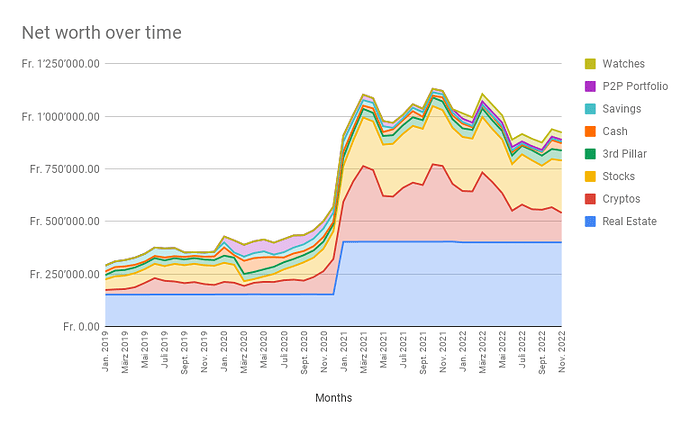

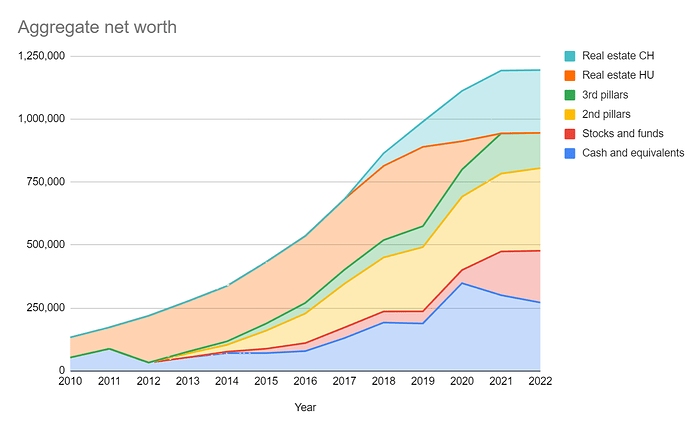

Still hovering around the 1M CHF mark, I hope these bear markets end soon, at least the income got a nice boost since September.

Read all about it here:

Hi there,

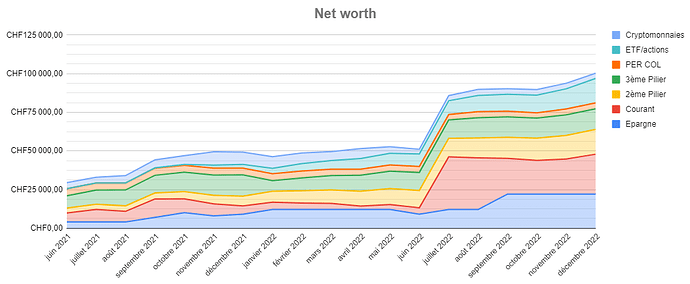

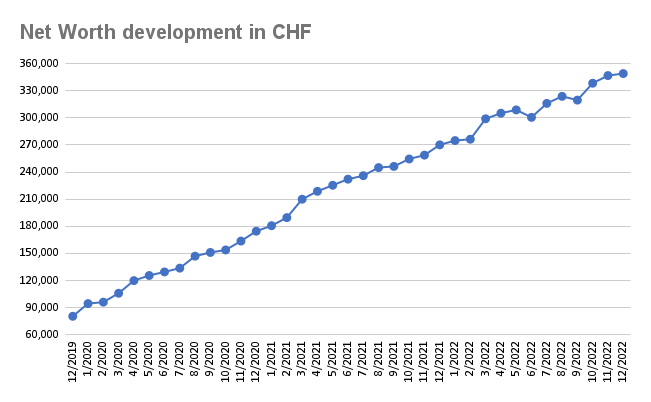

I am proud to reach my first step just before Christmas holidays : 100.000 CHF ![]()

Q1 and Q2 2022 where not so good in term of savings because of my 3A (I closed my life insurance 3A and my cryptos investments were not in a good way…).

Objective for 2023 : investing in a renting property.

