Having just paid serafe over 500 chf I am impressed by your Utilities costs of only 628 chf

my serafe is 335/2. Why 500? Fee overview

Voluntary contribution because of the great programming?

ah you are right, I do pay “only” 355, sorry for the noise

I’m disappointed.

Everything that can be planned and wire from my account are in the category of planned expenses (rent, daycare, internet …).

All the variables expenses are not forecasted and pay by credit/debit cards (airplane, train tickets, restaurant, holidays expenses).

The main difference compare to your situation is not having a second child, not owning a car, living in a small place.

Yeah. At one point we were paying 6k per month for daycare. House is a killer, on paper the mortgage was cheaper than renting, but I didn’t realise how inefficient older houses were - the energy costs are a killer. And even though I got a super low interest rate (0.75% fixed for 10 years) the capital repayments are no joke.

It is really impressive, congratulations!

I have some questions for you to improve myself:

- how did you get such a cheap rent?

- how do you manage to get this low food budget?

- can you tell me a bit more about leisure/holidays?

Thanks a lot, of course if you prefer not to share these details it is also fine ![]()

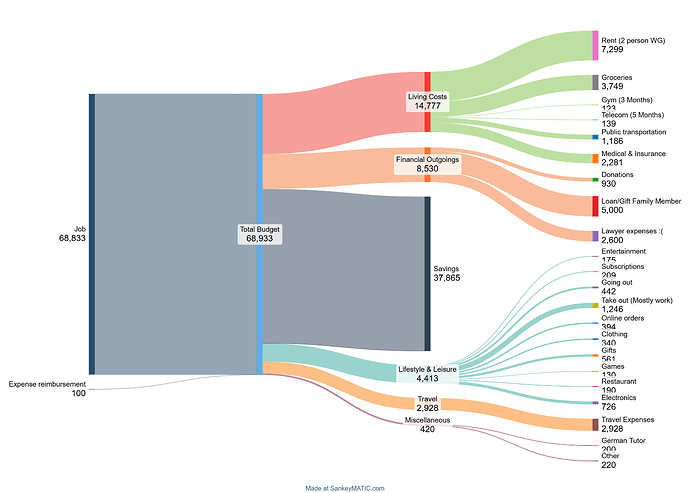

Hey everyone, first time posting on the forum!

Decided to share some yearly spending from a younger generation ![]()

About me:

Early twenties

Live in a WG

This year was first time when I tracked most of the stuff and was able to do a yearly review, yay

Here is my fancy Sankey diagram

Salary is already Netto without income tax and social contributions

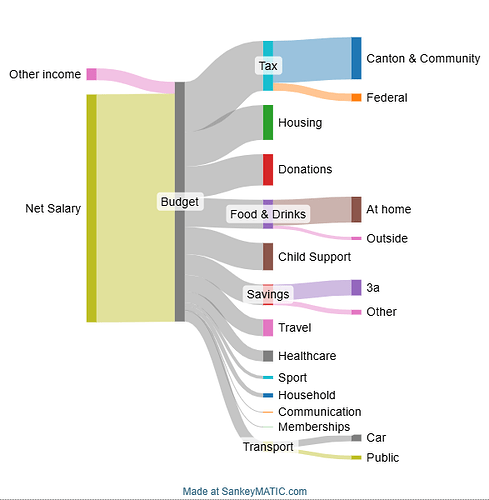

I’m 58 year old, have 1 kid (24 yo) still studying and living with his mom. I was unemployed and unpaid for 3 months in 2024, thus I could only save 10%.

I have 25% expenses that are discretionary or will stop after 2026: donations and child support. I consider the car a luxury and it will have to go at one point. Entertainment, IT equipment, clothes and gifts are summarized in other categories. But I am quite frugal in that regard. Not so frugal with wine though: my gf wants me to carve out what I have spent on alcoholic drinks but luckily, this is too difficult a task for me ![]() I hear that Gen Z is no longer interested in alcoholic beverages.

