Is this nominal or real? Risk-free rate of return of 10% in 1990? Investing all the way through 80s risk-free with 10% annual return, lol, those were the times.

Nominal, but risk free is kinda an (bad) approximation for it.

I would then rather take Swiss Re, they have a 6.3% dividend yield. ![]()

Wow thanks for the heads up, I’m not so aware of the CH market but this seems like an ultimate safe haven… what’s the catch? And now it’s 7% actually (minus 15% dividends tax)

Oh, edit: yearly dividend date was 2 days ago…

One catch is that they are insurers of insurances: they don’t have to pay much as long as nothing major happens, so they are distributing high dividends. The day something major happens, they’ll have to cough up big money, and probably won’t have it.

Another catch is that Swiss RE has registered a loss last year. They have globally rising dividends but have already cut them in the past (example: a 36% cut in 2016, from CHF 7.50 to CHF 4.60).

The stock price itself is supported by share buybacks, of which they’ve done roughly 3% p.a. since 2016 (not reconducted this year) and a total of roughly 20% since 2007.

So you’d have to ponder the company’s fundamentals. As with any individual company, the dividends distribution could cease to happen without notice and the title could loose value, going all the way down to 0. The drop in dividends fom CHF 7.25 to CHF 4.60 would worry me.

For the system, it means it’s an insurance that works when things are fine and have high chances of failure when things get really tough. Raising premiums and using that money to pay dividends when there are no claims to fill is an excellent business model, but a very poor insurance one.

Data from:

Share details on SIX

Simply Wall-St article -Are Dividend Investors Getting More Than They Bargained For With Swiss Re AG’s (VTX:SREN) Dividend?

Edit - Disclosure:

SREN is on my “bitcoin” list: buy a few of it when its price is cheap to gamble on good returns but don’t expect return of capital to be guaranteed.

That is not quite how it works, you are excluding the fact the reserves are build up over time to pay out in case claims happens. Swiss Re reported a strong capital position at YE 2020 with a SST Solvency Ratio between 200%-250%, this should make people comfortable that even in the case of an adverse scenario the company is going to be able to absorb any kind of shock.

If you look at the underlying results, net of COVID-19 adjustment, the Group Net Income went from 727m USD to 2173m USD which is quite good and indication that the management action taken in the last years are yielding the right results.

For example I would look at the re-vitalization of Swiss Re CorSo (primary insurer in the P&C field) which went to have a combined ratio of 129.6% to 93.2% (net of COVID-19 adj) essentially becoming profitable after 5/6 years.

It is going to be interesting to see how COVID pans out, Swiss Re has put aside in 2020 3.8bn USD, which is a massive figure in line with other similar companies in the market. In the case that the impact is lower than expected you are going to see a release of reserves leading to even more higher profits in the next year or two.

Overall Swiss Re has always been a financially stable company (I know 2008 was particularly though) so the notion of them not having money in the future to pay-out seems a little bit too pessimistic. On the dividend side I would always expect them to pay rather high dividend to remunerate investors during though times, in the end some of them could have pulled out during the pandemic and decided to stick around and the remuneration is reflecting that.

Even though dividend might fluctuate over time I think that in general they will always keep quite a generous level.

Source: Swiss Re press release FY 2020

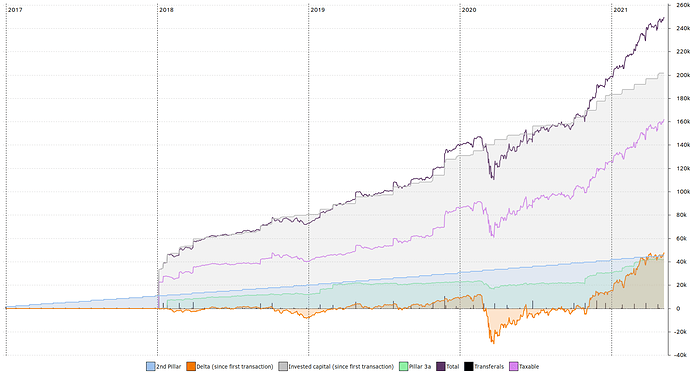

Lets get back to net worth progressions.

