True, those money you’ll get back if you leave. And I always “forget” about them in my NW so I get a nice surprise when they are release once in a while ![]()

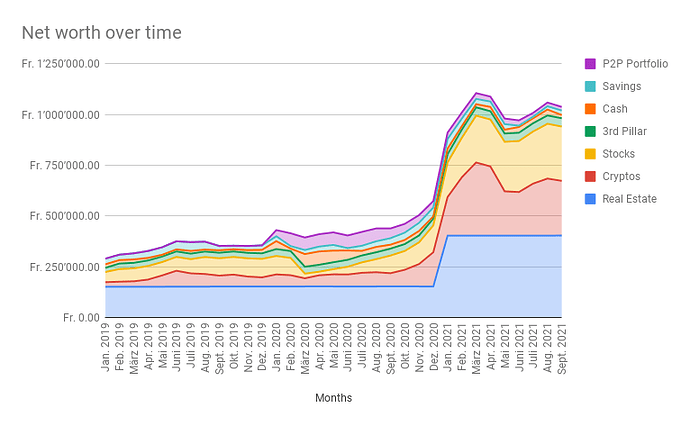

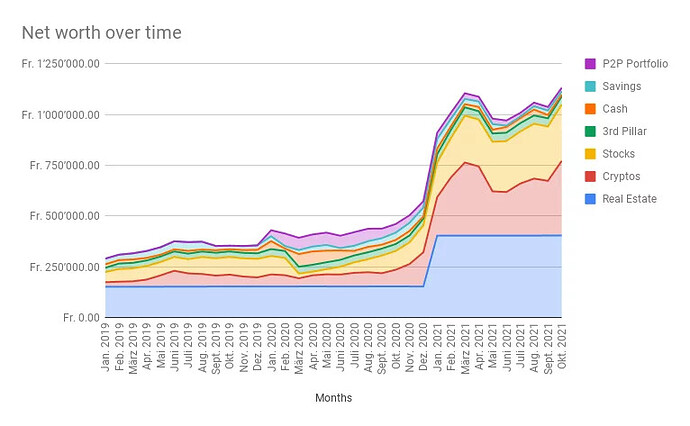

Since some people complained that my single bar chart didn’t have enough information I’ve updated it.

Full blog post about my September here:

Wow, how did you double your Money from 500k to 1000k in just one month? Looks amazing! Congrats!

I think large part is from the reevaluation of his apartment.

By the power of “incorrect” accounting  (for appreciation of his RE)

(for appreciation of his RE)

Come on if the bank claims it has that value and renews my mortgage with that valuation it certainly counts, no?

I’d have thought the comment was more about how it’s displayed in the graph?

(The bank assessment didnt change the value, the value changed over time)

NHF, it was a tongue in cheek comment

What nabalzbhf says (and most of us did back then) - you should have spread it backwards, linearly or whatever.

But it’s more work, for sure.

definitely counts.

depends.value will have increased over time, but also the initial value may have been wrong. Important that cadastral value is as low as possible (taxes) but value held by bank as high as possible (stop required direct amortisation for example as soon as you high 66% of the value held by the bank…and invest the new cash flow available). When I realised how much was retained for my mortgage, a simple visit from the bank increased the value held by 200k in 30min allowing me to « save » 3k chf cash flow a year and free up the gage on my 3a next time I négociate my hypo (has to be done then, most won’t let you out between dates)

Important to do especially if you make renovations/improvements on your house either over time or a big one off.

I would adjust the RE price increase linearly back to the original purchase date of your appartment, in order to correct your chart. I mean, it’s fancy and all, but certainly not correct

Is that actually allowed in Switzerland – to have two different values associated with a property? In many countries it would either be considered tax fraud, or bank fraud…

Bank value is market value roughly.

Cadastral value is tax value, less than market value.

Right?

I believe that in many cantons the tax authorities use a property value that is lower than the market price, so you become poorer (for tax purposes) when you buy, similar’y the deemed rental value is usually below market rates

Geneva is an exception, for new purchases the price you pay is the taxable value and deemed rent is close to market rates

In Fribourg, the tax value of our house is twice lower than what we paid. This is is great for us since our debt is then significantly higher than the tax value of our house and this makes our taxable net worth negative. But we did not choose the taxable value, it was set by the canton tax office.

Its exactly like @Ardius, @Fliss and @anon95353169 mention.

The valuation of your property is both a tax issue (face value for tax on fortune) and commercial issue (market value for amortisation on your loan).

Importance of commerical value (besides selling of course): once your mortgage hits <67% of the market value of your property, you are no longer obligated to reduce the principal (only interest)…this step is required within 15years of the purchase (usually 2nd rang). But the faster you get the value up to move the 66% mark, the less money you pay to amortise your debt. So, if you can get the value retained by your bank to go up, you can free up your gage and stop direct amortisation at the next renegociation of your mortgage (they don’t like to do between dates).

Importance of cadestral value: revenue taxes and fortune taxes. I don’t know anyone that has managed to have it reduced once its been raised…good luck negociating with tax authorities once its been set. Though, I know lots that have fought (dit negociated) to keep it from increasing, and most were successful to a point. If you don’t ask, then they won’t lose sleep getting more in taxes from you for the next decades. This situation is at best avoided, and at worst well anticipated. If you do any major renovations requiring new formal plans, the canton will eventually find out and come for an update of the cadestral. I prefer it to be on my terms…

You mention fraud…this would imply intentionally misleading the value of the house in either of the above cases. Hard to fraud the Cantonal Tax Authorities when they set the cadestral value not me. They came to the same house that my bank did when I had it re-evaluated by the bank that set their own valuation for my mortage. I’m not hiding anything from either. That being said, I think it simply “normal” to prepare accordingly and influence them as much as possible. 1) when the tax authorities came I had an accountant friend come and talk down the property relative to the existing cadestral value. 2) when the bank came, I staged the house as if I were gonna sell it (put things put in the attic, highlighting everything little improvement i’d made and how nice the area, schools, transportation is etc etc)…the motivations between banks and taxes are different, so their valuations are too…worth a theoretical 275k CHF in my case, so not bad for a few days of cleaning

I write too much, sorry

P.S. @Fliss mentions another key point…the rental value of your property (taken as theortical revenue in your taxes) is also being calculated as a gradually decreasing percentage of your cadestrale value (i.e. 3.5% for the part < 500k, 3.3% for the part 500k to 1000k, 2.7% 1000k to 1500k etc) and not a potential dynamic market value…ergo in general for the same property: your monthly charges to rent it would tend to be higher than the equivalent to own it. Your mortgage capacity and down payment is the bitch. Chicken and the egg.

As @Barto mentions there may be a link in some cantons but not in Neuchatel that I am aware of. They are used differently. Bank value is (subjective) market value. Cadestral is tax value.

I am no expert though…so may be nuances that I don’t know…

Unvested RSUs instead will be all gone the day stop working for that company, one way or another: they are just the carrot held in front of your nose to keep working for them.

Not necessarily. Check your specific regulations!

For me that’s the case, whether I quit or I die or get fired, unvested stocks are gone. Could be different for other companies. How is it for you?