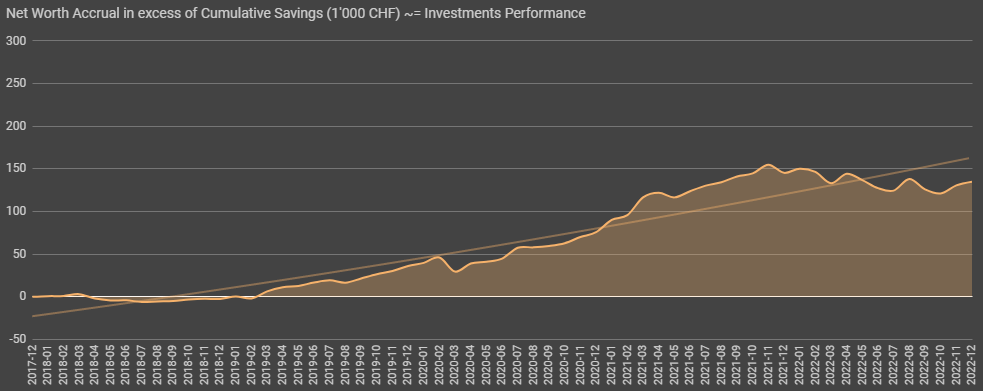

Is none of you tracking separatly what money you invest in stock, and what they yield ? meaning it would be possible to separate investment from passive income in the net worth ?

Yes we are (at least one of us).

There are some charts further upwards from earlier (planned to update soon ![]() )

)

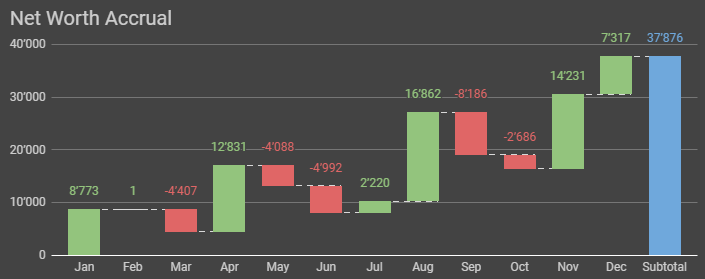

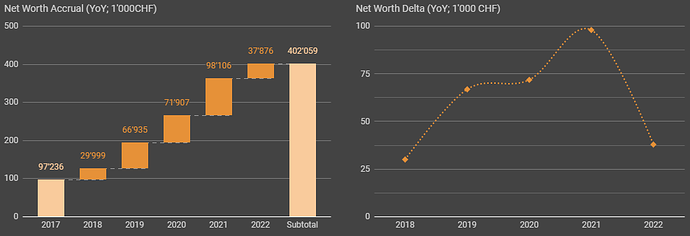

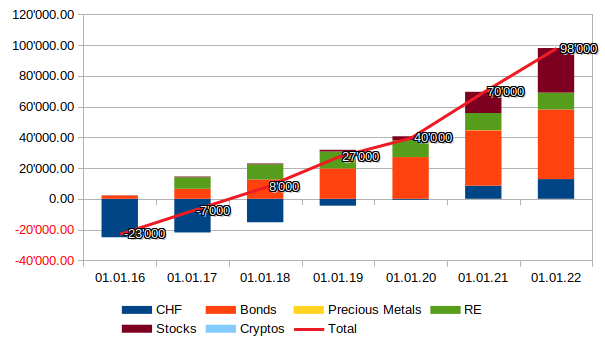

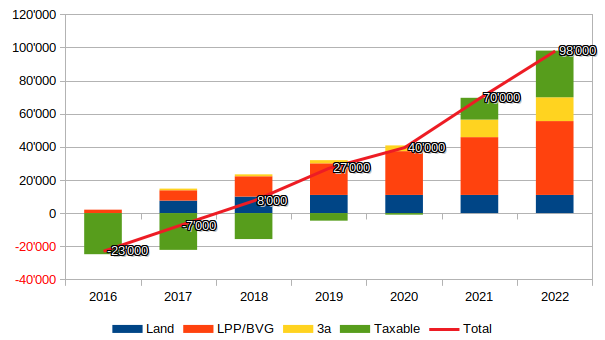

Time for a 2022 update from my end.

2022 in review

YoY: ~10% / 38k

As for most of us, bit of a slowdown this year (investment components turning negative, basically eaten up ~20% of my savings).