I hear that Gen Z is no longer interested in alcoholic beverages.

Other income is what I get through Twint (balancing expenses or selling items online. As I have a strict 2024 view, I do not transfer expenses from/to other years: e.g. the tax bill is partially for 2023 income.

I do not have any subscriptions but my behavior gets more and more difficult as this business model has become the new normal. Having a gf who likes her media, I can benefit a bit from her spending habit.

Not shown is the whole brokerage aspect where dividends and unrealized gains stay in their own universe.

You are very generous with donations. Not very frugal. Anything you support in particular? And why?

I didn’t need my whole salary for a good life. So I supported gifted orphans by providing them with a secondary school education. Education is one of the few things that keeps its value after I stop donating.

If it is not done by direct payments to the individuals, could you please share through which organization(s) you are doing this ?

Unfortunately around 100K

Family of 4 with 2 kids under 3 yo in private crèches

Essentially one of us works for nothing as expenses equal one salary

Covering expenses isn’t nothing, unless you could do everything you get through them by yourself in the amount of time you use for work. ![]()

The organization is called

I supported their very capable Swiss chapter after visiting the project in Kenya in 2012.

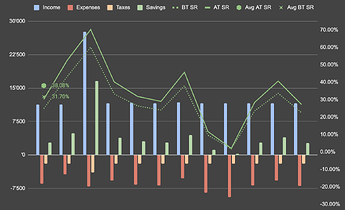

History summary

| Year | Expenses | SR (BT) | SR (AT) | SR (wP2) |

|---|---|---|---|---|

| 2021 | 62k | N/A | 34% | N/A |

| 2022 | 63k | 37% | 45% | N/A |

| 2023 | 62k | 38% | 47% | 51% |

| 2024 | 80k | 32% | 38% | 43% |

2024 hit hard re. expenses; but life happens and changes. ![]() (~2 persons in ZH)

(~2 persons in ZH)

- Total expenses: 80k

- Savings rate:

- Pre-tax: 32%

- Post-tax: 38%

- Post-tax incl. P2 employer contributions: 43%

Key “one-offs” (which now seem a regular occurence ![]() ), probably accounted for ~15k extra:

), probably accounted for ~15k extra:

- Wedding

- Wife moving over to CH (and needs to rebuild her business here)

- Moving apartments (+rent pump by 50%)

- Replacement of (stolen but unfortunately uninsured) tech equipment

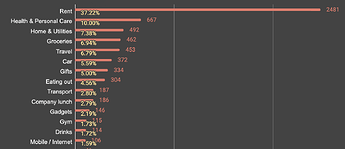

Breakdown of monthly averages (>100CHF) and development:

For 2025 I started drafting a rough budget, and we should end up with cca

- 70-75k yearly expenses

- 40-45% post-tax savings rate (not accounting for wife’s income, which will hopefully build up)

Let’s see what happens.

