The usual exception is getting fired for reasons other than your performance, e.g. due to a reorganisation or change of control after a merger.

If I leave of my own free will:

If I get laid off:

Some shares (not RSU) then get unblocked, others stay blocked and must be held at a bank chosen by the company until they are released, depending on when they were assigned in the first place.

Should nudge them to lay you off into RE when you reach FI then

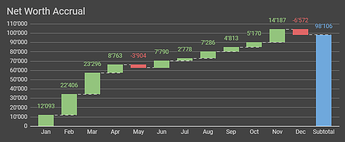

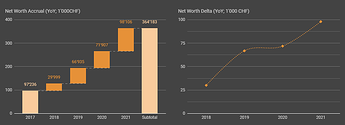

15th is here, which closes the “accounting year” for me. ![]()

So here a 2021 year in review.

This rolling month was a bit painful, as I was looking forward to close off with 100k YoY (which is probably not the right way to define goals, as big part of it is out of my control).

But all in all another lucky upwards year. ![]()

Basic info:

- early 30s

- living alone (ZH since recently)

- working for past 7 years in CH; data/tech roles within pharma and now financial industry

2021 view

YoY: ~37% / ~98k CHF

A few key events, such as extra-normal out/inflows and portfolio shifts:

- In Feb I closed the leasing and bought off the (good value) car

- Feb and Mar brought the bonus and company shares unvesting (and sale thereof)

- This summer saw me change jobs and move apartments (and cities), so all the moving and furniture change costs amounted to a bit of a slowdown Jul - Sep

- Went on a mountain expedition at the end of summer, which slimmed my wallet by some ~1000CHF

- This year I diversified into another asset class: I arranged a couple of (direct) personal loans - so far things are developing well

MoM change

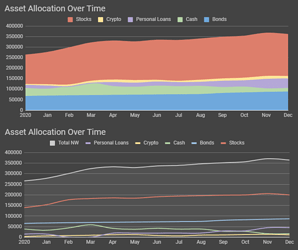

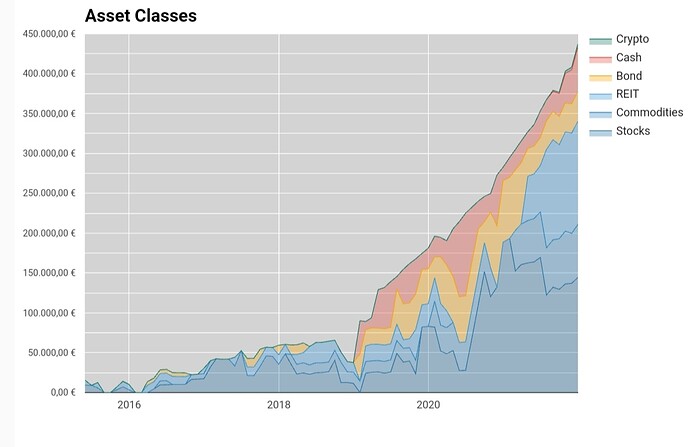

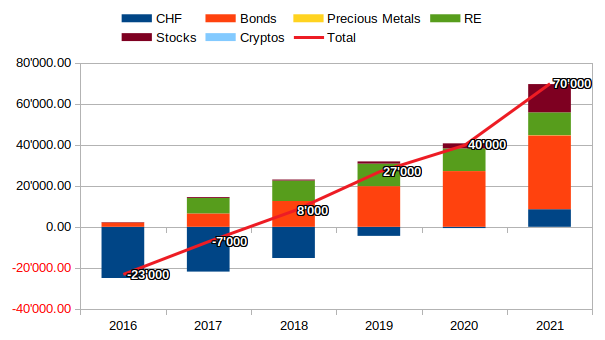

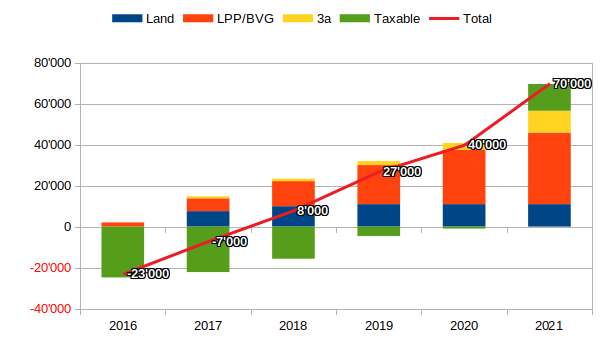

AA view (stacked and non-stacked)