Quite of a rollercoaster ride. ![]()

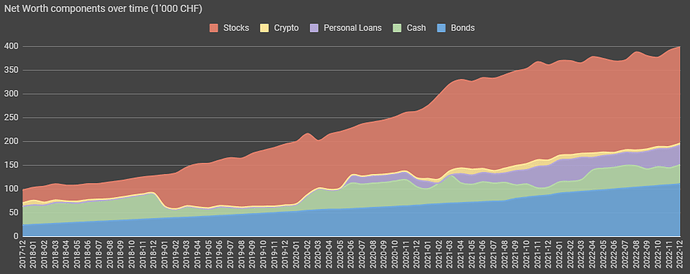

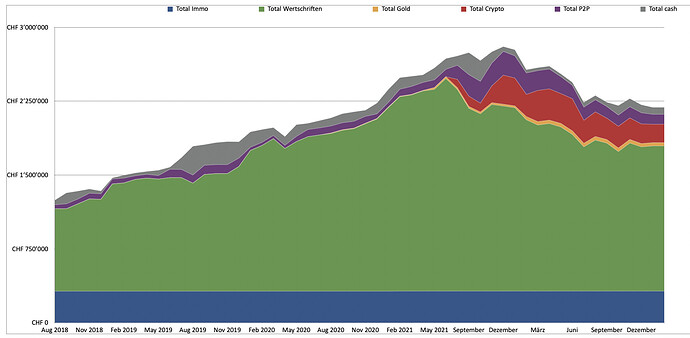

I did remain quite “stock-light” in the grand scheme of things, so the downward impact has at least been muffled.

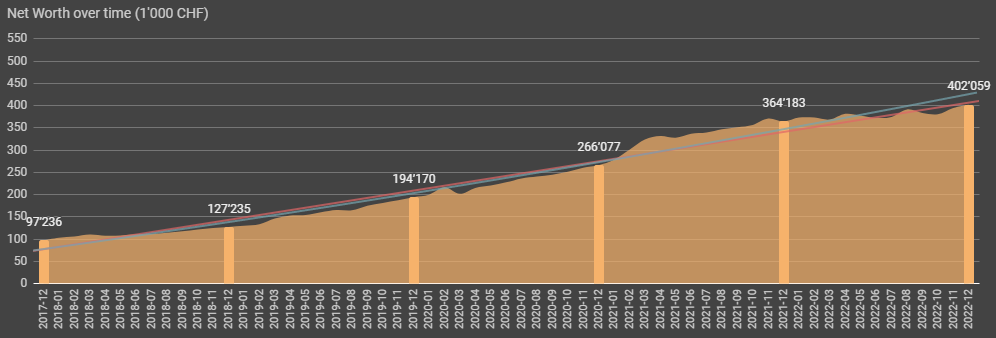

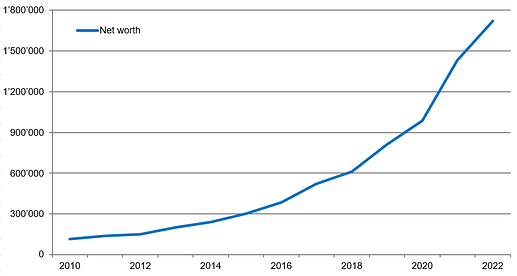

The big picture

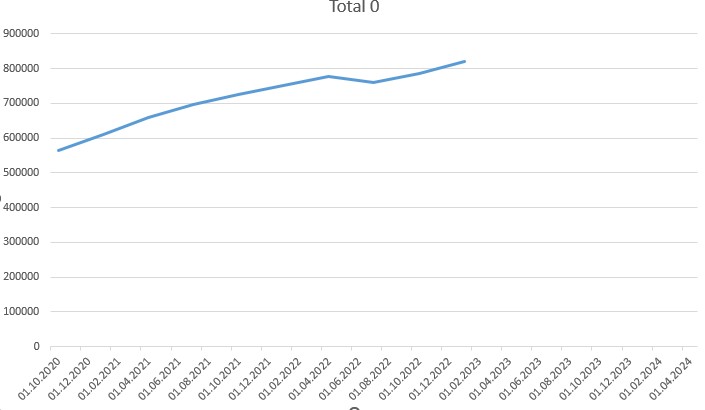

Zooming out, the “polynomial” growth has ended, but the wave-y plateau looks a bit less scary. ![]()

