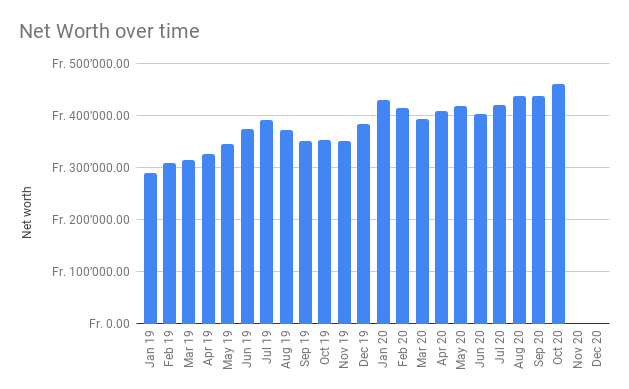

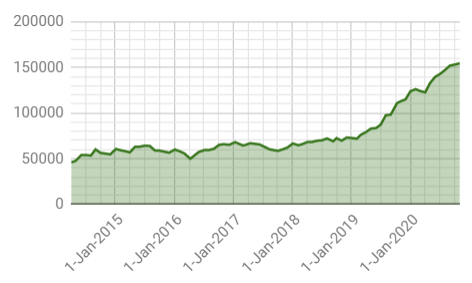

This is mine, including taxes but excluding Pillar 2. Probably breaking thru the 500k this month.

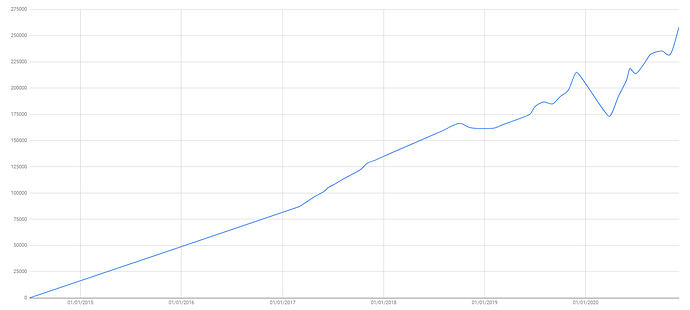

Starting from 2014 where I started at 0 after studies. I started to record regularly around 2017 (so just an interpolation between 2014 and 2017). Pillar 2a is not included,

EDIT: does not include investments in our own company as well.

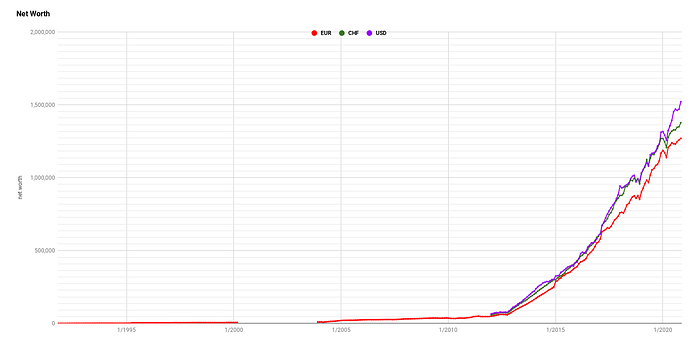

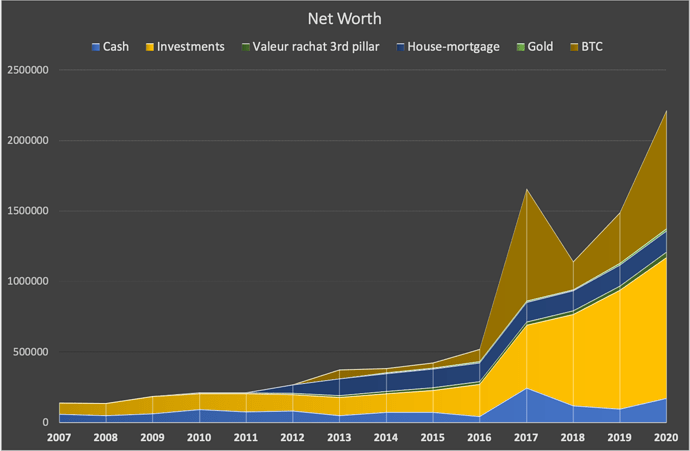

I track my Net Worth since 1991 (LOL)

It’s hard to appreciate the ups and downs before 2012, since the exponentiality of Hooli compensation flattened whatever happened before ![]()

Live numbers are here

I wish I kept track that far back!