Sorry, big question; which app can I use to create my share net prog.?

Basic basic basic knowledge on programming exc, Danke euch

Excel / Google Sheets?

No programming knowledge needed, other than using a few basic built-in functions/formulas.

Just draw it on a sheet of paper and take a photo

You could have a look at @MrRIP spreadsheet, he has a very interesting series of posts in his blog describing how he keeps track of Income/Expenses and so forth.

In Part 3 he talks about Net Worth, you can check it out and see if that works for you as well.

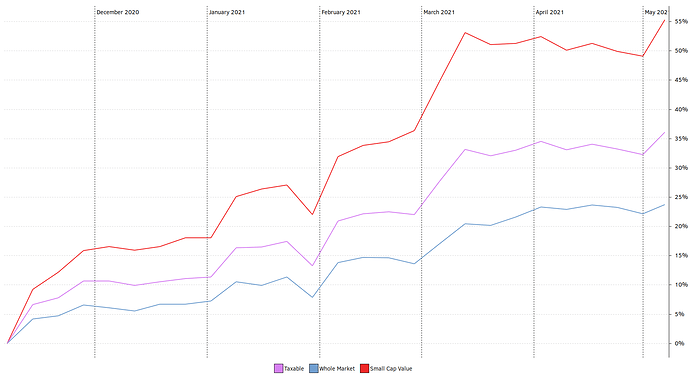

scv juicing it up since Nov 2020

I love to work myself (I hope you do too, @Bojack) and I like how Matthias Richter in the Financial Independence Podcast defines FIRE: Recreational Employment or Retire to Entrepreneurship. Being in the LEAN FIRE area, I am comfortable to quit my job and look for recreational employment elsewhere. Switzerland is already an important part of the FIRE equation for you, guys and girls! Every month when I look at my net salary in my current home Luxembourg, I nearly cry over what the government has taken away for taxes and health care.

Hello! Recently I found out the google sheet “Homemade Net Worth Calculator” that you set up together with Mr. Golden Pioche. Great! If I got it right, some of the cells are connected to google Finance, and it gets automatically updated; but if I download the file as .xls and I use it ‘offline’, is it possible to keep these cells connected to the daily financial info?

I haven’t use it yet, but it seems very useful. Merci et bon week-end!

Hey Architect,

Thanks for the question. Indeed, the sheet uses googlefinance, but it’s only for currency exchange (EUR->CHF, USD->CHF, …), and not to fetch the price of stocks or such things. I wanted to keep the sheet flexible and easily customisable for any use.

If you use Excel, you can just modify the related cells and use techniques explained here or here (found with a quick search engine query).

Note that it’ll not work if you are really “offline”, but otherwise it should work.

Enjoy  (I fancy feedback regarding the sheet, don’t hesitate to write me, thanks!)

(I fancy feedback regarding the sheet, don’t hesitate to write me, thanks!)

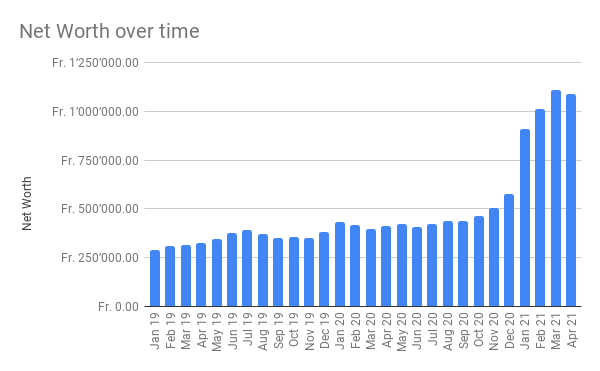

Wait… but in this progression you are counting your monthly/yearly salaries that you set aside and then you invest into assets, right?

It should be simple - you just make a (monthly/quarterly/yearly) snapshot of all your accounts / asset values.

So part of your income could be sitting either on the bank account, be poured over into brokerage account, or a new car (which you would probably “model depreciate” accordingly).