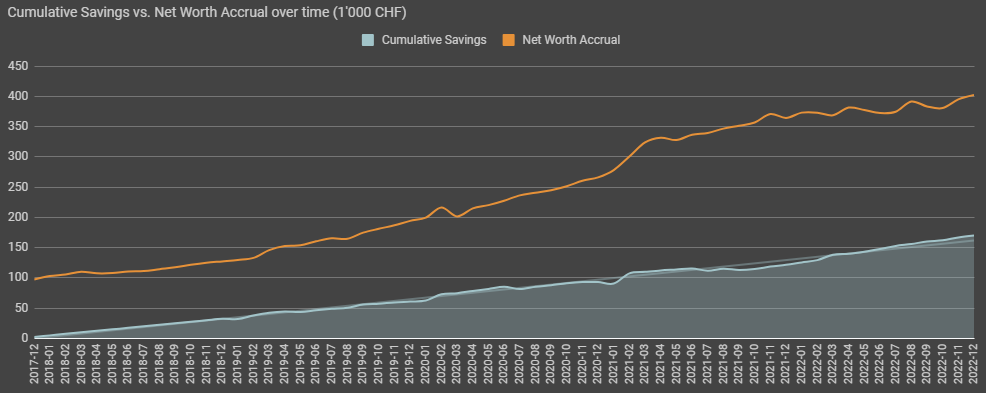

Putting into perspective savings vs. “investments performance”:

Cheers to the new year and return to nonlinear (and hopefully 6-digit) growth for everyone! ![]()

Very nice progress! Do you also track 3a and pension plan?

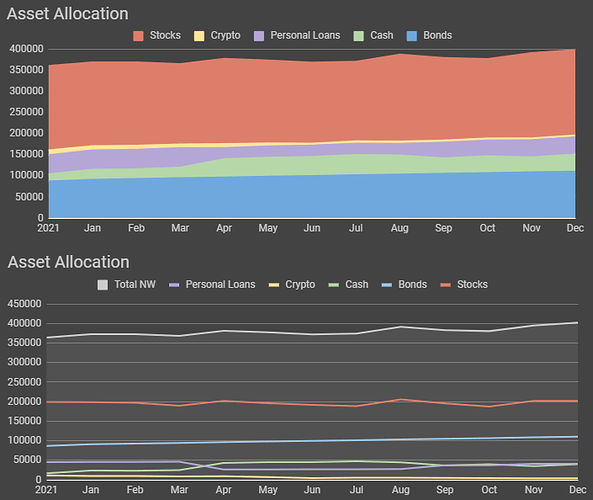

Yes, 3rd pillar sits under “stocks” (and tiny bit of cash), 2nd under “bonds”.

I have some further breakdowns, but I think I spammed with enough of charts already. ![]()

I kept DCAing here and there (although less than I would in a “usual” year) so it doesn’t show as much.

I will see the actual performance when I generate a yearly report from IBKR - pretty sure it will be very visible then. ![]()

(Just checked - around -20% TWR/MWR)

But the last chart should show investment nominal behavior, presenting part of “the drop” at least.

For NW tracking - I pretty much just do a “simple snapshot” of all my accounts once a month, so do not track to such level of detail (for each single equity purchase).

I do take note of “cash flow” from savings into IBKR and 3rd pillar, but don’t go much further than that.

Then I have another set of sheets tracking my investments overall - but vs. avg buy price only - as that’s what I am most interested in.

For detailed “lot performance” I can check my portfolio on Yahoo finance, as I take note when I buy there.

Nice progress and reports !

We cannot see the negative performance of global economy for 2022 (-22%) on your stock investments

How do you track your savings invested ?

