I don‘t know. Just looks like there is a ceiling of 2% inflation max that the snb will tolerate:

Swiss National Bank (SNB) - Questions and answers on monetary policy strategy (last three questions)

I think @MUFC_OK meant possible inflation, not a prediction. For projections into the future you need to use a range of possible outcomes regarding inflation and other factors. Inflation (>> 0) is an issue for someone living on his/her liquid investments. Deflation is an issue for real estate with a high leverage. But I’m confident central bankers will continue to do “whetever it takes” to fight deflation.

I’d like to present you…me.

Haha, yes me too.

I tend to change employers every 10 years, in the past increasing approx 30% at change. In between increase is <1% p.a.

I did about 80% jump in 8 years. Gunning for another 15% soon.

I‘d be fine with 5% real yearly return.

IT. Same role. From junior to senior. Rather poor starting salary after apprenticeship.

I said after apprenticeship. I don‘t hink anyone in IT works for 40k here in Switzerland ![]()

Some nominal salaries from back then still seem unreachable, never mind inflation in the 20+ years since.

Doesn’t sound too far off. In financial consulting, I‘ve gotten +100% going from junior to director position over ~12 years, averaging 15% jumps every 2-3 years. Most people don’t (want to) make it that far, though.

Executive Director at UBS or Director at the other large ZH financials should be similar in terms of compensation from what I heard (say 160k-190k base). At my employer 12 years is average.

The next pay raise is substantial, to MD level (or junior partner in a consulting firm). However, that’s much harder to achieve than “just” a Director position though. Might very well not be in the cards for me, not sure whether I’d want it either.

Out of curiosity, how large is the typical non-base comp (bonus/equity) for those base salaries?

In my case it’s comparatively limited in relative terms, I’d say 15-20% in good years (still welcome i absolute terms  ). Only if you sell multi-million consulting projects that can double or triple, but I’ve never done any of that. It’s also precisely the thing you must do to get towards partnership.

). Only if you sell multi-million consulting projects that can double or triple, but I’ve never done any of that. It’s also precisely the thing you must do to get towards partnership.

As for bonuses at ‘standard’ financials, I don’t know - no one ever told me  . Director is usually still a mid-level function, say up to 20 ppl under management, so I’d expect it to be similar. The days should be over that a relative nobody (let’s be honest, that’s what it is) at UBS got a 100k bonus. Obviously it’s different story for hedge funds and trading firms, but they have a different remuneration structure altogether.

. Director is usually still a mid-level function, say up to 20 ppl under management, so I’d expect it to be similar. The days should be over that a relative nobody (let’s be honest, that’s what it is) at UBS got a 100k bonus. Obviously it’s different story for hedge funds and trading firms, but they have a different remuneration structure altogether.

That’s a great and very simple metric. According to this I’m in the top bracket, but I’m not feeling so wealthy ![]()

If your assumption on the stock market is 3%, you don’t need to go to the stock market as you can get this much with much less risk today.

So I think assumptions (and expectations) matter.

Where? (in CHF)

(character count)

real estate, more generous BVG schemes, “mutual” 3a/3b products

(or conversely, just buying Nestlé and forgetting about the share price level).

No you can’t.

Also this is an estimate for the US stock market. There is a reason why you shouldn’t invest 100% into US equities.

There is also the timeframe. For less than 10 years, I would not plan with a positive premium. For 20 years, you should not depend on a return that is greater than 3 or 4%. (you can hope that, but don’t rely on it)

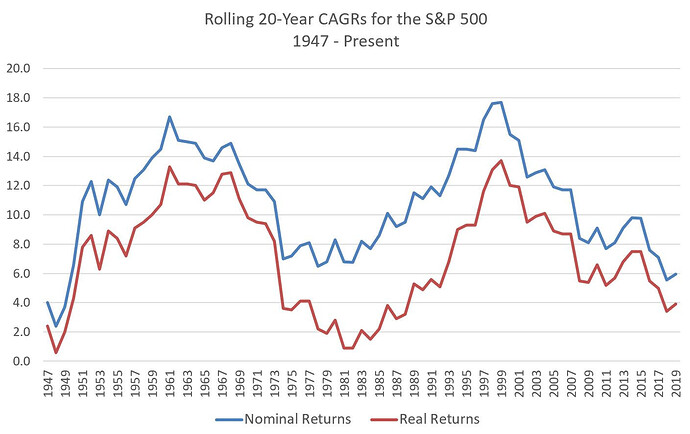

Here’s a great chart to get a good feeling of what to expect:

4% real return is very possible, even 8% was true for half of the recorded history. But if you imagine we are now at the same point like in 1973, we could look at another 20 years of +/- 4% returns. Hope that’s not the case. But the actions of politicians and central banks do not fill me with hope.

Yes, and this is with a market that has done better than most other markets. It isn’t certain that this market will continue to do better than the average.

A 1 in 4 failure rate is quite high if you depend on it.

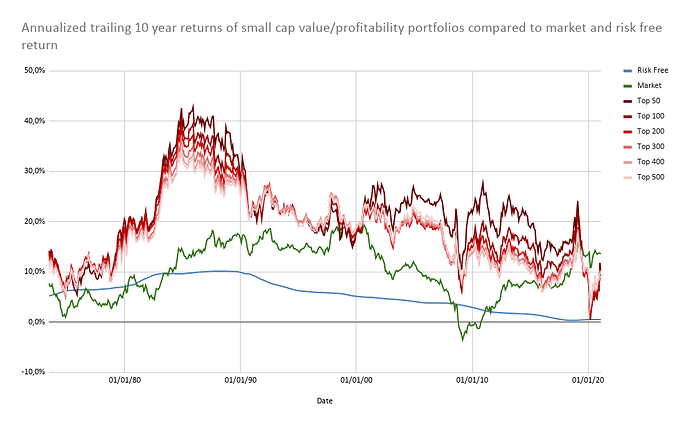

This one is also pretty interesting, it is constructed based on academic portfolios that constructed based on size, profitability, and book to market from here:

https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html