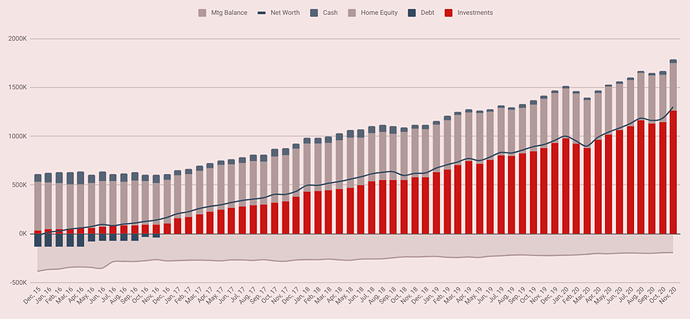

FYI - I’m not including “Home Equity” as part of my “Net Worth”, as I intend to live in the house, or at least use that sale to buy a different home for us.

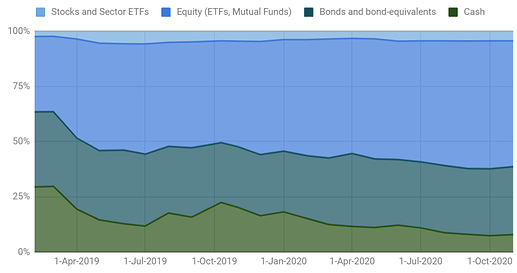

78% Bonds? Hardcore… ![]()

I know, I’m reassessing my risk tolerance these days

Great chart, wonder what tools you’ve been using.

I track everything monthly since 2014 (will do my start-of-month inventory tomorrow!). but only in CHF since I moved here at the end of 2017. Here is my net worth (incl. Pillar 2 and 3 + overseas equivalents, not accounting for eventual taxes) in my original base currency (I’ll leave it to your imagination, but know that it is not zlotys)…

This includes 2 babies (one of which I had to pay most of the costs for out of pocket), several years of postgraduate studies, lots of travel, a foreign tax nightmare (resolved), and probably a few other things.

Edit: I also have lots of more complex charts that I won’t share, but this is a good simple summary of assets. I have a fixed target for cash, and then investment targets are percentages of what is left over. I also make a distinction between broad equity holdings and more targeted ETFs/stocks…

custom development… maybe I open source it one day.

Is this a Financial Times theme for matplotlib or something like that?

Very good eye! Specifically taken inspiration from https://blog.datawrapper.de/beautifulcolors/

wow, a million in crypto? how do you sleep at night?

What’s your current exposure in Crypto/BTC? Mine is currently more then 50%.

Is this really all in BTC?

If so, what is your reason for not diversifying your Crypto-Assets (e.g. ETH)?

Nice read… I’m a scientist and can definitely say that many in my domain should read this ![]()

”On a large pile of money with many beautiful women.” -Rainier Wolfcastle

Seriously though, to amass 1M in crypto is not for the paper handed. I guess s/he has made peace with it a while ago.

diamond hands for sure

As there seems to be some interest, I will give a bit more information.

I discovered Bitcoin in June 2011 while I was bored at work. First bubble, up to 30$ ! I bought the way up and the way down to 5$. Baby roller coaster. I came for the money, stayed for the tech and the possible money. And the drama.

Between 2011 and 2013 I decided to accumulate 100 bitcoins in total. I thought it was enough to be filthy rich if it was a success and not lose too much if it was a failure (3500$ or something).

Having spent not much on it, it was easier not to sell. I kept telling myself that it was worth a few thousands, not hundreds thousands. When it reached 9000$, I set selling points such as 1BTC at 10000, 1BTC at 12000, etc… I sold half of my bitcoins following this plan, in 2017. I continue to follow the plan. I remove the emotional factor as much as I can.

I am nevertheless reconsidering from time to time, because things change and I change. I am now wondering if I will not sell half of the stash in one go.

Alts: I got interested in many of them and bought quite a few. Always with bitcoins so it was like free money. My feathercoins, peercoins, namecoins are not worth much now ![]() See below for the ones I really like.

See below for the ones I really like.

Security: having cryptos is a heavy work. Really. I had to learn a lot. I now have secured the cryptos in a way that should prevent hacking and personal threats. In particular I use multi-sig, one of them by a notary.

If you mean how much of my net worth would disappear shall BTC fail, around 35%.

My other cryptos do not account for much. I personally like ETH, I was part of the ICO and followed since then. If you have to pick one, pick this one. Also Monero: it has proper privacy and tries to be ASIC resistant. BCH: (I don’t want to start a war) that was the vision for Bitcoin in the early days, i.e. to be able to use the currency for transactions and not only as a store of value.

A post was split to a new topic: Security tips on holding a large crypto position