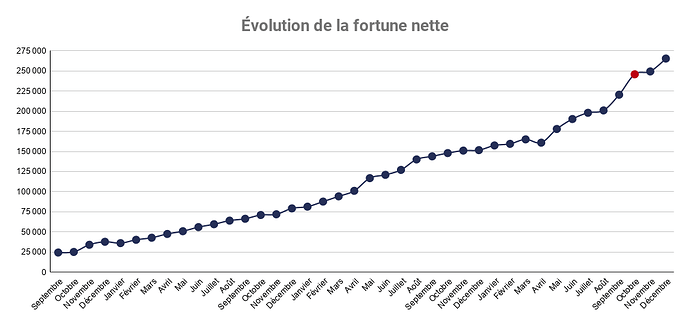

I track my net worth since September 2017, which was the first day of my working life. Please see below my net worth progression:

Please note that the red dot represents the date at which I combined the net worth of my wife (approx. CHF 25k) with mine.

I share a monthly update of my net worth on my blog, which is written in French.

I still have a looooong way to go until I can compete with you guys ![]() But your net worths give me hope as they tend to validate that the concept of FIRE is achievable in Switzerland!

But your net worths give me hope as they tend to validate that the concept of FIRE is achievable in Switzerland!

You’re pretty well on your way though, the hardest part is the first 200K  . I spent more than 20 years of my professional life to get there (admittedly living in the wrong country for accumulation of wealth, I should have come to Switzerland way before

. I spent more than 20 years of my professional life to get there (admittedly living in the wrong country for accumulation of wealth, I should have come to Switzerland way before  , even if it is to work remotely for US companies

, even if it is to work remotely for US companies  ).

).

Wow, almost six billion!

SCNR.

Wow, I didn’t know that. Might be another variable for the playbook.

wow that’s a cool graph - what are you using to draw it?

I’m using Google Sheets