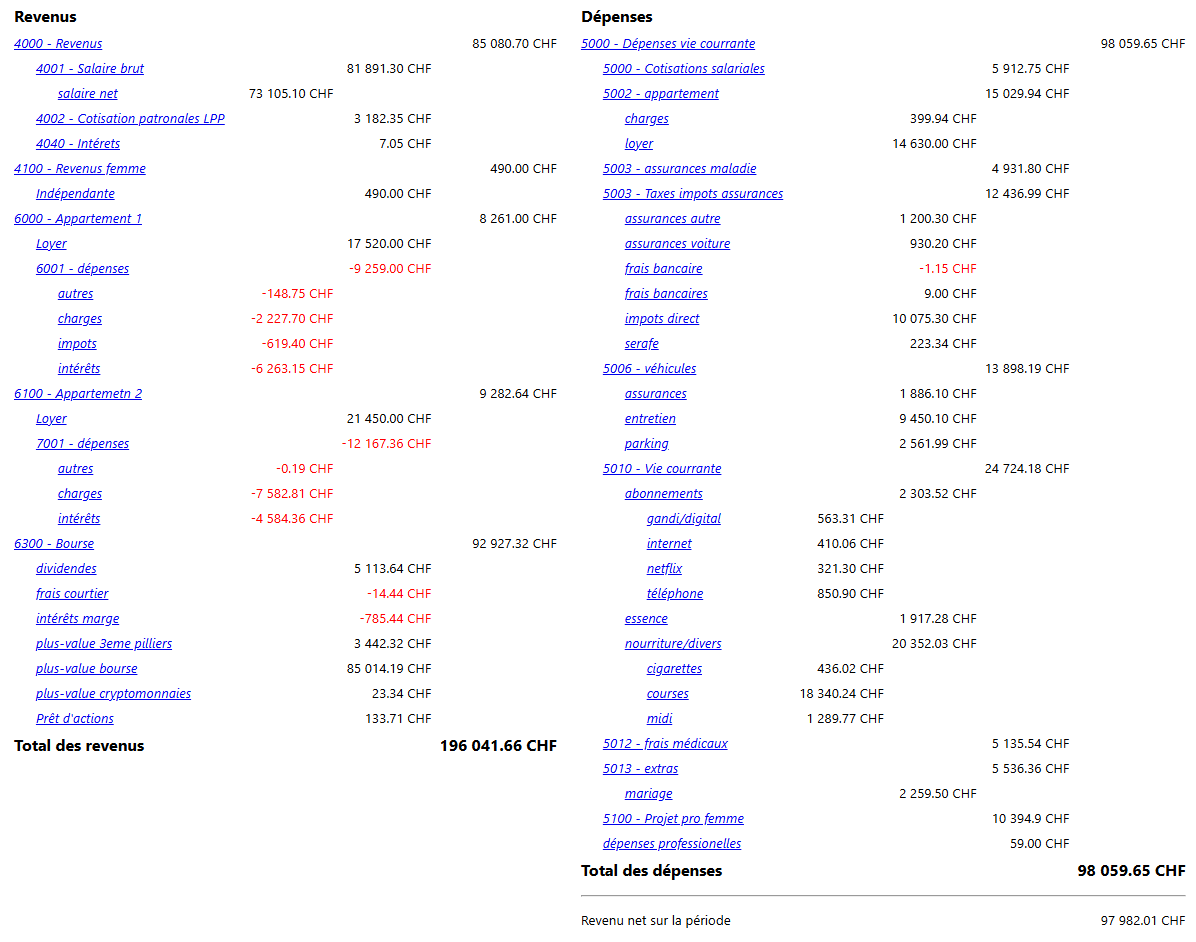

Here is our yearly spending for 2024 (agregated from bank accounts and cc statements, so it’s not perfectly put in categories).

We are a family of four (7 & 4 year old kids) living in an owned Home somewhere in Solothurn.

all expenses without taxes: 78545.- CHF (up 5k from 2023 :-S )

some categories:

childcare (1 day per week for both kids): 11591.- CHF

health: 14755.- CHF

house: 14616.- CHF (no renovations this year)

Car, phones and home internet are paid for by our business and therefore not included in the above expenses.

again a bit higher than last year. really want to try to keep expenses steady or even a bit lower.

Spending for two people. She’s trying to get her career back on track but is an artist.

Might say we are living over our means in a pretty non mustachian way, but whatever. As long as net worth is going up, and 2024 has been a whopping + 20% NW.

“frais médicaux” has mainly been our 14 years old dog GDV. She’s recovered fully.

sorry for french version

Are you renting out your apartments?

I wouldn’t add dividends and definitely not capital gains into the income part…

As well as donations (pro femme) into expenses.

Your taxable income from renting two apartments (if I understand correctly) is not much higher than what you pay for rent (no tax deductions). Are you sure it is a good arrangement?

You also seem to spend a lot on a car.

Congratulations with your marriage, by the way ![]()

![]()

![]() .

.