Another year, another update:

As expected during a weaker market phase my cash-rich stock picks outperformed the market drastically despite some individual disappointments (not exactly sure yet but slightly positive return). My general portfolio lost (surprisingly) a lot less than the market too (around -10%). Made the majority of the return with investments in energy stocks, investing in very late 2021 and again in early 2022 (feeling a bit guilty to have then profited from the Ukraine invasion, but energy prices in Europe increased in the six months prior to that already, just nobody seemed to care yet). Also some nice trades with put options (market seemed eager to again and again ignore macro-economic trends).

On top came substantial new savings, and most importantly I will get a very big promotion, and should be able to save some 250k in 2023.

Nice exponential progression and congrats on those savings!

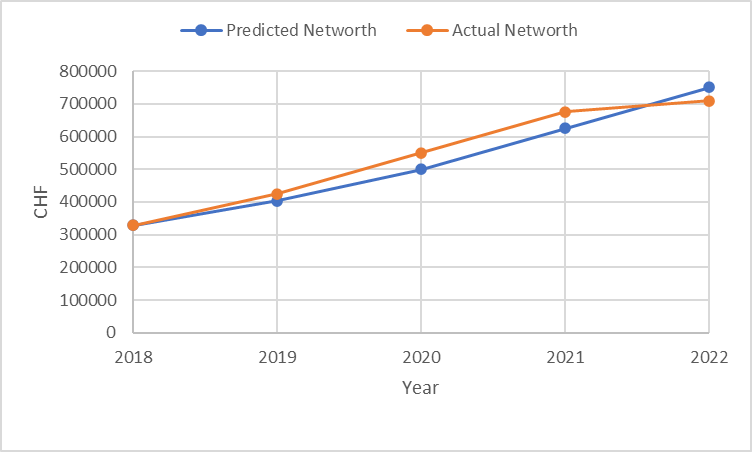

I started investing from 2018. Predicted net worth is simply adding a constant number to previous year’s actual net worth. The constant number is what I expect to save. This year, I would have done better if I had sold everything at the end of last year ![]()

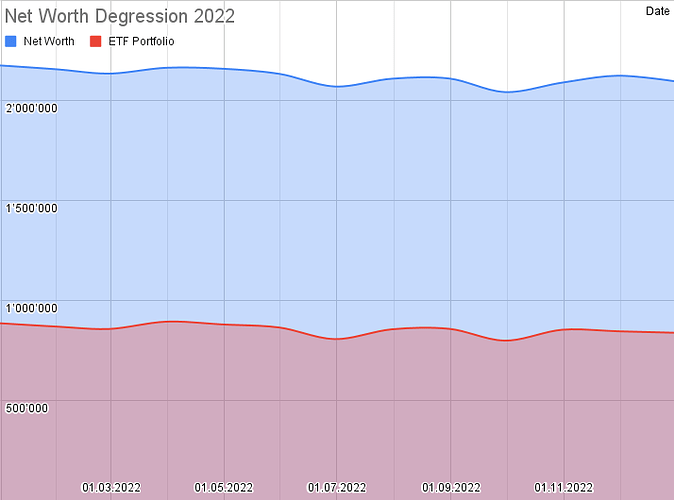

What a year! Despite >200K income and >100K investments in my ETF portfolio, the overall net worth is down considerably. But let’s not despair, stocks will go up in the long run… ![]()

I started tracking in 2020. Actually quite happy with 2022´s progression considering the markets. Hope to cross 1mo CHF this year.

Awful progress this year. First plateau in net worth growth in, like, forever… but at least not a minus.

In a way I’m happy that we still have some cash powder dry for 2023.

2022 Year update

Slowed down the progression due to investment performance but all in all happy about promotion and girlfriend moving in with me.

Particularly happy about the changed perspective around spending money, it took me 4 years before I actually realized you can be frugal and still enjoy life with a tiny bit of lifestyle inflation (compared to life in Italy before).

Some metrics:

- YoY growth (29%, c.a. 79k)

- Saving rate stable at 65%

Being still in early accumulation, neither the market fluctuations nor my 2022 try and learns in the market have had a significant effect on the evolution of my net worth. Ending the year shy of 100K.

I feel you. But still - what a portfolio!

I think that to allow a better comparison of all these YoY values it would be valuable to add also the external funding (if any) during the year, no ?

It’s good point but I never monitored it so far.

So at everytime, you review your accounts you should also log the saving invested to your brokers.

Anyone does it differently ?