Stocks == IBKR + 3rd pillar accounts

Bonds == 2nd pillar

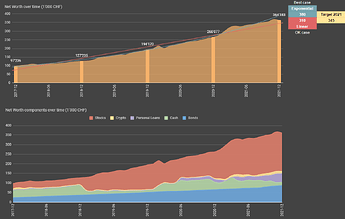

Big picture

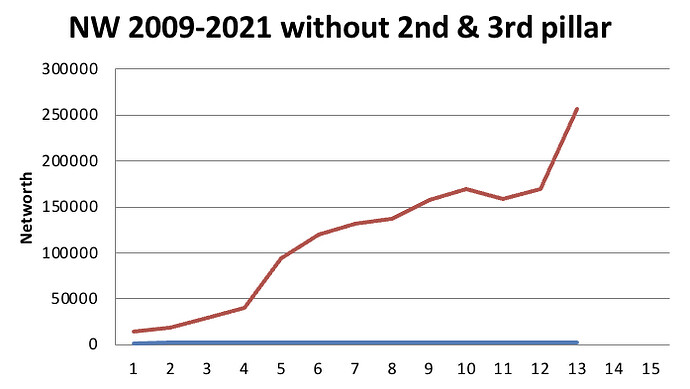

Now zooming out a bit…

Beginning of last year I ran 2 models to try and guesstimate where I might end up at the end of the year (for pure fun, I know well there is no predictive power there ![]() ) and set a “target”:

) and set a “target”:

- one exponential for “best case”

- one linear for “OK case”

Finished up somewhere in the lower half of that band. ![]()

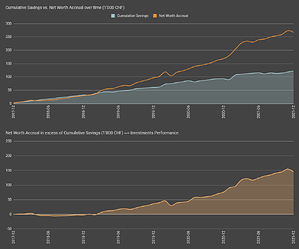

Cumulative savings vs. total NW

(subtraction of which ~= invested assets performance)

YoY change

May it continue waving upwards. ![]()

So much from me.

Wishing everyone a great end of the year and start of the new one.

And enjoy holidays with your close ones.

Stay healthy and on track. ![]()

Impressive ~100K keep rolling

Passed 500k couple of times during Q4 but still not in the books cause of the crypto volatility

Hmmm.

Liquid 450k.

Net tax value of investment RE 100k. (Value for mortgage calculations: 345k; 100k mortgage left).

Own home, tax value 660k. (Purchase price 750k, renovations 150k; 810k mortgage. Unsolicited offer received this spring, 1.7m).

What do you mean with liquid? Cash only???

Nah. 100k cash emergency fund (I’d go lower, but my wife thinks a full year of revenue is needed – we settled on this), rest bonds and stocks.

I also had a good Financial Year, thanks to Crypto and Meme Stocks

Liquid Networth: CHF 405k (60 % YoY)

-

Crypto (BTC & ETH) - CHK 123k

-

ETFs & RSUs - 95k (GME gains of 20k)

-

Cash - 50k (Emergency fund + saving for RE Downpayment)

-

Pillar 2 - 85k

-

Pillar 3A - 52k (Frankly)

Non-Liquid: Equity in Real Estate (Apartment) - CHF 237k (80 k amortisation left)

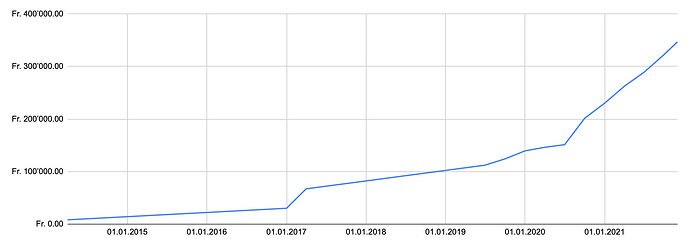

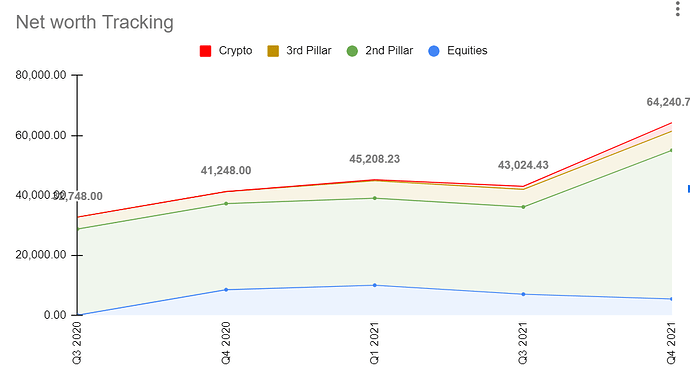

So here we go again:

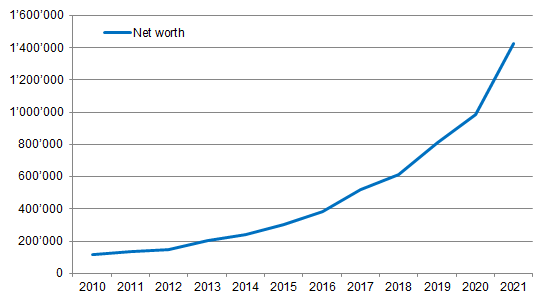

Got lucky with share picks, timed the market correctly (including temporary using leverage again) and traded more actively (also experimented with a variety of options). No cryptos and no meme stocks. Also still no real investment strategy. A nice extra bonus for a finished project helped too.

Over 400k CHF increase sounds (and is!) astonishing, but despite the previous comment it’s to a large degree merely a consequence of a growing equity-heavy investment portfolio with nice market returns (really felt the compounding effect this year) and a very decent savings rate.

You can see from the graph the exact points when I’ve started to make a “decent” salary first, and then when I’ve started to invest

Impressive growth, kudos! ![]()

Mind to share some details about your choices ?

I guess you imagine when moved to Switzerland ![]()

After some years of decent saving rates 2021 has been first year feeling the compound effect. Many hints and ideas coming from this forum, thanks for that!

Generally I invest in companies with strong cash generation or that are in a unique market position. I don’t like to talk about specific investments, and I learned my lesson not to give advice. I also consider myself more lucky than skilful, and don’t think my recent returns can be regularly repeated (we all should know better than trying to beat the market).

That being said, in short: I was successful in selecting pandemic profiteers, specifically laboratories and companies profiting from covid testing (e.g. ABT, WAT) and logistics companies profiting from freight rate increases (e.g. KNIN, MAERSK). At the same time I shortened some highly overvalued companies that surged in 2020 (e.g. most profitable trade were ZM put options). Beyond that, some older more sustainable picks performed extremely well again (e.g. ASML), some beyond anything I ever anticipated or could explain (e.g. I exited INTU a while ago because of the valuation, but still make money from call options to ride it out).

2020 has been a miss at 40K, 2021 closes near 70K. After some more struggle in the first half of the year, I’m finally in a position to invest regularly, looking forward to the future.

Feeling pretty satified with myself giving the circumstance. Recap of my situation :

- 41yo, 2 kids, started being financially responsible and looking for FIRE (at least FI) only a year ago

- Before that no credit or debt, but living paycheck to paycheck without any asset (not even an emergency fund)

- Lost job due to Covid mid 2020, had to take a crappy job (-20% salary) starting 2021

- 2nd kid born in 2020, so almost +25% expenses in 2021

By reducing seriously my expenses, setting up my investements and structure my finance overall, I managed to have positive year non the less! ![]()

Still a long way to go :

- had to reduce my equity portfolio for unexpected expenses for the kids

- still have not a satisfying emergency fund

- wasn’t been able to top up my 3a this year…

But overall I feel way more confident and “in charge” of my finance. Thanks so much to everyone here on the forum for the great inputs and sharing you provide, it have been life changing. I wish I had that education younger, I would be in a total different place right now (but I’d probably never had done some of the crazy stuff and travel I did while burning my money all that time ![]() ). I can’t wait to educate my kids in that way, to give them more tools to face their futur.

). I can’t wait to educate my kids in that way, to give them more tools to face their futur.

Tomorrow I’m starting my new job, great one and motivating, with the same salary pre-covid, so +20% increase this year of net income. Can’t wait to see next year evolution ![]()

![]() !

!

Well done @Zurtan! It’s never too late! And good inspirations for your kids! Keep it up!

Never regret experiences like that. I spend tons of money (about 20-25% of my yearly spending) on travel, no regrets.